How conservative investors risk falling short of their goals

A reader query prompted this post on the risks of not investing in volatile assets for long term goals.

A reader query prompted this post on the risks of not investing in volatile assets for long term goals.

Being new to mutual funds, not able to initiate any investment related formalities thinking about the adverse effects. How to motivate ourselves and move forward? - Reader

I have come across many people who delay investing due to innate fear or misunderstanding of how investing works. The noise coming from financial media, specifically the negative ones, adds to their anxiety. There are also misconceptions at play here, with “stock markets are gambling” being one of them. The result delays in starting investing that can go well into the forties. The delay can be traced back to a misunderstanding related to the concept of volatility and risk.

Volatility is the fluctuation of the price of something. In the context of investing, volatility is the prices of stocks and bonds going up and down for various reasons. However, it is easy to conflate volatility with risk, but they are not the same. Risk is best illustrated with some examples. Risk is:

There is no guarantee that investing in volatile assets will eliminate these risks. You can minimize risks by choosing and executing goal-based investing as a plan. However, unless the portfolio value is substantial compared to the goals (say ten crores vs ten lakhs), avoiding volatility will surely lead to the risks as described above.

A common fear of late investors is that I invest 50 lakhs today, and the market will fall 20-30% soon. The question to ask at this point is: so what? We can say so what because of two reasons: 1. If the market falls, it will recover. 2. Only the money you will not use for the next ten years or more will be invested in equity.

It is indeed painful to see your investments fall in value. But that is normal in an asset class like equity that fluctuates a lot in the short term but generally goes up in the long term.

When you create a portfolio, you need to invest monthly as per income, called Systematic Investment Plan (SIP), and invest the money you have at hand for the same goal, the lump sum. The lump-sum may be a substantial amount for late investors, say 50L or a crore or even more. It is normal to fear the fate of this investment since you have never invested in risky assets before.

The longer you stay invested with a lump sum, the more likely you will not lose money, as shown below. We will use Nifty 50 price index data from 1993 to calculate this probability across multiple holding periods. We see that only beyond ten years or more, the likelihood of losing money drops to mostly zero.

If we repeat this analysis with some chosen active funds with data from 2006, we see the same result.

To average the initial fluctuations, investors should spread this lump sum investment over a few months up to one year. This plan will slowly familiarise them with market volatility.

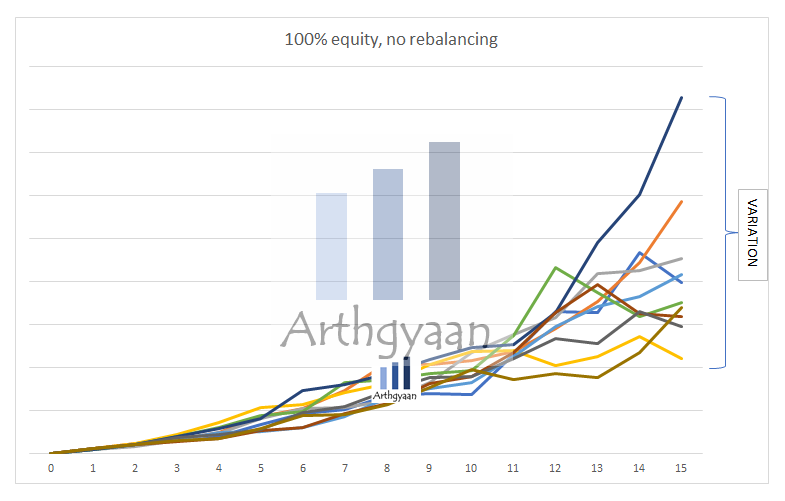

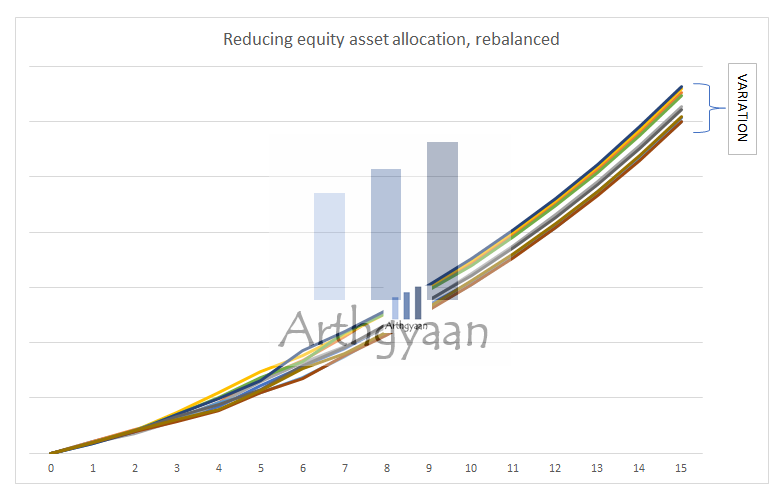

We use actual Nifty 50 price index returns to show running a 25-year SIP. The result shows a significant variation in the final portfolio amount depending on the SIP and the intermediate yearly returns.

However, we also see that the overall return has been positive as per past data.

