What are the axioms of personal finance?

There are some fundamental rules that you can use to navigate any personal finance scenario. This post discusses how to use them.

There are some fundamental rules that you can use to navigate any personal finance scenario. This post discusses how to use them.

We have all heard of the statement that personal finance is “personal”, i.e. it varies from person to person or person. However, there are a few underlying principles that you can use to answer the billions of possible personal finance query variations. The potential number of variations of questions where to invest, how much, how long, how to manage assets etc., is vast, and without a framework to analyse them, it will be challenging to deal with them on a case by case basis.

We borrow concepts from mathematics, specifically geometry, typically covered in school to understand how to go about this.

An axiom, postulate or assumption is a statement that is taken to be true, to serve as a premise or starting point for further reasoning and arguments. - Wikipedia

The entire subject of geometry is based upon the following framework:

The same applies to personal finance as well, where there are a few basic rules or axioms that govern everyone’s use cases. We cover some of them below.

There are entire industries and professions out there that attempt to predict the future. They have many names and offer, for a “tiny” fee, offer to get you, the investor, higher returns than their competitors. A few examples of these are

This article does not discuss the merits or futility of attempting future prediction as long as the investor understands what the service represents.

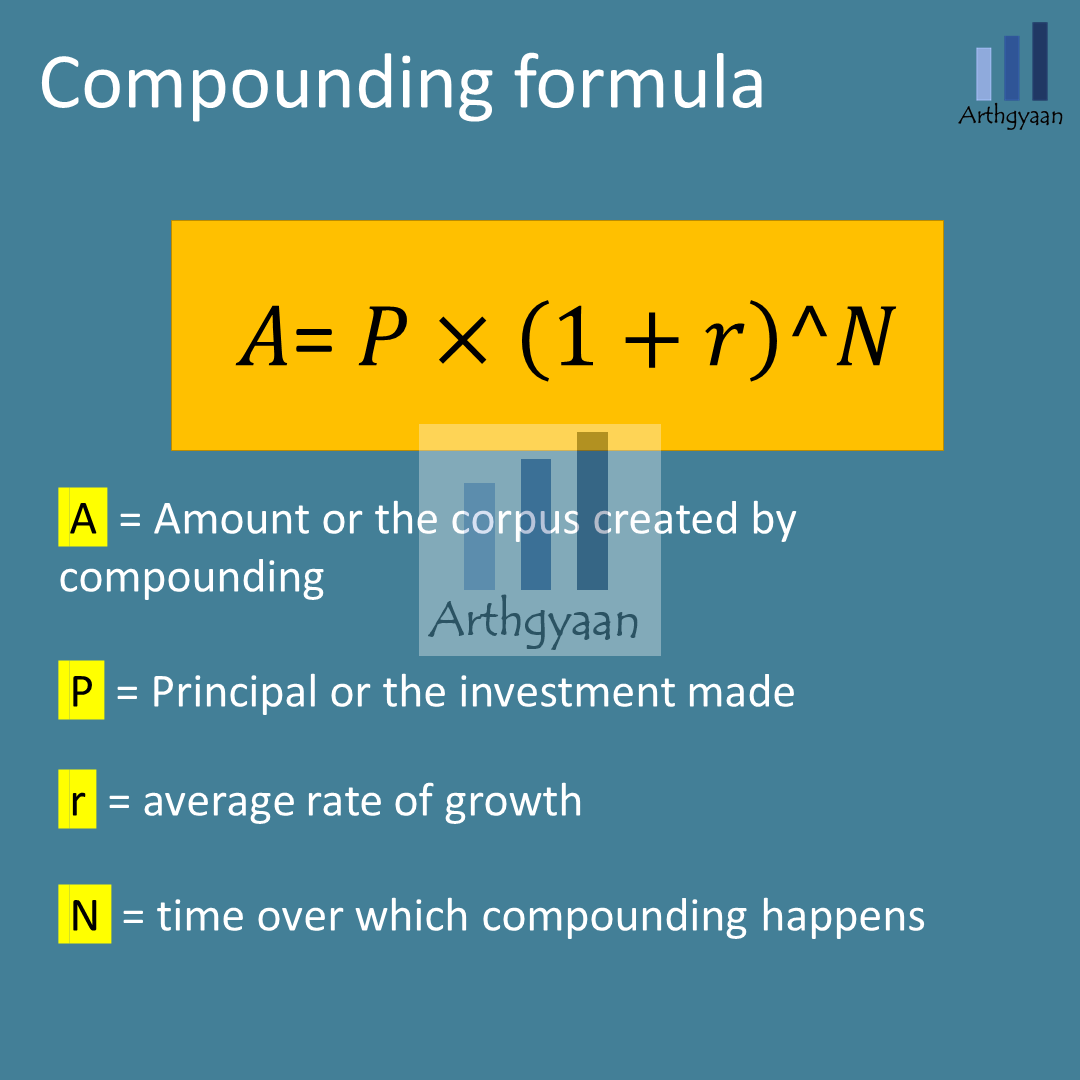

There are three takeaways from the compounding equation:

We cover compounding in more detail in this post: 12 mistakes that interrupt compounding: what to do instead

Annual income twenty pounds, annual expenditure nineteen nineteen and six , result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery - Charles Dickens.

