What are the best index funds for new investors in India?

This article shows the steps that a new index fund investor can follow to shortlist an index fund for investing

This article shows the steps that a new index fund investor can follow to shortlist an index fund for investing

Disclaimer: Fund names in the article are not recommendations to invest into or exit those funds.

This article is a part of our detailed article series on the concept of index funds in India. Ensure you have read the other parts here:

This article gives an easy to use Excel list of Index Funds in India for you to know which ones to avoid and which ones can be considered for investing.

Understanding the risk of every asset class in our portfolio is essential. This article talks about the risk in index funds.

What are index funds, why invest in them and how to choose one?

A “new investor” belongs to one or more of the following categories:

• someone starting their first investment in mutual funds

• someone looking for an index after being convinced of the reasons to choose an index fund over active funds for example to avoid Closet indexing or chasing performance

• someone looking for another index fund in a different AMC

We have already covered the concept of why you should invest in index funds. If you are unfamiliar, please review that article first: Which index funds to invest in and why?.

Investing in index funds is the first step in the journey towards lazy portfolios: What are lazy portfolios and why you should implement them for your goals?.

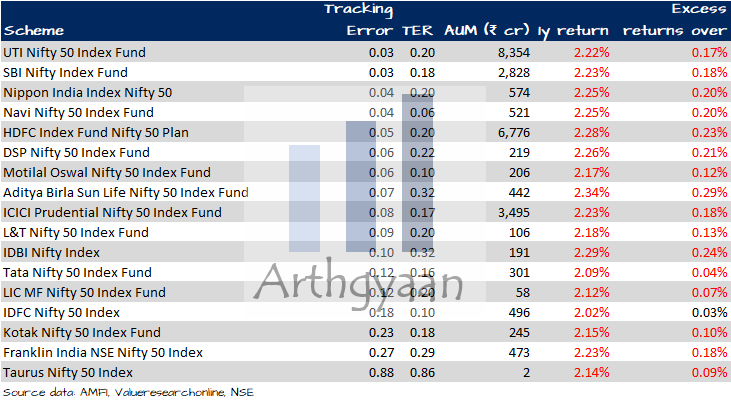

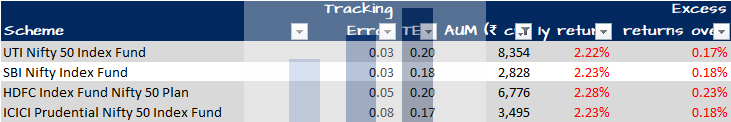

An index fund is a commodity offering that does not differ too much from one AMC to another. A few factors help differentiate between different index funds tracking the same index. The table below is sorted on tracking error ascending.

Here is how you choose an index fund once you have decided which benchmark index (like Nifty 50, Nifty Next 50, S&P 500 or MSCI World) you want to invest in:

Total Expenses Ratio (TER) is what AMCs charge to a fund as the cost of running that fund. This includes salaries of the fund manager and team, trading and related costs of buying/selling and distributor costs. Index funds generally have lower TER than active funds since there is not much to do for both AMC employees, trading is less, and distributors have no incentive to push them vs high-cost active funds.

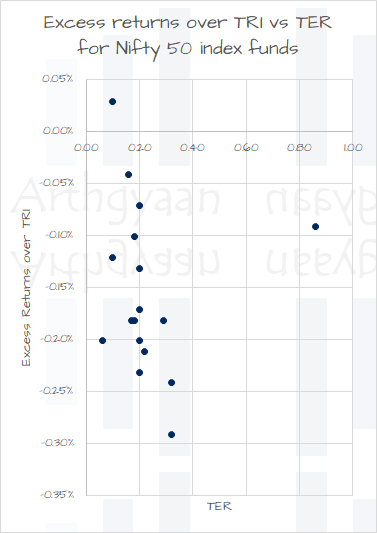

Since all index funds give returns similar to the index by design, a fund with lower expenses, i.e. TER, will provide better returns than another fund with higher fees. Everything else remains the same. Mutual fund portals generally give TER for all funds as a convenient list/table. Keep a watch on this one since AMCs have a habit of abruptly increasing it.

