Should you sell your mutual funds to buy a house?

This article talks about the best funding mix for buying your dream home from investments and home loans.

This article talks about the best funding mix for buying your dream home from investments and home loans.

Take a home loan or sell your investments can be a tough decision that depends on not only on pure mathematics but also a lot on how you feel about loans, the economy and also your financial condition. We break down each of these factors, so that at the end of the article, you have a clear picture regarding what approach works best for you. In the context of this article we will consider both buying a ready to move property as well as those being constructed.

This article is part of our series on “How to purchase a home”:

Buying a house is one of the most significant financial decisions you will make. It requires a fair bit of time to understand how you will pay for it. There are three basic options to pay:

Obviously, if you cannot cover the entire amount with you, a loan is a must. But taking a loan has two purposes:

A word of caution is advised here regarding the points above:

Banks require some amount of down payment for a home loan, say 20% from the buyer’s funds and the rest is given as a home. The amount of the down payment depends on the credit score of the borrower, their profession and the property in question. So in effect, this article covers the use case where you have an option of paying more than the minimum down payment to buy the house. Also, the more of your funds you are using for house purchase, there is a direct impact on the investments you need to make monthly since you are using up a part of your capital earmarked for long term goals into buying the house. The impact is:

At the end, you will be selling your assets like mutual funds to buy the house (partially or fully), but that will come from an investment allocated to that house purchase goal and not to other goals.

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that includes both interest and principal in the same amount.

EMI = Principal + Interest

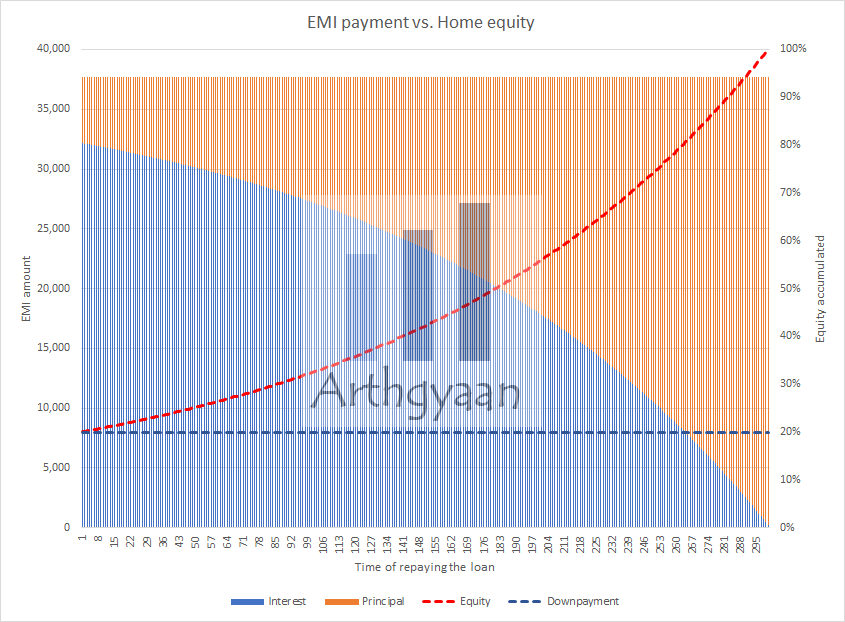

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

As you pay back the loan, your ownership share in the house will increase in the same way. At the point of taking the loan, you own 20% of the house (12.5 out of 62.5, of which 50 is the loan). The bank owns 80%. As the loan is repaid, you own more and more of the house as the principal is paid off. This is the concept of building equity in an asset. Equity is the part of the asset you own after subtracting the part that the bank owns.

Home equity value = Current home value - Outstanding loan balance

Once you build equity in your home, that has additional benefits:

As discussed earlier, in our article on EMI Traps, a home loan is an example of a good debt provided it is building an asset that appreciates with time. A critical distinction between a good and bad debt is whether the asset is appreciating or not. An apartment, depending on age and location, may have a lower appreciation potential than a plot of land that can get rezoned and converted into a building.

