Portfolio rebalancing during goal-based investing: why, when and how?

Rebalancing is a simple way to buy low and sell high while managing risk. Here’s how you do it.

Rebalancing is a simple way to buy low and sell high while managing risk. Here’s how you do it.

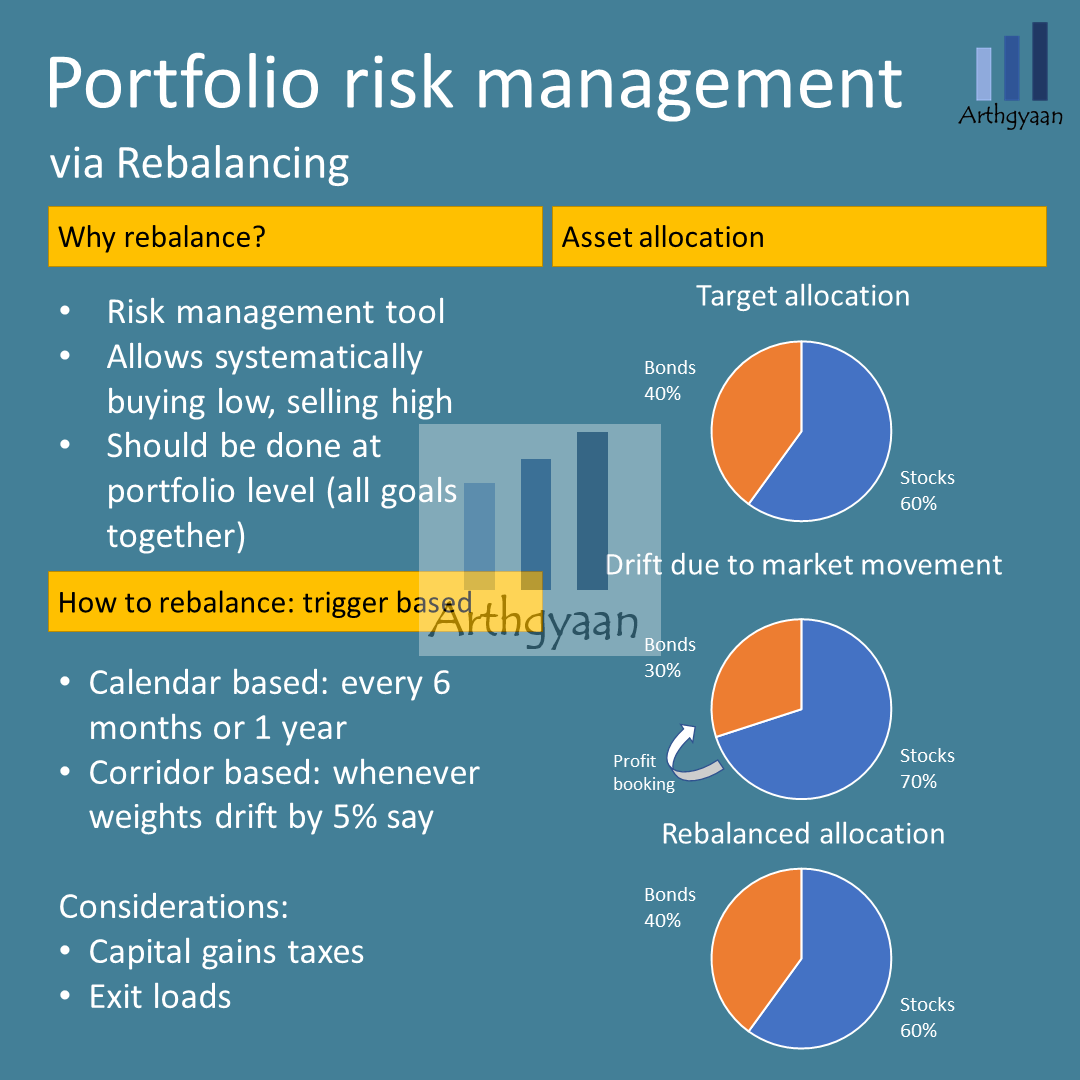

Rebalancing is a vital risk management tool to achieve one objective: portfolio risk over time needs to be managed per market movement and horizon of the goal. For example, bull markets make the portfolio’s equity component go up, increasing the portfolio’s risk once a market correction comes. Having the plan to rebalance from equity to debt manages this risk. Similarly, there is a buying opportunity in a bear market if you sell a part of debt holdings to buy equity. Also, as the goal comes closer, the portfolio’s risk must be lowered by lowering the equity component. Rebalancing allows this as well.

