I have started a 15k SIP. How much money will I have in 15 years?

This post shows a way to estimate the final corpus for a SIP

This post shows a way to estimate the final corpus for a SIP

A common question amongst investors is what corpus value they will reach if they start investing in mutual funds via SIP form.

Before that, read this article to know more about SIP and the related terms STP and SWP: SIP, SWP and STP - what do they mean, which one should you choose and when?.

Given that we cannot predict the stock market, we need to make multiple assumptions regarding future returns and the ability of the investor to increase the SIP amount if the market does not move as per these assumptions. The final corpus will depend on the actual path followed by the stock market from now till the end.

We need to avoid uncertainty in predicting the final corpus figure. For example, if investing is for retirement, we need to know whether we will accumulate one crore as the corpus or ten crores. The quality of life in these two extreme cases will be very different.

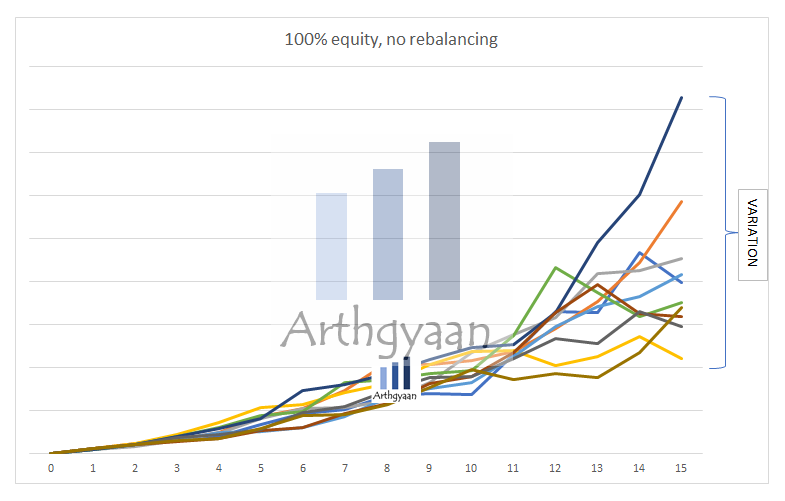

Here is an example of a 15,000/month SIP run for 15 years. The SIP amount is increased by 5% every year as a step-up SIP. The chart shows ten different possibilities assuming the average equity return is 11% post-tax and risk of 15%. The results are:

We have deliberately omitted the y-axis from the chart since this level of variability is not effective in answering the question: how much we will get after 15 years?

Can we do better? But before that, you can use this calculator to see how a SIP can create wealth over time assuming fixed returns:

Total Investment (₹):

Total Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

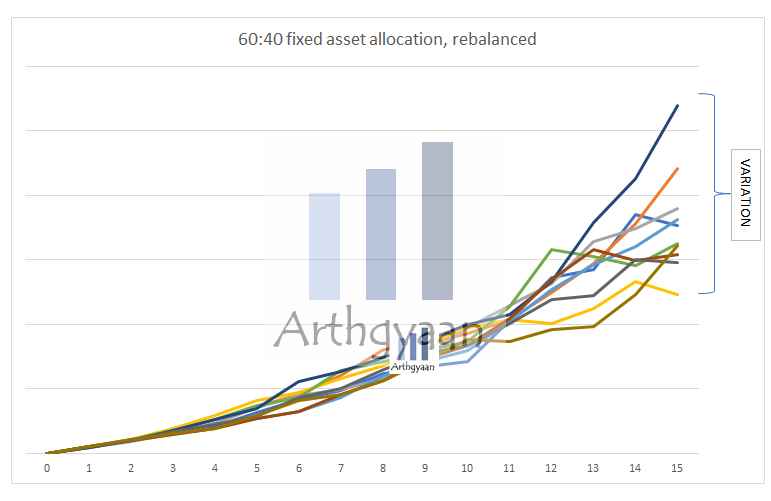

If you found this useful, check out the Arthgyaan step-up SWP calculator.The variation in the previous case is the effect of market risk that shows us that the returns of the equity market are unpredictable. Since we need market risk to make high returns, we need a way to manage this risk. Rebalancing via a suitable asset allocation is the solution here which will be via allocating to equity and debt. For this example, we will invest 60% in equity and 40% in debt and keep this allocation fixed for 15 years by rebalancing annually. We will use the same sequence of equity returns as before.

As these results show (corpus range of ₹49-108 lakhs), the variability is now lower but still unpredictable.