As long as you see either usage potential like staying, or decent rent and price appreciation potential, there are benefits of taking a loan and keep it as long as you have stable income. Otherwise, if it just a consumption asset like a 15 year old apartment that you will live for 10 years before shifting to another city for retirement, then take the minimum amount as loan and pay it off as soon as possible. It may be difficult to sell such properties in the future.

Income tax laws currently offer two deductions to home buyers as an incentive to purchase real estate:

For joint loans, the benefits double since both borrowers get the deductions. However, these deductions reduce the effective rate of interest on the loan and make taking an EMI more affordable. Alternatively, by lowering the loan’s interest rate, it lowers the hurdle rate for other investments.

If you can invest money at 10% in the stock markets, when the loan rate is 8%, you are taking the market risk to get 2% extra returns. If tax deductions reduce the effective rate of the loan to 7%, you are taking the same risk in the stock markets and getting 3% extra return.

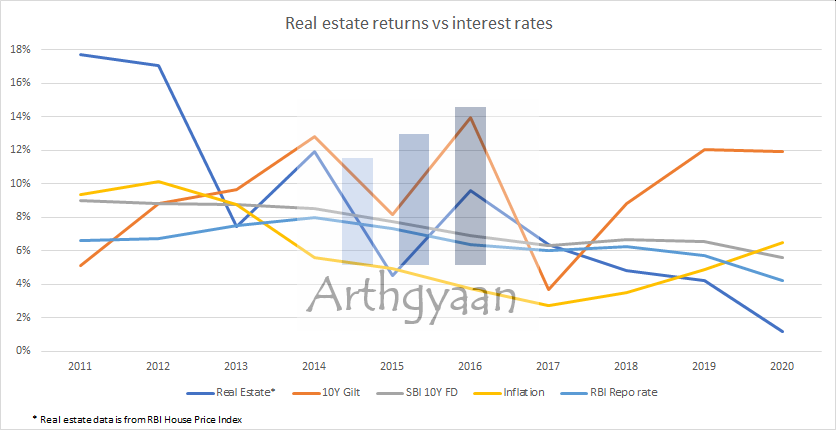

Real estate returns depend on many economic factors like interest rates in the economy like 10-year bond yields, RBI repo rates that move home loan rates, and FD rates.