Index funds returns will vary slightly from index returns since it is impossible to perfectly replicate the index by buying and selling stocks all the time since that will become too expensive to trade frequently. The difference between the index return and fund return is called excess return. Tracking error (TE) measures how much these excess returns vary from each other (mathematically, TE = standard deviation of excess returns).

It is generally advisable to go for the lowest tracking error since that indicates consistency in how the fund is run. This information is usually present in fund information documents. Alternatively, investors can calculate this from index data from the NSE/BSE website and fund NAV data from AMFI using at least one year of trading data.

However, if Tracking Error data is not available, choose funds with low TER and not too much return difference from the index (i.e. low excess returns) and go with that.

AuM is an easy metric to check since this is present in all fund portals, AMFI, and AMC websites. The bigger the size of the fund, the easier it is for the fund manager to buy/sell stocks as per the index. Also, it is easier for the fund to deploy cash from inflows and handle redemptions if the fund size is larger. However, for some indexes, too much AuM may create liquidity issues if the underlying stocks are not traded, for example, in the mid and small-cap universe. This will lead to higher tracking errors.

We will now show how to choose an index fund step-by-step.

We will start with the Nifty 50 index. Nifty 50 has the highest number of funds tracking it. Also, a large-cap index will be the core portfolio for any investor.

There are now multiple AMCs that have index funds. There are now 19 different index funds that track the Nifty 50 as per AMFI. While most index funds are similar, some are better than the rest.

We will exclude ETFs here due to considerations of liquidity issues that lead to high price-NAV variations: Which are the best and worst ETFs of India?

This article has an updated list of funds and their tracking errors: Which are the best and worst index funds of India?

Use Google Search to get to any Nifty 50 fund page and then click through to the category page (direct link).

There are a few things to do here:

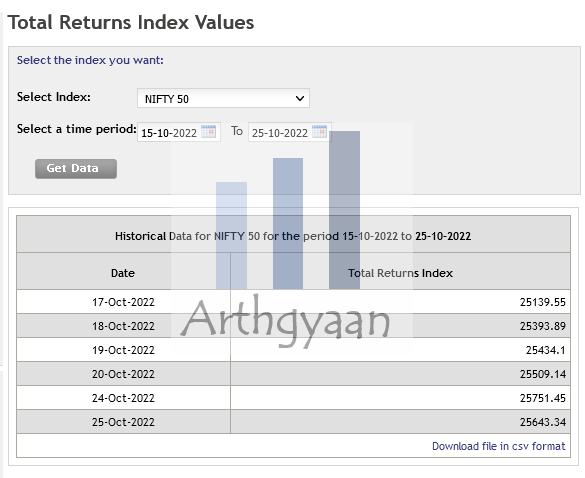

We recommend that investors do this step since it is an important metric. But, if the process is too technical, it can be skipped. The result adds the Excess return as a column to the table created above.

Source of this data:

TRI return = Index Level Today / Index Level 1-year back -1

In this case:

TRI return = 25,509.14 / 26,042.59 - 1 = -2.05%

We already have the 1-year fund return data from Valueresearchonline. We calculate Excess returns like this:

Excess Returns = Fund returns - TRI returns

For UTI Nifty 50,

Excess Returns = -2.22% - (-2.05%) = -0.17%

As the table shows, there are:

We have a way to see all the Tracking Error and Tracking Differences of major index funds in one place: Which are the best and worst index funds of India?

You should know that the analysis above is at this point. If you repeat the whole sequence of steps a year later, you will likely get a slightly different answer. Index funds form the core of the equity portfolio. You will not switch between them frequently though it is reasonable to diversify between AMCs

Here are the points you should note:

Ultimately what matters more is the consistency in the returns, measured by excess returns and tracking errors. Both being close to zero is the ideal situation. But realistically, consistency of return is one of the factors that you cannot control. You should revisit this framework once a year to see if your current index fund does not drift too much away from their peers. We maintain that the investor should focus more on increasing their investments year-on-year and perform effective risk management instead of focusing on finding the best index fund.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the best index funds for new investors in India? first appeared on 26 Oct 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.