Emergency fund: what, why, how much to save and where?

Saving 6-12x monthly expenses as an emergency fund helps you sleep well at night.

Saving 6-12x monthly expenses as an emergency fund helps you sleep well at night.

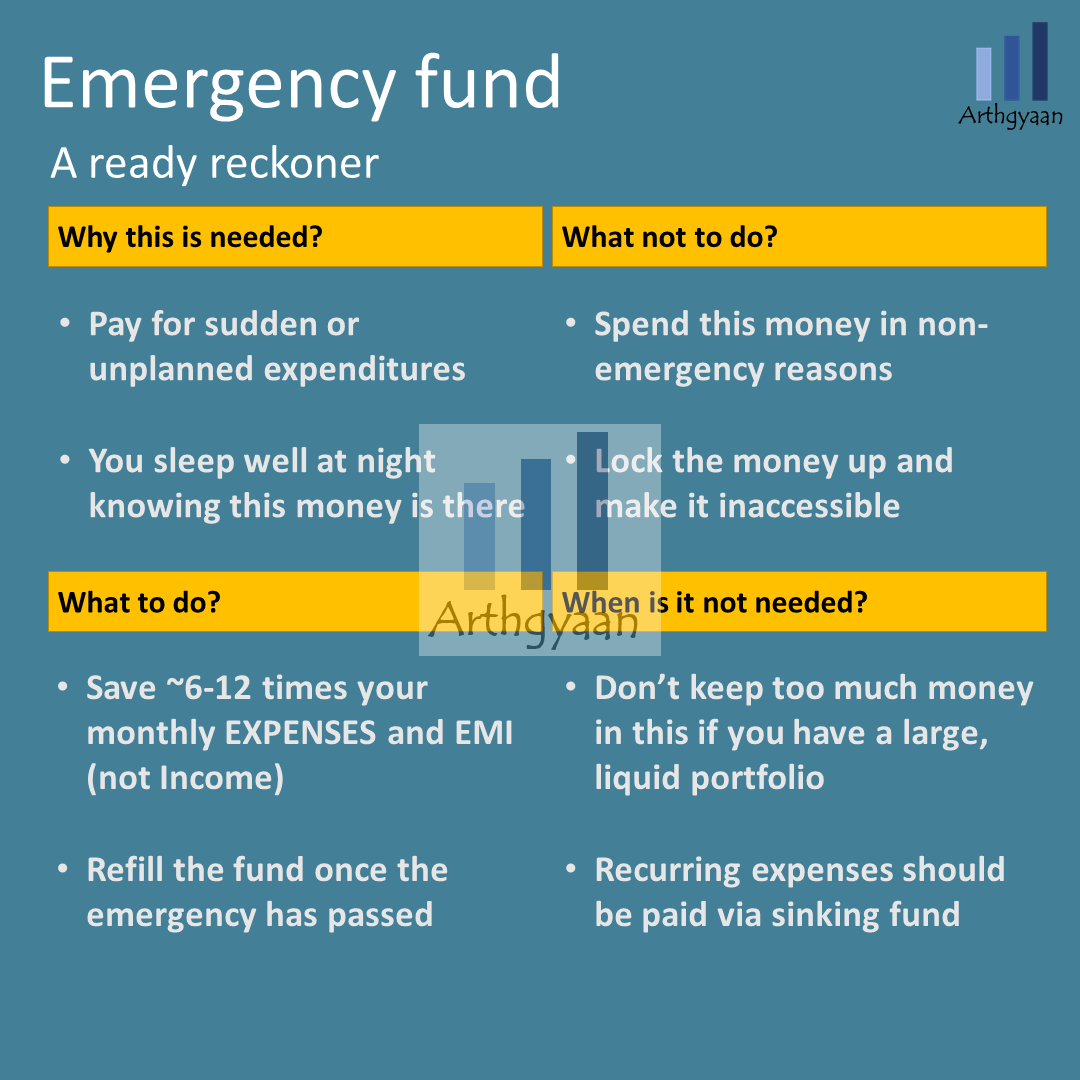

An emergency fund is a stack of money kept aside for a sudden or unplanned expenditure or contingency. This money is needed to be available for immediate use in emergencies. Without this safety net in place, you will have to run around for money, depend on a loan or use a credit card at high interest rates.

