I am now ready to do goal-based investing. What now?

Part 3: I am now ready to do goal-based investing. How do I get started?

Part 3: I am now ready to do goal-based investing. How do I get started?

Click to read the other parts:

You have now heard of goal-based investing, completed the pre-requisites (see Part 2) and are now finally ready for investing.

Goal-setting is the most fundamental step. Like when you go on a trip, there is a destination; it is the same for any investment. You cannot and should not invest without a goal. Investing without a goal is like getting into a taxi, and when asked, “Where to go?”, you answer “I don’t know, take me somewhere”. You can set goals in many ways:

For more details on how to arrive at your goals, please see this detailed post

Once you have identified the goals, for each goal, note down the

A quick way to classify goals are:

You can use this goal-setting framework as well: How to set S.M.A.R.T goals for investing?

The concept of inflation applied to the goal: how much do you think the goal will increase in cost every year in the future. It would be best to beat this figure, including the investments you make and the returns you get.

Important: CPI/WPI figures from the government are different from actual inflation applicable to your lifestyle. You should be in a position to calculate the changing cost of your basket of goods and services consumed under major budget heads on a year-on-year basis.

Some inflation assumptions:

Review goals at least yearly to figure out the current prices of your goal (the change since the last review will indicate the inflation)

There are two aspects to risk related to a goal: ability (can take a risk) vs willingness (want to take a risk).

The investor can ascertain both willingness and ability via a questionnaire and discussion. The formulation of asset allocation requires both to be in sync and post-meeting with a competent fee-only planner. By merging the two traits, overall risk classification (per goal based on the need to take risk) can be made using a simple three point scale: high, medium and low.

Here is a detailed post on how to get your risk profile for any goal.

Typically sources of risk include equities, bonds, commodities, real estate and cash. Each has a different risk/return characteristic and, more importantly, interplays with the others depending on how you mix them. This is called asset allocation (AA). Asset allocation is not fixed. Every year you need to review and manage the portfolio glide-path for that goal. The suitable equity: debt mix that you need to have every year is found via risk profiling.

Caveat: while taking risks is needed to generate returns, just taking a high risk does not guarantee high returns. In that case, the risk would be low and not high. Based on this flawed understanding of risk, many new investors go 100% in equity or choose a significant allocation to small-cap funds.

See this detailed post on asset allocation.

There are three steps here:

Choosing funds is the first problem that new investors generally start with, but it is the 5th step in this framework. Many new investors spend the maximum amount of time here. The importance of this particular step (in the overall goal-based investment process being discussed here) is tiny. As long as you have followed the framework being laid down (completing the pre-requisites and setting the goals, you will need to spend very little time in this step)

The following are indicative choices and not recommendations:

Avoid all ETFs due to liquidity and price/NAV divergence issues: Which are the best and worst ETFs of India?

How to determine SIP amount is covered here: SIP amount for a single goal

Based on the return expectation of each of the funds chosen and the asset allocation, you can arrive at a return expectation for the investments as per this post: How much returns should you estimate for your goals?.

See this detailed post for determining the SIP amount once you have the returns.

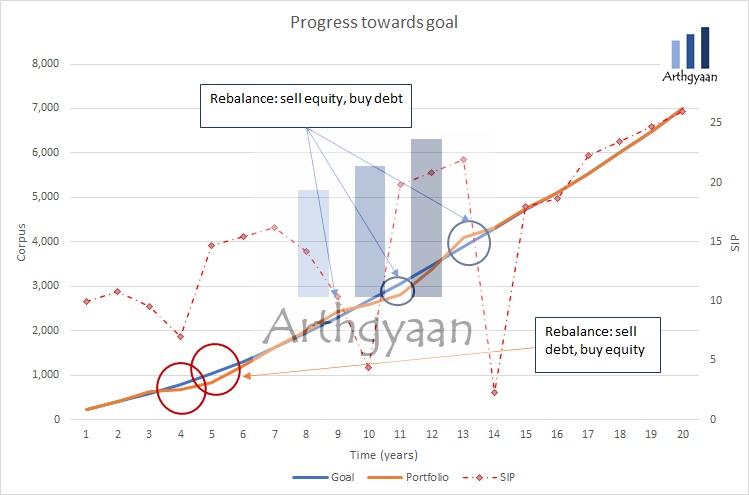

The rebalancing step is critical to managing the portfolio’s risk and allows systematic buying low and selling high. Of course, exit load and capital gains taxes will have to be considered, but these are minor considerations to the benefits that rebalancing brings.

Here is a detailed overview of rebalancing your portfolio.

Ultimately reaching your target corpus for your goal is the only thing that matters: Why you should chase your target goal corpus instead of returns

There are two primary considerations:

Since markets do not move linearly up like an FD while the value of the goal does, you must keep checking if you are on track. Therefore, you must increase the investment/SIP amount on every review as much as possible.

Rebalancing is a highly critical risk management tool to achieve one goal: risk over time needs to reduce as the goal comes closer, typically done by stepwise reducing the equity exposure of the goal.

See this detailed post regarding how to do rebalancing.

See this post for a worked-out example for review.

We can have expectations from the market regarding returns (5%, 10%, 15%, 20% or whatnot); however, we will only get what the market gives us. Hence it is essential to manage expectations from day 1 of investing

Bottom line: Best process »» best product any day. Next, you will need to document this process as the investment policy statement or IPS. It is the process of investing and creating the IPS as described in this series of 3 posts that give an excellent chance to reach financial goals methodically. Good luck.

Click to read the other parts:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled I am now ready to do goal-based investing. What now? first appeared on 30 Mar 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.