Life stage investing: how to manage finances when you are joining your first job

This post from our life stage series shows how your finances need to be managed when you transition from being a student to joining your first job.

This post from our life stage series shows how your finances need to be managed when you transition from being a student to joining your first job.

In this article, the first of our Life-stage Investing series, we discuss how someone joining their first job should manage finances. The series is here:

More articles will come soon.

First of all, a big Congratulations is due for having finally completed studies and landed a job that pays you money. After all the 15-17+ years spent in education has brought you to this point and it is a big achievement.

Getting the very first salary of our very first job can be an incredibly liberating experience. The experience of transitioning from a student to a working professional, meeting colleagues instead of classmates and typically moving to a new house managed only by you means a lot of changes that are happening around the same time. Knowing, managing and keeping track of money is an integral part of that experience.

This guide focuses on being functional and straightforward, and not exhaustive to cover all possible use cases. Nevertheless, it will serve most people. If you wish to understand something specific, please comment below.

There will be a lot of jargon in this post which is unavoidable. Google, like for everything else, is your friend to learn more.

An emergency fund is money kept aside for usage in a sudden or unplanned expenditure or contingency. This money is needed to be available for immediate use in emergencies. Without this safety net in place, people will have to run around for money, depend on a loan or use a credit card at high-interest rates. Your target should be to save a minimum of 3-6 months of mandatory expenses (rent, food, internet, electricity, mobile, housing-related costs, transportation, EMI) in a simple FD or sweep FD linked to your salary account. Use the emergency fund to pay for medical emergencies, Vehicle accidents, sudden repairs/theft, Job loss and family illnesses. This fund is not your entertainment or travel fund.

A sinking fund is used to pay for general expenses that are usually mandatory (insurance payments), but a few of them can be discretionary as well (like mobile phone replacement). The key here is that the expense is periodic at a frequency lower than once a month and having the sinking fund smoothens your monthly expenditure. Monthly periodic expenses like rent, mobile/Netflix bill, EMI etc. come from monthly salary. Periodic expenses can be once a quarter, once every six months, annually or once every 2-3 years. A bank recurring deposit or SIP in a liquid fund is sufficient for this purpose.

According to a 2019 study by an app-based credit line, most young earners borrow money to pay for medical expenses and weddings. An emergency and sinking fund takes care of all of these use cases together.

Read more here:

