Why you should chase your target goal corpus instead of returns?

Many investors are obsessed with returns. This post shows a different target to chase to ensure the purpose of investments is met.

Many investors are obsessed with returns. This post shows a different target to chase to ensure the purpose of investments is met.

Many investors start investing by looking for where to invest (stocks / mutual funds / PF / gold / FD etc.) without putting a lot of thought into the purpose of that investment. Common motivations for investing at this point are:

Instead, a more focused approach can be to decide the purpose of investing and the target you are trying to reach. Therefore the investment process changes like this:

Read more on this concept here: Set a goal before looking for what to invest in

In this example, we will consider a single payment goal like a foreign vacation, buying a car, or a down payment on a house to understand how to calculate the corpus.

Taking the example of the house down payment, let us construct this example:

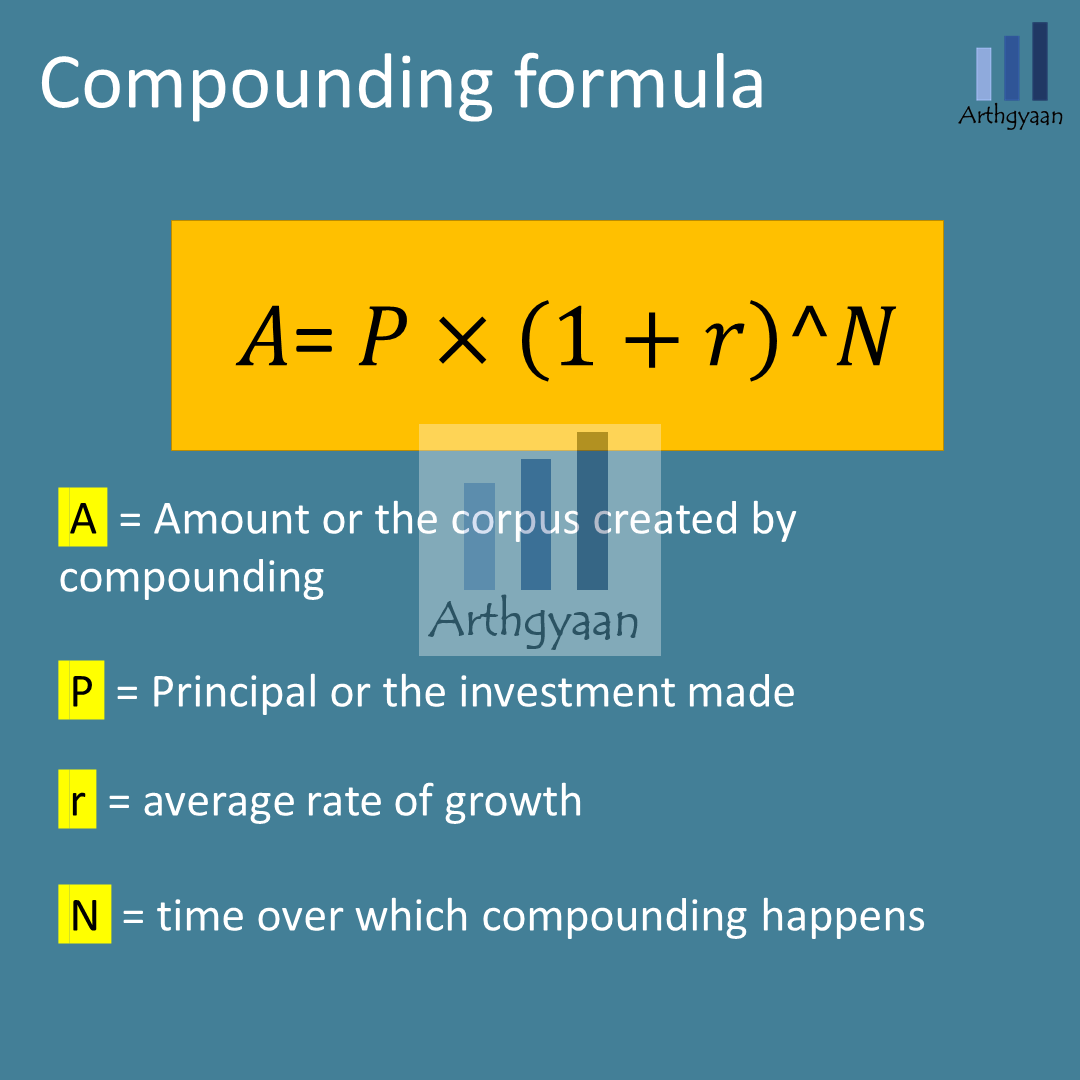

Once we know the goal, we will calculate the corpus using the formula below:

Future Value or Corpus = Current Value * (1 + Inflation) ^ TIme_to_goal

When the house is actually bought, due to 5% inflation over 10 years the down payment needed will be higher. Let us call this future value as the corpus

Corpus = C * (1+I)^H = 20 * (1+0.5)^10 = 32.58 lakhs

Once you know the target corpus, the following steps are clear:

At the end, you need to have the corpus ready for spending on the day you need to spend it.