An emergency fund is a part of everything you need to do before investing in financial goals. Read more here: As someone who has heard about goal-based investing, how do I get started?

An emergency fund allows you to pay for:

An emergency fund prevents the requirement of new debt: both personal loans and worse credit cards have extremely high interest rates. If you already have loans, having an emergency will severely strain the monthly budget. People who earn and save well sometimes take their good fortune for granted and ignore having an adequate emergency fund. It is one of the axioms of personal finance?.

First, know your monthly expenses (not income) that include mandatory items like

Notes:

Emergency fund estimation varies between people:

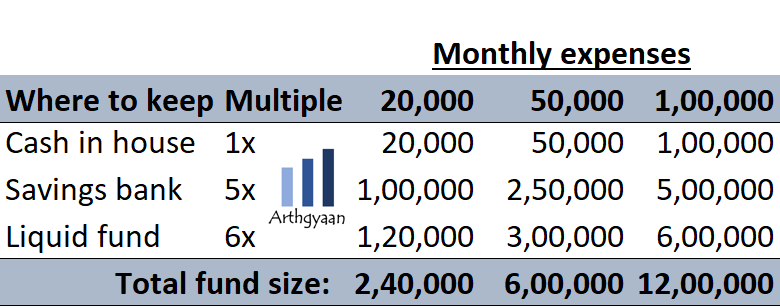

Since a middle ground is needed, the standard recommendation is six times (6x) expenses calculated in the previous step:

Since monthly surplus = income in hand - mandatory expenses, aggressively start saving most of the surplus to build up the emergency fund until at least 3x is saved. Do not invest in long-term (>5 years) goals until at least 6x is saved.

When an emergency fund is:

Divert all bonuses, gifts etc., into building your emergency fund until you reach at least 6x. If your spouse does not have any income, please consider a slightly higher allocation to your emergency fund.

You can consider a psychological hack keeping one year of children’s school fees in a separate bank account as FD. This FD will give you peace of mind that your children’s schooling will not be interrupted due to any emergency.

Important: refill the emergency fund if you use it back to the original level. Review the requirement of 6-12x every time things change: job, family situation etc., to ensure you have adequate coverage.

Caveat: for people with large liquid portfolios (in stock/debt MF), it makes little sense to exceed 12x as the emergency fund. Since then, you have been tying up too much capital that can be used for long-term goals.

The emergency fund needs to be liquid, i.e. immediately available. Apart from household cash, bank accounts offer the next best place, followed by liquid mutual funds. Do not chase returns here and lock up this money in a way it is not available.

For banks, you can go with large banks like SBI, HDFC or ICICI (due to their SIFI status) and look for banks that offer sweep FDs. If your bank does not provide sweep FD, it is okay - keep some money in a savings account and some in FD. Make this a joint account with all adult family members and have multiple debit cards. At all times, look for good ATM coverage for your bank and have Netbanking via apps set up on your phone. Avoid banks that have been in the news lately for issues with their operations or have a recurring history of trouble.

After choosing a bank account, liquid mutual funds can be used (choose those liquid MF which invest in 91day T-Bills and cash only). If you cannot determine which funds have this feature, please stick to banks.

A high-limit credit card can be used as a part of an emergency fund if you have the money to pay it off and use it in an emergency. However, sometimes hospitals or medical stores may not accept credit cards, so this should not be your first choice.

Do not keep family gold, stock/equity MF etc., as an emergency fund - these are not liquid and can lead to losses if sold in a down market. These are for long-term emergencies like medical treatment etc., where everything needs to be spent.

Many people choose housing loans or overdraft accounts like SBI Maxgain etc., for an emergency fund. However, please don’t do this since the lender may change withdrawal terms, or it is difficult to take out the money in an emergency. Only the EMI part of the fund should be stored here.

Ultimately it would help if you wished that you never have to use your emergency fund but will be relieved to know it is there.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Emergency fund: what, why, how much to save and where? first appeared on 27 May 2021 at https://arthgyaan.com