How can Investors in Their 40s Who Have Not Invested Before Reach ₹10 Crores Before Retiring?

This article helps investors plan a large mutual fund portfolio for retirement, especially those who are late starters.

This article helps investors plan a large mutual fund portfolio for retirement, especially those who are late starters.

This article addresses all investors who, for various reasons, have not yet started investing in Mutual Funds and may therefore not have a corpus sufficient to retire.

There are many different ways to calculate their retirement corpus. For this article, we will keep things simple and assume:

With these assumptions, the only other input is expenses per month needed at the start of retirement, which essentially includes:

These expenses are expected to be over in retirement.

The calculator shows the retirement corpus needed for someone planning to retire in 15 years and spend ₹1 lakh/month (in today’s money) in the essentials and discretionary categories for the next 30 years.

Readers wishing to follow a more robust retirement calculation approach should check out this post: A low-stress step-by-step guide to creating a retirement portfolio.

We will use the Arthgyaan SIP Calculator for Target Amount here:

Monthly SIP (₹):

Required Monthly SIP (₹):

Total Investment (₹):

Target Value (₹):

Inflation-Adjusted Value (₹):

Once you know your own SIP and Lump sum investment requirements, you can get started like this:

In the calculator, we have used a default lump sum amount to start the ₹10 Crore journey. It might be a different number based on your own situation. However, if you are in your 40s and have not invested before, having a significant lump sum investment will give a huge boost to the retirement portfolio. You can find the lump sum investments from multiple sources:

At this point, a lot of investors will get stuck on the eternal “SIP or Lump sum” question: should they invest the whole lot at one go or split it over a few months? Since the investment is for a retirement portfolio that will be there for multiple decades (say up to the age of 90), any benefit (or not) of splitting the lump sum over a few months will be minimal over such a long period of time.

If it makes sense, given that the investor does not have much experience with market movements, the lump sum can be split into 3-6 equal chunks and then invested over that many months. It will give some comfort to the investor that they are “spreading out risk”, although the same market crash that they are trying to avoid by spreading out the lump sum might happen the day after the whole lump sum is invested. That is just how risky assets like mutual funds operate.

