How to plan for retirement using the bucket approach?

Use the bucket theory of asset allocation to create a simple and stress-free retirement portfolio.

Use the bucket theory of asset allocation to create a simple and stress-free retirement portfolio.

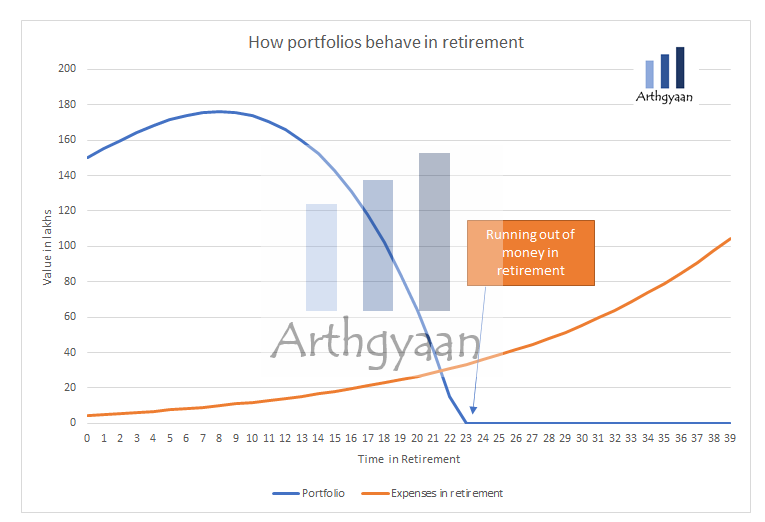

There are a lot of theories and complexities around retirement portfolio construction that involves complexities around debt to equity allocation, inflation assumptions and safe withdrawal rates (SWR). We have tackled some of these in a simplified manner in this post on retirement portfolio construction using Excel.

This post simplifies the problem further for someone ready to enter retirement by creating just three buckets of cash, bonds and equity for the construction of a retirement portfolio. This post is targeted at someone entering retirement anytime between today to a year from now. Anyone with retirement expected to start more than 1 year from now should simply follow this post instead. Please note that at all times, there should be adequate emergency fund, health insurance and personal accident insurance over and above the retirement portfolio. Ensure that the yearly budget includes health insurance premium. Once the buckets have been created then periodic review and rebalance must be done to ensure that risk is being managed. The Rebalance column in the Excel calculator will show how rebalancing is to be done. See this detailed post on how and when to do rebalancing.

