How to choose a debt mutual fund?

Choose a debt mutual fund without breaking your head over it.

Choose a debt mutual fund without breaking your head over it.

Originally published: 14-Apr-2021

Updated: 07-Jun-2021 - new SEBI debt fund classifications added

Updated: 21-Dec-2021 - added category returns

We start a new series today on choosing a debt mutual fund. Debt funds provide exposure to credit and interest rate risk to a portfolio and are critical for diversification purposes.

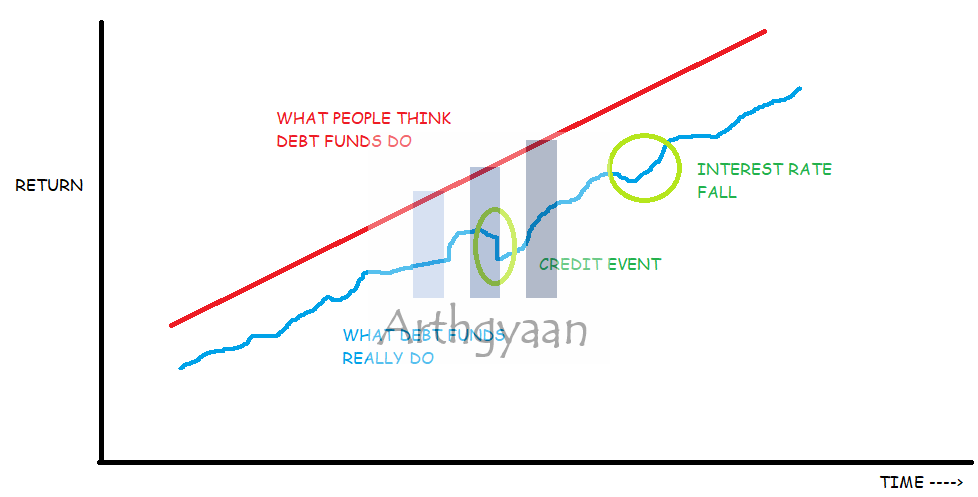

A debt fund has a single purpose in a portfolio: reduce the overall risk and provide a small amount of return. The purpose of having debt as a part of the overall asset allocation of a goal is to stabilize the portfolio risk. It is extremely risky for DIY investors to chase returns from debt in their overall portfolio since debt funds can crash drastically like this.

There are 18 categories of debt mutual funds in India which makes choosing one very difficult. The onus has been put on the investor to understand how these work and perform the very difficult task of choosing one suitable for the goal.