Rebalancing allows you to

Here is a detailed post on how to get your risk profile for any goal in case you want to review that first.

In general, rebalancing is a trade-off where you balance the effects of mean reversion (what goes up will eventually come down and vice versa) and momentum (what goes up/down will keep going up/down for some time). Thus, there is no need to time market top/bottom while rebalancing as long as a systematic process is followed.

Rebalancing removes key behavioural issues that affect investors:

For example, a starting portfolio with a 60:40 equity-to-debt ratio can become over time 70:30 due to market movement, i.e. equity going up faster than debt. However, your target asset allocation, which as per your risk profile, should be 60:40, has now changed. So you sell a part of your equity to buy into debt (one sell transaction followed by immediate buy once you have the money) to bring the balance back to 60:40. This allowed you to “book profits”, and you could sell high (since equity has gone up) and buy low (since the debt portion has not gone up that much.

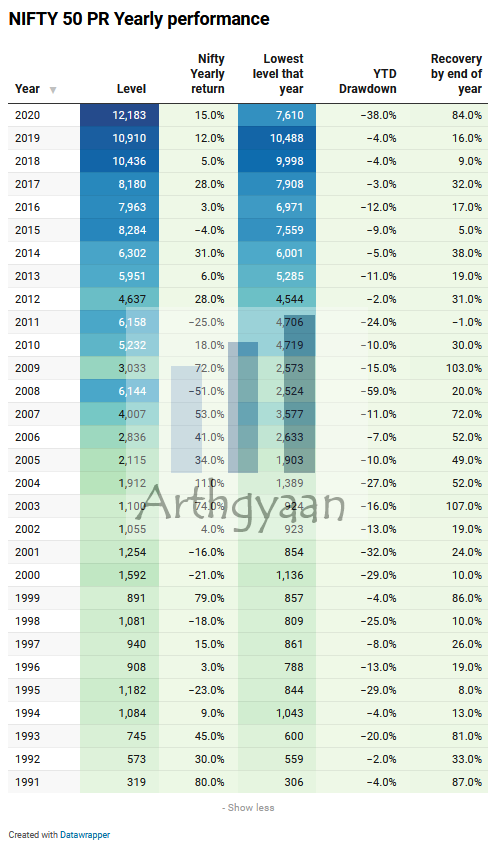

This works in reverse as well. Equity markets generally fall 10-15% annually, and opportunities keep arising (see image below).

This is where you can profitably use corridor rebalancing.

We have covered this particular topic in more detail in this post: Is there a correction in the stock markets?

