How to use the bucket theory to plan for your goals?

This article shows you a simple set of rules for planning any financial goal: from a month to decades away via three buckets of assets.

This article shows you a simple set of rules for planning any financial goal: from a month to decades away via three buckets of assets.

We extend the concept of the bucket theory of portfolio construction to create a framework to be used in the accumulation, i.e. the pre-retirement stage when the investor has active income and is investing for future goals.

The Arthgyaan Have vs Needs framework (HvN) is a simple tool to tell you how much money you need to invest:

We will now break this down in simple terms. There are two important questions that investors who are investing for their goals ask:

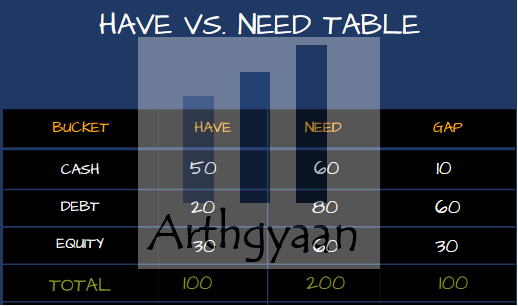

The Arthgyaan HvN framework needs you to make a very 4x4 simple table with three asset class buckets and for each bucket asks you to calculate three numbers: the amount you already have (the HAVE column), the amount you need to reach your goals (the NEED column) and the difference between the two (the GAP column).

The three buckets are:

The columns are:

We also have a TOTALs row to give a high-level view of the portfolio.

The Arthgyaan Have vs Needs Framework helps you answer questions like:

We will cover these questions in detail in a future article.

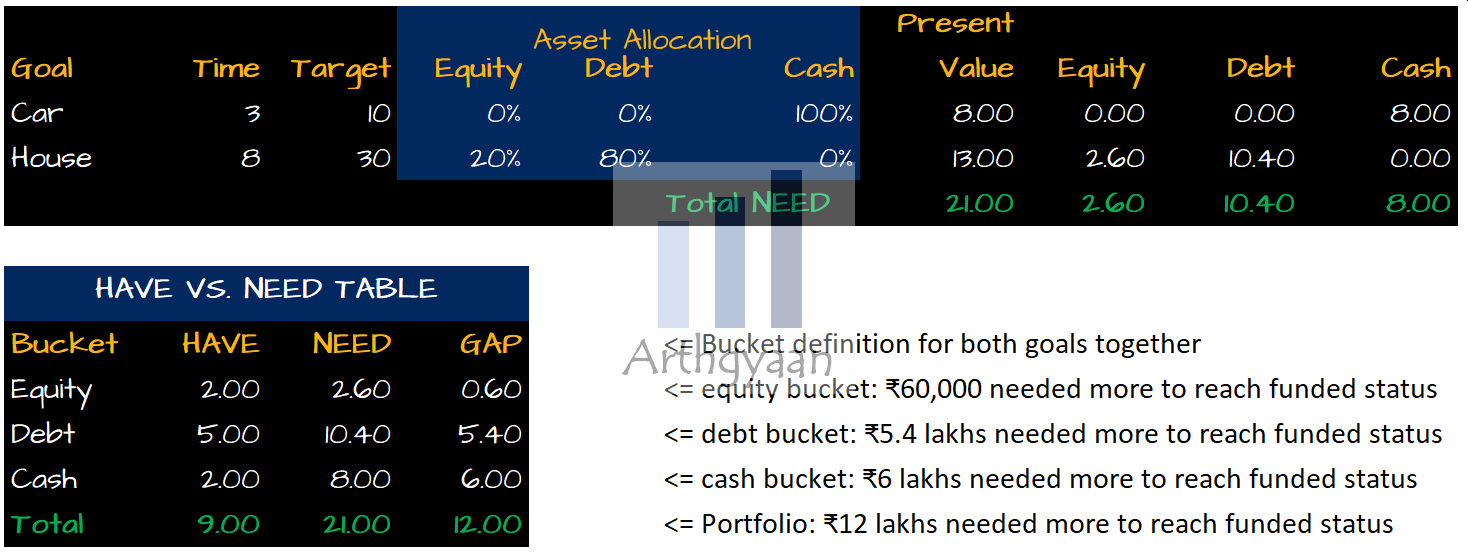

We will use a simple numerical example to calculate this. Let us say that the investor has two goals:

As the table shows, the investor has ₹2 lakhs, ₹5 lakhs and ₹2 lakhs in equity, debt and cash, respectively. The table also shows the total amount needed to reach the funded status of both goals combined. By funded status, we mean that for each goal, there is no need for further investment. This point is essential since the invested amount will grow over the time left to reach the goal value when the goal is due.

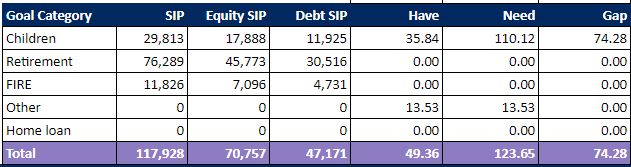

If you are using the Arthgyaan goal-based investing calculator, then it is effortless to calculate the numbers and use this framework for all your goals together as below:

Asset-wise view:

Goal-wise view:

We use the sample asset allocation defined in this post to create the asset allocation plan for the goals.

If you have not read the article before, please read that first and then come back to this post: What should be the Asset Allocation for your goals?

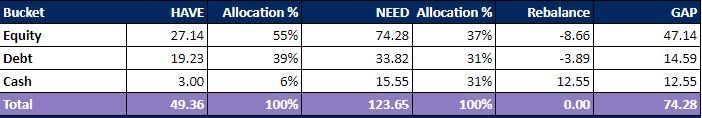

We go from equity > debt > cash in that order because we will give the most amount of time for the equity bucket to grow. In the case above a lump sum of say, 3 lakhs will go towards filling the equity bucket (by 0.6 lakhs) and then the rest ₹2.4 lakhs into the debt bucket.

Removing from buckets will go in the reverse order: redeem from cash first, then debt and then equity last.

Monthly investment in SIP form will go into the cash bucket since that bucket funds short-term goals. In the example, the investor needs to ensure that the cash bucket is filled by increasing the cash bucket value by ₹6 lakhs in 3 years. However, the cash bucket NEED value will also grow as the goal comes closer as per the glide path of the goal.

The test for making progress is watching the value of the Gap column. We have mentioned before that over time the NEED column will increase since that is the present value of the goal. For example, if there is only one goal and the rate of return is 10% with the target of 10 lakhs to be reached in 5 years then:

This means that the gap figure should be chased by the investor to ensure that it reduces with time. If it is increasing with time, either due to market fall or lower than required investments, then the plan needs to be reviewed and more investment is necessary.

Astute readers should notice that if the gap value becomes zero, then CoastFIRE is reached since at this point the return of existing assets will take you to your FIRE goal since you no longer need to invest for your goals.

If you have an excess amount of equity in your child’s college education goal, instead of selling it as per the glide path, reallocate that to your retirement portfolio instead. Now you can build up that amount via current income over the time left until college starts.

We discuss this topic in detail in this article: How to invest for college education goals for teenaged children?.

We have discussed the concept of rebalancing in detail here: Portfolio rebalancing during goal-based investing: why, when and how?.

There we have mentioned that rebalancing can be triggered when the proportion of one asset class vs another changes by 5%. An alternative could be that if the GAP figure in any row becomes more than 6 months of investment value, trigger a rebalance.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to use the bucket theory to plan for your goals? first appeared on 14 Sep 2022 at https://arthgyaan.com