Can debt funds beat inflation?

Many investors have a need where they want the safety of assured returns and wish to beat inflation simultaneously. Can debt funds do that?

Many investors have a need where they want the safety of assured returns and wish to beat inflation simultaneously. Can debt funds do that?

Inflation is one of the axioms of personal finance and enjoys the same permanence as death and taxes. Investors who are looking for safety in debt as an asset class would have a perpetual worry as to whether debt products beat inflation or not. Given the downtrend in interest rates in the last decade, anyone dependent on debt as an asset class, pensioners, and general investors allocating a part of their portfolio to debt products have a cause for concern.

Chart: Arthgyaan • Source: RBI • Get the data

Falling interest rates have led to two effects on portfolio valuation and income. First, long-duration bonds have risen in price over this period while interest income from fixed deposits, small saving schemes (like provident fund, NSC) and annuities have gradually come down.

We will examine the historical returns of debt mutual funds and SBI 10-year FD rates vs inflation.

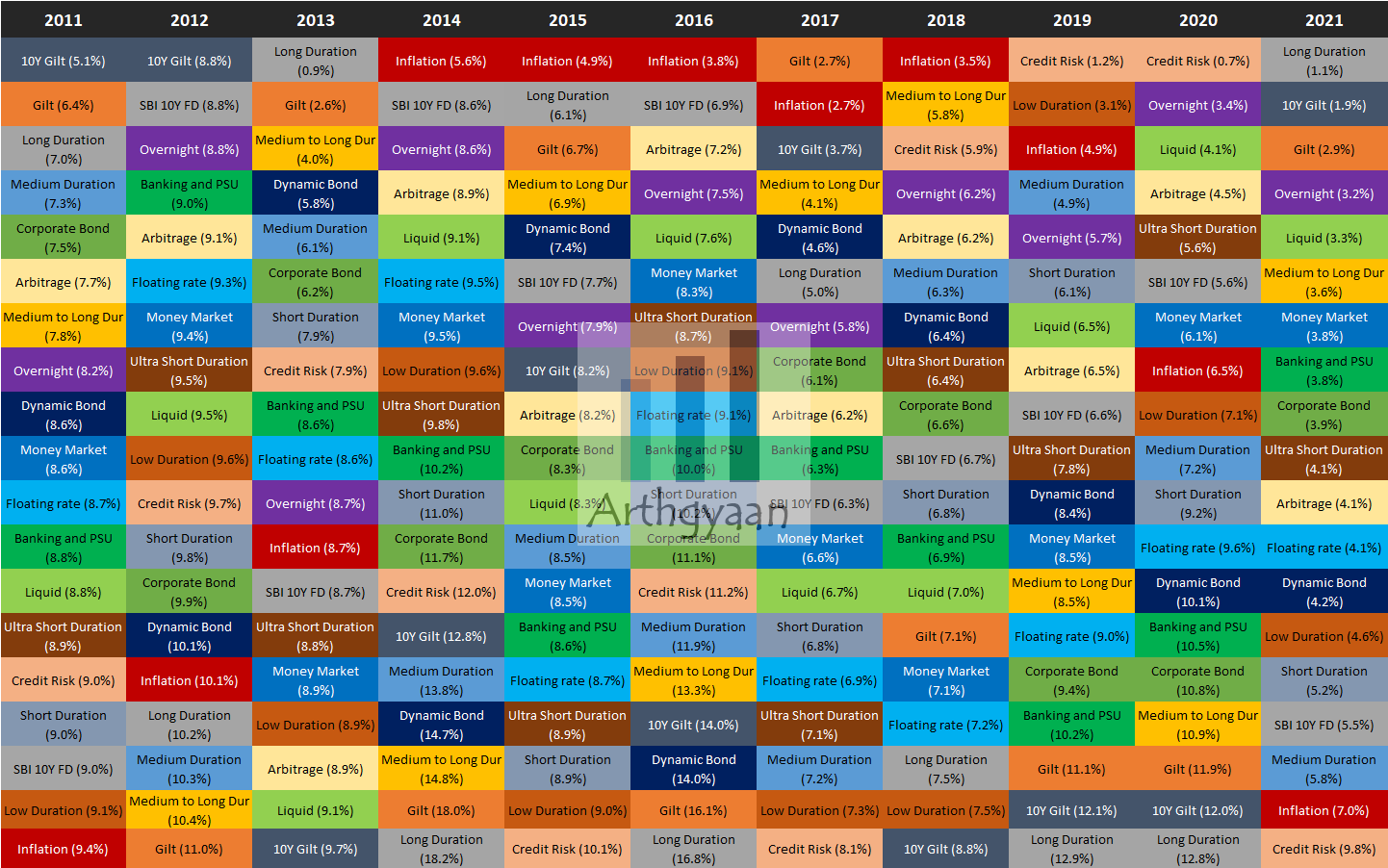

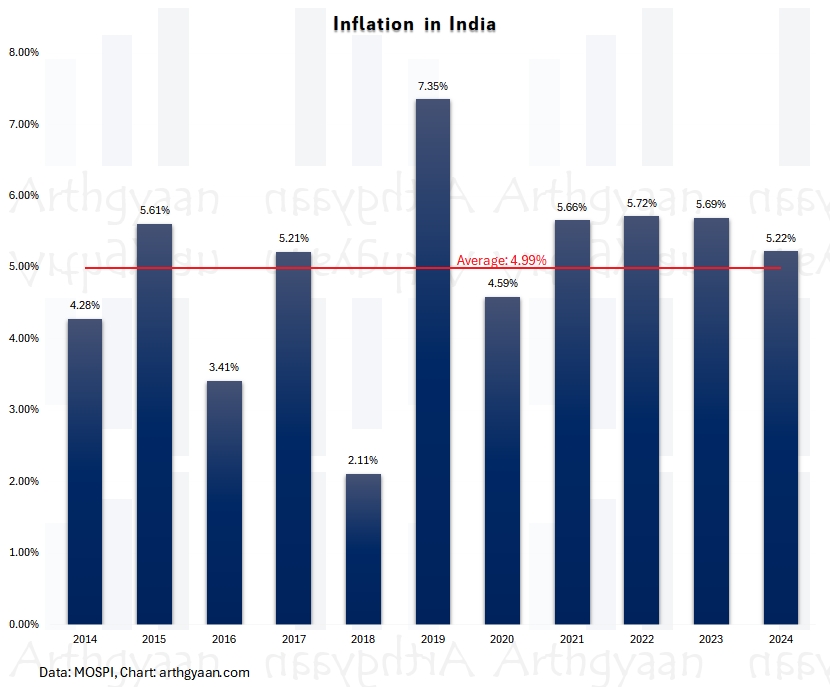

Using inflation data from MOSPI, SBI 10-year FD rates and mutual fund data from Valueresearchonline, we have created the following exhibit showing yearly inflation and category-wise returns (not that of an individual fund) of debt funds (regular plans until 2014, direct plan post that) and SBI 10-year FD. The inflation figures are from MOSPI and apply to the whole country, not an individual investor. The returns are also pre-tax.