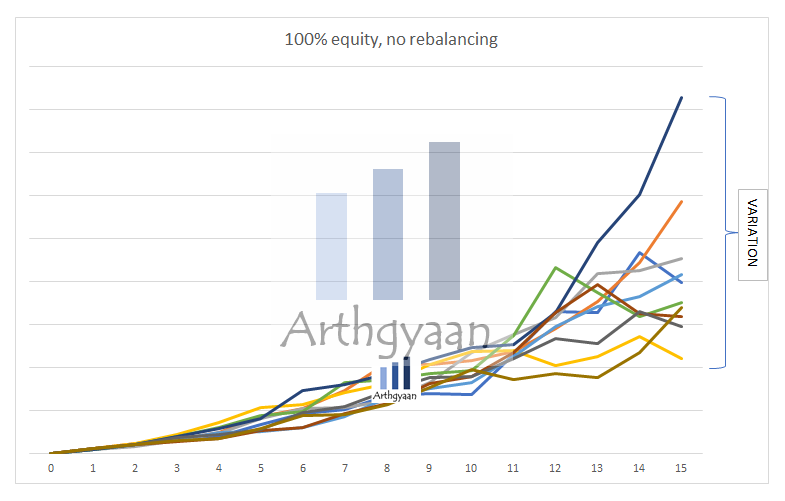

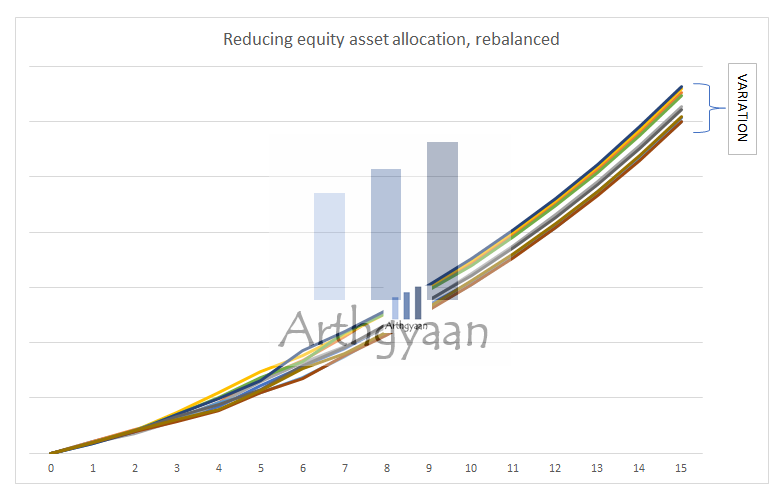

Here is an example of a 15,000/month SIP run for 15 years. The SIP amount is increased by 5% every year. The chart shows ten different possibilities assuming the average equity return is 11% post-tax and risk of 15%. The results are:

Here is our article about the danger of having only equity without rebalancing: The lie of wealth-creation via SIP in mutual funds

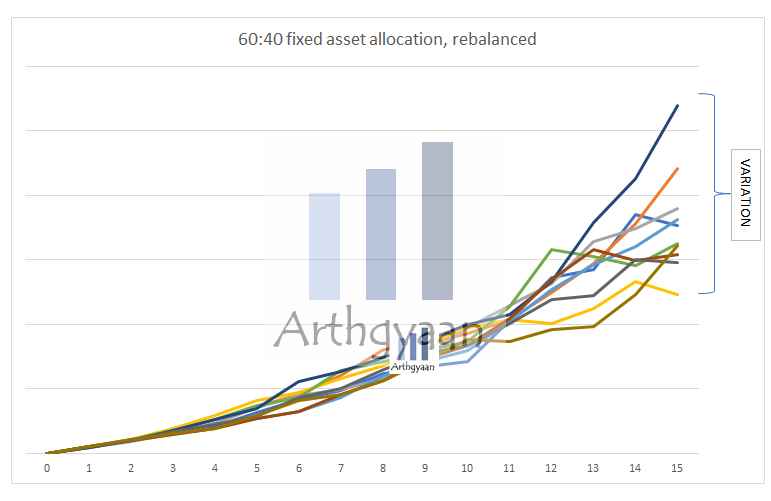

The variation in the previous case is the effect of market risk that shows us that the returns of the equity market are unpredictable. Since we need market risk to make high returns, we need a way to manage this risk. Rebalancing via a suitable asset allocation is the solution here which will be via allocating to equity and debt. For this example, we will invest 60% in equity and 40% in debt and keep this allocation fixed for 15 years by rebalancing annually. We will use the same sequence of equity returns as before. As these results show (corpus range of ₹49-108 lakhs), the variability is now lower.

This is still not ideal.

Here we extend the concept of asset allocation and introduce the idea of the glide-path that will allow us to manage market risk. We start at 60% equity (the rest will be in debt) and gradually reduce that yearly until it drops to zero when you fully invest the corpus in debt.

We see that the range is finally predictable, as the results show with the corpus range of ₹60-66 lakhs. This example also shows the effect of diversifying the asset allocation and managing risk via rebalancing.

This article shows the difference of the average, maximum and minimum returns of various asset allocation values: Should Indian investors invest 100% in equity for their goals?.

The new target weights of equity: debt for each goal will be per the portfolio glide path for that goal. Once you have the target weights, two general methods trigger rebalancing:

You can also combine the two methods: have yearly rebalancing but monitor the market for significant falls/rises and use the corridor method. As mentioned earlier, the equity component of the goal will generally reduce as the goal comes closer - this means a 60:40 equity: debt portfolio may need to become 40:60 a few years later via rebalancing.