As the above quote represents, continuously overspending will lead to disaster. People borrow either via credit cards or personal loans if there is a temporary budget crunch. However, living on debt will eventually catch up, where monthly interest payments on loans will not leave money for anything else. We cover debt payment here: Which debt to pay off when you have more than one loan?

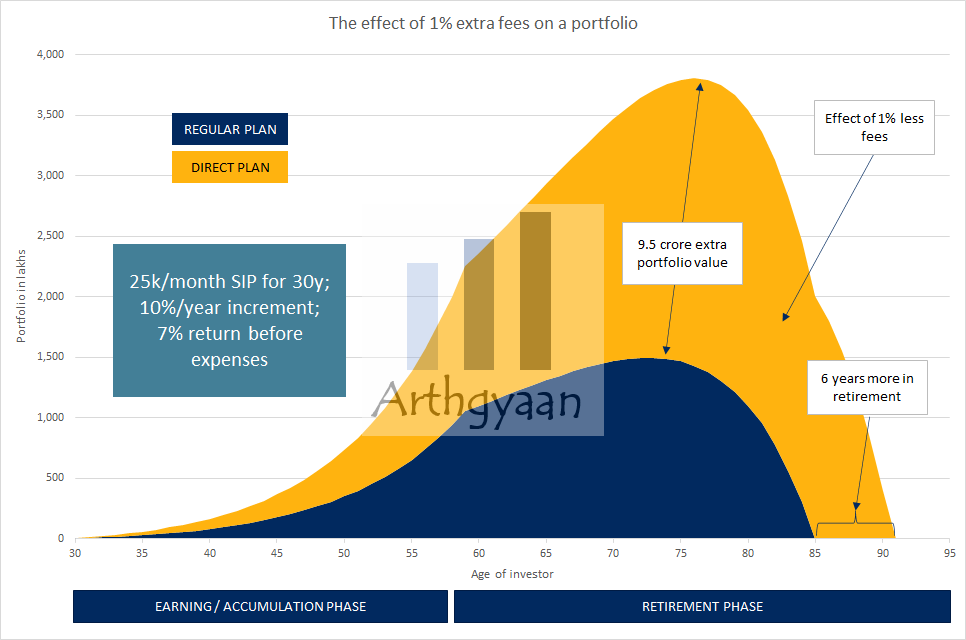

Returns are uncertain; however, costs compound. This cost consists of doing business (like running an asset management or insurance company with enough profits) and commissions to the salesman. Examples of commissioned advisors are mutual fund distributors and insurance agents. In addition, social media content with affiliate links that advertise products are examples of commissioned sales. High costs are inherent in most mutual funds, insurance-cum-investment products (like endowment products and ULIPs) and other investments schemes pushed by salesmen. A basic thumb rule is that the stronger the sales pitch, the higher is the commission being paid to them, which ultimately comes from the investor’s corpus. Investment advice is not free, and if it is offered for free, there is a commission involved.

In the compounding equation above, costs come from the ‘returns’ term and directly impact the final corpus. Here is a basic example of two investments with only a 1% difference in costs using an example of a 30 year in the same fund for a direct vs the regular plan

Read more here: Do not make this mistake when investing in mutual funds

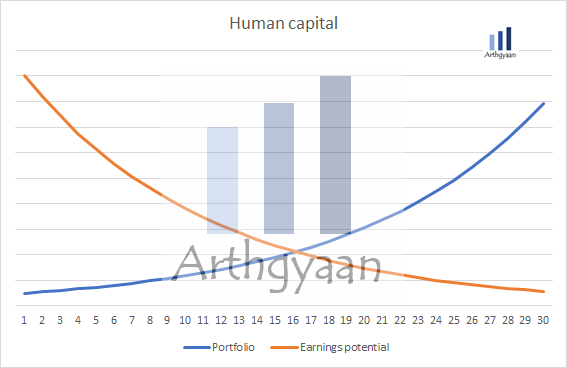

Human capital is an estimate of the future earnings potential of an investor, either from salary or business. As age increases, human capital will reduce; however, the investments create a portfolio that meets all financial goals.