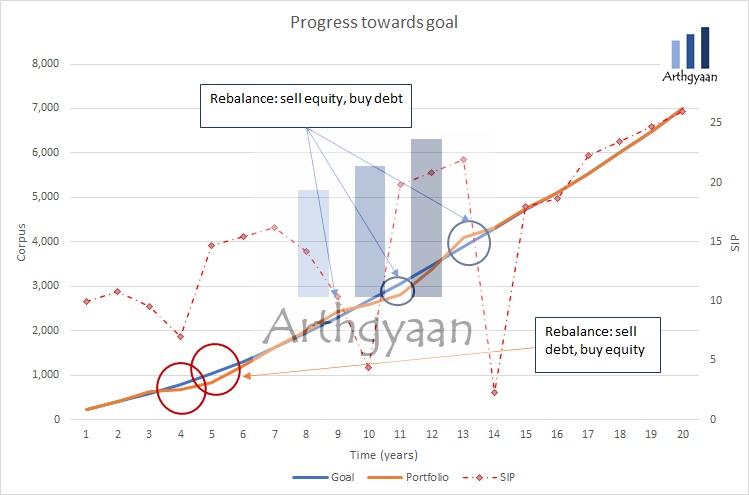

Read more on how this process works based on historical data: Goal-based investing: does it work in India?

My life has been a product of compound interest” - Warren Buffett.

There are three takeaways from the compounding equation:

We cover compounding in more detail in these posts:

You Can’t Eat IRR - Howard Marks, Oaktree Capital

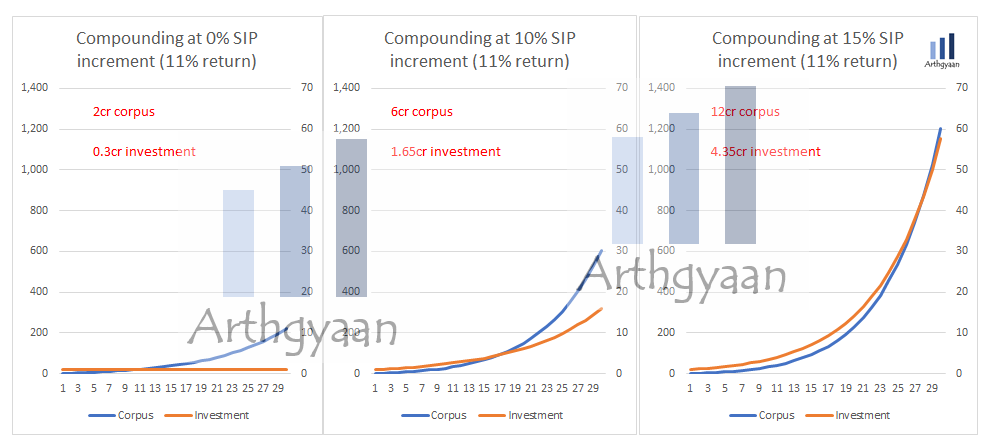

You might come upon the best possible fund manager or get access to an opportunity to invest in many multi-bagger stocks. However, none of that will matter if you did not reach your target corpus since you did not increase your investments over time as income increased:

