Your portfolio needs a glide path: what, why and how?

Don’t just start a SIP. You need a glide path. Here’s how you do it.

Don’t just start a SIP. You need a glide path. Here’s how you do it.

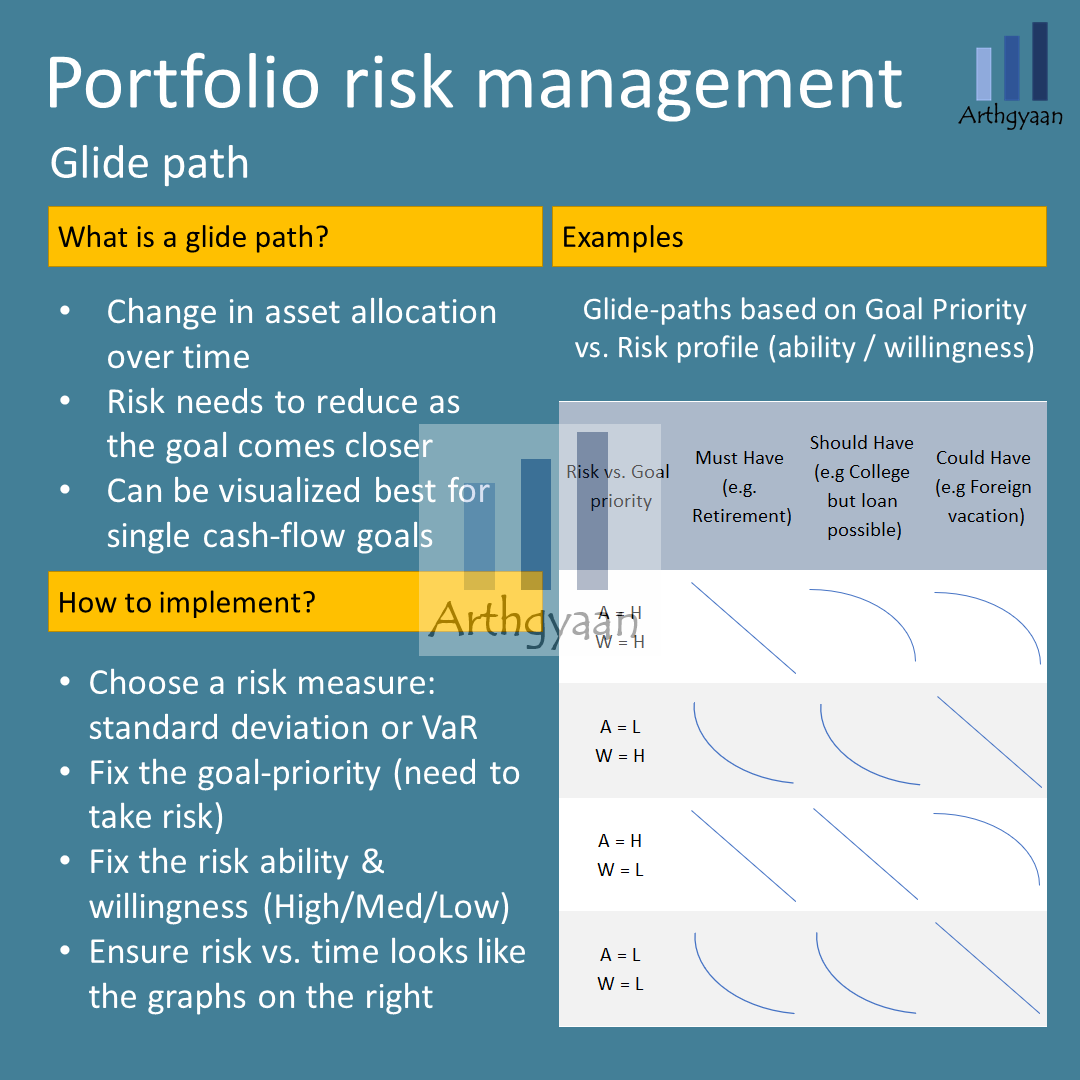

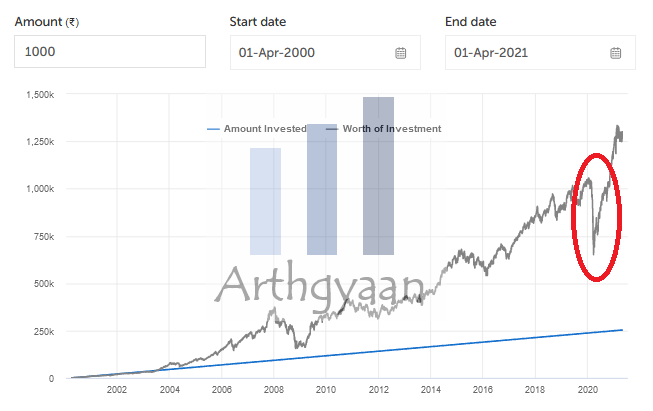

A glide path shifts a portfolio towards less-risky assets over time by varying the asset allocation. As goals come closer, it is very risky to keep investing in the same equity to debt mix as in the beginning. The corpus size is large and any market fall will wipe out years of compounding close to the goal. This is because just having a SIP does not really reduce risk and give returns as expected. See the following example of the effect of a portfolio with SIP investments over time due to market fall.

