How can children help their retired parents to set up their finances?

This article shows the steps to set up an investment portfolio for retirees with the help of their children.

This article shows the steps to set up an investment portfolio for retirees with the help of their children.

This article will cover cases where resident Indians, as opposed to NRIs whom we cover separately here, can ensure that their parents in India have regular income with the least possible setup and maintenance hassles, simple taxation and low to no activities needed in the physical world by focusing on online transactions.

We will focus on these investments’ simplicity, ease of maintenance and safety. We will avoid situations that involve running around by elders like:

The point of this article is not to imply that the children have more knowledge than the parents but to ensure both generations work together in the retirement plan.

We will explore the following options:

We will cover using the following flow:

Warning: The children should remember that their understanding of various investment options and risk tolerance will differ from their parents. Recommendations of investing in risky products, like equities and mutual funds, might be received with scepticism and mistrust regarding how the products work. In such cases, the children should not force the issue.

There is a word of caution as well. Retirees are a prime target for relationship managers for selling high commission, poor return products like ULIPs and endowment plans. Retirees need health insurance. They do not require life insurance.

Before creating a retirement corpus, ensure that these are in place:

Priority: Very high

A simple bank account transfer, automated using an NEFT standing instruction, will work if the parents are savvy with ATMs. Children can also pick up the bill payment (electricity, internet, mobile, DTH etc.) via their bank or bill payment apps.

There is no tax on the parents who receive money from their children.

Priority: Very high

An RBI-issued long-term government bond is a safe option that pays half-yearly interest (called a coupon) and gives back the principal at the end of the period. You can purchase this bond via RBI’s Retail Direct Scheme or brokers like Zerodha.

These bonds are available with maturities from 91 days to 40 years. Investments may range from ₹10,000 to ₹2 crores per PAN.

The most significant benefit of this scheme is that due to the government of India’s guarantee on coupon payments and return of principal, there is no risk of receiving interest and principal. You must remember that the interest payments are fixed and will not increase over time with inflation.

For example, if you buy a 2062, 7% coupon bond at ₹106 by investing ₹50 lakhs, then you get:

It will be prudent to hold these bonds in a joint mode with your parents so that transmission, in case of their demise, is hassle-free.

You can use this formula to calculate monthly income from bond price and coupon rate:

Monthly income = 100 * Coupon * Investment / Price / 12 * (1 - TaxRate)

Here, investment = 50 lakhs, price = 106, tax = 30%, coupon = 7% and hence the monthly income = 100 * 0.07 * 50,00,000 / 106 / 12 * (1 - 0.3) = ₹19,250

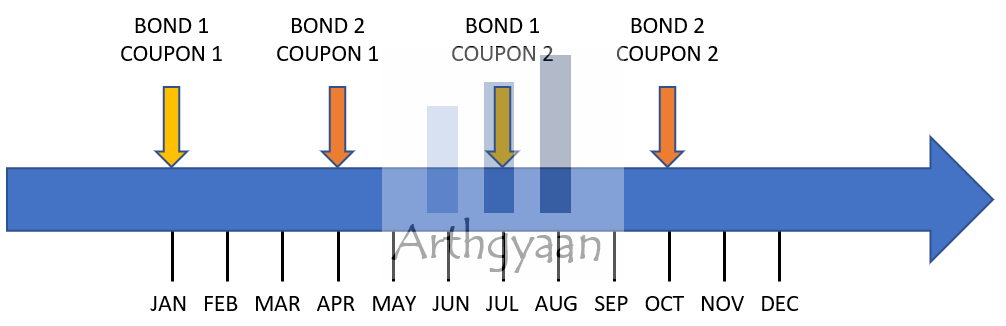

You can spread out buying the bond over a few months to allow income every few months like this:

The example above shows two bonds purchased three months apart, allowing interest payments every three months.

Steps to follow:

The concept of RBI bonds is explained in detail here: How to use the RBI Retail Direct Scheme to get guaranteed income?

Priority: High

Fixed deposits (FD) are a perennial favourite of retirees and offer higher rates, usually 0.5%. However, fixed deposits have a few pros and cons:

For banks, you should go with large banks like SBI, HDFC or ICICI (due to their SIFI status). Opening FD in these three banks will maximise peace of mind since these banks are considered too big to fail. One may argue that all banks are equally safe due to the existence of DICGC insurance up to ₹5 lakhs, but that might take longer than the proposed 90 days since liquidation proceedings may take longer. Ultimately, it is a case of, using a driving analogy, buying a high-safety car vs relying on others not hitting you on the road while driving.

Priority: High

There are a few schemes with minimal risk that you can consider:

The latest (as on 30-Sep-2025) rates are:

| Instrument | Rates of interest from 01-Oct-2025 to 31-Dec-2025 |

|---|---|

| Saving Deposit | 4.0% |

| 1 Year Time Deposit | 6.90% |

| 2 Year Time Deposit | 7.00% |

| 3 Year Time Deposit | 7.10% |

| 5 Year Time Deposit | 7.50% |

| 5 Year Recurring Deposit | 6.70% |

| Senior Citizen Savings Scheme (SCSS) | 8.20% |

| Monthly Income Account Scheme (MIS) | 7.40% |

| National Savings Certificate (NSC) | 7.70% |

| Public Provident Fund (PPF) scheme | 7.10% |

| Kisan Vikas Patra (KVP) | 7.50% (will mature in 115 months) |

| Sukanya Samriddhi Account (SSA) | 8.20% |

Source:: https://dea.gov.in/index.php/documents-orders-notices-dea

Priority: Medium

Pension plans that generate a fixed income for life may be an option for someone looking for an excellent fit-and-forget solution. You can gift the money to your parents and let them take a pension plan in their name. You should compare the annuity rate with the RBI bond return before purchasing.

There are a few problems:

Priority: High

Debt mutual funds are an excellent FD replacement from a safety, liquidity and taxation perspective if:

You can read more on this topic here: Mutual Fund vs Fixed Deposit - where should you invest?

On the other hand, equity mutual funds offer the potential for inflation-beating returns. As we have discussed in our post on retirement portfolio construction using buckets, equity MF is a part of the third bucket: How to plan for retirement using the bucket approach?.

Priority: Very low

We do not recommend that investors invest in direct stocks due to the research and tracking overhead involved. However, since stock dividends have the potential to provide inflation-indexed returns, you may consider if your parents are comfortable with the extra effort and risk.

Read more here on choosing dividend-paying stocks: How to plan for retirement/FIRE using dividend income?

Priority: Avoid

You should avoid these options at all costs:

We have discussed an alternative to most traditional safe investment options for seniors that you can refer here: Building Generational Wealth through an Alternative Retirement Portfolio Planning Technique

“nastiest, hardest problem in finance.” - William Sharpe, Nobel Prize winner, regarding the withdrawal stage of retirement

While this article talks about multiple options for investing, retirement portfolio construction is a bigger problem than “where to invest”. Rather instead, it needs to answer the following three questions:

The 3 bucket portfolio, which we have referenced once above, may be used to create such a resilient portfolio.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can children help their retired parents to set up their finances? first appeared on 17 Aug 2022 at https://arthgyaan.com