Can you run a SWP from mutual funds when you are retired?

This article shows the maximum withdrawal in SWP form that you can take out from a retirement portfolio to make it last 30 years.

This article shows the maximum withdrawal in SWP form that you can take out from a retirement portfolio to make it last 30 years.

This article is a part of our detailed article series on Safe Withdrawal Rates. Ensure you have read the other parts here:

This article brings together the interrelationship between the size of the retirement corpus, inflation, asset returns, longevity and the amount you wish to spend in retirement.

This article shows how much you can withdraw from an equity mutual fund if you have a pension plan as well in retirement.

We examine the results of running a long-term SWP in index funds for retirement.

This article shows that if you decide to retire today, how long will the corpus last realistically based on real rates of return.

The article investigates if you can retire in India with only 25x your expenses saved as retirement corpus.

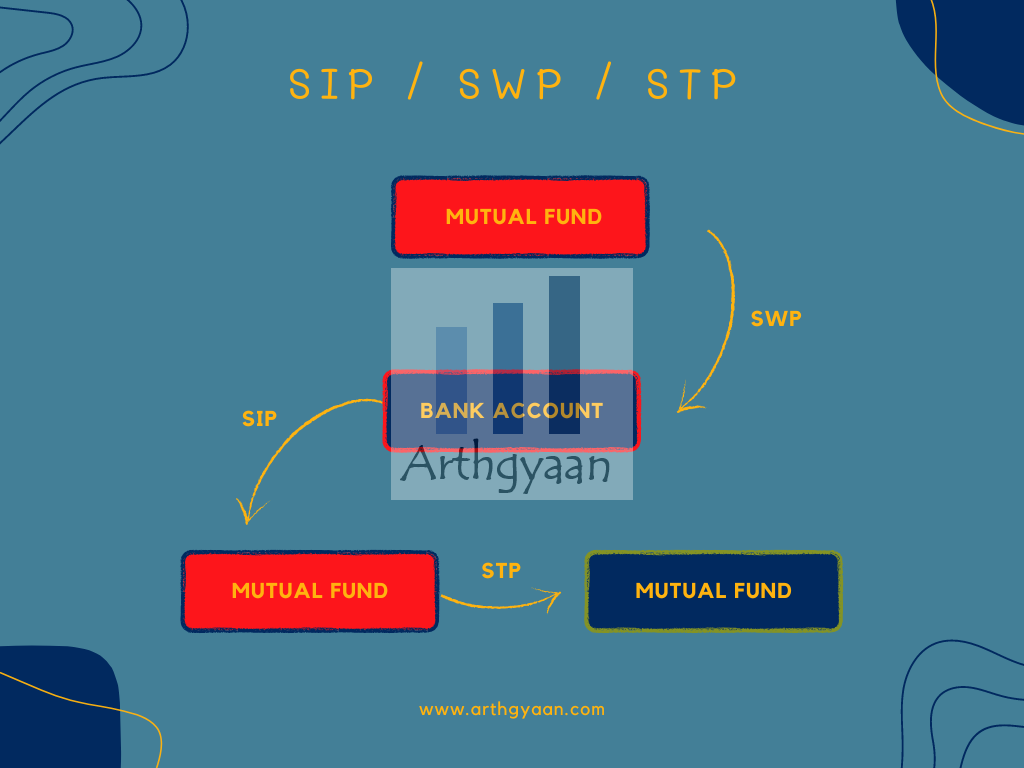

All of these are standing instructions that get executed as per a schedule you specify:

In this article, we will see if you can have an SWP during retirement to fund in-retirement expenses. Here the success criterion is:

There should be multiple other income sources in a retirement portfolio like a pension plan, SCSS, Post Office MIS, RBI bonds or bank FD. We will see how much of the additional income can be funded via SWP and what the minimum return should be expected from the fund(s) from which the SWP is running.