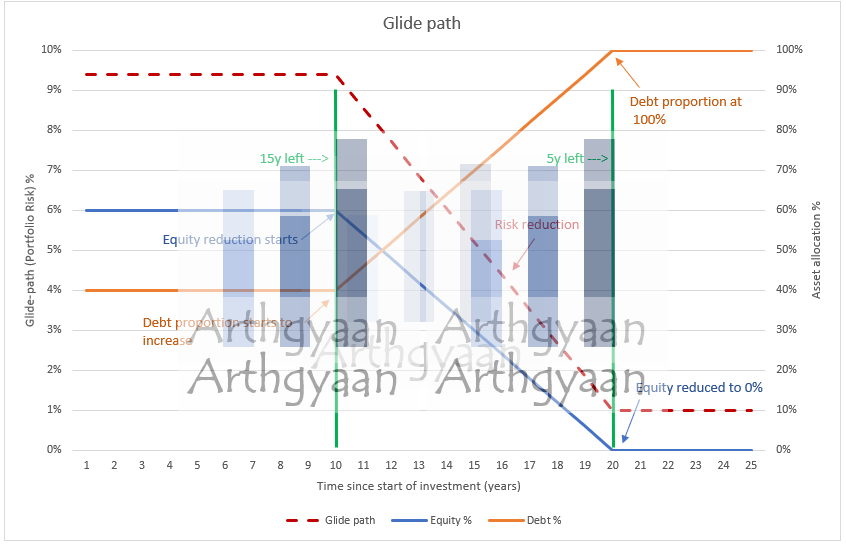

As goals come closer, you need to reduce the proportion of risky assets like equity and shift it to safer ones like debt. The figure above shows a simple example for a 25-year goal with equity proportion starting at 60% (debt = 100% - equity) that starts to reduce when 15 years are left. When 5 years are left, the portfolio shifts completely to debt funds. Why we choose 5 years for exiting equity is explained here: How many bear markets have we seen in India?.

Read more on how to choose equity and debt funds suitable for your goals.

The suitable equity to debt mix that you need to have every year for each goal can be found via risk profiling](/blog/riskProfiling.html). We cover why risk needs to reduce overtime by looking at the three factors that impact risk profile:

Once you know the asset allocation for the goal that is to be followed this year, please trigger rebalancing to ensure you reach the target weight.

This post covers rebalancing in detail: how to rebalance? while handling changes of asset allocation over time is explained in this article: How to use the bucket theory to plan for your goals?.

The table shows a typical single-payment goal and the effect of the glide path over the period and how risk is managed. For example, the -48% equity return in year 18 has no impact on the goal since the portfolio is completely moved out of equity at this point. On the flip side, the 46% return in Year 13 has limited impact on the portfolio since only 18% of the portfolio is in equity at this point. The process of reducing the equity allocation over time prevents extreme events of both types once the corpus has become large. More details are available here: What is the lifecycle of a goal?.

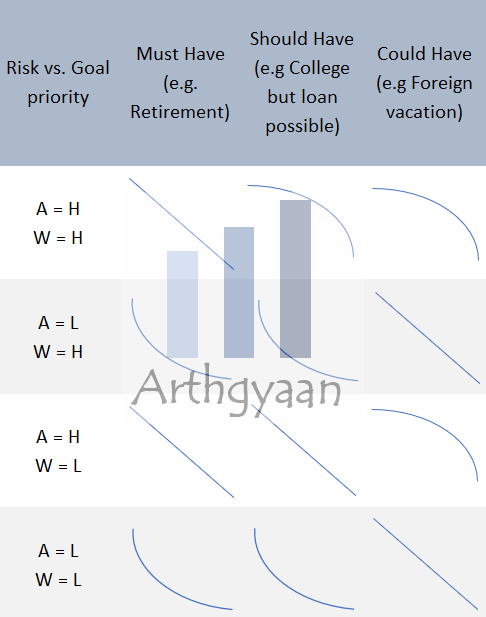

There are multiple types of glide paths depending on the three risk factors described above and the examples are given in the above image. In each chart overall portfolio risk is plotted against the passage of time. For example:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Your portfolio needs a glide path: what, why and how? first appeared on 26 May 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.