Should Indian investors invest in the permanent portfolio?

This article analyses if a permanent portfolio (equal proportion of stocks, bonds, gold and cash) works for Indian investors.

This article analyses if a permanent portfolio (equal proportion of stocks, bonds, gold and cash) works for Indian investors.

The permanent portfolio was created by American investment analyst and politician Harry Browne in the 1980s. This investment portfolio is designed to perform well in all economic conditions by holding:

The permanent portfolio is supposed to be implemented by those looking for an unified portfolio for all of their goals.

The elegance of the permanent portfolio lies in being low volatility by design. There is also an implicit assumption that the portfolio will never go down to zero under any economic circumstances. However, we can see one problem with the premise of doing well in all economic conditions. Since all scenarios are mutually exclusive, the portfolio will underperform a pure allocation in 2 or more asset classes in case of a prolonged period in any one of these economic periods.

For example, in rising stock markets, an equity heavy portfolio will outperform the permanent portfolio easily. Therefore, we will consider how the portfolio fares against the conventional 60:40 equity to debt portfolio and one more alternative.

The permanent portfolio is designed to be rebalanced either annually, or with a 10% corridor i.e. rebalance when any asset classes breach either 15% or 35%. We show the data from 1978 to 2021 in the USA using the PortfolioVisualizer tool. We assume a $10,000 starting portfolio and a $100/month SIP increasing annually with inflation. The portfolios are rebalanced annually and there are no taxes. We show the performance of three portfolios:

The third option is chosen to minimize the impact of gold on the portfolio and to simulate the returns of multi-asset funds currently available in India with 10% allocation to gold.

The 60/40 portfolio beats the other two handily as expected. However, that is not the point of choosing the permanent portfolio since the economic condition has favoured 60/40 via both a bull market in stocks and falling interest rates that has boosted long term bond returns.

Interestingly, the 30-30-30-10 portfolio has performed very similar to the permanent portfolio, even with considerably lower gold allocation.

Rolling returns are an average 3% higher for the 60/40 portfolio, given that we are in a bull run going on for a long time, especially in the US. In the last ten years, US markets have beaten global markets as well.

Here we see the appeal of the permanent portfolio in terms of risk reduction. It is also interesting that downside risk in most stressful periods has been comparable with the 30-30-30-10 portfolio.

If you wish to explore more, use this Portfolio visualizer link: here

We have used data from MSCI, Crisil and Yahoo Finance since 2004 to implement the same three portfolios in India. Again, we see that the results are fairly comparable with what we have seen in the US.

Gold does not generate any income, unlike assets like stocks (via dividends), bonds (via coupons), real estate (via rent) or fixed deposits (via interest). Given how recurring cash flows like in the cases above are used to value assets like stocks, bonds and real estate, there is no way to value gold beyond hoping for a buyer to buy it at a higher price in the future.