An advanced technique called constant proportion portfolio insurance (CPPI) can be used by investors comfortable managing their portfolios for some time.

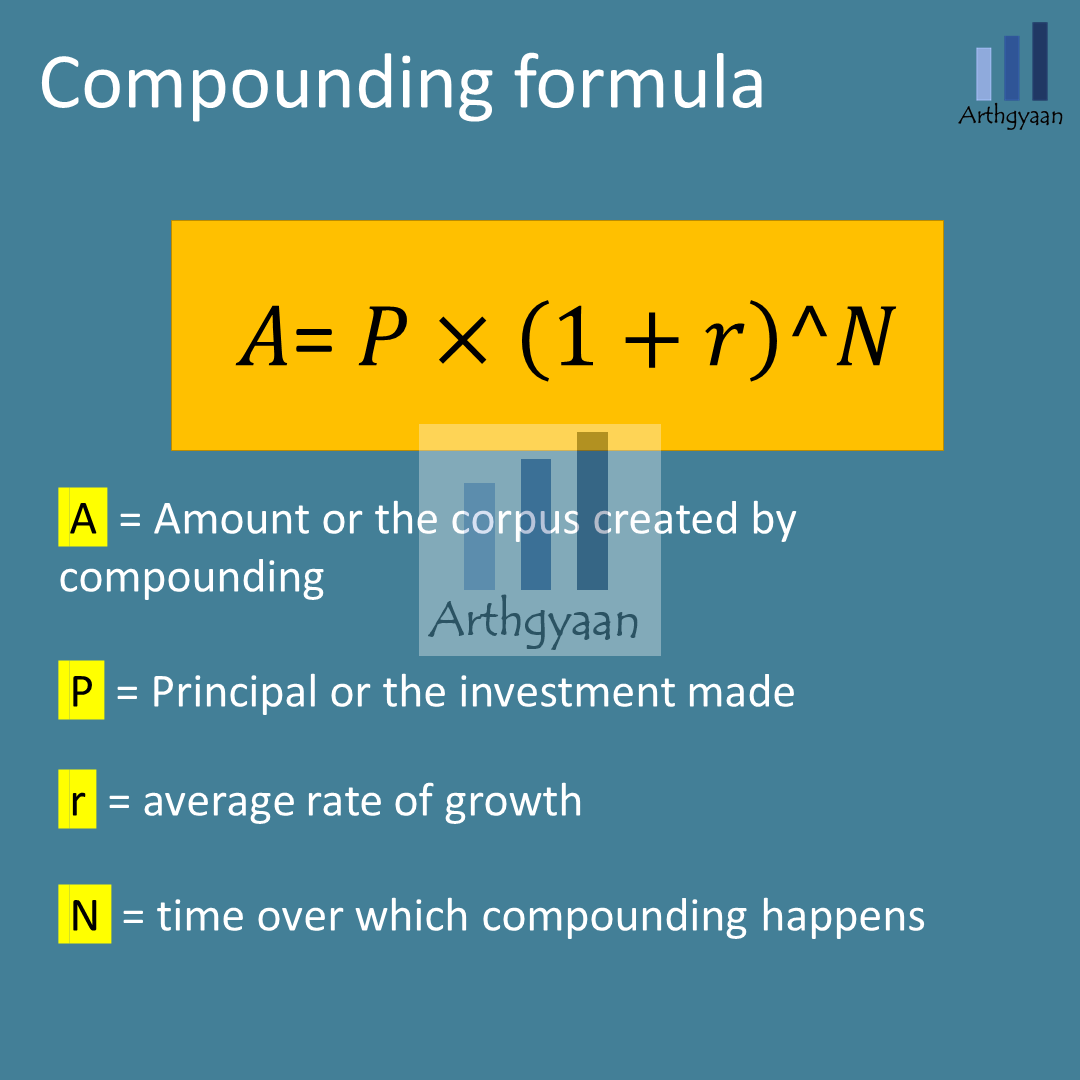

If we look at the compounding formula, rebalancing does not impact any of the terms in the equation. Rebalancing does not remove money from a portfolio. Instead, it moves money from either one asset class to another (like selling equity and buying debt) or from one fund to another (e.g. selling large caps to buy mid-caps).

