How do you get SIP amount for complete portfolio: Part 5

Walk-through: Get SIP amount for all goals together

Walk-through: Get SIP amount for all goals together

We have already covered

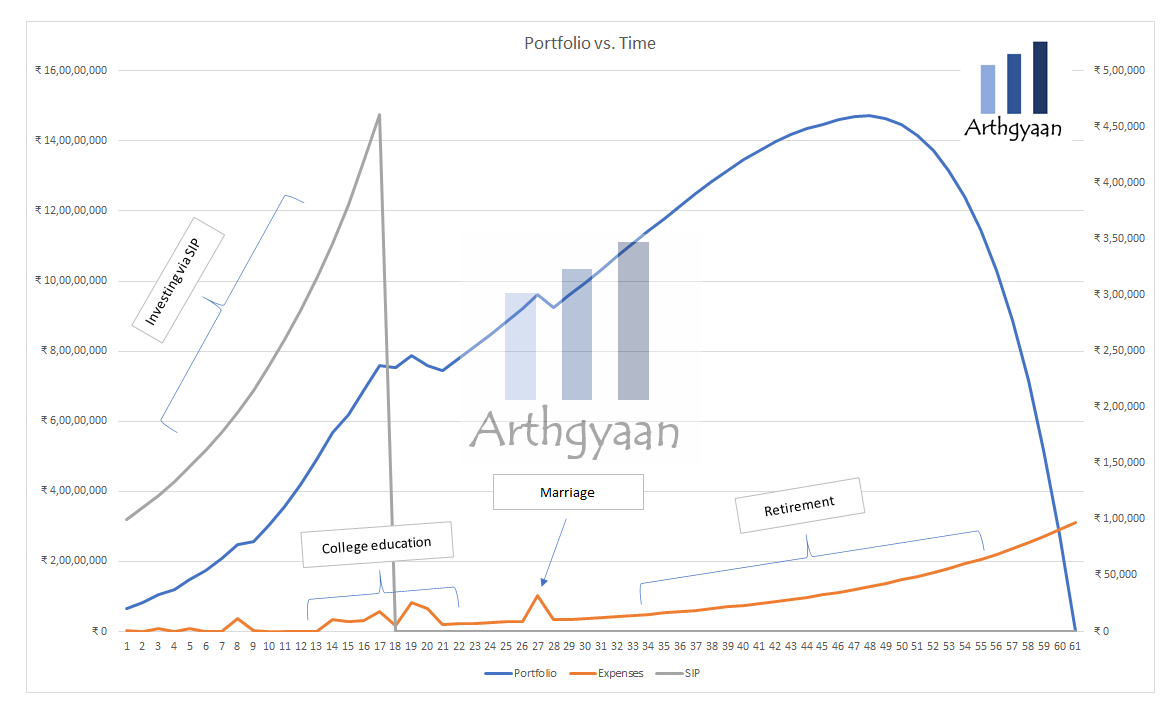

We will now combine all of these together to cover all goals together in the family.

Typically for married couples, this is the life expectancy of the younger spouse and could be as 100 years nowadays. We need to adjust the duration of the retirement accordingly. The longer the duration (assumed 40 years in the Excel example), the more savings are needed every month.

Here each year of retirement is modelled as a separate goal. Naturally, once the retirement period ends, there is no money expected to be left for any heirs. If that is needed, please create a separate goal for that using this method.

One of the important assumptions will be the expenses in the first year of retirement (22 years from now in the example) assuming the retirement starts immediately. This needs to include expenses like housing, health insurance and travel and will assume no income. If pension or other income is present, then the expenses will be assumed beyond this income.

The model deals with a 36-year-old salaried individual with retirement at age 58 (22 years from now) who is also targeting retiring 5 years earlier. We will assume a figure for annual expenses if traditional retirement happened today (5 lakhs in the example), model it forward by 22 years of inflation (at 7%) and then use the figure to save for each year of early retirement.

These calculations are explained in this Google Sheets workbook.

A very important part of planning for a long term goal is increasing the monthly SIP amount as income increases. In the example, the increase is assumed to be 10%/year. The model handles rebalancing automatically by showing the amounts to be Invested and Redeemed and over time reduces the amount of equity exposure for each goal so that risk can be managed.

The following needs to be done in this order:

See this detailed post for the process for reviewing.

At all times ensure that you have the following in place

Please see below:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How do you get SIP amount for complete portfolio: Part 5 first appeared on 07 Jun 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.