We will assume that the first year’s withdrawal to be a value between 1% and 5%. The withdrawal amount will be increased by inflation every year. As a practical example, we will take

| Start | ₹ 1,00,00,000 |

|---|---|

| Withdrawals ⬇️ | – |

| Year 1 | ₹ 2,50,000 |

| Year 2 | ₹ 2,67,500 |

| Year 3 | ₹ 2,86,225 |

| Year 4 | ₹ 3,06,261 |

| Year 5 | ₹ 3,27,699 |

Astute readers will notice that this 2.5 lakhs out of one crore withdrawal increasing at inflation is equivalent to a 2.5% safe withdrawal rate (SWR) and the starting corpus is 1/2.5% = 40x expenses.

We see that a 5% return from the corpus, post-tax, is sufficient to fund the withdrawals for 30 years.

| Year | Withdrawal | Portfolio value* |

|---|---|---|

| Year 1 | ₹ 2,50,000 | ₹ 1,02,37,500 |

| Year 2 | ₹ 2,67,500 | ₹ 1,04,68,500 |

| Year 3 | ₹ 2,86,225 | ₹ 1,06,91,389 |

| Year 4 | ₹ 3,06,261 | ₹ 1,09,04,384 |

| Year 5 | ₹ 3,27,699 | ₹ 1,11,05,520 |

| Year 6 | ₹ 3,50,638 | ₹ 1,12,92,626 |

| Year 7 | ₹ 3,75,183 | ₹ 1,14,63,315 |

| Year 8 | ₹ 4,01,445 | ₹ 1,16,14,964 |

| Year 9 | ₹ 4,29,547 | ₹ 1,17,44,688 |

| Year 10 | ₹ 4,59,615 | ₹ 1,18,49,327 |

| Year 11 | ₹ 4,91,788 | ₹ 1,19,25,416 |

| Year 12 | ₹ 5,26,213 | ₹ 1,19,69,163 |

| Year 13 | ₹ 5,63,048 | ₹ 1,19,76,421 |

| Year 14 | ₹ 6,02,461 | ₹ 1,19,42,658 |

| Year 15 | ₹ 6,44,634 | ₹ 1,18,62,925 |

| Year 16 | ₹ 6,89,758 | ₹ 1,17,31,826 |

| Year 17 | ₹ 7,38,041 | ₹ 1,15,43,474 |

| Year 18 | ₹ 7,89,704 | ₹ 1,12,91,459 |

| Year 19 | ₹ 8,44,983 | ₹ 1,09,68,799 |

| Year 20 | ₹ 9,04,132 | ₹ 1,05,67,901 |

| Year 21 | ₹ 9,67,421 | ₹ 1,00,80,504 |

| Year 22 | ₹ 10,35,141 | ₹ 94,97,631 |

| Year 23 | ₹ 11,07,600 | ₹ 88,09,532 |

| Year 24 | ₹ 11,85,132 | ₹ 80,05,620 |

| Year 25 | ₹ 12,68,092 | ₹ 70,74,405 |

| Year 26 | ₹ 13,56,858 | ₹ 60,03,424 |

| Year 27 | ₹ 14,51,838 | ₹ 47,79,165 |

| Year 28 | ₹ 15,53,467 | ₹ 33,86,983 |

| Year 29 | ₹ 16,62,210 | ₹ 18,11,012 |

| Year 30 | ₹ 17,78,564 | ₹ 34,070 |

In the table below, we have summarized the returns you need for a 30-year SWP.

| SWR | Minimum Return |

|---|---|

| 2.0% | 3.6% |

| 2.5% | 5.0% |

| 3.0% | 6.3% |

| 3.5% | 7.4% |

| 4.0% | 8.5% |

| 4.5% | 9.4% |

| 5.0% | 10.3% |

This table shows that if you are planning to withdraw in SWP form, then you cannot withdraw more than the rate in the SWR column.

Readers should note that these returns are post-tax and beyond 6% will not be guaranteed. We will provide a few options for each case for investing the retirement corpus. Your SWR will be slightly lower than half in each case.

In a future article, we will consider those cases where the minimum return exceeds 6%. It is not possible to get a guaranteed return beyond these values.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Can you run a SWP from mutual funds when you are retired? first appeared on 04 Sep 2022 at https://arthgyaan.com