How do you get from goal to SIP amount: Part 2

Walk-through: Get SIP amount for a goal with multiple payments

Walk-through: Get SIP amount for a goal with multiple payments

We have already covered

This post will deal with a goal like college education that has multiple payments using the framework built in the three posts linked above.

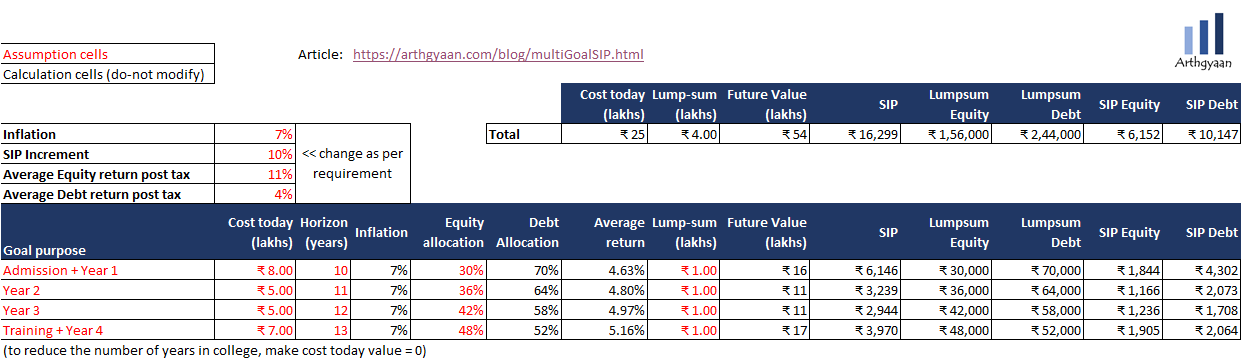

Assume the target goal is a 4-year college education due to start 10 years from now. The current costs are 5 lakhs per year for course fees and hostel, 3 lakhs for admission and 2 lakhs for industrial training at the beginning of the 4th year (i.e. total 25 lakhs) all expected to increase by 7% a year. Assume 4 lakhs is available today which is allocated to all 4 goals equally.

These are essentially 4 single payment goals:

Using the single goal model the following SIP amounts are determined and the totals are added up as shown:

The 25 lakhs initial cost of the goal is expected to be around 54 lakhs 10 years from now. The initial lump sum amount and SIP amounts are allocated to the four goals. A single set of SIPs are created: equity 6,000 and debt 10,000 along with lump sum investments in equity and debt of 1.5 lakhs and 2.5 lakhs respectively as per asset allocation. Refer to these posts for investing in equity and debt funds.

These calculations are explained in this Google Sheets workbook.

The following needs to be done in this order:

See this detailed post for the process for reviewing.

At all times ensure that you have the following in place

Please see below:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How do you get from goal to SIP amount: Part 2 first appeared on 05 Jun 2021 at https://arthgyaan.com