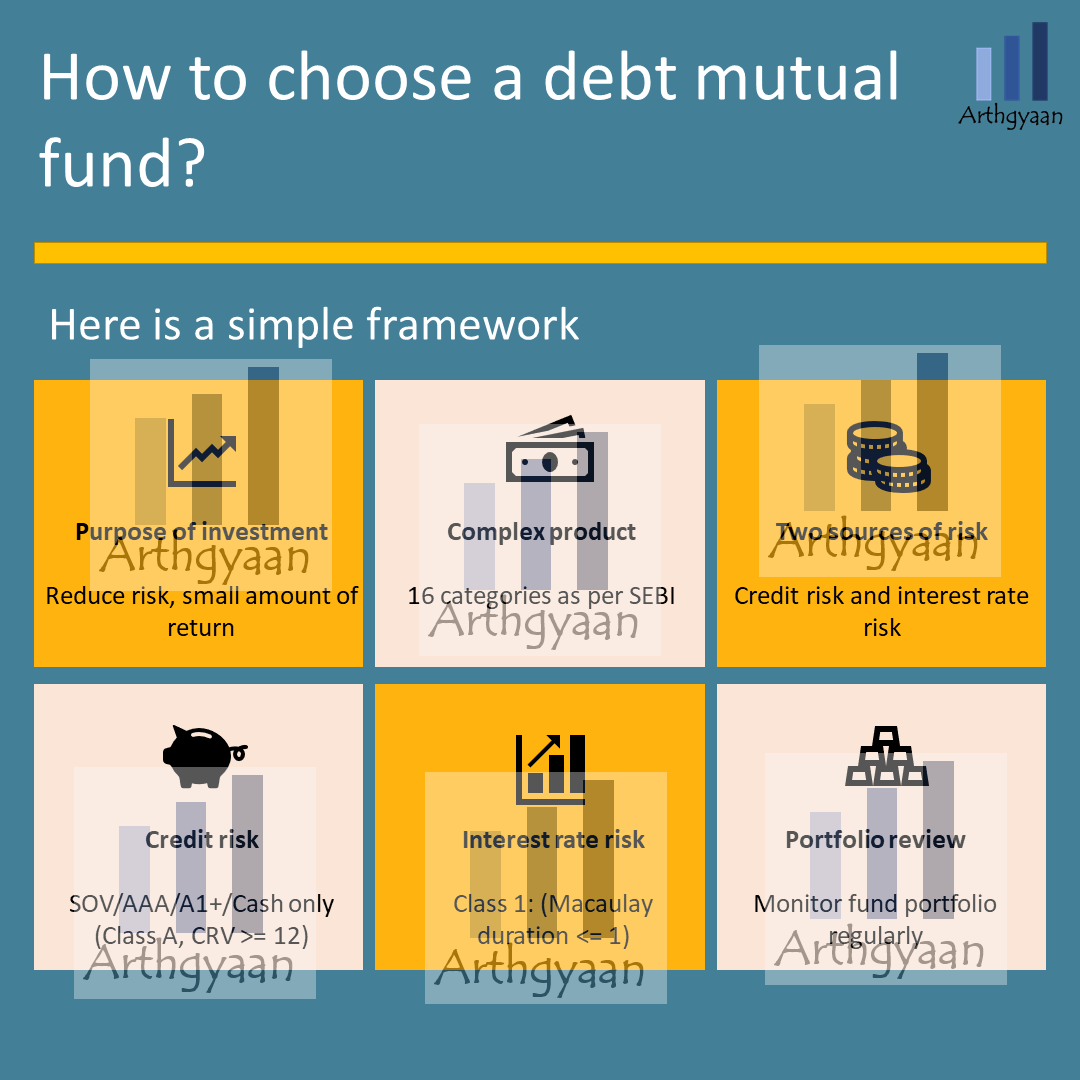

In this article, we present an easy-to-follow 3-step framework to cut through the clutter and choose funds that meet the stated objective.

This article assumes that you know what a debt fund is: a mutual fund that invests in one or more bonds issued by one or more different companies or the Government of India/State Governments. Entities that raise money via bonds are called issuers.

Like all mutual funds, and unlike Fixed Deposit (FD), debt fund returns (and the principal invested) are not guaranteed and returns can fluctuate continuously.

In a debt mutual fund, risk (and return) comes from two main sources:

This determines how good the underlying bond is in terms of the issuer’s capability of paying back the regular interest (called a coupon) and the money borrowed (the principal) of the bond.

Issuers are rated by Credit Rating agencies (like S&P, Moody’s, Fitch, CRISIL, Indiaratings, etc.) and given a scale like AAA (best quality), AA (lower than best), to D (worst quality - unable to pay back the money borrowed). The higher the credit rating (AAA or SOV - for the government), the lower the coupon and the lower the credit risk.

For our framework for selecting debt mutual funds, we stick to a mix of SOV/AAA/A1+/Cash only (same as SEBI’s new Class A, i.e., CRV >= 12 categorization).

This affects the prices of bonds already in the market.

If an existing bond offering a 7% coupon is pitted against a new bond that offers a lower coupon of 6% (interest rates are falling), then the existing bond is more desirable and so is a debt fund holding these older 7% bonds. The reverse happens if interest rates rise in the economy - debt fund NAVs fall. This metric, for measuring interest rate risk, is called Modified Duration, and is available for all debt funds. It measures the rate of change of the portfolio NAV due to changes in interest rates.

For our framework for selecting debt mutual funds, we will stick to a duration of up to 1, which effectively means that for every 1% rise (fall) in interest rates, the fund NAV will fall (rise) by 1%. The debt fund categories that satisfy this criterion are overnight, liquid, ultra-short, low duration, and money market funds. This is the full list from SEBI. The new June 2021 debt fund classification by SEBI defines Macaulay Duration of less than or equal to 1 year as Class 1. This recommendation is in line with the SEBI definition since Duration < Macaulay Duration for all debt funds.

In general, funds with large AuM increase diversification. There is no role of star ratings or past performance in choosing a debt fund.

Debt fund investors should be wary that, unlike western countries, there is no bond market in India for corporate bonds. There is a market for government bonds, but mostly banks and other institutions participate in that market with deals happening in crores.

