Your human capital, not investment returns, is your biggest wealth creator

Do not chase returns. Invest more instead. To do that, focus on increasing your income by focusing on human capital.

Do not chase returns. Invest more instead. To do that, focus on increasing your income by focusing on human capital.

The purpose of investing is to have money ready to be spent for a particular purpose, on the date needed, for the intended amount. For example, when your child was three years old, you started investing, using a plan like this, to ensure that sufficient money is there for paying for their college education the day the admission is due to happen. The entire fee and other expenses is available for spending as per an investing process followed for the last fifteen years.

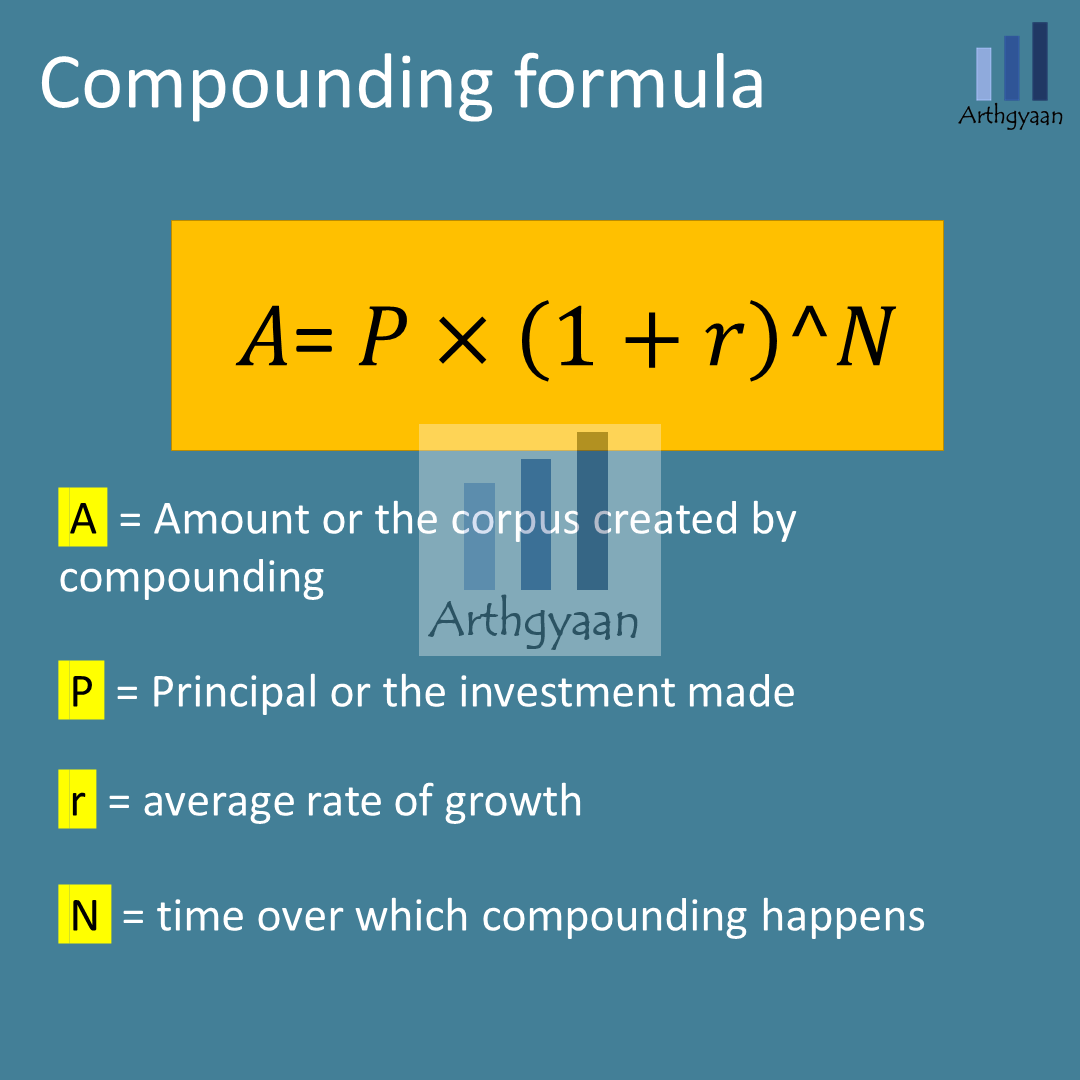

Compounding is the process that gets us to that goal, and we implement the compounding process via goal-based investing. This is the reason growing wealth is not a goal, but having a target lifestyle in retirement, sending children to the desired college, buying a particular house or car, or regular vacations are goals. To do this, we need to understand how compounding helps us on the journey:

This formula is an example of an exponential curve where the current period growth happens on the entire corpus from the previous period. A good example is simple vs compound interest:

This interest-upon-interest feature is the reason compounding grows so fast and is the premise of this quote:

My life has been a product of compound interest” - Warren Buffett.