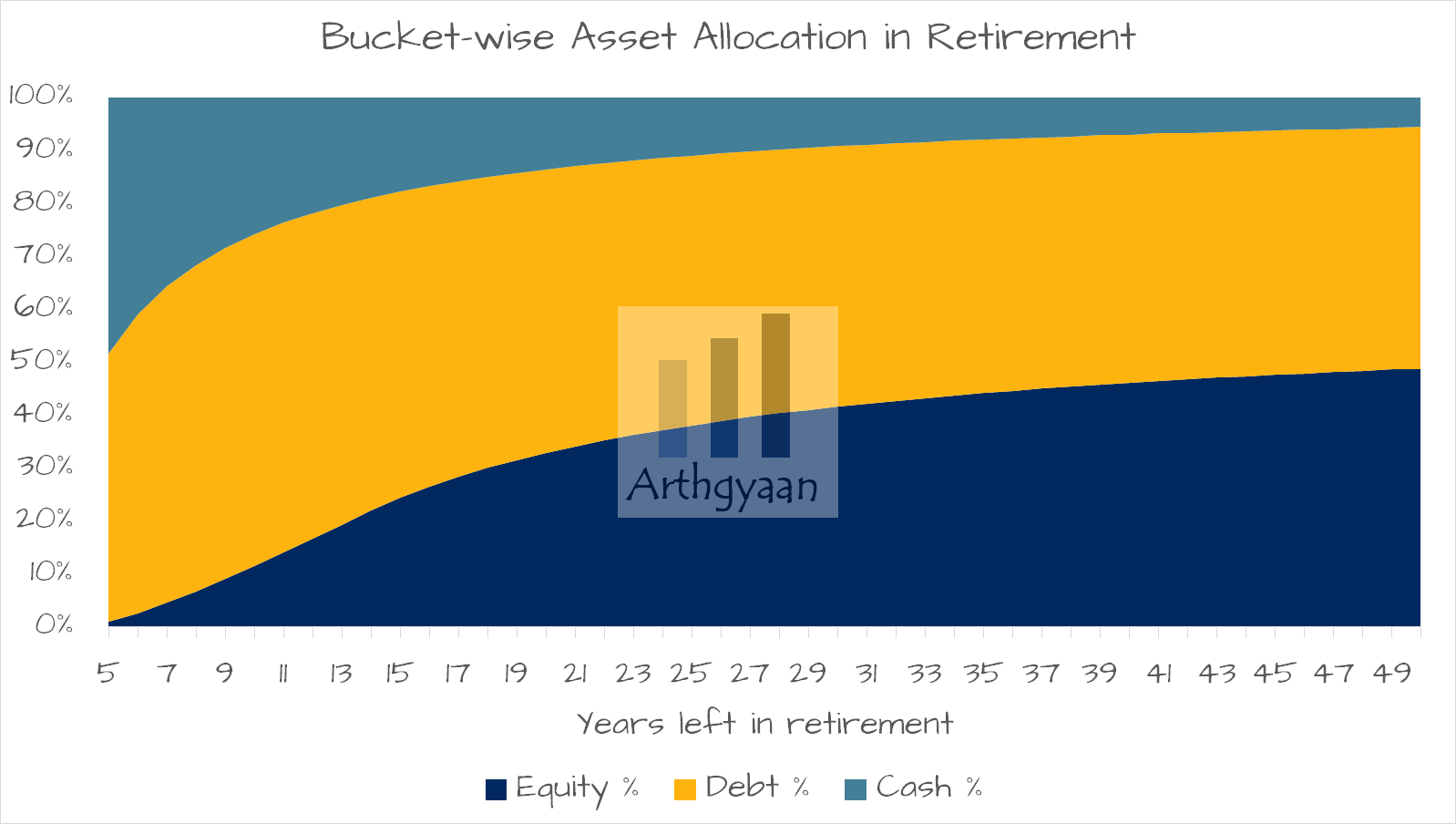

The amounts allocated to each bucket is calculated on the basis of appropriate asset allocation for each year of retirement and each year has its own glide-path and plan for rebalancing. The aggregate view for each year for cash, income and growth assets is summed up to create the buckets.

The purpose of this bucket will be to hold living expenses for the next 5 years. These living expenses are inflation-adjusted and will be based on the yearly expenses in the first year of retirement. Any interest payments, rents, pension income or dividends (all post-tax values) should be excluded from the value of the yearly expenses before finding out the amount to be saved in this bucket. Over time, these income sources are expected to grow at the after tax cost of debt.

For example, if living expenses in the first year of retirement is 60,000/month (7.2 lakhs/year) and post-tax pension, rent and interest payments of 3.2 lakhs/year are expected to be received yearly then we need to keep 29 lakhs in this bucket. Keep the money in big banks like SBI/HDFC/ICICI that are considered “too-big-to-fail” by RBI. This bucket, will also contain the emergency fund equal to 12 months of living expenses (7.2 lakhs in the example). Estimation of the expenses in retirement is covered in more detail here.

The cash bucket gives the peace of mind that a 2008 style crash in the equity markets will not require a fire sale of stock portfolio to fund regular expenses.

You can use an SWP to generate regular income from the cash bucket: SIP, SWP and STP - what do they mean, which one should you choose and when?.

The purpose of this bucket is to hold assets that generate income via

This income feeds down to bucket 1. This post has more details on the suitable debt instruments during retirement.

This bucket will have around 35-50% of the total retirement corpus.

This bucket will have everything that is not there in buckets 1 and 2 above. This bucket exists to provide growth that beats inflation over time. This is very important given the interest rates in India have been falling in line with global trends. Going forward, as India becomes more and more developed as an economy, interest rates are expected to remain low and investing in equity remains the only way to beat inflation. Choose equity funds from this framework. High dividend-paying stocks can be also included here however their price appreciation will not be as much as growth stocks.

We have calculated an optimal allocation of risky and lower-risk assets in this detailed post: How to construct buckets for your retirement portfolio?

In retirement, you do not need a salary but you need money for monthly expenses which will always come from Bucket 1. Instead of running an SWP (Systematic Withdrawal from mutual fund) from any of your buckets, you should withdraw as and when required.

A regular review process will need to be conducted every year to move money between the three buckets as per requirement. This is due to market movements in debt and equity funds as well as changing interest rates. Each rebalancing is handled first for each year in retirement and summed up to get the aggregate change at the bucket level.