Credit and interest risk manifest as liquidity risk. Liquidity risk means that the bond cannot be sold without incurring a substantial loss since there would not be any buyers. The lack of buyers could be due to:

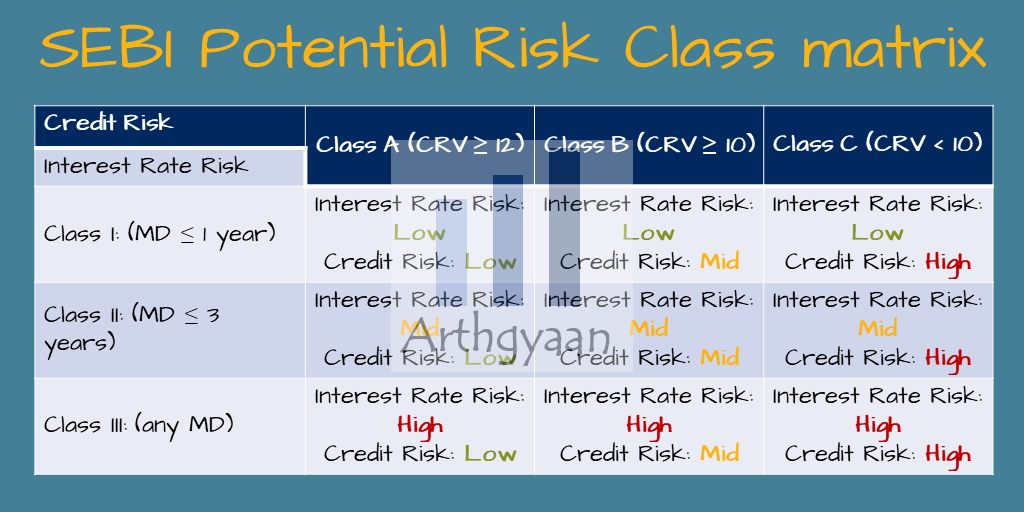

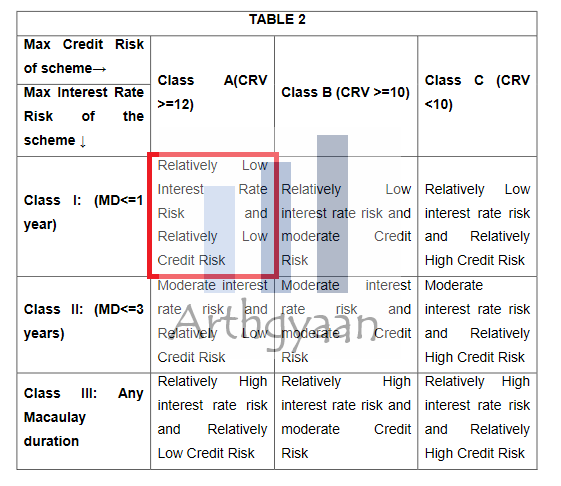

SEBI on Jun 07, 2021, amended the regulations for the classification of debt funds to better allow investors to understand the risks when choosing one. These new classifications are effective since December 2021.

As per the new SEBI criteria, stick to debt funds with:

If you are investing by yourself, the funds should be DIRECT GROWTH funds only.

One word of caution: The SEBI criteria refers to the maximum risk that the funds can take. Also, the credit and interest rate figures are average values. This means that there could be bonds in the portfolio with risk numbers worse than the average without affecting the average. It is therefore recommended that the investor carefully looks at each bond in the portfolio on regular basis to ensure that they are within the risk limits of CRV>=12 and MD<=1.

For example, a hypothetical portfolio of 90% in 91-D T-bills and 10% in 10-year GSec will have MD<=1 at a portfolio level but the interest rate risk will be higher than a fund that invests 100% in 91-D T-bills.

You can get bond portfolio details (for both credit quality and duration) via portals like Valueresearchonline. For each fund, look for these metrics:

Another two metrics that you need to note:

🤖 Explainer: Yield To Maturity of a Bond

Yield To Maturity (YTM) is the total return an investor expects to earn on a bond if they hold it until it matures. It considers the bond's coupon rate, the time to maturity, and the bond's current market price.

For example, let us say you buy a bond with a coupon rate of 5% and a maturity of 10 years. The bond's current market price is 950. The YTM for this bond would be 5.26%. Suppose you hold the bond until it matures. In that case, you can expect to earn an average annual return of 5.26%.

YTM is an important metric for investors to consider when evaluating bonds. It can help you compare different bonds and make an informed investment decision.