There are three takeaways from the compounding equation:

We cover compounding in more detail in these posts:

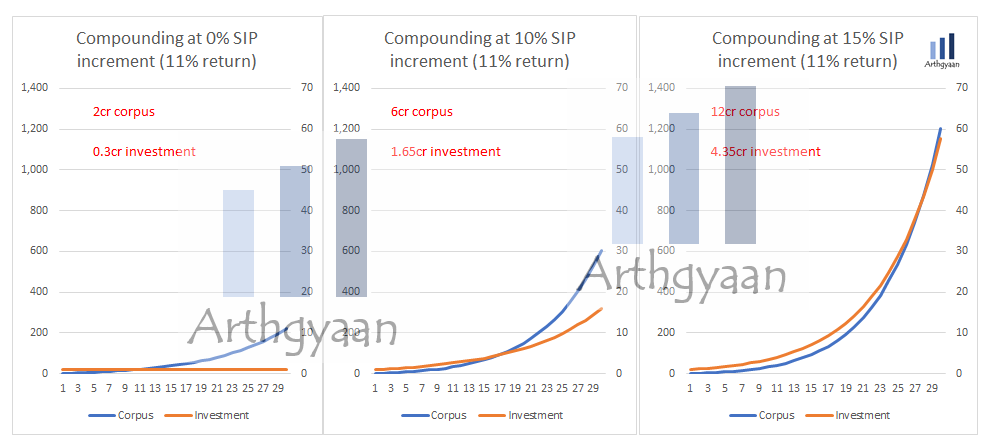

We can control how much we can invest every month by reducing our expenses or, even better, by increasing our income. How much we invest monthly and what we withdraw has a substantial impact on the final corpus. For example, investing too little is a common mistake. This issue happens when investors have not calculated the target corpus for their goals. Due to this issue, investors believe that a small SIP is sufficient for reaching their goals. As a result, they keep the rest of their investments in the bank, which does not beat inflation.

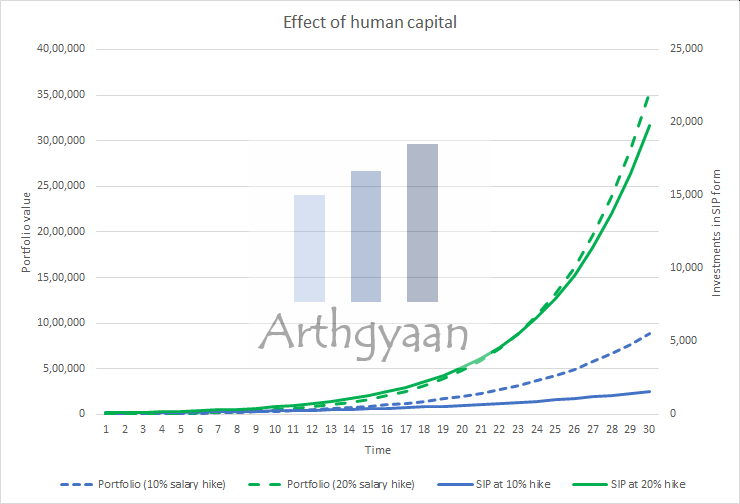

A SIP should also be increased every year, as a step-up SIP, as salary/income increases as part of the yearly goal review process. Assuming a 30 year investment period and average 11% returns,

Investors can plan for their goals and figure out how much they need to invest using this Excel template. This entire discussion, specifically the point of you needing money to make money, brings us to the point of human capital and what is it’s role in ensuring that we reach our investment goals.

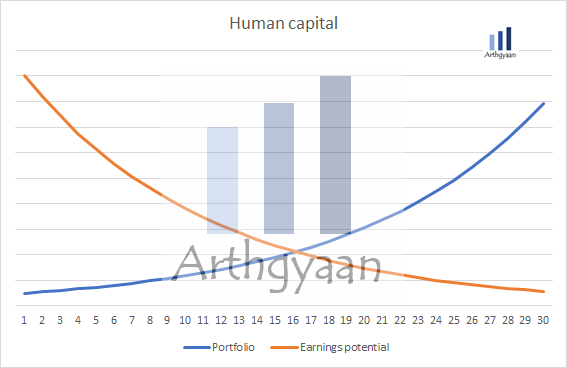

Human capital is an estimate of the future earning potential of an investor, either from salary, profession or business. As age increases, human capital will reduce; however, the investments made by the investor create a portfolio i.e. financial capital that meets all financial goals.