Inflation data source: here

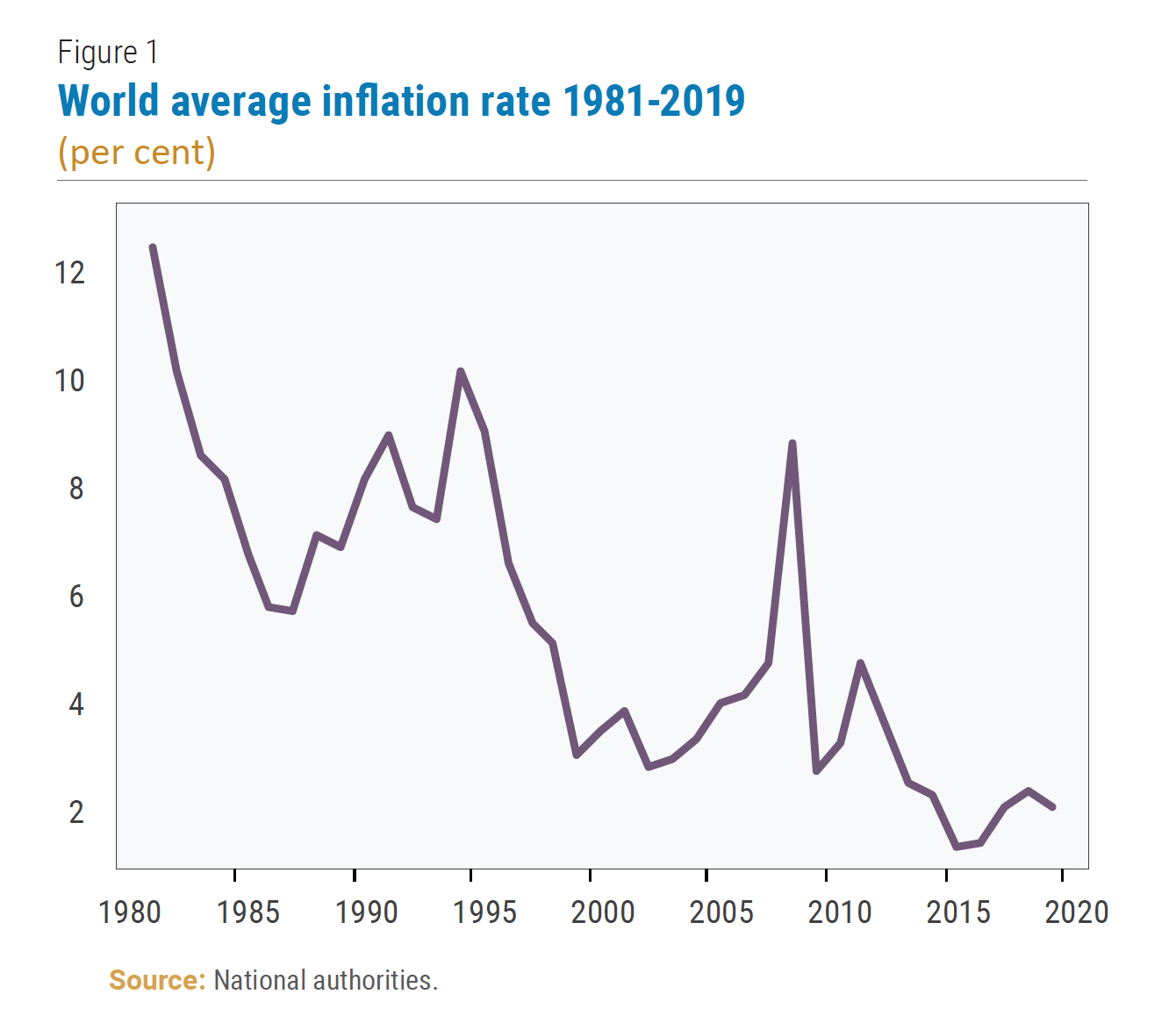

While inflation is expected to reduce in the economy over time, the real value of the EMI you will be paying will slowly reduce due to inflation.

Inflation: the impact on your goals and how to choose assets that beat it

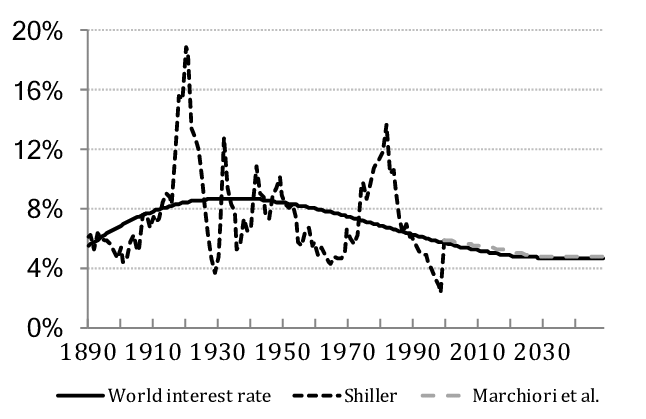

Interest rates data source: here

We expect that interest rates in India will move downward over time, in line with global trends as the economy matures. The loan rate typically changes with interest rates in the broader economy. In that case, either the EMI amount or the loan duration will vary to accommodate the new rate. Since most home loans are floating rate loans, the EMIs will reduce over time.

Personal finance is more personal than finance. - Tim Maurer

At this point, you need to decide what is your personal attitude towards loans:

If you are comfortable with a loan and will have income long enough to pay it off, then take the maximum possible home loan and invest the rest of your monthly surplus.