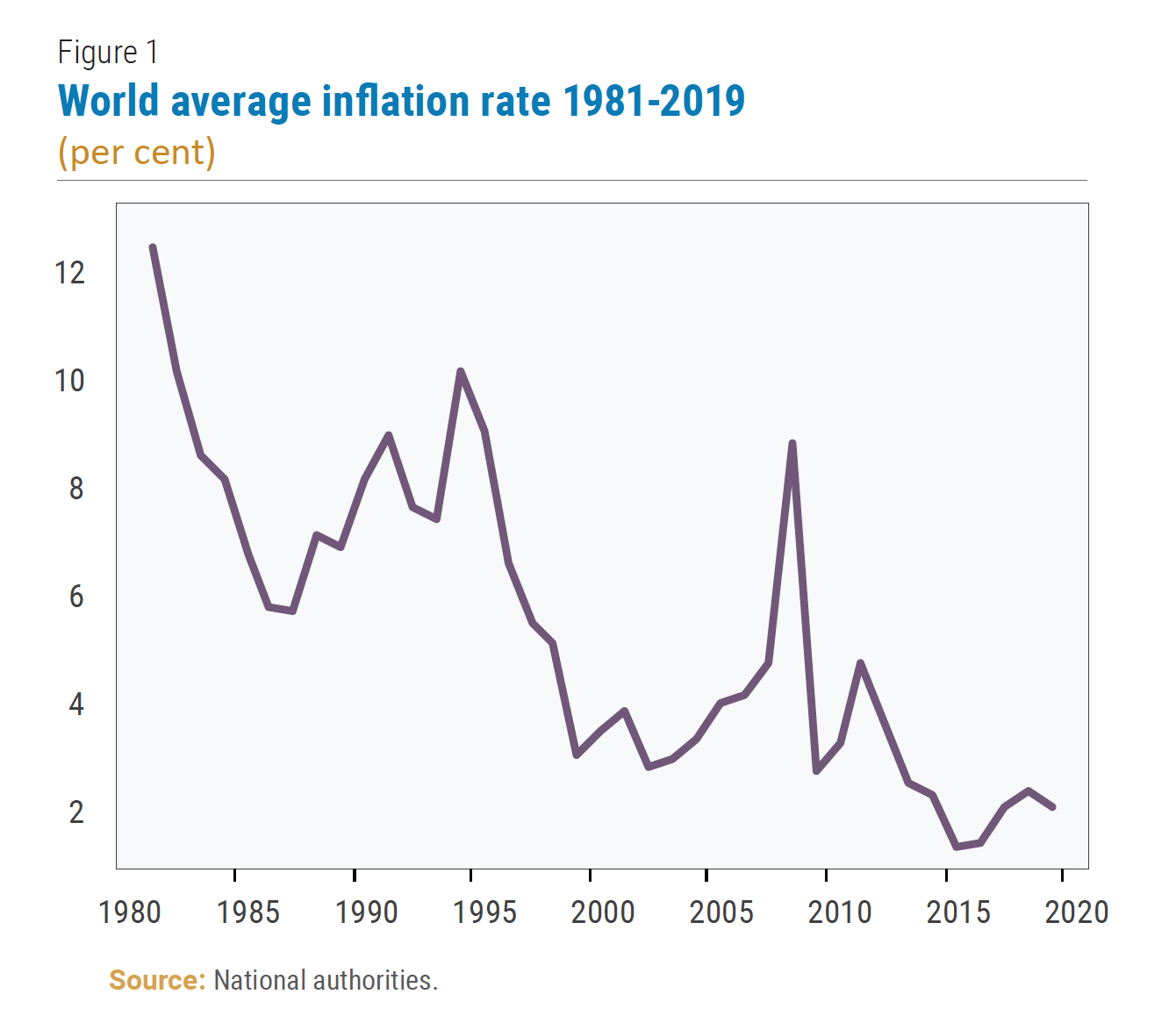

A large allocation to a non-productive asset like gold is the main criticism for the permanent portfolio, given that inflation had been mainly falling since the 1970s (followed by a COVID-related rebound in 2021).

Inflation data source: here

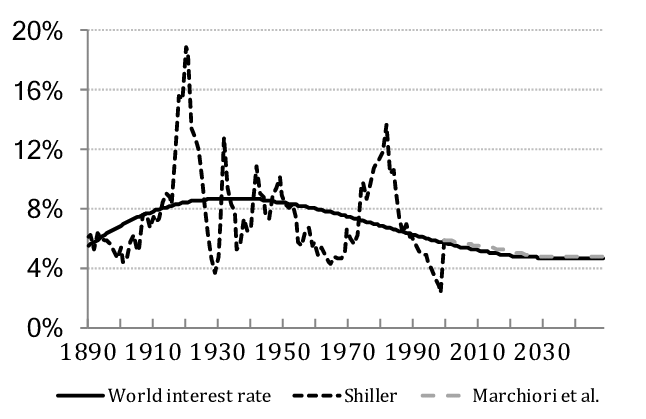

Interest rates data source: here

Long term bond returns are inversely proportional to the movement of interest rates. Falling rates boost bond returns and vice versa. Given its conceptual age, the permanent portfolio has not been tested in a rising interest rate regime. Barring small term impacts on both inflation and interest rates due to COVID-19, we expect interest rates (and inflation) to keep falling as India matures as an economy similar to the trends in global developing markets. This forecast should lead to an overweight position in long term bonds vs cash/short term bonds but the permanent portfolio requires both to be equal-weighted.

Since rebalancing implies selling, investors will be impacted by how they are implementing the portfolio. If the permanent portfolio is implemented as a multi-asset mutual fund in India, there would be no taxes for the investor due to rebalancing happening inside the fund. However, if the investor chooses to implement the permanent portfolio via individual mutual funds there will be a severe impact of taxes on the portfolio performance.

A unified portfolio has a single asset allocation (equity, debt and other asset classes) for all goals irrespective of goal horizon and priority. As a result, the investor’s risk profile will be considered uniform for all goals.

Read more: Goal-based investing: should you use a unified portfolio?

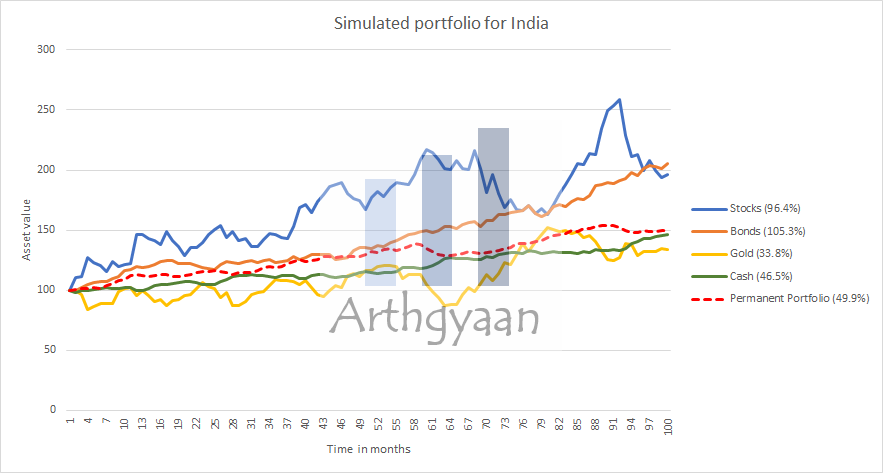

Using eight years of monthly historical data from 2013 (100 observations), we have performed a Monte-Carlo simulation by generating simulated portfolios for the next eight years. One such portfolio is shown below:

As shown below, it is interesting to see how the portfolio behaves when multiple simulations are run. However, you should not take the runs below too seriously since the correlations will stay constant for eight years. That is one of the drawbacks of the simulation method - the results are only as good as the inputs.

Readers should appreciate the limited history of the permanent portfolio being implementable in India. While the past has shown favourable results, anyone looking to invest in the permanent portfolio as a unified portfolio should understand the risks very well.

The permanent portfolio can be implemented as an equal-weighted allocation of

To lower trading and rebalancing costs due to taxes, a multi-asset fund-of-fund with suitable allocations will a better alternative than implementing via individual funds. A 30-30-30-10 portfolio is easier to find than one with 25% gold.

Investors can invest using the permanent portfolio if

Investors should avoid the permanent portfolio if

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should Indian investors invest in the permanent portfolio? first appeared on 09 Jan 2022 at https://arthgyaan.com