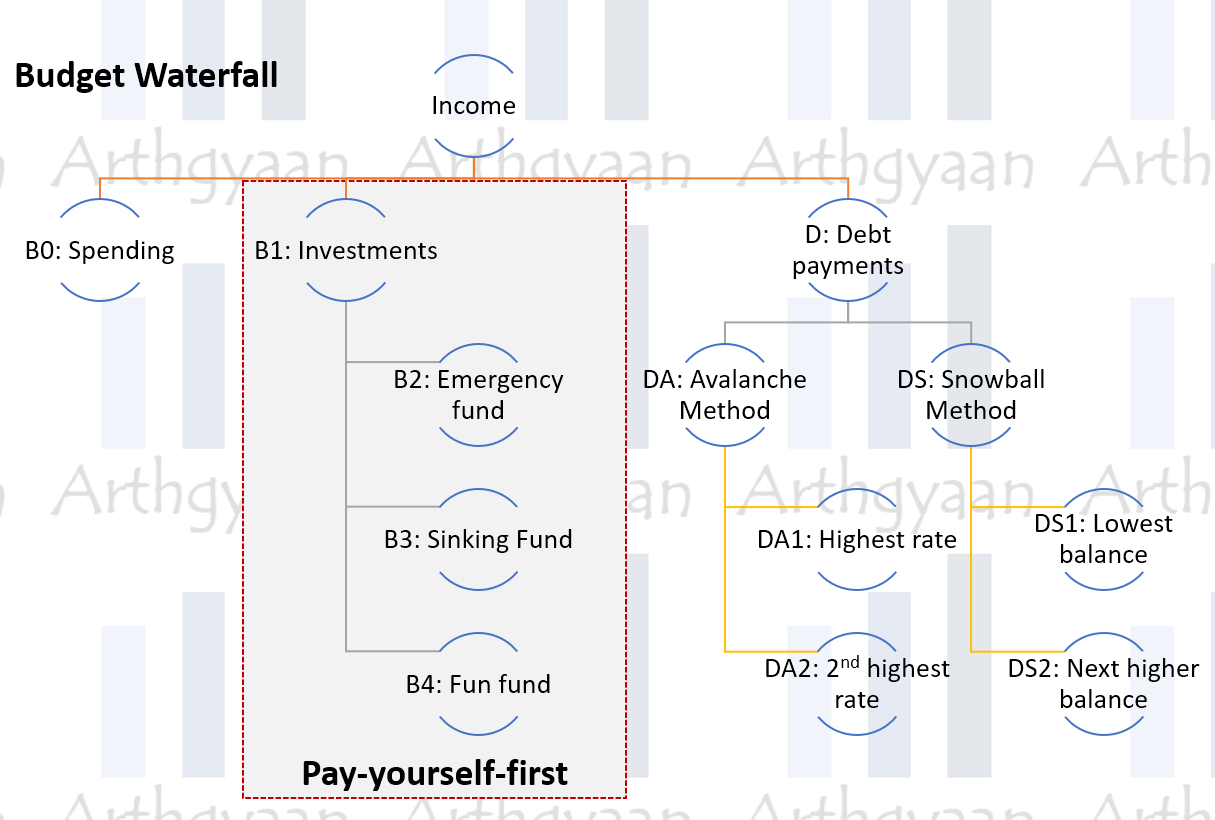

Pay-yourself-first is one of the golden rules of personal finance that builds up a habit of saving and investing. This concept is similar to a loan where the lender automatically deducts the EMI every month. There are penalties for missing a payment. We can use the same technique for savings and goal-based investing. The main benefit of paying-yourself-first is that the money is moved out of reach before discretionary expenses start. It is like a salary that you are paying to your future self.

Read more here: How to budget, save and invest in a stress-free manner?

Apart from your salary account, open another account solely to invest. For example, use the accounts like this:

You need to perform a one-time Know Your Customer (KYC) process for investing in stocks and mutual funds. This can be done online. After KYC is complete, you can start investing. To invest:

A lot of people spend a lot of time anguishing how to get started on investments given that there are too many products and choices out there. As a simple first step, take the following steps to start investing.

Every month, make a note of how much money is there in the salary account just before the salary is credited. This is the amount you did not spend last month. Now make four equal parts of this money:

This post will help you choose funds: Which funds should I invest in?. If you are looking for a step-by-step guide, refer to this article: What are the best index funds for new investors in India?.

If your emergency fund is complete, make two equal parts for the sinking fund and long-term goals. If the emergency and sinking funds are both full, the whole money will go into your long-term goal fund. Repeat this process every month until you set your investment goals. At this point, do not get bogged down by the “which is the best stock/mutual fund for investment?” question. There are bigger challenges to be overcome first as explained below: goal setting is the first step before investing.

Read more here:

This allows you to safeguard your future earnings at the cheapest possible cost. Try to get coverage amount is a multiple (15-20x) of current post-tax annual income and take annual premium (once-a-year) payment option from an insurer you are comfortable with. The premium can be saved via a sinking fund (see below). At this point you must politely and firmly refuse any insurance plan that will get pitched by a friendly or “well-meaning” relative no matter the relationship, pressure and statements like “you don’t know anything about money.” While that last statement might be true, it is an easy research to perform and will save you a lot of anguish later. Also remember that a good and must-buy product does not need to be sold; it sells itself. Do not waste your money by mixing insurance and investments. A term policy will suffice for life insurance.

Here is an article that deals with buying term insurance step-by-step.

Health insurance costs are relatively cheap at the beginning of the career so this is a good time to take a family floater coverage (separate from the company-provided one if any) for a ₹10-15 lakhs base policy with a 50-100 lakhs super-top up. You must include elderly parents in this since due to co-morbidities, their premiums will increase drastically a few years later. You can save the premium via a sinking fund.

The purpose of the personal accident (PA) insurance policy is to provide a replacement for your income if you have an accident and cannot work after that. Unlike term insurance, where claims are paid on death, a PA cover is applicable when one of the following is the result of an accident:

A credit profile is an individual’s ability to pay back loans measured by a number called credit score. The higher your score, the lower is the perceived risk on you from banks that you will not pay back a loan. In the future when you plan to take personal, car, education or home loans, you will get loans at lower rates if your score is high. In India, CIBIL is the most common place to know your score, and you can check your score online for free once a year.

If you have never taken a loan before or held a credit card, your credit score will be undefined due to a lack of credit history. If you have a credit card, or already have a loan, or make bill payments through Net-banking, you must not miss any payment as that will lower your score. In addition, trying to open new cards or loans creates a hard pull enquiry on your credit score, which may temporarily reduce the score.

