Step Up SWP Calculator (with Inflation and Capital Gains Tax)

Total Withdrawal (₹):

Remaining Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

Capital Gains Tax paid (₹):

Also try out our Monte Carlo simulation-based FIRE calculator.

If you are looking to understand how to best manage your mutual fund portfolio, you can get a free Mutual fund portfolio review.

What is a step-up SWP?

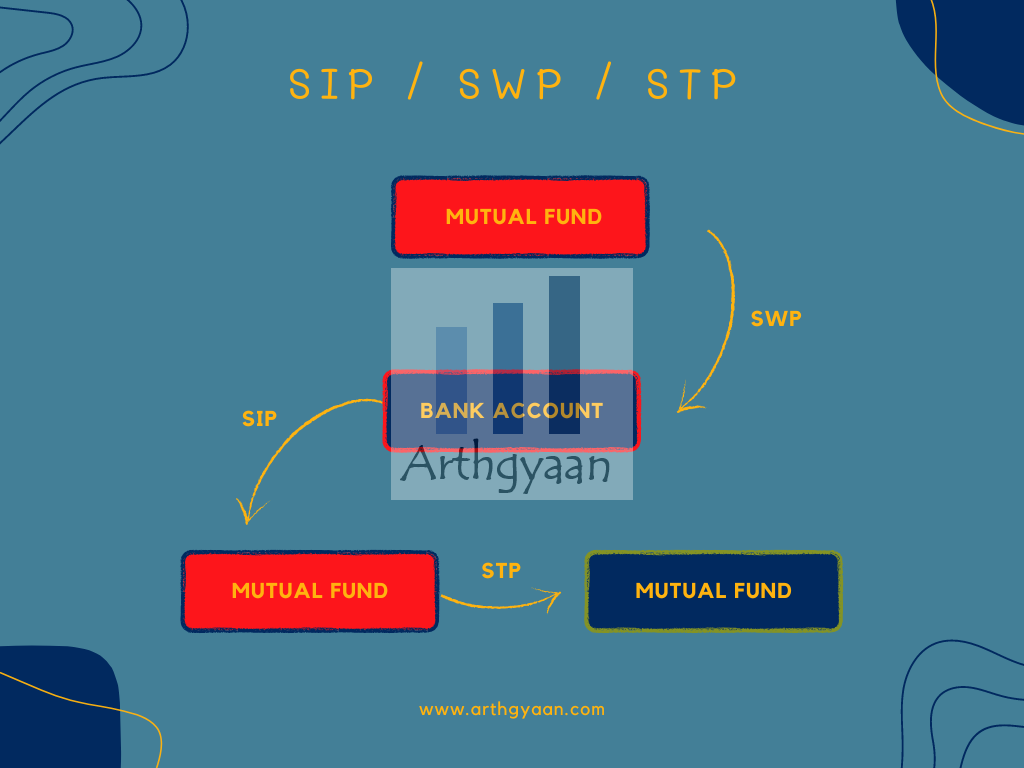

All of these are standing instructions that get executed as per a schedule you specify:

- Systematic Investment Plan (SIP): Money from a bank account is invested into a mutual fund, typically once a month

- Systematic Transfer Plan (STP): Units from a mutual fund are redeemed to invest in another mutual fund of the same AMC

- Systematic Withdrawal Plan (SWP): This is the reverse of the SIP. You sell the units from a mutual fund to send money to a bank account

A SWP is an instruction to a mutual fund to sell a units worth a fixed amount of money, typically every month, to give you income in retirement. The amount invested stays the same every month.

A step-up SWP is a retirement income tool where you increase the monthly amount withdrawn, say by 5% or 10%, every year from your mutual funds. This way your income in retirement keeps pace with inflation.

You can see how the monthly amounts in a SWP and step-up SWP change like this:

| Year | SWP per month | 10% Step-up SWP per month |

|---|---|---|

| 1 | 1,00,000 | 1,00,000 |

| 2 | 1,00,000 | 1,10,000 |

| 3 | 1,00,000 | 1,21,000 |

| 4 | 1,00,000 | 1,33,100 |

| 5 | 1,00,000 | 1,46,410 |

| 6 | 1,00,000 | 1,61,051 |

| 7 | 1,00,000 | 1,77,156 |

| 8 | 1,00,000 | 1,94,872 |

| 9 | 1,00,000 | 2,14,359 |

| 10 | 1,00,000 | 2,35,795 |

To understand more about SWP, please refer to these articles:

- Can you run a SWP from mutual funds when you are retired?