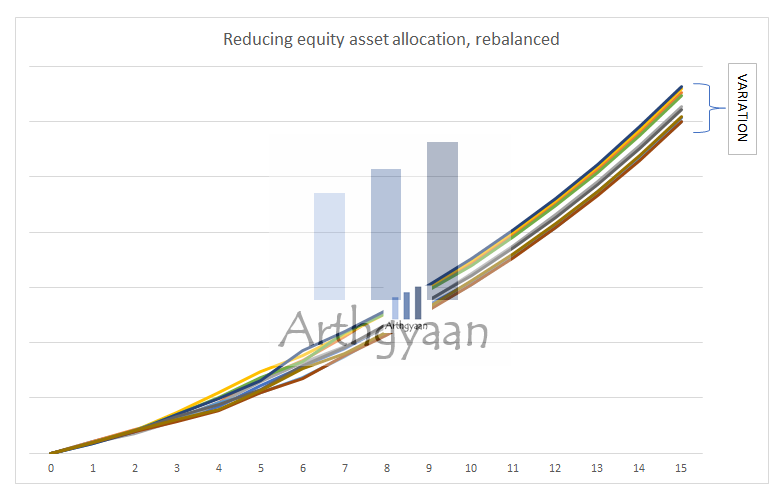

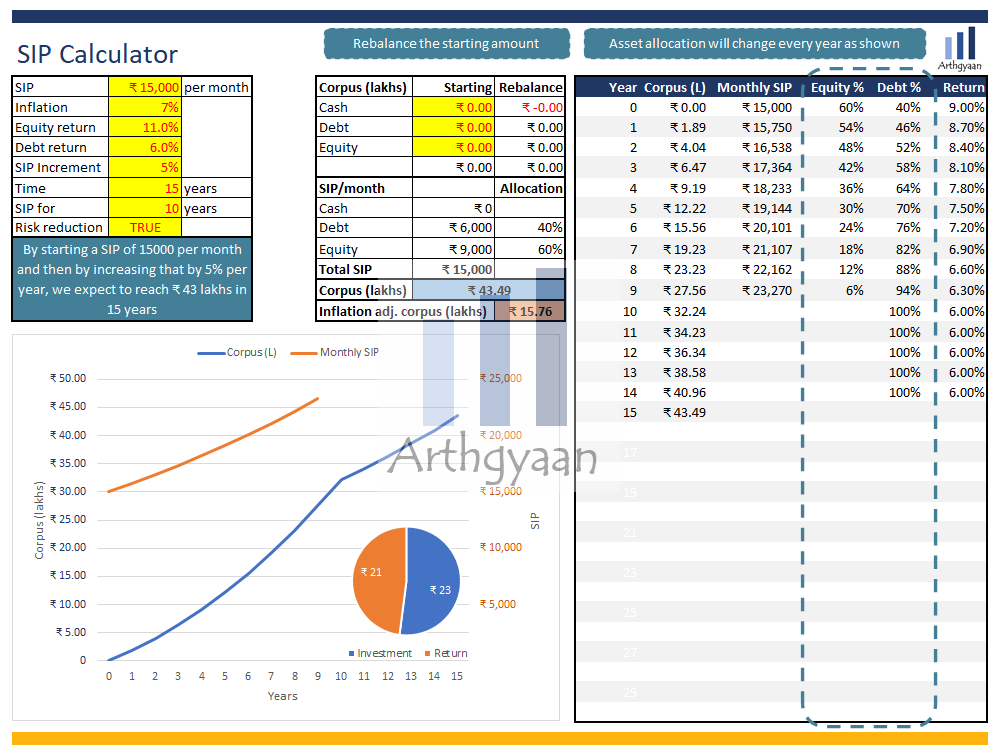

Here we extend the concept of asset allocation and introduce the idea of the glide-path that will allow us to manage market risk. We start at 60% equity (the rest will be in debt) and gradually reduce that yearly until it drops to zero when you fully invest the corpus in debt.

We see that the range is finally predictable, as the results show with the corpus range of ₹60-66 lakhs. This example also shows the effect of diversifying the asset allocation and managing risk via rebalancing.

| Case | Max corpus | Min corpus | Average | Variation |

|---|---|---|---|---|

| 100% equity, no rebalancing | ₹ 166 | ₹ 44 | ₹ 84 | ₹ 35 |

| 60:40 fixed asset allocation, rebalanced | ₹ 108 | ₹ 49 | ₹ 72 | ₹ 17 |

| Reducing equity asset allocation, rebalanced | ₹ 66 | ₹ 60 | ₹ 63 | ₹ 2 |

In this article, we have covered how to estimate the returns for your SIP: How much returns should you estimate for your goals?