If an asset is sold that gives rent or interest, it will impact bucket 1 value. So in that case, allocate like this: Asset value > Cash, Cash > other buckets. For example, when land is sold then add the post-tax sale value to cash and set the land value to 0. Then the sheet will again show you how much to sell from Bucket 1 to move into other buckets.

We give a walk-through of the worked-out example in this Excel workbook.

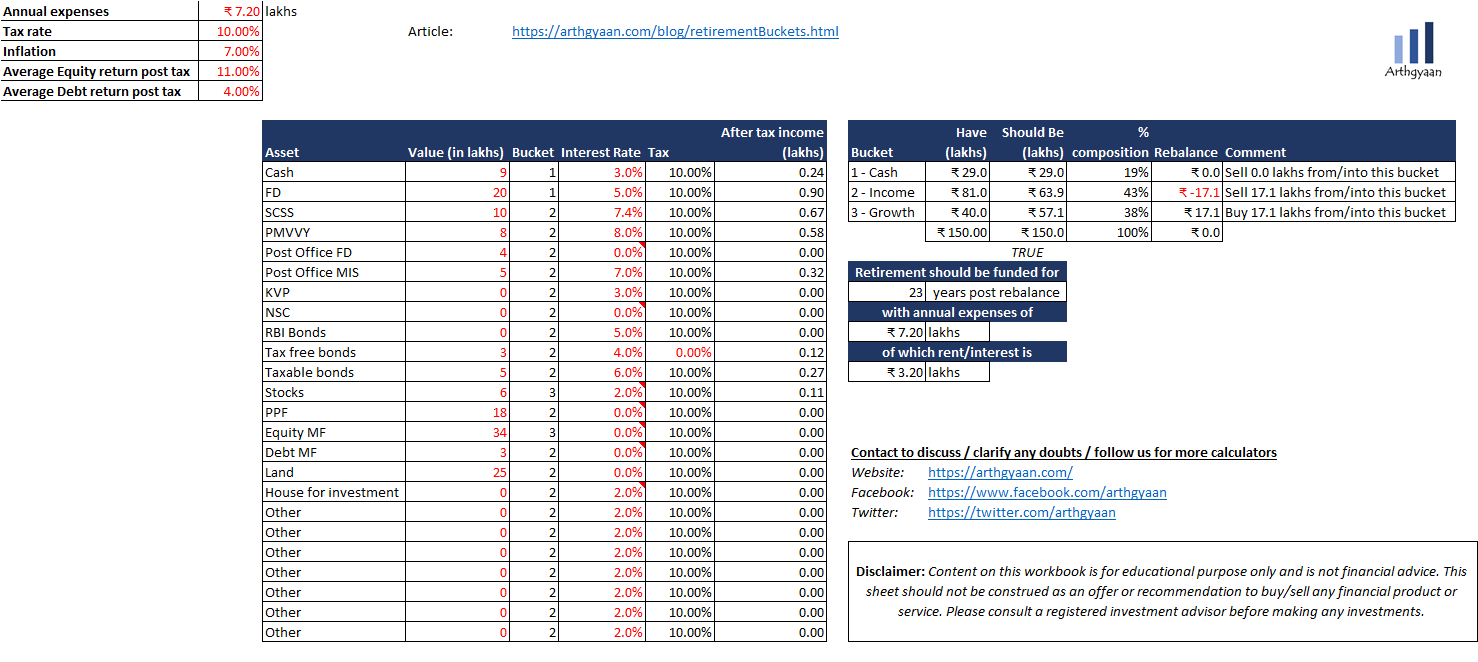

The annual expenses in the first year of retirement are assumed to be 7.2 lakhs with 7% overall inflation and equity/debt returns (after-tax) to be 11% and 4% respectively. The tax rate is assumed to be 10% (assets split between spouses to lower taxable income)

Here all the existing assets (total 1.5 crores) are entered along with their market value, interest rate and applicable tax rate. Please note that

This shows the current value in each of the three buckets (Have column). The “Should Be” column shows the value which should be as per the right asset allocation. The Rebalance column shows the amounts to be moved in and out of each bucket to maintain the correct asset allocation. After that, the “Retirement Should be Funded for” value shows how many years the corpus is expected to last. There is another alternative in constructing this portfolio using a pension plan. This post deals with retirement with pension.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to plan for retirement using the bucket approach? first appeared on 21 Jun 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.