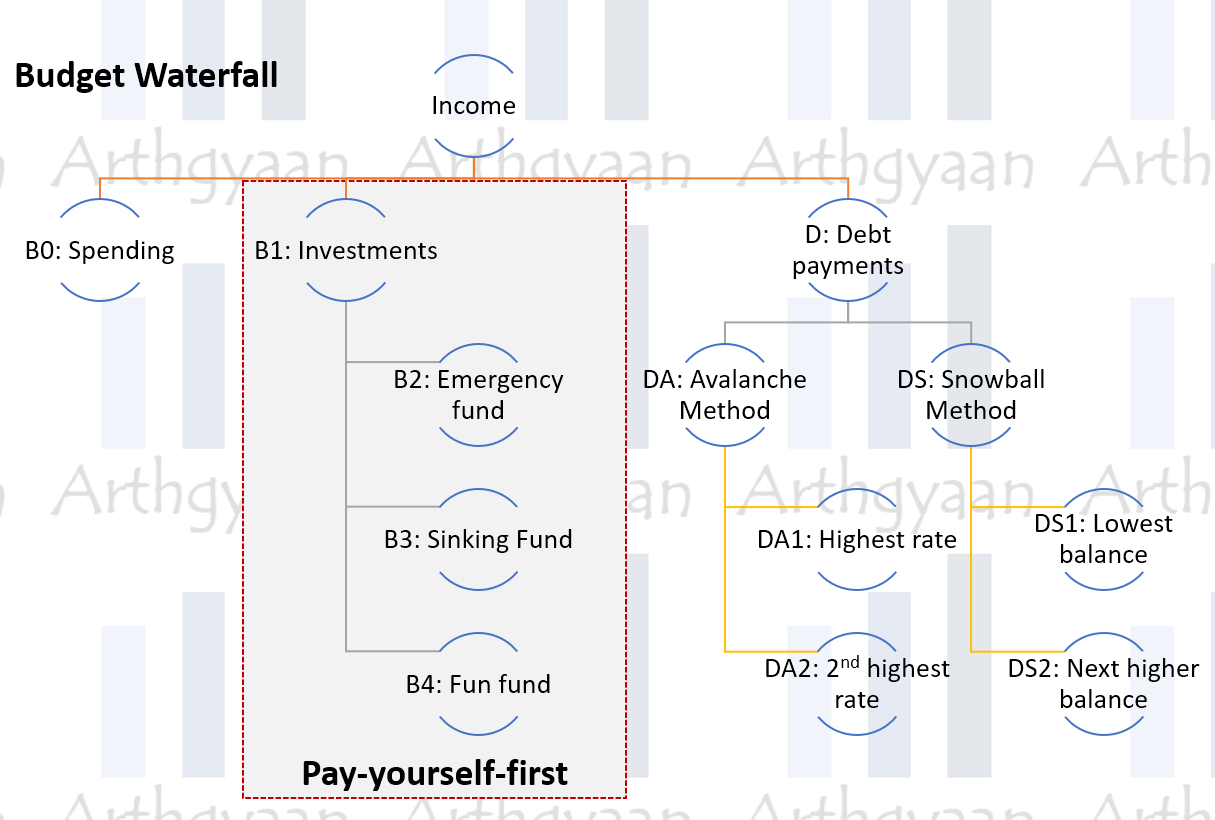

SIP amount for your ₹10 crore journey will come from monthly income post other expenses, EMIs and investments for other goals like children’s college. Using the Budget Waterfall method here can be very useful to find the SIP amount:

Use your income to fill expense buckets in this order:

At all times, ensure that you have the following in place when you are getting started on your ₹10 crores journey:

Best mutual funds do not exist since the list of best funds (performance-wise) changes daily. The key here is to choose consistent performers and let the fund manager do their job. Otherwise, switching funds based on performance will lead to failure to reach the target amount due to capital gains tax and underperformance. The table below shows median returns of selected mutual fund categories:

| Category | 10Y lump sum | 10Y 目↑ SIP |

|---|---|---|

| Equity: Large Cap | 14.2% | 15.12% |

| Equity: Mid Cap | 17.83% | 19.55% |

| Equity: Small Cap | 17.85% | 19.89% |

| Hybrid: Aggressive | 13.72% | 14.64% |

| Hybrid: Multi Asset Allocation | 14.19% | 16.51% |

| Solution: Retirement | 11.73% | 11.55% |

To understand which funds are suitable for creating your portfolio:

Here is the latest data regarding mutual fund returns that will give you an estimate of what to expect based on past returns.

| Category | Any 1Y SIP | Any 2Y SIP | Any 3Y SIP | Any 5Y SIP | Any 7Y SIP | Any 10Y SIP |

|---|---|---|---|---|---|---|

| Equity: Large Mid Cap | 14.32% | 11.42% | 17.39% | 17.35% | 18.33% | 16.64% |

| Equity: Sectoral or Thematic | 12.6% | 11.73% | 16.98% | 16.41% | 17.39% | 16.13% |

| Equity: Flexi Cap | 12.87% | 10.73% | 15.23% | 15.78% | 16.46% | 15.82% |

| Equity: ELSS | 13.71% | 10.43% | 16.07% | 16.0% | 17.03% | 16.06% |

| Equity: Large Cap | 13.73% | 11.11% | 14.37% | 14.09% | 14.69% | 14.22% |

| Equity: Value | 13.66% | 11.51% | 17.56% | 16.47% | 17.04% | 15.96% |

| Equity: Mid Cap | 16.32% | 12.9% | 19.73% | 19.88% | 21.81% | 19.09% |

| Equity: Multi Cap | 14.19% | 12.06% | 17.37% | 17.9% | 18.35% | 16.44% |

| Equity: Contra | 16.65% | 12.43% | 18.23% | 18.71% | 20.74% | 19.01% |

| Equity: Dividend Yield | 12.87% | 10.0% | 15.14% | 16.66% | 17.67% | 16.04% |

| Equity: Focused | 13.7% | 11.0% | 15.69% | 15.26% | 15.85% | 15.27% |

| Equity: Index | 11.73% | 9.06% | 15.41% | 14.76% | 15.01% | 13.87% |

| Category | Any 1Y SIP | Any 2Y 目↑ SIP | Any 3Y 目↑ SIP | Any 5Y 目↑ SIP | Any 7Y 目↑ SIP | Any 10Y 目↑ SIP |