Human capital is defined as:

Human capital = Present value of discounted earnings of an individual over their lifetime

and is the total effect of intelligence, education, skills, knowledge, training, health, performance, attitude and work ethics.

Human capital increases when:

Human capital decreases when:

An average investor who lacks the time or skills to track markets or pick funds/stocks should aim for

Growing wealth depends on income and investments and is one of the axioms of personal finance. There is an intrinsic limit to the amount of time you can spend per day or week in your primary profession. If you know your hourly wage, and you should like this, you should also be aware that you cannot scale the denominator i.e. hours spent working every day indefinitely. This leads to the concept of increasing human capital, where you are enhancing your skills and knowledge to increase your income - both active income from your profession and passive income from other sources.

For example, if you are investing in stocks directly, either trading and investing, you are spending a good amount of time in that activity trying to get higher returns than the index. You should consider if it will be prudent to divert that time to your profession instead to increase your income to get more capital for investing and leaving investing to mutual funds. Here we see two investors getting the same average return from their investments over 30 years. One of them gets salary hikes of 10% a year while the other gets 20% hikes. Over time, their portfolios diverge, and the second portfolio ends at a value that is 4 times higher than the first.

If two people join the same company and one gets a 10% salary hike in one year and the other does not, then assuming that the rest of their careers and expenses and investment returns over time are same then the one with the hike will come out ahead. Such hikes come by increasing human capital.

We defined earlier that human capital is the totality of intelligence, education, skills, knowledge, training, health, performance, attitude and work ethics. If you have an extra say, 10 hours a month and have the option of deciding what to do with it, then spend that time in:

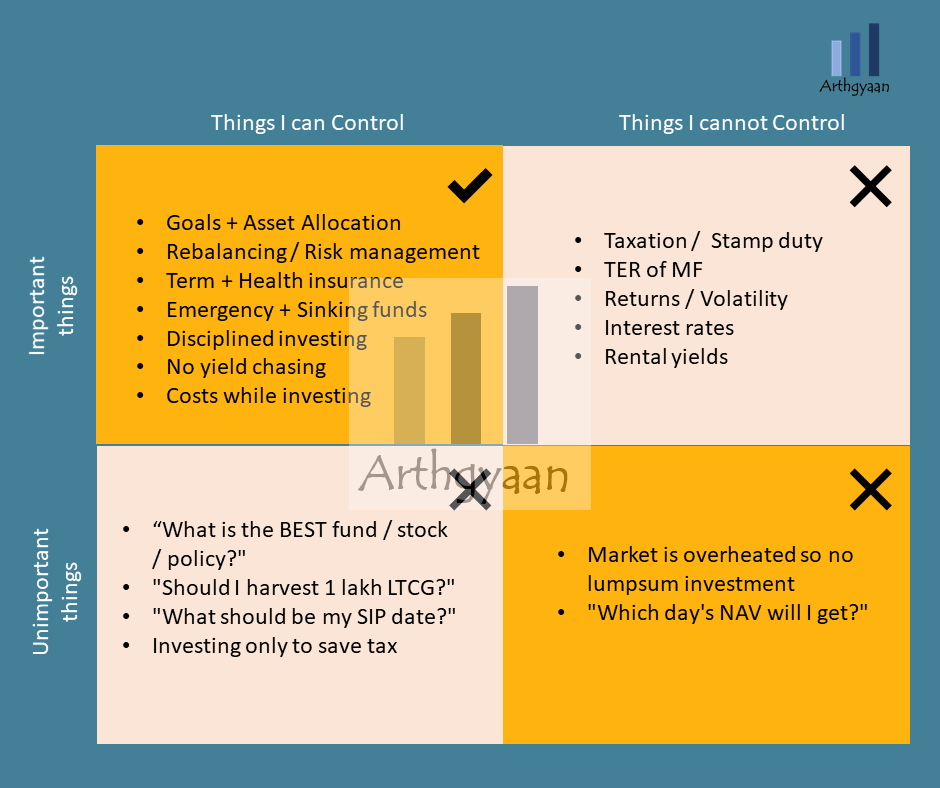

You should prioritise these steps over anything that improves investments returns which is the only part of the compounding equation that is not under our control. Analysing stocks, funds and IPOs or trading in shares and derivatives (FnO) can be exciting but only as a pastime. These activities should be recognised as a time sink at best and detrimental to your future financial goals at worst. Ideally, spend as little time as possible in:

We have discussed the process of goal-based investing extensively in this blog. These three articles will get you started on the process:

Along with this, you need to understand the concepts of

Ultimately you need to understand which of the various factors that affect your investments are under your control and which are not vs. which of these are important and which are not.

Read more here: Investor behaviour: control what is possible.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Your human capital, not investment returns, is your biggest wealth creator first appeared on 06 Feb 2022 at https://arthgyaan.com