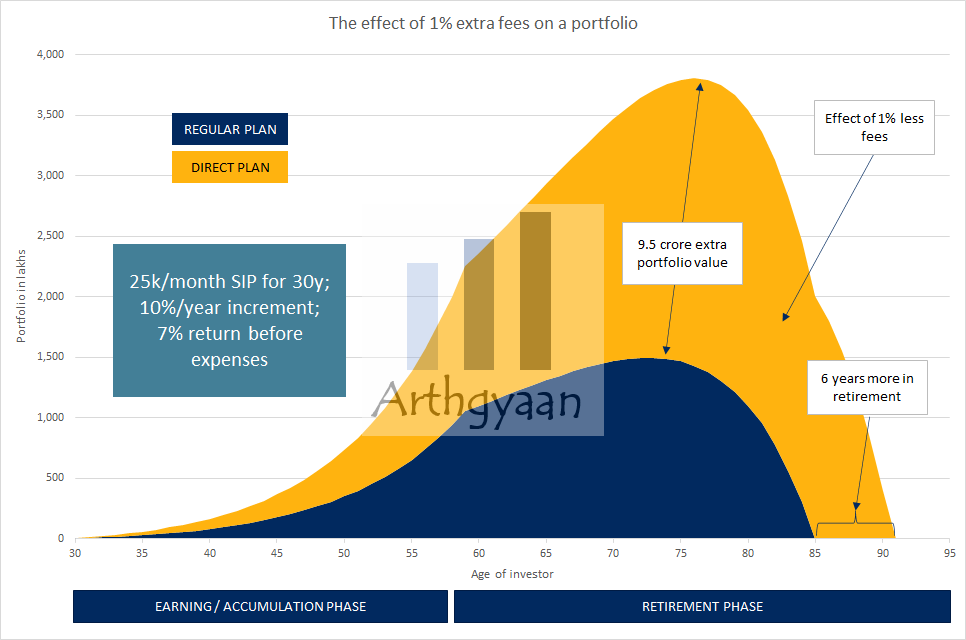

It is the livelihood of Wall Street, Canary Wharf and Dalal Street to convince you to let them manage your money to get returns that beat the benchmark index. This is should be a red flag for investors solely because if every portfolio manager claims to be able to do this, in the same market then how is it possible for everyone to beat the index at the same time? This should be the time when you start wondering if the only 1% fee they are asking for is worth it.

As we have argued before, it is impossible to know which fund, stock or managed portfolio will do better in advance since we as humans cannot predict the future. While excess returns over the benchmark or alpha is transient, the portfolio management costs are permanent. Instead of chasing returns via high-cost active funds or solutions that offer back-tested alpha, investors should focus on the following:

This post on which index funds to invest in and why? shows how to choose investments suitable for goals at a low cost.

I am looking for 12-15% returns over ten years to retire

I wish to add a small-cap fund to my portfolio

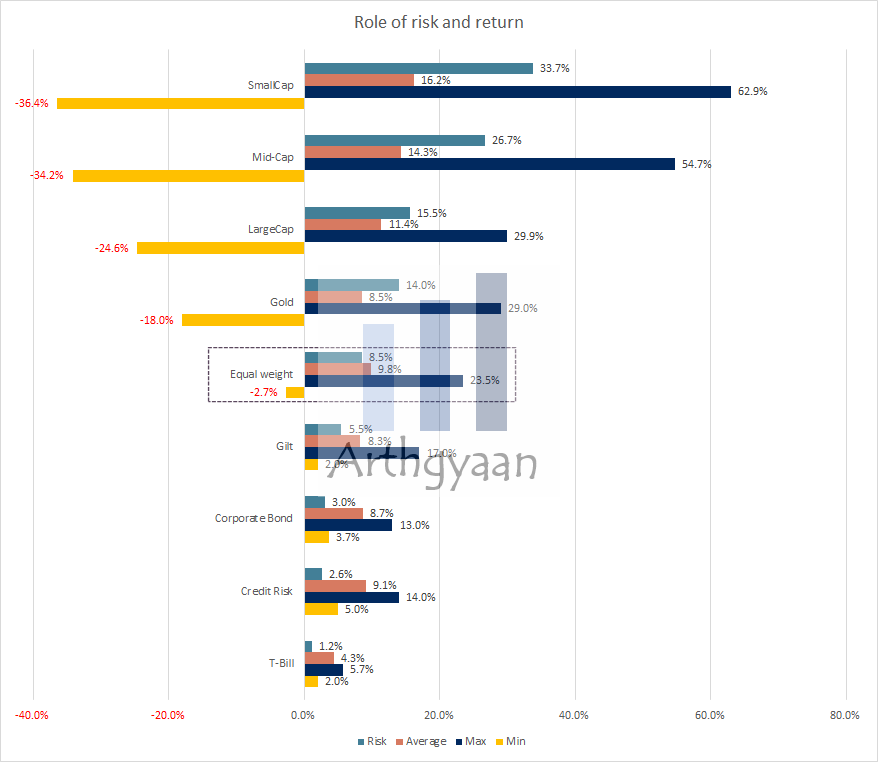

Many investors have a belief, as the statements above show, that they can increase the returns of the portfolio simply by taking more risk. The opposite is actually true - higher returns generally come due to higher risks. The higher risk just increases the chances of both higher and lower returns.

Some points to be noted here:

Investors who specifically load up on small and mid-cap funds to get higher returns should consult this chart and be comfortable with the 30%+ falls that come along with the 60%+ gains. A strategic asset allocation plan with a diversified mix of multiple asset classes has a better potential to reach financial goals than one that is overexposed to any one of these factors.

Beating inflation is essential but does not necessarily get to the target corpus:

For example, we assume that:

In such a case, merely beating 7% inflation will not get the child admitted to their dream college. Instead, you need to ensure that you reach the actual fee amount as the corpus on the admission date. Goal-based investing works in this case as well as shown here: What is the best way to invest for your child’s college education?.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Why you should chase your target goal corpus instead of returns? first appeared on 17 Apr 2022 at https://arthgyaan.com