|---|---|---|---|---|---|---|

| Equity: Large Mid Cap | 14.32% | 10.52% | 16.52% | 17.49% | 19.2% | 17.42% |

| Equity: Sectoral or Thematic | 12.6% | 10.69% | 16.12% | 17.17% | 19.05% | 17.15% |

| Equity: Flexi Cap | 12.87% | 9.54% | 14.62% | 15.62% | 17.26% | 16.36% |

| Equity: ELSS | 13.71% | 10.22% | 15.53% | 16.02% | 17.82% | 16.56% |

| Equity: Large Cap | 13.73% | 10.0% | 14.33% | 14.62% | 15.98% | 15.12% |

| Equity: Value | 13.66% | 9.48% | 16.32% | 17.63% | 19.35% | 17.11% |

| Equity: Mid Cap | 16.32% | 11.65% | 18.4% | 19.62% | 22.22% | 19.55% |

| Equity: Multi Cap | 14.19% | 10.39% | 15.9% | 17.12% | 20.07% | 18.09% |

| Equity: Contra | 16.65% | 10.79% | 17.71% | 19.6% | 21.73% | 19.67% |

| Equity: Dividend Yield | 12.87% | 9.19% | 15.5% | 18.37% | 20.48% | 18.04% |

| Equity: Focused | 13.7% | 9.93% | 15.06% | 15.82% | 17.54% | 16.24% |

| Equity: Index | 11.73% | 9.07% | 14.77% | 14.36% | 14.96% | 14.18% |

| Category | Any 1Y | Any 2Y | Any 3Y | Any 5Y | Any 7Y | Any 10Y |

|---|---|---|---|---|---|---|

| Equity: Large Mid Cap | 10.37% | 16.32% | 18.98% | 18.37% | 17.37% | 15.9% |

| Equity: Sectoral or Thematic | 8.95% | 16.84% | 18.1% | 16.85% | 16.26% | 15.24% |

| Equity: Flexi Cap | 10.19% | 14.86% | 16.36% | 15.77% | 15.78% | 15.22% |

| Equity: ELSS | 10.9% | 15.09% | 16.82% | 16.77% | 16.19% | 15.51% |

| Equity: Large Cap | 10.52% | 14.21% | 14.52% | 14.3% | 14.01% | 14.2% |

| Equity: Value | 10.26% | 15.8% | 18.05% | 16.32% | 15.5% | 15.31% |

| Equity: Mid Cap | 13.65% | 19.25% | 22.03% | 20.79% | 20.04% | 17.83% |

| Equity: Multi Cap | 10.53% | 17.78% | 18.86% | 17.88% | 16.71% | 16.2% |

| Equity: Contra | 13.97% | 17.1% | 18.91% | 19.79% | 19.48% | 18.21% |

| Equity: Dividend Yield | 10.06% | 15.62% | 17.36% | 18.83% | 15.78% | 15.27% |

| Equity: Focused | 10.64% | 14.77% | 17.17% | 16.59% | 15.26% | 15.34% |

| Equity: Index | 6.57% | 15.02% | 16.99% | 15.59% | 13.92% | 13.53% |

| Category | Any 1Y SIP | Any 2Y SIP | Any 3Y SIP | Any 5Y SIP | Any 7Y SIP | Any 10Y SIP |

|---|---|---|---|---|---|---|

| Debt: Medium To Long Duration | 6.72% | 6.41% | 7.42% | 6.95% | 6.73% | 6.89% |

