What does the 1983 World Cup win teach us about investing?

A guide to both new and seasoned investors for choosing suitable investments for their portfolio in the same way selectors choose a World Cup winning team.

A guide to both new and seasoned investors for choosing suitable investments for their portfolio in the same way selectors choose a World Cup winning team.

Last evening I had a chance to finally watch 83, a full three months after the movie was released in the theatres. The events of the film are well documented where India thrashed West Indies, the reigning world champions, to win the ICC 1983 Cricket World Cup Trophy.

While the movie itself had mixed reviews, there are lessons every investor can take away from the winning Indian team in the context of portfolio diversification and asset allocation.

In the context of creating an equity portfolio, the investing question is:

Given the outperformance of sectoral funds like IT/Technology in the last few years, does it make sense to allocate such funds significantly in the equity portfolio?

The cricketing analogy is:

If you are the selector of the 1983 Indian team, would you choose the team that was actually chosen or a hypothetical team of 11 Kapil Devs?

This question will seem strange, and Kapil Dev is just an example. We can make the same case for 11 Sunil Gavaskars, Mohinder Amarnaths or Ravi Shastris.

Using data from Cricinfo, we show what the Indian team did in the eight matches they played in the tournament. We have separately shown the Man of the Match’s efforts and Kapil Dev’s performance.

| Match | Against | Result | Man of the Match | Kapil Dev’s summary |

|---|---|---|---|---|

| Final | West Indies | India won by 43 runs | Mohinder Amarnath, 26 (80) & 3/12 | 15 (8), 1/21 |

| 1st SF | England | India won by 6 wickets | Mohinder Amarnath, 46 (92) & 2/27 | 1 (6)*, 3/35 |

| 23rd Match | Australia | India won by 118 runs | Roger Binny, 21 (32) & 4/29 | 28 (32), 0/16 |

| 20th Match | Zimbabwe | India won by 31 runs | Kapil Dev | 175 (138)*, 1/32 & 2 catches |

| 14th Match | West Indies | West Indies won by 66 runs | Vivian Richards, 119 (146) | 36 (46), 1/46 |

| 11th Match | Australia | Australia won by 162 runs | Trevor Chappell, 110 (131) | 40 (27), 5/43 |

| 8th Match | Zimbabwe | India won by 5 wickets | Madan Lal, 3/27 | 2 (8)*, 1/18 |

| 4th Match | West Indies | India won by 34 runs | Yashpal Sharma, 89 (120) | 6 (13), 0/34 |

Let us look at some of the events in the team:

As it should be clear, from the table and any cricket match that you have witnessed, that cricket is a team sport. While the captain’s role is critical, it does not mean that only a single player is needed to win the Match. Different team members have different strengths and weaknesses that are useful under different situations. Factors like weather, pitch, batting conditions, opposition composition, and experience are just some of the items that require various team members to contribute at various times and work together as a team to win the Match.

Over-reliance on a single player does not lead to a successful outcome. Anecdotally, heavy dependence on Sachin Tendulkar in the late 90s and early 2000s led to a lot of fan disappointment.

Investing and, consequently, portfolio construction is not different.

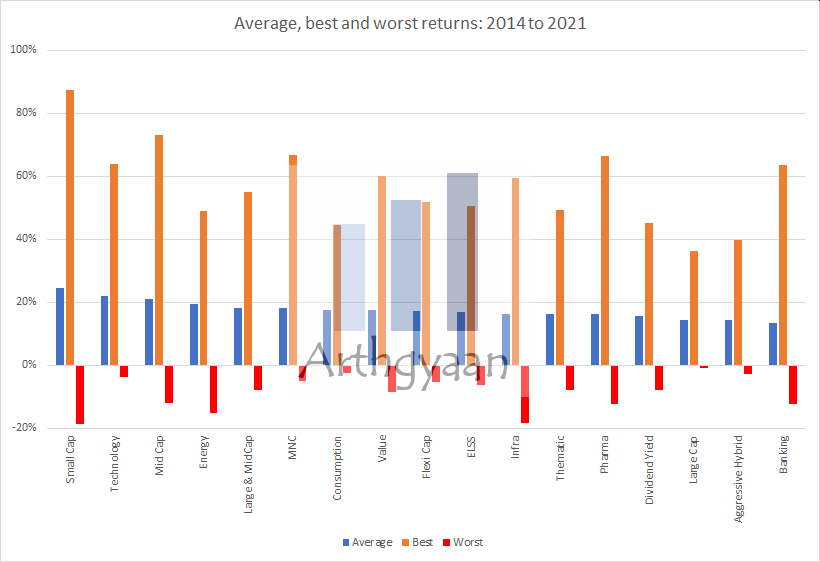

We use data from Valueresearchonline to plot average, minimum and maximum returns from the highest equity fund (and one hybrid) categories. It is very easy to conclude from the data that Technology stocks are a sure shot bet based on historical data. They have the second best average, very little loss-making years and considerably high maximum returns.

