Tax

News

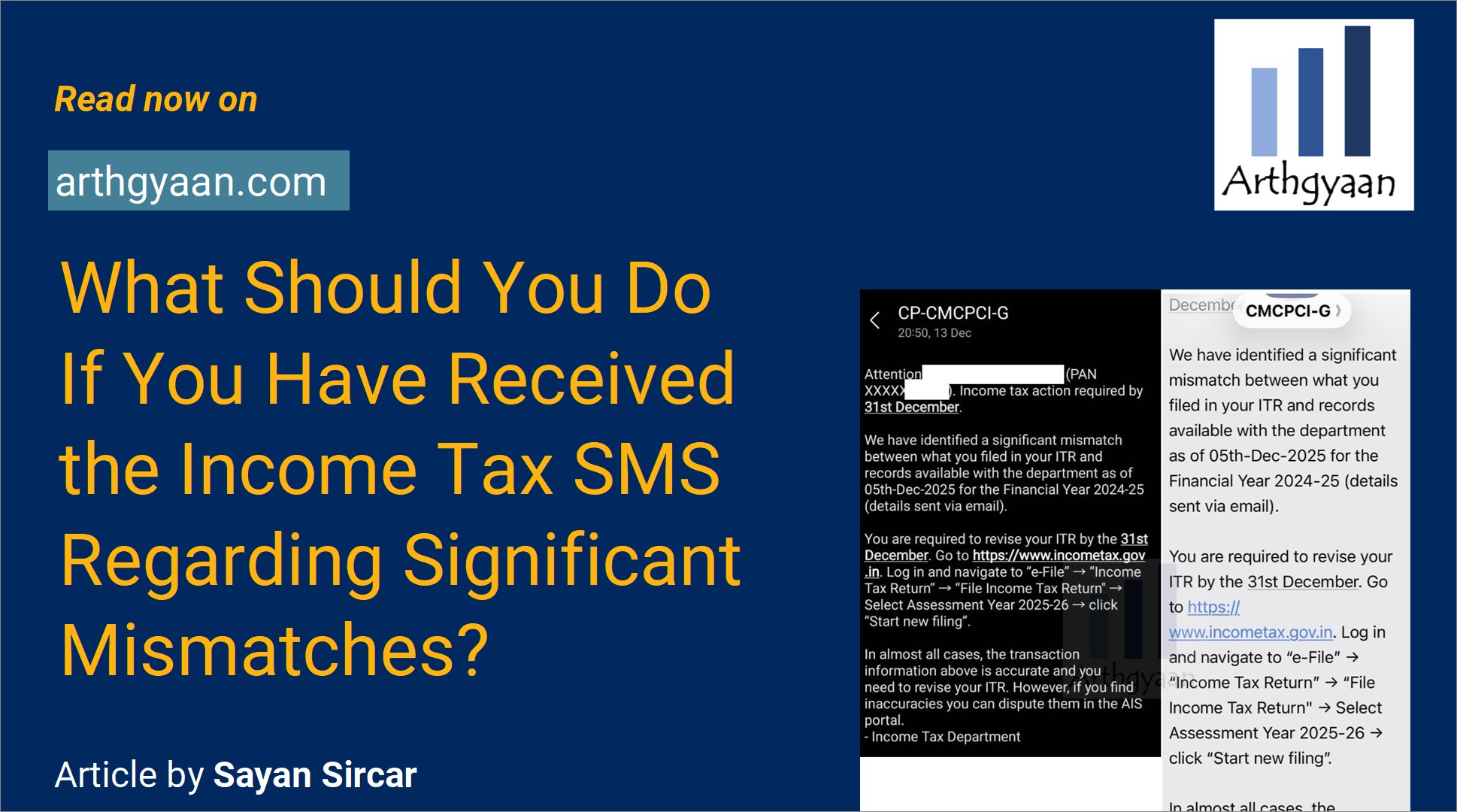

What Should You Do If You Have Received the Income Tax SMS Regarding Processing of the said return was held?

Article: This article shows the next steps to be taken for tax payers receiving the SMS regarding processing of their income tax return is now held as it was identified under risk management process.

Published: 23 December 2025

12 MIN READ

Tax

News

What Should You Do If You Have Received the Income Tax Email Regarding Data Has Been Shared by a Foreign Jurisdiction or the USA authorities?

Article: This article outlines the next steps for taxpayers who receive an email or SMS regarding missed or incomplete Schedule FA, based on FATCA/CRS data-sharing agreements.

Published: 18 December 2025

15 MIN READ