| Debt: Liquid | 6.5% | 6.51% | 6.49% | 6.13% | 5.87% | 5.97% |

| Debt: Gilt | 7.24% | 6.55% | 7.46% | 7.24% | 7.01% | 7.17% |

| Debt: Medium Duration | 8.12% | 7.95% | 7.83% | 6.69% | 6.44% | 7.26% |

| Debt: Money Market | 7.19% | 7.22% | 7.21% | 6.96% | 6.55% | 6.55% |

| Debt: Long Duration | 7.04% | 7.37% | 7.49% | 7.65% | 7.52% | 7.41% |

| Debt: Dynamic Bond | 7.06% | 7.05% | 7.54% | 7.21% | 6.92% | 7.2% |

| Debt: Low Duration | 7.64% | 7.93% | 7.73% | 7.12% | 6.93% | 6.8% |

| Debt: Corporate Bond | 7.46% | 7.75% | 7.54% | 7.3% | 7.28% | 7.35% |

| Debt: Ultra Short Duration | 6.78% | 6.59% | 6.7% | 6.7% | 6.46% | 6.37% |

| Debt: Banking And PSU | 7.5% | 7.67% | 7.72% | 7.11% | 7.1% | 7.14% |

| Debt: Overnight | 5.34% | 5.76% | 5.93% | 5.93% | 5.47% | 5.38% |

| Debt: Gilt Fund With 10 Year Constant Duration | 8.49% | 8.22% | 8.2% | 8.78% | 7.89% | 7.56% |

| Debt: Floater | 6.99% | 7.61% | 7.91% | 7.38% | 7.33% | 7.38% |

| Debt: Short Duration | 7.78% | 7.8% | 7.7% | 7.28% | 6.89% | 7.18% |

| Debt: Credit Risk | 8.59% | 9.45% | 8.89% | 8.16% | 7.74% | 7.52% |

| Debt: Index | 8.13% | 8.34% | 7.86% | 0% | 0% | 0% |

| Category | Any 1Y SIP | Any 2Y 目↑ SIP | Any 3Y 目↑ SIP | Any 5Y 目↑ SIP | Any 7Y 目↑ SIP | Any 10Y 目↑ SIP |

|---|---|---|---|---|---|---|

| Debt: Medium To Long Duration | 6.72% | 6.08% | 6.79% | 6.88% | 6.88% | 6.9% |

| Debt: Liquid | 6.5% | 6.56% | 6.68% | 6.48% | 6.07% | 6.03% |

| Debt: Gilt | 7.24% | 5.6% | 6.33% | 6.49% | 6.52% | 6.87% |

| Debt: Medium Duration | 8.12% | 8.48% | 8.28% | 7.71% | 7.39% | 7.4% |

| Debt: Money Market | 7.19% | 7.36% | 7.47% | 7.02% | 6.65% | 6.63% |

| Debt: Long Duration | 7.04% | 6.9% | 6.83% | 6.72% | 6.64% | 6.9% |

| Debt: Dynamic Bond | 7.06% | 6.79% | 7.21% | 7.03% | 6.97% | 7.14% |

| Debt: Low Duration | 7.64% | 8.08% | 7.97% | 7.33% | 7.05% | 6.86% |

| Debt: Corporate Bond | 7.46% | 8.11% | 8.08% | 7.35% | 7.2% | 7.36% |

| Debt: Ultra Short Duration | 6.78% | 7.31% | 7.33% | 6.94% | 6.68% | 6.43% |

| Debt: Banking And PSU | 7.5% | 7.83% | 7.81% | 7.22% | 7.09% | 7.18% |

| Debt: Overnight | 5.34% | 6.0% | 6.16% | 5.96% | 5.53% | 5.42% |

| Debt: Gilt Fund With 10 Year Constant Duration | 8.49% | 7.43% | 7.86% | 7.14% | 6.93% | 7.35% |

| Debt: Floater | 6.99% | 8.15% | 8.21% | 7.59% | 7.38% | 7.46% |

| Debt: Short Duration | 7.78% | 8.02% | 7.95% | 7.46% | 7.27% | 7.29% |

| Debt: Credit Risk | 8.59% | 10.31% | 10.08% | 9.01% | 8.47% | 8.02% |

| Debt: Index | 8.13% | 8.36% | 7.83% | 0% | 0% | 0% |

| Category | Any 1Y | Any 2Y | Any 3Y | Any 5Y | Any 7Y | Any 10Y |

|---|---|---|---|---|---|---|

| Debt: Medium To Long Duration | 7.41% | 7.64% | 7.45% | 6.44% | 7.11% | 7.19% |