We have also added Arbitrage funds to this list. Many investors prefer these funds because of their debt-like returns and equity-like taxation.

The diagram shows that no single category, including FD, has consistently beaten inflation over this period.

We collate the information in the image above to show how the categories have behaved year-wise vs inflation and the yearly returns exceeding inflation pre-tax. Success is defined as the number of times the annual returns of the category have beaten inflation over these ten years.

| Category | Success (pre-tax) | Yearly Outperformance (pre-tax) |

|---|---|---|

| Dynamic Bond | 70% | 2.8% |

| Banking and PSU | 70% | 2.6% |

| Corporate Bond | 70% | 2.6% |

| Credit Risk | 60% | 1.9% |

| Floating rate | 70% | 2.4% |

| Gilt | 70% | 3.2% |

| Medium to Long Dur | 80% | 2.5% |

| Liquid | 70% | 1.3% |

| Low Duration | 70% | 1.8% |

| Medium Duration | 80% | 2.4% |

| Money Market | 70% | 1.9% |

| Overnight | 60% | 0.8% |

| Ultra Short Duration | 70% | 1.9% |

| Short Duration | 70% | 2.4% |

| Long Duration | 80% | 3.4% |

| 10Y Gilt | 80% | 3.4% |

| SBI 10Y FD | 70% | 1.4% |

| Arbitrage | 70% | 1.2% |

We adjust for taxes over a ten-year holding period using CII indexation data. Tax is calculated as 20% tax on profits after indexation for debt mutual funds and 10% without indexation for arbitrage funds, for uniformity’s sake.