If you are taking or plan to take Buy-Now-Pay-Later (BNPL) loans, keep in mind that

BNPL schemes have high-interest rates that will kick in if you cannot pay off the bill in full every month, just like credit cards.

Credit cards are loans at interest rates of 36% or more. They are offered to people to trap them into either spending more by offering points, discounts, cashback and EMI offers or put them into an EMI trap that is difficult to break out of. Suppose you are in a position where you are making only minimum payments on your credit cards with discretionary purchases. In that case, you need to seriously review how you are going to pay down the loan.

Read more here:

A chicken-or-egg problem comes when you try to take a loan like a personal loan or credit card and you do not have a credit history. If your request for a new credit card is rejected due to lack of credit history, or if your score is reducing since you are trying to get new cards but getting rejected, then there is an easy solution: apply for a secured credit card.

A secured credit card is issued against a fixed deposit you make with a bank that gives you the card. Typically you will get a credit limit of 80% of the value of the FD, and the card will be issued without delay. Since the bank already has money from you as FD, it will not consider your lack of credit history or low score as a deterrent.

Do this:

Your credit score will get updated in a few months.

A friend or colleague may approach you to cosign a loan. This makes you responsible for their loan and may harm your credit as well if they delay payments. Additionally, you are now legally obligated to pay back the loan if they default.

Politely and firmly say no to all such requests no matter how good your relationship with the person.

Good debt is essentially a loan taken to purchase an asset that gives a return (either via income or via a price increase). Bad debt is used for buying a consumption item whose value reduces with time. A few examples are of good debts are loans for:

In general, a loan for buying things that increase in value, produce an income, increase human capital or are to be used for business purpose is classified as good debt. Such loans typically offer a tax deduction on the interest and in some cases on principal. Home and educational loans offer deductions to individual tax payers.

The opposite examples are taking a loan like:

Read more on this concept here: My EMIs take up all my salary. How do I start investing?

Paying income tax is one of the inevitabilities that everyone with income has to deal with sooner or later. However, new investors are typically shocked to see how much taxes they are paying on their salary slips for the first time. This article gives a quick overview of applicable taxes for a resident taxpayer as per FY2020-21 (return filed by 31-Dec-2021).

The most basic tax calculation is:

Tax is due on net income i.e. gross income minus deductions. Deductions allow you to save tax. Tax in India is based on slabs. As the income increases, taxes are levied at higher rates on the additional income above thresholds. This means that the highest tax slab is applied only on the income above the value over which 30% is applicable, not on the entire income. There is a surcharge on the total tax only if the taxable income exceeds ₹50 lakhs.

Read more here:

Risk profiling is the first step before you make any investments. This step is important to know what kind of an investor you are based on your temperament, background, knowledge and clarity about the future. It is all too common to start investing in the wrong asset classes, have outdated or incorrect concepts or have unrealistic expectations. A few common examples are:

All of the above statements can be proved inapplicable to the general majority and should be reconsidered if you follow any of them. A few common mistakes that interrupt compounding is discussed here: 12 mistakes that interrupt compounding: what to do instead.

Read more on risk profiling here: Do not invest in mutual funds before doing this.

Housing costs and vehicles are the most significant line items in any household budget. However, over-spending on home loans and car EMIs can divert money from other goals significantly. This is where prioritization comes in. There are smaller items are more frequent but tend to add up over time. This is called the Latte Factor.

The Latte Factor was popularized by author David Bach. The concept is simple. Small amounts of money spent on a regular basis cost us far more than we can imagine - [Source: Forbes.com: ‘https://www.forbes.com/sites/robertberger/2017/05/27/the-latte-factor-7-key-lessons-we-can-learn-from-a-cup-of-coffee/’]

It would help if you prioritize your spending on discretionary items like this:

This way, you can spend more money on what you care about and cut down on those items you do not. At this point, it will be good to figure out our hourly wage to make conscious spend-or-avoid decisions: How long does it take to earn what we spend on?.

Read more:

We are highlighting a few common mistakes made at this point that will save you years of cleaning up the mess later. You will be ahead of your peers, without spending more money, by simply avoiding these mistakes:

Read more here:

The right way to invest is to follow Goal-based investing. This is complete process described in three parts:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Life stage investing: how to manage finances when you are joining your first job first appeared on 10 Feb 2022 at https://arthgyaan.com