| Debt: Liquid | 6.65% | 6.7% | 6.47% | 5.78% | 5.78% | 6.28% |

| Debt: Gilt | 7.33% | 7.76% | 7.79% | 7.47% | 7.79% | 7.86% |

| Debt: Medium Duration | 8.02% | 8.17% | 7.81% | 6.69% | 6.96% | 7.52% |

| Debt: Money Market | 7.35% | 7.4% | 7.24% | 6.46% | 6.7% | 6.9% |

| Debt: Long Duration | 7.67% | 8.71% | 8.24% | 7.36% | 8.33% | 7.95% |

| Debt: Dynamic Bond | 7.3% | 7.97% | 7.84% | 6.97% | 7.4% | 7.69% |

| Debt: Low Duration | 7.77% | 8.09% | 7.6% | 6.79% | 6.87% | 7.1% |

| Debt: Corporate Bond | 7.87% | 8.13% | 7.68% | 7.14% | 7.66% | 7.81% |

| Debt: Ultra Short Duration | 6.89% | 6.64% | 6.68% | 6.3% | 6.5% | 6.64% |

| Debt: Banking And PSU | 7.73% | 7.94% | 7.71% | 6.88% | 7.55% | 7.53% |

| Debt: Overnight | 5.48% | 5.87% | 5.81% | 5.28% | 5.17% | 5.61% |

| Debt: Gilt Fund With 10 Year Constant Duration | 8.66% | 8.95% | 9.01% | 8.97% | 8.64% | 8.38% |

| Debt: Floater | 7.09% | 7.57% | 7.81% | 6.89% | 7.45% | 7.58% |

| Debt: Short Duration | 7.95% | 7.89% | 7.77% | 7.04% | 7.32% | 7.57% |

| Debt: Credit Risk | 8.72% | 9.37% | 8.73% | 7.99% | 7.2% | 7.62% |

| Debt: Index | 8.22% | 8.55% | 7.84% | 0% | 0% | 0% |

| Category | Any 1Y SIP | Any 2Y SIP | Any 3Y SIP | Any 5Y SIP | Any 7Y SIP | Any 10Y SIP |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 12.08% | 10.31% | 14.37% | 14.57% | 15.07% | 14.16% |

| Hybrid: Conservative | 8.63% | 8.06% | 9.17% | 8.71% | 8.91% | 8.61% |

| Hybrid: Equity Savings | 9.7% | 8.91% | 10.08% | 9.82% | 10.1% | 9.46% |

| Hybrid: Arbitrage | 6.46% | 6.71% | 6.58% | 6.36% | 6.23% | 6.29% |

| Hybrid: Balanced | 8.83% | 10.83% | 0% | 0% | 0% | 0% |

| Category | Any 1Y SIP | Any 2Y 目↑ SIP | Any 3Y 目↑ SIP | Any 5Y 目↑ SIP | Any 7Y 目↑ SIP | Any 10Y 目↑ SIP |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 12.08% | 9.79% | 13.69% | 14.34% | 15.55% | 14.64% |

| Hybrid: Conservative | 8.63% | 7.63% | 8.98% | 8.88% | 9.15% | 8.78% |

| Hybrid: Equity Savings | 9.7% | 8.71% | 10.21% | 9.91% | 10.28% | 9.55% |

| Hybrid: Arbitrage | 6.46% | 7.04% | 7.3% | 6.97% | 6.61% | 6.48% |

| Hybrid: Balanced | 8.83% | 10.82% | 0% | 0% | 0% | 0% |

| Category | Any 1Y | Any 2Y | Any 3Y | Any 5Y | Any 7Y | Any 10Y |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 9.79% | 13.69% | 14.65% | 14.43% | 14.07% | 13.72% |