More details on taxation of mutual funds are here: How is tax calculated on selling shares/MFs?

We have assumed a 30% tax on FD. For simplicity, we assume that the FD tax is paid on maturity. If the tax on FD is paid yearly, the effective return will reduce further.

Return over inflation, i.e. real return, is calculated as

Real return = (1+Nominal)/(1+Inflation)-1

| Category | Nominal post tax return | Return over inflation post tax |

|---|---|---|

| Dynamic Bond | 7.9% | 0.9% |

| Banking and PSU | 7.8% | 0.8% |

| Corporate Bond | 7.8% | 0.8% |

| Credit Risk | 7.1% | 0.2% |

| Floating rate | 7.6% | 0.7% |

| Gilt | 8.3% | 1.3% |

| Medium to Long Dur | 7.6% | 0.7% |

| Liquid | 6.7% | -0.2% |

| Low Duration | 7.1% | 0.2% |

| Medium Duration | 7.6% | 0.7% |

| Money Market | 7.2% | 0.2% |

| Overnight | 6.3% | -0.6% |

| Ultra Short Duration | 7.2% | 0.2% |

| Short Duration | 7.6% | 0.6% |

| Long Duration | 8.3% | 1.3% |

| 10Y Gilt | 8.5% | 1.5% |

| SBI 10Y FD | 5.3% | -1.6% |

| Arbitrage | 6.4% | -0.5% |

Since FDs are taxed at individual slab rates, investors at high slab rates should avoid them for long-term goals unless they need the principal protection of FDs.

The above table proves that the investor has to take risks to beat inflation using debt funds. Some observations:

We have covered tax-adjusted returns of debt funds here: Pay lower capital gains taxes for debt mutual funds: understand how indexation works

We do not have an extensive history of data for India. For this purpose, looking at similar analyses done for US markets is helpful. How to Invest Your Money When Inflation is High has an excellent discussion on real returns of multiple asset classes in the US.

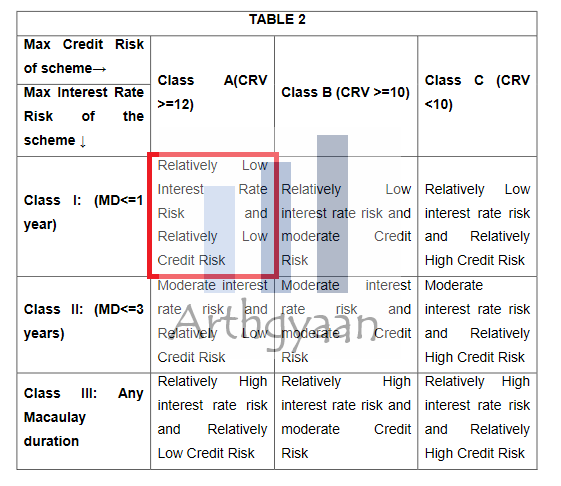

Our debt fund selection process focuses on choosing debt funds

Read more: How to choose a debt mutual fund?

| Category | Post tax return | Return over inflation |

|---|---|---|

| Liquid | 6.7% | -0.2% |

| Money Market | 7.2% | 0.2% |

| Overnight | 6.3% | -0.6% |

As per the table of post-tax real returns, we see that as per the above framework, real returns for the portfolio can range from -0.6% to 0.2%. Therefore, we will stay conservative and assume that long-term real debt returns will be at most zero. As the Indian economy matures, we expect real returns for high credit quality, low-duration bonds to fall further, as shown in the data from the US.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Can debt funds beat inflation? first appeared on 09 Dec 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.