Here are some additional things to keep in mind about YTM:

YTM of a bond fund is a weighted average of all the YTMs of the individual bonds in the portfolio. Cash has a YTM of zero.

Estimated return from the debt fund in 1 year: (YTM - TER) - D * ChangeInRates

where ChangeInRates > 0 for increases in rates. The minus sign in front of D signifies that the return falls when rates rise and vice versa.

For some typical numbers,

YTM = 4%, TER = 0.2%, D = 0.16, Change = .5%,

expected return = 4 - 0.2 - 0.16 * .5 = 3.72% in 1 year before taxes.

Your objective should be to maximize this expected return within the credit and interest rate limits mentioned in this framework.

Warning: When filtering on yield (and TER), do not get enticed with higher-than-average yields. Critically evaluate the credit risk of the portfolio (and read the scheme document) as well to see that you are comfortable with the constituents of it, and how they have evolved in the past (debt fund portfolios are disclosed every fortnight as a requirement from SEBI).

Here is a table of historical data for debt funds (and Arbitrage funds) from 2011-2020:

| Category | Post tax return | Return over inflation |

|---|---|---|

| Liquid | 7.5% | 0.5% |

| Money Market | 7.9% | 0.9% |

| Overnight | 7.0% | 0.1% |

We have performed a detailed analysis of debt fund category returns vs inflation in this post: Can debt funds beat inflation?.

Debt funds, along with the right equity funds, should be a part of the portfolio of new investors: What are the best mutual funds for first-time investors?.

Debt fund taxation is different from equity:

It is therefore recommended that debt funds be typically used for goals more than three years away for the sole purpose that before 3 years, and FD gives more predictable returns and is taxed the same. Read more: Mutual Fund vs Fixed Deposit - where should you invest?

When held for more than 3 years, thanks to indexation, the tax on debt funds can be significantly low compared to FD. More details on debt fund taxation are covered in this post.

Additional options for debt instruments are covered here:

Common advice found in multiple places regarding investing in debt funds is to:

match your intended investment horizon with the portfolio duration

This is not terrible advice per se, but it fails to highlight two risks:

Due to this reason, it is a good idea to keep the duration of the fund low, i.e. below a year to avoid both these risks. This concept is addressed in more detail in this post: Should you match debt portfolio duration with goal duration?

We will refer to the category returns table above for some of the data.

The recent (2019, 2020) high returns of gilt funds are due to falling interest rates which can abruptly reverse and lead to heavy losses. Since short-term interest rates can be volatile, so can gilt fund NAVs. Recent returns of debt funds do not predict future returns in any way (see the 3rd panel above). It is up to the investor’s risk appetite to try to profit from this volatility or else avoid this category altogether.

More on gilt fund investment: Gilt funds do not always go up in value. Should you invest in gilt funds?.

Banking and PSU funds: This category has very less credit risk but can have interest rate risk. Investors should note the modified duration of this category before investing and avoid it if they are uncomfortable with the value.

Corporate bond fund: These funds will have more credit risk than Gilts by definition and can have any amount of interest rate risk.

Fixed Maturity Plans (FMP): These are closed-ended funds with a fixed maturity which prevents investors from exiting in case they are unhappy with credit or interest rate issues with the bonds. These funds are exchange-listed but thinly traded making exit difficult. These are generally structured to be highly tax-efficient.

Floating rate funds: these funds in theory should protect against changes in interest rate risk since their duration is small and underlying coupon payment rates change in sync with interest rates in the market. In practice, not a lot of floating-rate bonds are issued and as a result, all floating-rate funds use swaps and other derivatives to simulate, imperfectly, the benefit of floating rates

Credit risk funds: These funds have the highest range of returns (>13%) and it is the only category with average negative minimum returns. The risk/reward ratio is among the poorest with post-tax returns over 10 years lower than 12 other categories with lower risk.

Pre-requisite: Goal > 3 years since otherwise, you can use FD

This article shows why sticking to these categories is sufficient if you are looking to rebalance with equity: Which category of debt mutual funds is best for rebalancing?

A regular review process needs to be put in place once an investment is done in a debt mutual fund. Since SEBI mandates that the fund publish its portfolio every fortnight, a review of the fund portfolio every 3-6 months needs to be put in place. This is a guide: How to understand the portfolio composition of a debt mutual fund?.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to choose a debt mutual fund? first appeared on 14 Apr 2021 at https://arthgyaan.com