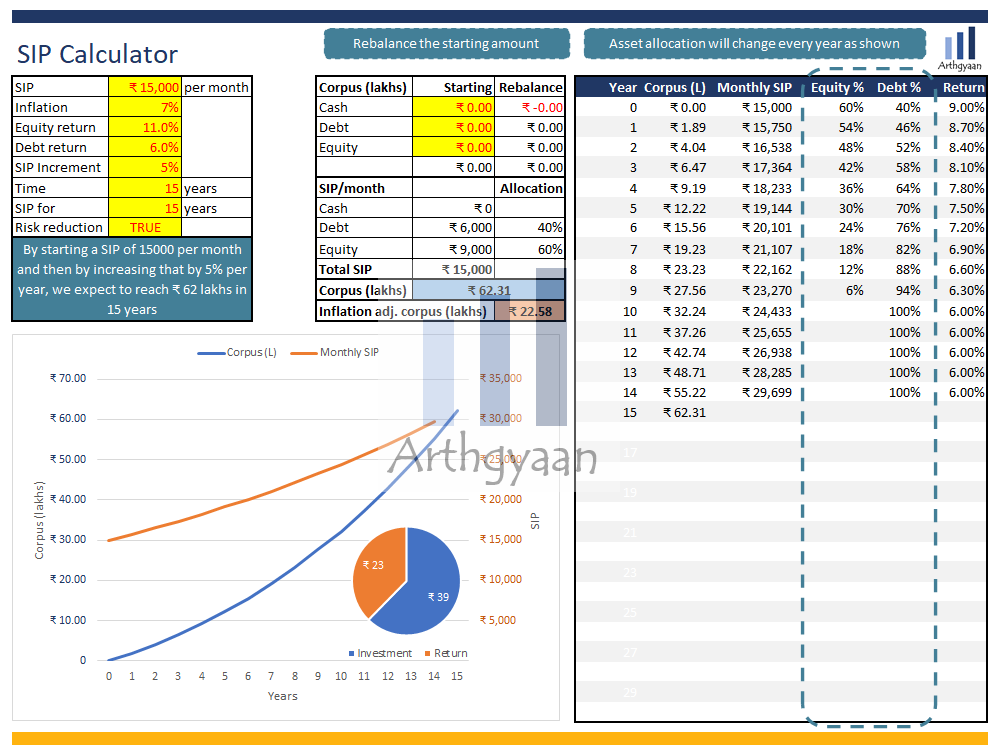

We have designed a SIP calculator that supports reducing asset allocation and rebalancing as described above.

Using the example, a ₹15,000/month SIP increasing at 5% per year should reach a corpus of ₹62.31 lakhs, which is in line with the range of ₹60-66 lakhs we have seen before.

Total Investment (₹):

Total Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

If you found this useful, check out the Arthgyaan step-up SWP calculator.The calculator allows you to save for a shorter amount of time than the goal horizon by changing the “SIP for” value so that you can save for a goal without having income or investing during the last few years. The final corpus will be adjusted accordingly downwards as shown below:

We have reached a similar conclusion in this post where we have shown the probabilities of reaching a particular target return.

As we have seen in the figures above, there is some element of uncertainty associated with stock market investing, which can be minimized (at the cost of lowering potential returns) but not eliminated. The investor needs to revisit the portfolio at least once a year to check if they are on track and take remedial actions like rebalancing as per the glide path and modifying the SIP amount.

See this detailed post for the process for reviewing.

The final corpus value after 15 years will have its purchasing power reduced due to inflation. The “Inflation adj. corpus (lakhs)” field shows the inflation-adjusted value. In our example, the ₹ 62.31 lakhs will be worth ₹ 22.58 lakhs (in today’s money) at 7% inflation. You can choose which inflation value you think applies to your goal.

Inflation: the impact on your goals and how to choose assets that beat it

“Writing and tracking financial goals actually fuels the commitment required to achieve them” - Gaurav Rastogi, CEO of Kuvera

As discussed here, it is essential to set a goal before investing. While investors choose a SIP amount based on available capital, it is also critical to have a target corpus in mind before investing. The method allows you to check for progress and take remedial measures if you fall short of your target corpus.

Link to the Excel calculator: here

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled I have started a 15k SIP. How much money will I have in 15 years? first appeared on 02 Sep 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.