| Hybrid: Conservative | 8.06% | 9.45% | 9.46% | 8.82% | 8.73% | 8.63% |

| Hybrid: Equity Savings | 8.59% | 10.29% | 10.38% | 9.9% | 9.69% | 9.15% |

| Hybrid: Arbitrage | 6.57% | 7.01% | 6.5% | 6.04% | 6.11% | 6.41% |

| Hybrid: Balanced | 9.88% | 14.89% | 0% | 0% | 0% | 0% |

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” - Peter Lynch

Market corrections are normal and frequent. As we have shown in this previous post, What returns should we expect from equity investing?, we have estimated the returns you can get based on the holding period for lump sum and SIP investments. The risk, for example, a 30% fall every 2 years, has two implications:

Investors should note that creating a portfolio of ₹10 crores is simple in principle, but not easy and is very different from choosing a bunch of funds randomly and starting an SIP. A lot of things have to happen right for this to happen:

These are the tools that help manage the risk of the portfolio irrespective of where the market is going:

Retirement Corpus = Years In Retirement x Inflation Effect Until Retirement Starts x Annual Expenses in Retirement

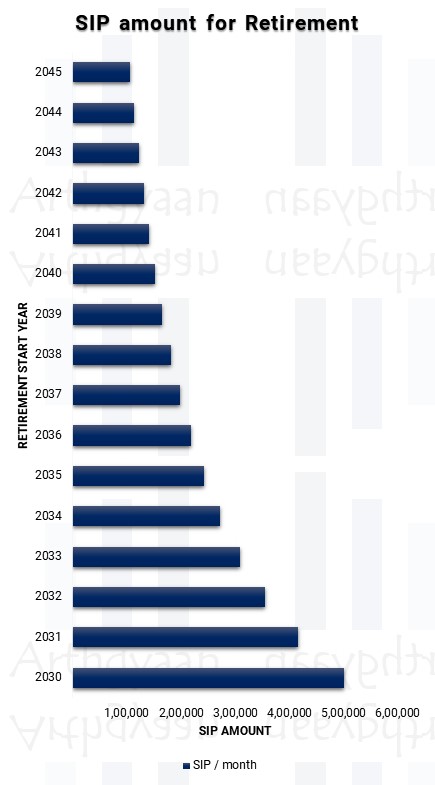

₹10 Crores as a retirement corpus came out of two inputs: when does the retirement start, and how much is to be spent in retirement.

If your retirement starts today, and you plan to spend the same ₹1 lakh/month, then the corpus needed is ₹3.6 crores for 30 years since the inflation factor is not applicable:

Corpus = 30 x 1 x 12 = 3.6 crores

Similarly, if your retirement starts 5 years from now, and you plan to spend the same ₹1 lakh/month, then the corpus needed is more since the inflation factor is applicable as 1.07 to the power of 5 = 1.4, assuming 7% inflation for the next 5 years:

Corpus = 30 x 1.4 x 12 = 5 crores

You can use the calculator at the top of this page to check the retirement target for yourself.

The Arthgyaan Package is a structured investment plan for retirement, ensuring financial security in later years through systematic wealth accumulation.

Each package encapsulates the portfolio creation assumptions (equity / debt / cash asset returns, inflation, longevity and rebalancing plan) and creates a mutual fund (and EPF, PPF and NPS if applicable) portfolio.

Rebalancing is done annually or when asset classes drift by more than 5% due to market fluctuations.

Each portfolio has assets that are allocated into the three buckets and comes with the rebalancing plan as above.

You can look at Arthgyaan Packages for making your retirement planning simpler. Each Arthgyaan Package is a structured investment plan for retirement, ensuring financial security in later years through systematic wealth accumulation tagged to a particular retirement year. A package encapsulates the portfolio creation assumptions (equity / debt / cash asset returns, inflation, longevity and rebalancing plan) and creates a mutual fund (and EPF, PPF and NPS if applicable) portfolio. Choose the year closest to your desired retirement year to get started:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can Investors in Their 40s Who Have Not Invested Before Reach ₹10 Crores Before Retiring? first appeared on 07 Dec 2025 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.