Since rebalancing requires selling, there will be exit load and capital gains taxes. Still, these are minor considerations of the benefits that rebalancing brings. However, it would be best if you did not do this too often since taxes will become very high. As noted in our article on capital gains taxes, the short-term capital gains limit for non-equity mutual funds is three years. Since investors invest in SIP mode, each new installment will be taxed at the marginal tax rate (i.e. 30%) if sold within three years for rebalancing. Funds investing in international stocks, all debt funds and many fund-of-funds have this three-year taxation rule.

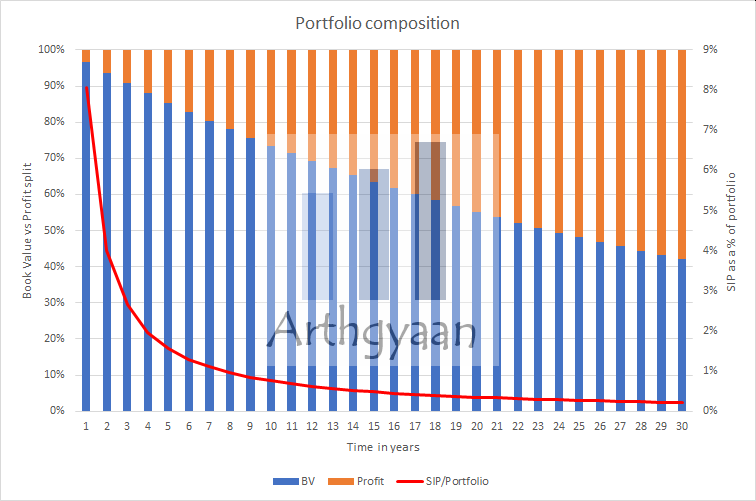

It is therefore essential to strike a balance. Investors who are unwilling to sell funds due to the tax impact, as a compromise, may want to consider pausing investments in funds/asset classes marked as a “sell” and instead invest in those marked as a “buy”. This method achieves a similar effect but reasonably slowly. However, this slow rebalancing also leads to incorrect risk exposure in the portfolio. The figure below explains how slow rebalancing becomes more and more ineffective with time:

In the beginning, it may be possible to adjust monthly SIP amounts to rebalance. Still, this will not be possible once the portfolio becomes more significant relative to the monthly investment. In general, investors who have just started investing with small portfolios will not see many benefits due to rebalancing by selling assets. They should wait some time until their portfolio becomes big relative to their monthly investment. Investors implementing core-satellite portfolios will need to rebalance frequently to manage their risk.

Read more on slow rebalancing here: How compounding works: the journey to a 10 crore portfolio

Rebalancing means selling an asset that has gone up and using the sale proceeds to buy another asset that has not gone up. Rebalancing is also an opportunity to get rid of active funds which are consistently underperforming their benchmarks. These are steps that you can follow:

Another way of rebalancing using triggers is explained in this article: How to use the bucket theory to plan for your goals?.

Some example calculations for convenience:

Caution: Many new investors have significant investments in debt via Provident fund (PPF/EPF) locked until maturity and generally do not allow easy withdrawals. For them, opportunistic rebalancing from debt to equity can be difficult until a significant liquid corpus in debt funds is accumulated. See How to choose a debt mutual fund for all goals. Investors investing in NPS Tier 1 also have limited control over the asset allocation being followed and do not have an opportunity to rebalance.

Rebalancing is a risk management tool used to balance the portfolio's equity and debt components over time, ensuring that portfolio risk is managed per market movement and the goal's horizon.

Rebalancing is for reducing risk by ensuring that the portfolio's risk exposures continue to stay as per plan. Any return enhancements is a side-effect.

Rebalancing involves selling and buying inside the portfolio. Selling activities will incur tax. However, a properly planned rebalancing activity will be beneficial to the portfolio after adjusting for the taxation hit.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Portfolio rebalancing during goal-based investing: why, when and how? first appeared on 10 May 2021 at https://arthgyaan.com