Based on this chart, an investor will be very tempted to include technology as a significant component in their portfolio.

A very different picture emerges if we take the same data and rank it yearly.

We can see that technology outperformance has been a relatively recent trend. Before technology started outperforming since 2018, there has been some years where an over-dependence on technology would have seriously tested the investor’s conviction. For example, in 2014, technology came at the bottom with even aggressive hybrid funds, which are a mix of debt and equity, giving higher returns. Also, the returns look extremely poor compared to small caps.

Investing heavily in a single sector or theme (or even market caps like small caps) run the risk that:

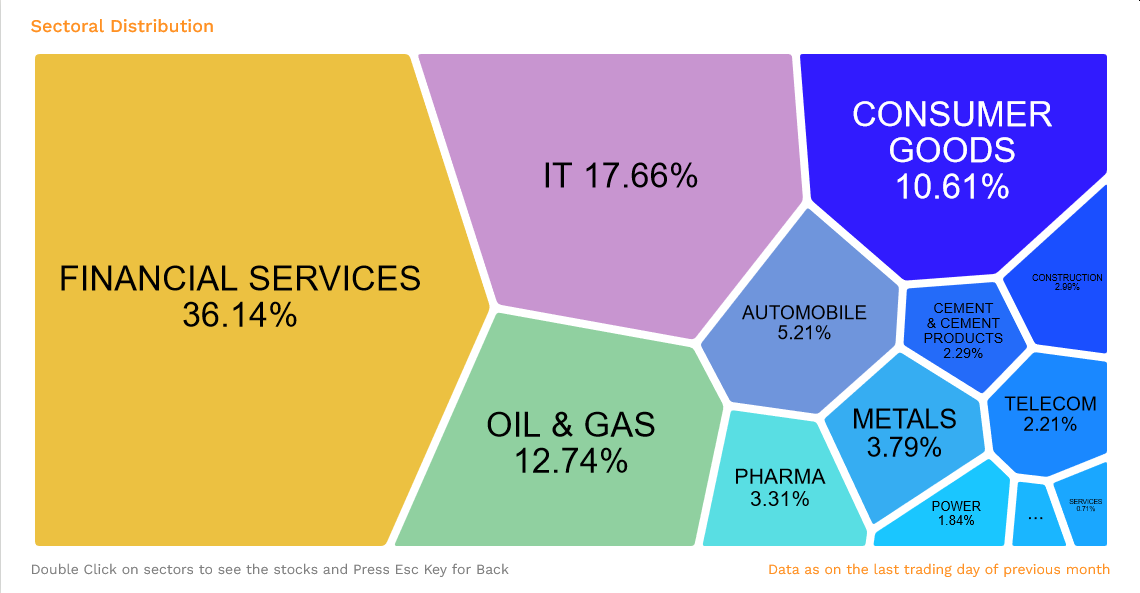

Using data from niftyindices.com, we can see that the biggest sectors are already a part of major indices. Two things happen when the index is rebalanced as a momentum effect:

The alternative is to diversify across market capitalisations (large, mid, small cap), sectors and themes as much as possible. There are two ways to construct such portfolios:

The passive approach works very well given that market capitalisation weighted indices constantly cycle across sectors as per index construction methodology. Here is an image that shows how sectors globally have evolved over time.

Read more:

There is no shortage of sectors and themes currently in the market that are investible via MF or Small case-type stock baskets. Apart from traditional sectors and themes like pharma, auto, banking and dividend-yield, we now have exotic themes like EV, factors (like momentum, low volatility etc) or even permanent portfolios.

Investors should consider such sectors or themes as a part of a satellite portfolio only if there is

Read more: What is a core-satellite portfolio, and when can you use it?

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What does the 1983 World Cup win teach us about investing? first appeared on 27 Mar 2022 at https://arthgyaan.com