How long will your money last if you retire today?

This article shows that if you decide to retire today, how long will the corpus last realistically based on real rates of return.

This article shows that if you decide to retire today, how long will the corpus last realistically based on real rates of return.

This article is a part of our detailed article series on Safe Withdrawal Rates. Ensure you have read the other parts here:

This article brings together the interrelationship between the size of the retirement corpus, inflation, asset returns, longevity and the amount you wish to spend in retirement.

This article shows how much you can withdraw from an equity mutual fund if you have a pension plan as well in retirement.

We examine the results of running a long-term SWP in index funds for retirement.

This article shows the maximum withdrawal in SWP form that you can take out from a retirement portfolio to make it last 30 years.

The article investigates if you can retire in India with only 25x your expenses saved as retirement corpus.

Inflation, as we discussed in our detailed article on inflation recently, increases the future value of goals to unexpected levels. We can use the rule of 72 as a convenient mental shortcut to understanding the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Rule of 72 lets us quickly calculate the impact of inflation over time. For example, using the rule, we can see that:

The above examples show the danger of linear thinking when money is involved especially in retirement. For example, any goal planning that ignores the effect of inflation will lead to inevitable failures when it is time to spend the money. Similarly, investing in insurance plans that give a fixed return over life will lead to getting smaller and smaller amounts in real terms that will be useless in the later years of retirement. The actual calculation is an application of the compounding formula like this:

Cost after N years = Cost today * (1+Inflation) ^ Time

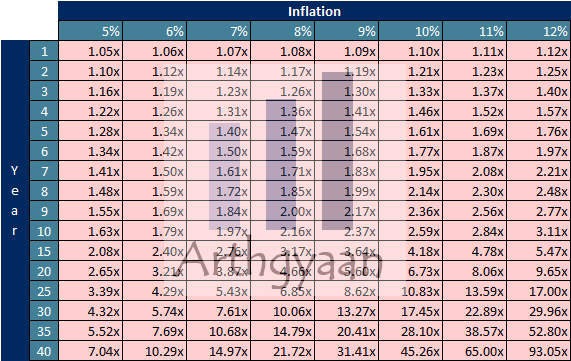

Here is a table that applies the above rule:

For example, at 9% inflation, a goal ten years away will increase by 2.37 times. If the cost today is ₹10 lakhs, after ten years, it will be ₹23.7 lakhs.

Given that we need to keep track of inflation while investing, the real return is a convenient tool to subtract the effect of inflation from the nominal portfolio returns.

Return over inflation, i.e. real return, is calculated as

Real return = ( 1 + Nominal Return ) / ( 1+ Inflation ) - 1

or more simply

Real return = Nominal Return - Inflation

The second formula is a bit less accurate but is simpler to understand and calculate.

Real return during the retirement period depends on:

With this background, we will look at how to use the concept of real return with the SWR in retirement.

SWR, as we have defined before while studying if the 4% SWR rule works in India, works like this:

We will assume that the first year’s withdrawal is a value between 1% and 5%. The withdrawal amount will be increased by inflation of 7% every year. As a practical example, we will take

| Start | ₹ 1,00,00,000 |

|---|---|

| Withdrawals ⬇️ | – |

| Year 1 | ₹ 2,50,000 |

| Year 2 | ₹ 2,67,500 |

| Year 3 | ₹ 2,86,225 |

| Year 4 | ₹ 3,06,261 |

| Year 5 | ₹ 3,27,699 |

If we assume a real return of zero, i.e. the portfolio grows at the same rate it is withdrawn from, a lot of our retirement calculations become very simple. With zero real returns, the starting retirement corpus divided by the expenses in the first year of retirement is the number of years the corpus will last. It is that simple.

A 1 crore corpus growing at 7% will therefore support a 2.5L SWR (growing at the same 7%), for 100/2.5 = 40 years.

If the real return is more than zero, that is if the portfolio grows faster than inflation, then the number of years it will last will be more. Conversely, if the portfolio is very conservative, the real return will be negative and it will last lower than in the previous case. We have discussed these points before as well:

The table shows the relationship between SWR and the real rate of return to show how long the corpus will last. From the table we can see that:

We have already done some inflation studies with historical data for India:

We will assume the following as the retirement portfolio

We see that the real return of the portfolio is:

Real return = 0.6 * 4% + 0.4 * (-3%) = 1.2%

We have covered the 1.2% real return case in the above table which shows that if SWR is 3% or less, the portfolio can easily last 40 years or more. There if you are planning to FIRE for 40 years, a 3% SWR with a 60:40 equity:debt portfolio is a good option with these assumptions.

If the SWR is higher than 4%, there is only a limited chance that the portfolio will last longer than 30 years.

This result was a portfolio with a fixed asset allocation, a bit like a unified portfolio. In a future article, we will see how a portfolio whose risk component is gradually reduced with time lasts in retirement against various SWRs.

If you are struggling to plan for retirement, this article will help you get started: Low-stress retirement planning calculations: worked out example.

A table of how soon money runs out is useful for

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How long will your money last if you retire today? first appeared on 18 Sep 2022 at https://arthgyaan.com