- What happens if you do an SWP from an index fund in retirement?

How to use the Arthgyaan step-up SWP calculator?

You need to enter just these numbers to get started with the Arthgyaan step-up SIP calculator:

- Starting Lump Sum: This is the money that you already have as your retirement corpus

- Monthly SWP Amount: This is the money you will withdraw every month in the first year

- Time Period (Years): Your step-up SWP will run for these many years. For most people this will be until the end of the projected lifespan of the younger spouse

These inputs are optional and can be left as-is

- Annual Step-Up: This is the step-up amount. You will increase the SWP amount by this amount next year to adjust for general (food, clothing, utilities, entertainment), lifestyle (travel) and medical inflation

- Expected Rate of Return: Enter the return you think you will get. 12% is a typical number but it will vary year-on-year. We will keep this number fixed but in real life it will fluctuate year-on-year

- Inflation Rate: This is how much the value of the corpus will reduce due to inflation (prices of things going up over time). This will give you a more realistic value of how much you will leave behind, in today’s money, for your children

How to understand the results of the Arthgyaan step-up SWP calculator?

The output of the Arthgyaan step-up SWP calculator has two easy to understand parts:

- a ring chart that shows how much your took out as income vs. the amount left over in the mutual fund

- four numbers that we now explain below

These are the numbers that have the result of the Arthgyaan step-up SWP calculator:

- Total Withdrawal: This is the total amount that you will take out of your mutual funds over your retirement

- Remaining Value: This is the final amount that you are expected to be left with that will go to your children and legal heirs

- Inflation-Adjusted Value: This is the remaining value left over after you adjust for prices going up over time

- Uncertainty-Adjusted Range: Arthgyaan is proud to say that the Arthgyaan step-up SWP calculator is the first to show the uncertainty of investing in the stock market by showing you a range of numbers for the corpus you are expected to leave behind after adjusting for inflation. The range will change every time you recalculate

- Capital Gains Tax: We also provide a way to get a simple estimate of the total capital gains tax you need to pay.

To understand more about Uncertainty-Adjusted Range, please refer to our detailed article that will help you adjust your expectations from investing in the stock market:

- The lie of enjoying financial freedom via SWP from mutual funds

- The lie of wealth-creation via SIP in mutual funds

What's next? You can join the Arthgyaan WhatsApp community

You can stay updated on our latest content and learn about our webinars. Our community is fully private so that no one, other than the admin, can see your name or number. Also, we will not spam you.For resident Indians 🇮🇳:

For NRIs 🇺🇸🇬🇧🇪🇺🇦🇺🇦🇪🇸🇬: To understand how this article can help you:

If you have a comment or question about this article

The following button will open a form with the link of this page populated for context:If you liked this article, please leave us a rating

The following button will take you to Trustpilot:Check out our two calculators: Arthgyaan step-up SIP calculator

Arthgyaan step-up SWP calculator

Latest articles:

Topics you will like:

Asset Allocation (19) Basics (8) Behaviour (20) Budget (24) Budgeting (12) Calculator (36) Case Study (7) Children (22) Choosing Investments (40) FAQ (20) FIRE (19) Fixed Deposit (10) Free Planning Tool (16) Gold (29) Health Insurance (8) House Purchase (43) Index Funds (6) Insurance (20) International Investing (16) Life Stages (2) Loans (27) Market Data (10) Market Movements (28) Mutual Funds (89) NPS (17) NRI (44) News (38) Pension (11) Portfolio Construction (61) Portfolio Review (32) Reader Questions (9) Real Estate (16) Research (6) Retirement (45) Return to India (8) Review (27) Risk (8) Safe Withdrawal Rate (6) Screener (8) Senior Citizens (6) Set Goals (29) Step by step (15) Stock Investing (5) Tax (108)Next steps:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Step Up SWP Calculator with Inflation and Tax first appeared on 15 Dec 2025 at https://arthgyaan.com

We are currently at 566 posts and growing fast. Search this site: Copyright © 2021-2025 Arthgyaan.com. All rights reserved.