An average investor who lacks the time or skills to track markets or pick funds/stocks should aim for

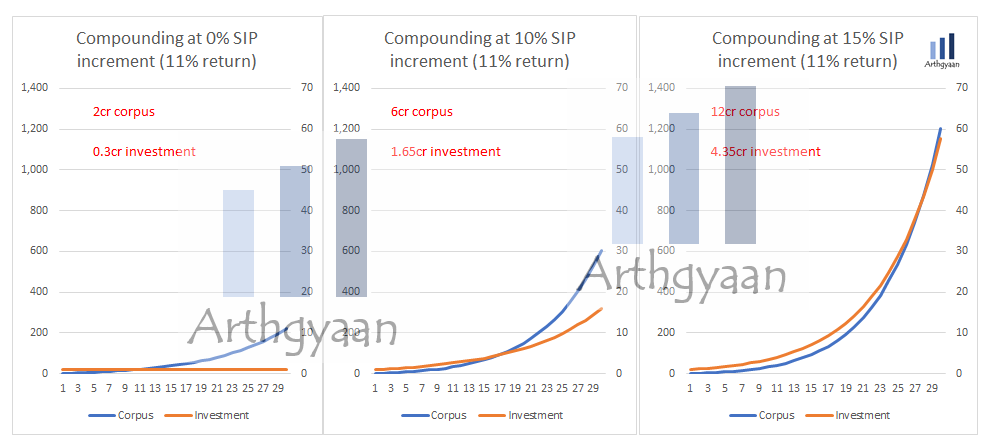

Over 30 years at average 11% returns,

The investor needs to figure out what is more likely to be achieved:

We discuss human capital in more detail here: Your human capital, not investment returns, is your biggest wealth creator.

Our time and ability to multitask is limited. Also, we have different demands on our time at various life stages.

Related reading:

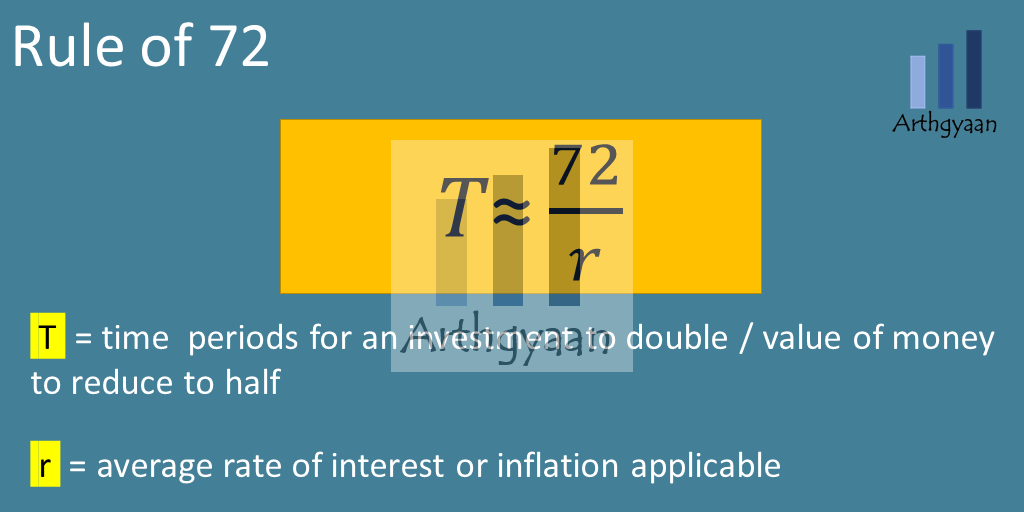

Inflation is an important input to goal-planning in an economy where prices are rising overall. We can use the rule of 72 as a convenient mental shortcut to understanding the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Rule of 72 lets us quickly calculate the impact of inflation over time. Using the rule, we can see that

Inflation: the impact on your goals and how to choose assets that beat it

The above examples show the danger of thinking linearly when money is involved. For example, any goal planning that ignores the effect of inflation will lead to inevitable failures when it is time to spend the money. Similarly, investing in insurance plans that give a fixed return over life will lead to getting smaller and smaller amounts in real terms that will be useless in the later years of retirement. The actual calculation is an application of the compounding formula like this:

Cost after N years = Cost today * (1+Inflation) ^ Time

Since goals must be set using the S.M.A.R.T framework, building inflation into the target corpus amount is crucial.

Read more here:

Imagine what the career of a trapeze artist looks like in case they insist on performing without a safety net.

The safety net in case of our financial goals are the following:

We cover this in more detail in this post.

Diversification, or not putting all your eggs in the same basket, is the only concept in finance where you get a “free lunch”. The basic premise is that different assets move in different directions simultaneously, and overall each asset moves up with time. If you combine this concept with rebalancing, you have a framework that allows you to buy low and sell high consistently.

Read more here:

Except for loans taken to purchase assets or knowledge, like home and educational loans, you should aggressively pay off all other loans. Money saved in not having high-interest payments is guaranteed and higher than any other form of investment. You should not be investing at all if you have a credit card (30%+) or outstanding personal loans (10%+).

The conversation becomes tricky when discussing housing loan pre-payment since that loan rate is considerably lower than credit cards and may be beaten over long periods via investing. We have covered this topic in these posts:

Investment products can be both simple and complex, can behave in unpredictable ways and may come with a lot of fine print. A few examples will make this clear. Do you understand:

The investor need to perform a good amount of due diligence before choosing the investment, using the rules in this post as well as review the investment itself regularly for any changes.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the axioms of personal finance? first appeared on 03 Dec 2021 at https://arthgyaan.com