If you are not confident that you will be working or have a stable job for a long period, say 20 years, then take the 20-year loan but pay off at the rate so that the loan gets over earlier. Say you are 35 and not fully confident that you will have a stable job beyond 45, then take a 20 year loan but adjust your monthly payment to pay off the loan in 8-10 years to have flexibility in case your career outlook changes. This Excel (or Google sheets) formula will help you find out the time it will take (in months) to pay off a loan:

Number of months = NPER(MonthlyRate,-EMI,LoanOutstandingBalance,0,0)

where MonthlyRate = (1+AnnualLoanRate)^(1/12)-1

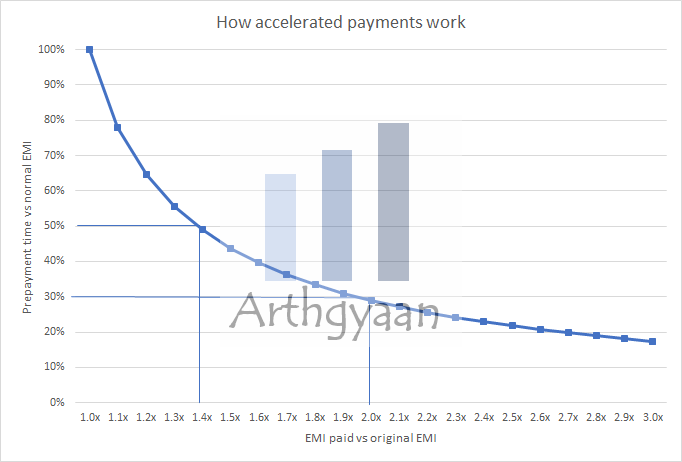

We have compiled this chart as an example to show you the impact of accelerated payments. For example, paying 1.4 times the current EMI pays off the loan in half the stipulated time while doubling the EMI pays of the loan in 30% time at 8% loan rate. So if you have a 20-year loan remaining, and want to pay it off in 10 years, just pay 40% more EMI every month.

Assessing your current financial situation is the first step towards buying a new house. Just like you should not build a house on a shaky foundation, you should not purchase a house without laying down the foundation of your finances:

This point is the crux of whether you should sell your current investments to fund the house and by how much. We have created a detailed affordability test that will tell you exactly how much loan you need to take based on your current finances, your goals, current investments and income.

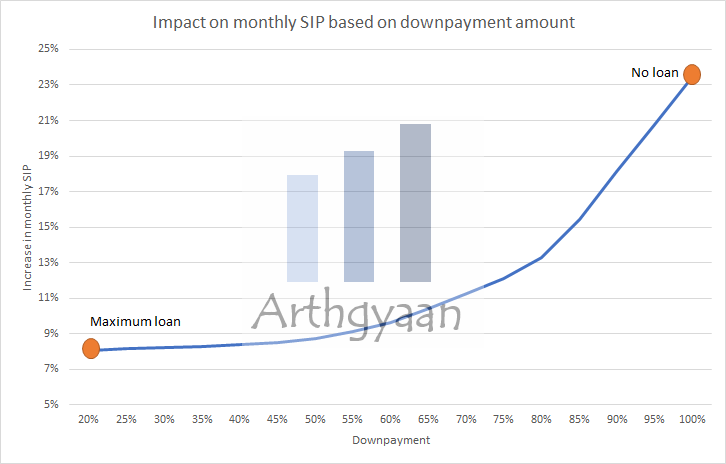

We use our goal-based investment planner, from here, to calculate the impact on a family which is considering selling a part of it’s investments to purchase a house one year from now. The minimum down payment allowed is 20% and the maximum of 100% means that the family sells their existing investments to buy the entire house using their current assets. As the amount of down payment varies, there is an impact on the monthly investment they need to make for their future goals since they are spending their current corpus to buy a house.

As the chart shows, the more the amount of down payment, by selling their investments, the more is the impact on future goals. This tool then provides an indication of exactly how much of the assets should be sold as down payment. To understand more on the impact on your existing finances, please refer to this post: Goal-based investing: how to purchase your dream home. The numbers are specific to the example in the sheet but you can customize it for your own use.

If the increase in monthly SIP is something your current income can handle, feel free to consider selling some of your investments to buy the home. If not, invest for it for some time and then purchase. This post discusses how to do that.

If you do decide, after due consideration, that you will sell your mutual funds to buy a house you will be in for a pleasant surprise. Section 54F of the income tax act says that long term capital gains, on selling mutual funds for example, are tax free if you use that money to buy a house.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you sell your mutual funds to buy a house? first appeared on 04 Feb 2022 at https://arthgyaan.com