What is diversification: how and why should you do it?

Diversification is spreading risk across various investments so that all of them don’t perform equally bad (or good) at the same time

Diversification is spreading risk across various investments so that all of them don’t perform equally bad (or good) at the same time

Diversification implements the saying “don’t put all your eggs in the same basket” to investing. By diversifying, you allocate investments across various types of asset classes like stocks, bonds, gold, real estate across various countries and issuers (governments, corporations and others).

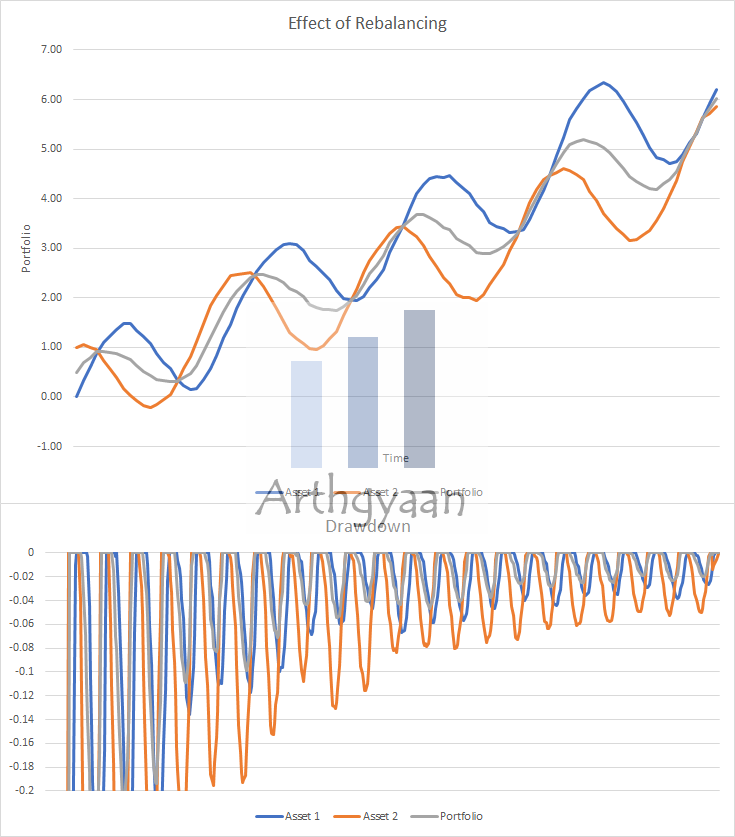

We see that the portfolio rises and falls at a rate lower than the individual components since it has two assets that do not rise and fall at the same time. The overall drawdown is lower than that of the constituents.

By diversifying, you are reducing the risk that all investments do not start falling (and conversely rising) at the same time. Diversification reduces the risk of the portfolio and if constructed carefully, will not reduce returns.

Diversification comes from two concepts:

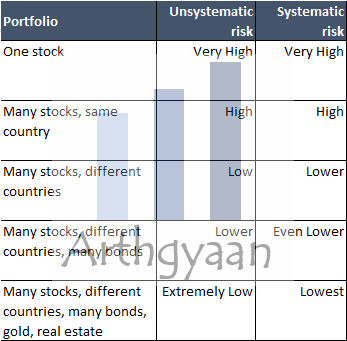

Each type of investment (e.g. a company) has two sources of risk:

Diversification reduces unsystematic risk not just across various companies but across different asset classes as well until only systematic risk remains. For example, by adding more and more different types of assets, the risk decreases as in the table above.

Diversification is the only concept in finance where you get a “free lunch”. If different assets (measured by correlation) move in different directions simultaneously, and overall each asset moves up with time. If you combine this concept with rebalancing, you have a framework that allows you to buy low and sell high consistently. Diversification is one of the axioms of personal finance?.