Asset allocation is the not-so-secret secret sauce of creating a portfolio that ensures that irrespective of what the stock market does, you have money at the time you need to spend it. Having the proper asset allocation ensures that

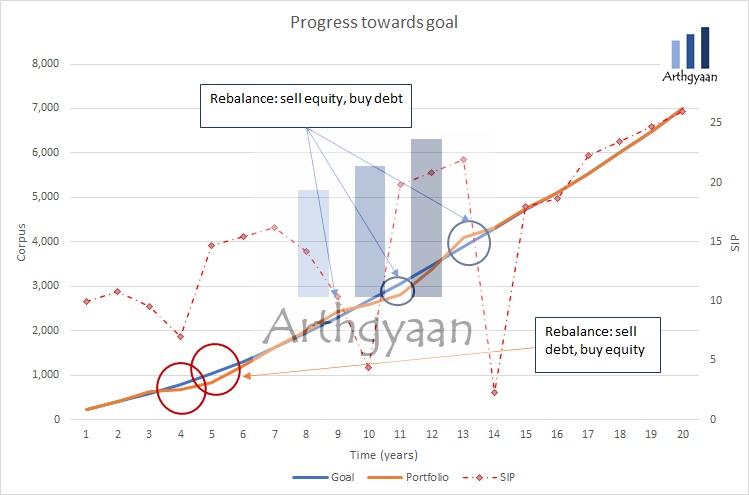

Once you start investing, the process looks like the image above. The blue line is the goal that increases at a smooth rate over the goal horizon of 20 years. This line is smooth since this is theoretical, assuming average returns from the assets in the portfolio, which would typically be equity and debt. The SIP amount is expected to increase linearly by a fixed percentage (like 5% or 10%) to accommodate rising income.

In real life, however, there will be two changes:

The first point (unpredictable returns) is countered using the concept of rebalancing, which manages portfolio risk by following a glide path. The glide path progressively reduces the exposure to risky asset classes as the goal comes closer, thereby locking in the returns at every point.

The orange line is the portfolio that fluctuates due to market risk. You are essentially trying to keep the orange line above the blue one at all times by adjusting the SIP amount and rebalancing to manage risk.

The concept of the life-cycle of a goal is described in more detail here: What is the lifecycle of a goal?

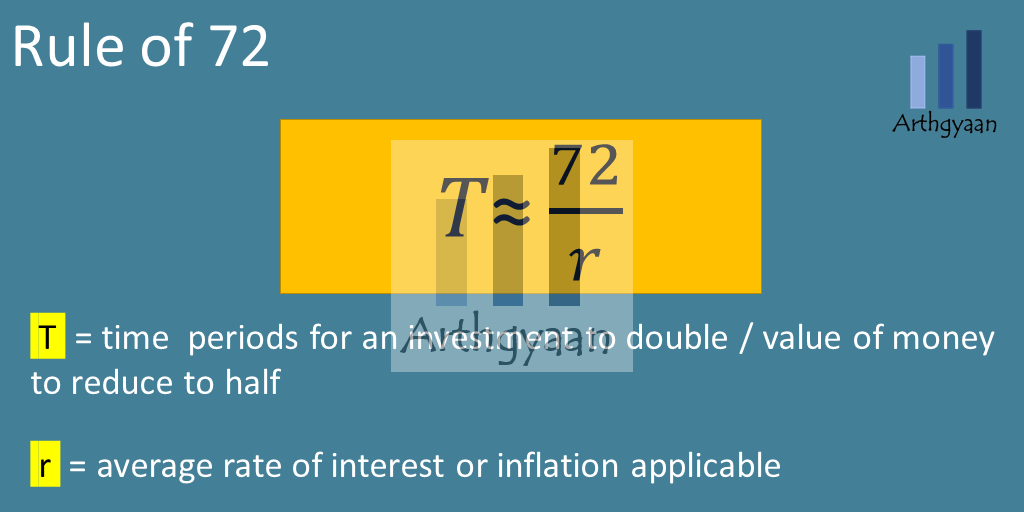

Inflation is an essential input to goal-planning in an economy that rises overall. We can use the rule of 72 as a convenient mental shortcut to understanding the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Rule of 72 lets us quickly calculate the impact of inflation over time. Using the rule, we can see that

The above examples show the danger of linear thinking when money is involved. For example, any goal planning that ignores the effect of inflation will lead to inevitable failures when it is time to spend the money. Similarly, investing in insurance plans that give a fixed return over life will lead to getting smaller and smaller amounts in real terms that will be useless in the later years of retirement. The actual calculation is an application of the compounding formula like this:

Cost after N years = Cost today * (1+Inflation) ^ Time

To beat inflation, one of the best options is equities. Historically equities have outperformed inflation in India and abroad, and the trend is expected to continue. This article discusses choosing equity investments in detail.

Apart from equity, there are many debt instruments for retirement corpus creation. This list includes debt mutual funds, NPS, provident funds and others, covered in more detail here.

We have performed a detailed analysis of debt fund category returns vs inflation in this post: Can debt funds beat inflation?

The wish of avoiding equity assets in retirement is common among investors

It is not compulsory to invest in equity for long term goals with the caveat that the corpus you generate will be much smaller in debt funds and FD. We have dealt with this case in detail in this post: Can you retire by keeping money only in FD or pension?.

Interest income from savings accounts, FD and bonds as well as dividends from stocks are taxable at your highest tax rate. If you have income from salary or profession, you are wasting a part of this capital as taxes since that does not get a chance to grow. A debt mutual fund, like from here, is taxed at a lower rate post indexation only when you sell the units. You can learn about tax calculation here: How is tax calculated on selling shares/MFs and how do to do tax harvesting?.

The only way you can justify keeping money in FD if you are an NRI in a low tax jurisdiction and do not have to pay taxes on FD income in India.

The right way to invest is to follow Goal-based investing. This investment method is described in three parts:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How conservative investors risk falling short of their goals first appeared on 02 Mar 2022 at https://arthgyaan.com