Are your investments on track for your goals?

Regularly review your portfolio to know if you are on track for your goals

Regularly review your portfolio to know if you are on track for your goals

If you have followed all the previous posts on setting goals and starting investments then you know that regular reviews must be necessary to check if you are on track.

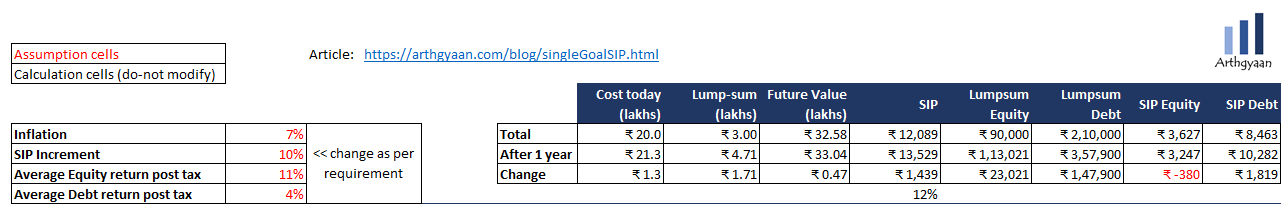

Goals like cars, houses, vacations, college education costs and retirement expenses etc. all increase over time due to inflation. If the initial goal target was ₹ 10 lakhs today with 10% inflation, then in two years the goal value is expected to increase to around ₹12 lakhs. In reality, it could have become ₹ 12.5 lakhs or stayed close to ₹11 lakhs. In either case, a replanning is needed.

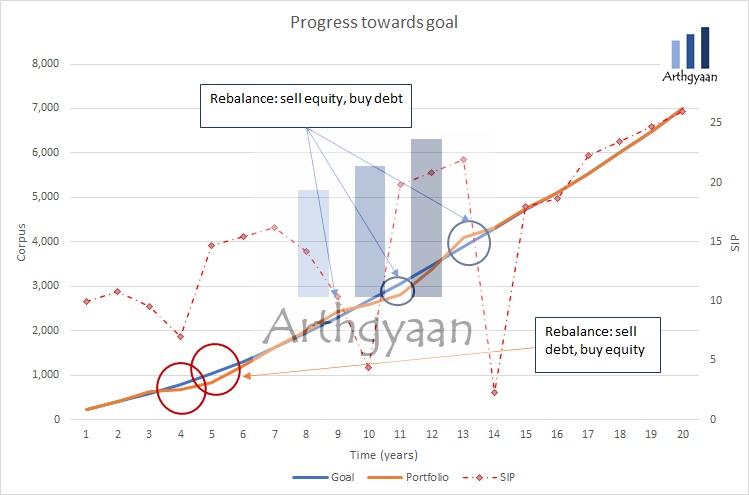

Markets do not go up in a straight line like a fixed deposit. Both equity and debt funds go up/down unpredictably and in most cases give a return very different from the expected return. If the target return was 8% for the first year but due to bear markets only 5% return was achieved, it would require additional monthly investments going forward.

The next process is rebalancing which is used for risk management to achieve one goal: over time, the risk of the portfolio needs to reduce as the goal comes closer. This is done via stepwise reduction of the equity exposure of the goal. Rebalancing:

See this detailed post regarding how rebalancing is done.

A replanning would require repeating the same process that was used to find the SIP amount

There are other ways of tracking investments at an asset level like the performance of individual funds which is covered here. Tracking progress of goals is one of the axioms of personal finance?.

In the example above (which is from here), a house down payment goal is shown during the start of investing and a year later. The numbers move as:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Are your investments on track for your goals? first appeared on 10 Jun 2021 at https://arthgyaan.com