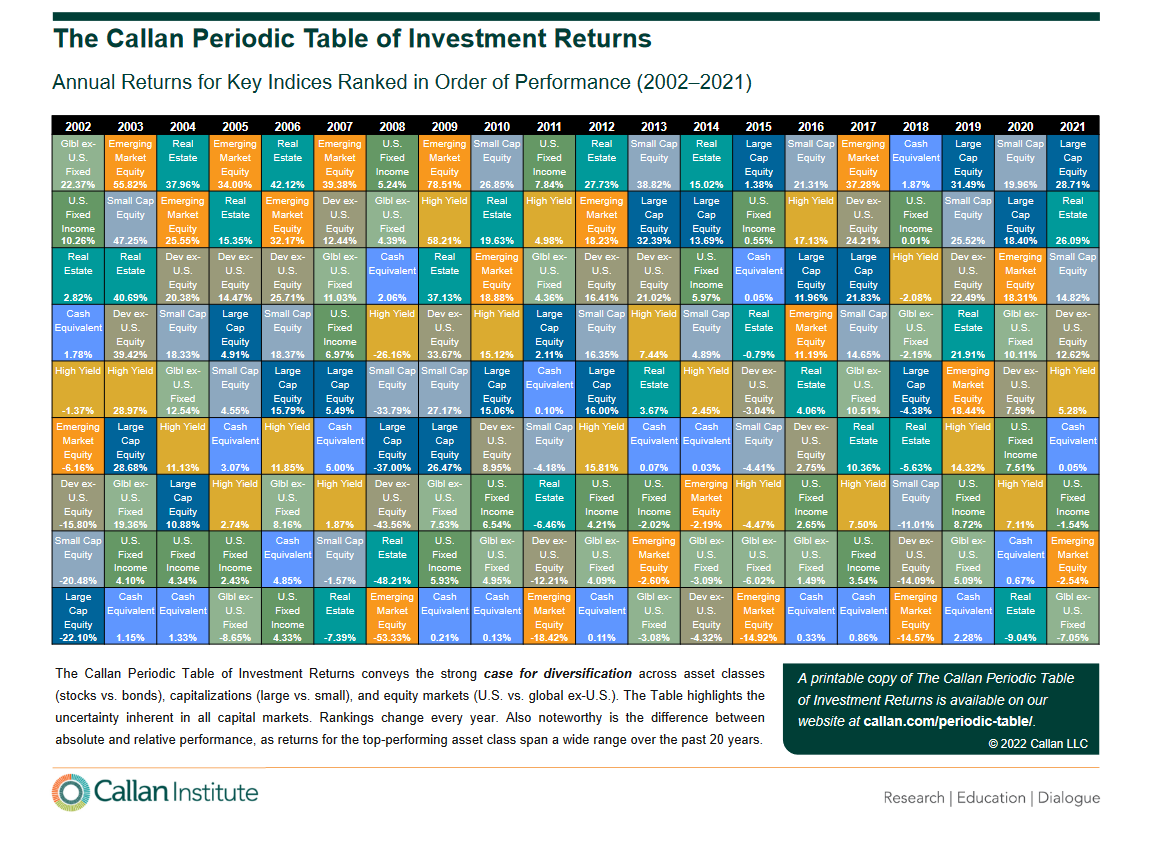

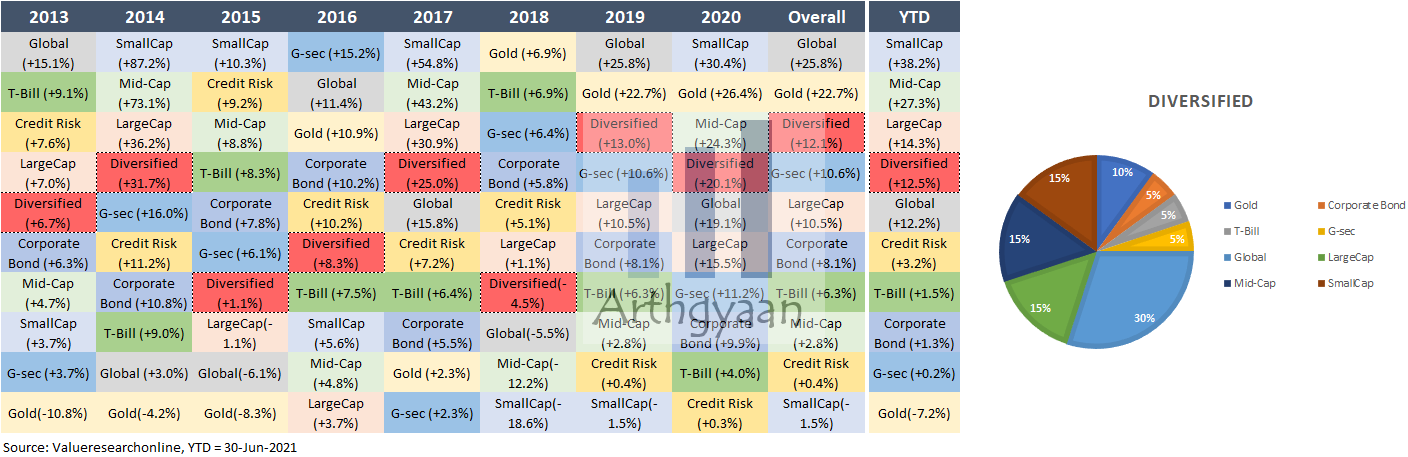

As this table shows, different assets perform differently at different times. It is difficult to predict in advance which asset class wil perform better next so we will invest a little in each.

For Indian investors, diversification can be done by choosing

We will deal with the various allocations and returns in future posts.

Related reading:

While creating a diversified portfolio, care must be taken that

These topics will be dealt with in future posts.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is diversification: how and why should you do it? first appeared on 28 Jun 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.