What are lazy portfolios and why you should implement them for your goals?

This article shows what lazy portfolios are and how investors can quickly implement the concept to make reaching their goals more manageable.

This article shows what lazy portfolios are and how investors can quickly implement the concept to make reaching their goals more manageable.

A lazy portfolio is one where the individual investments are chosen in a way that they:

🤖 Explainer: What is a lazy portfolio

A lazy portfolio is an investment strategy that requires little active management.

It is typically made up of a mix of low-cost index funds or ETFs that are rebalanced on a regular schedule.

Lazy portfolios are designed to be easy to set up and maintain, making them a good option for investors who want to invest for the long term but don't have much time to spend on their investments.

Lazy portfolios can be a good option for investors who want to invest for the long term but don't have a lot of time to spend on their investments. They are easy to set up and maintain, and they can provide a diversified portfolio with low costs.

Individuals in lazy portfolios do not

Implementing lazy portfolios requires commitment and maturity that can be cultivated or implemented under professional guidance. There are three steps can be seen that investors pass through.

Investors in this phase have a few common problems that they are trying to solve:

The portfolios of such investors suffer from two main problems:

Instead of a “where to invest”, we instead move to the goal-based investing approach by first setting investment goals: Set a goal before looking for what to invest in.

Click to read the complete three-step framework:

Once these steps are completed and an investment plan is created (some live case studies are here), then comes the “where to invest” part of the plan.

At this point, we decide to prepare the lazy portfolio by choosing low-cost index funds.

Why choose low-cost index funds?

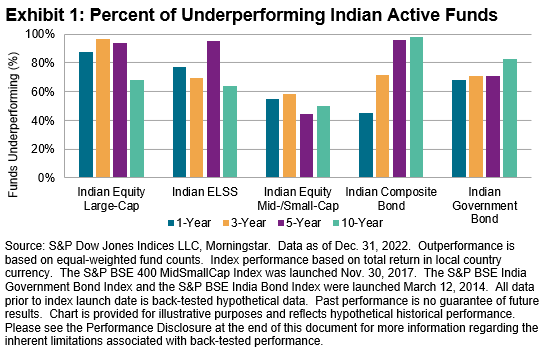

Image © spglobal.com

There is well-documented proof, for example, in the latest SPIVA report that active funds routinely underperform passive index funds. This fact, coupled with the observation that the same fund does not outperform or underperform its benchmark consistently yearly, means that choosing a “winning” active fund requires luck, not foresight.

Choosing index funds guarantees that the investor makes market returns without any effort or active decision-making. The path to a proper lazy portfolio starts with low-cost index funds.

In a future article, we will cover the step-by-step process for creating a lazy portfolio.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are lazy portfolios and why you should implement them for your goals? first appeared on 14 Jun 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.