How compounding works: the journey to a 10 crore portfolio

This article shows how the power of compounding works to create phenomenal wealth.

This article shows how the power of compounding works to create phenomenal wealth.

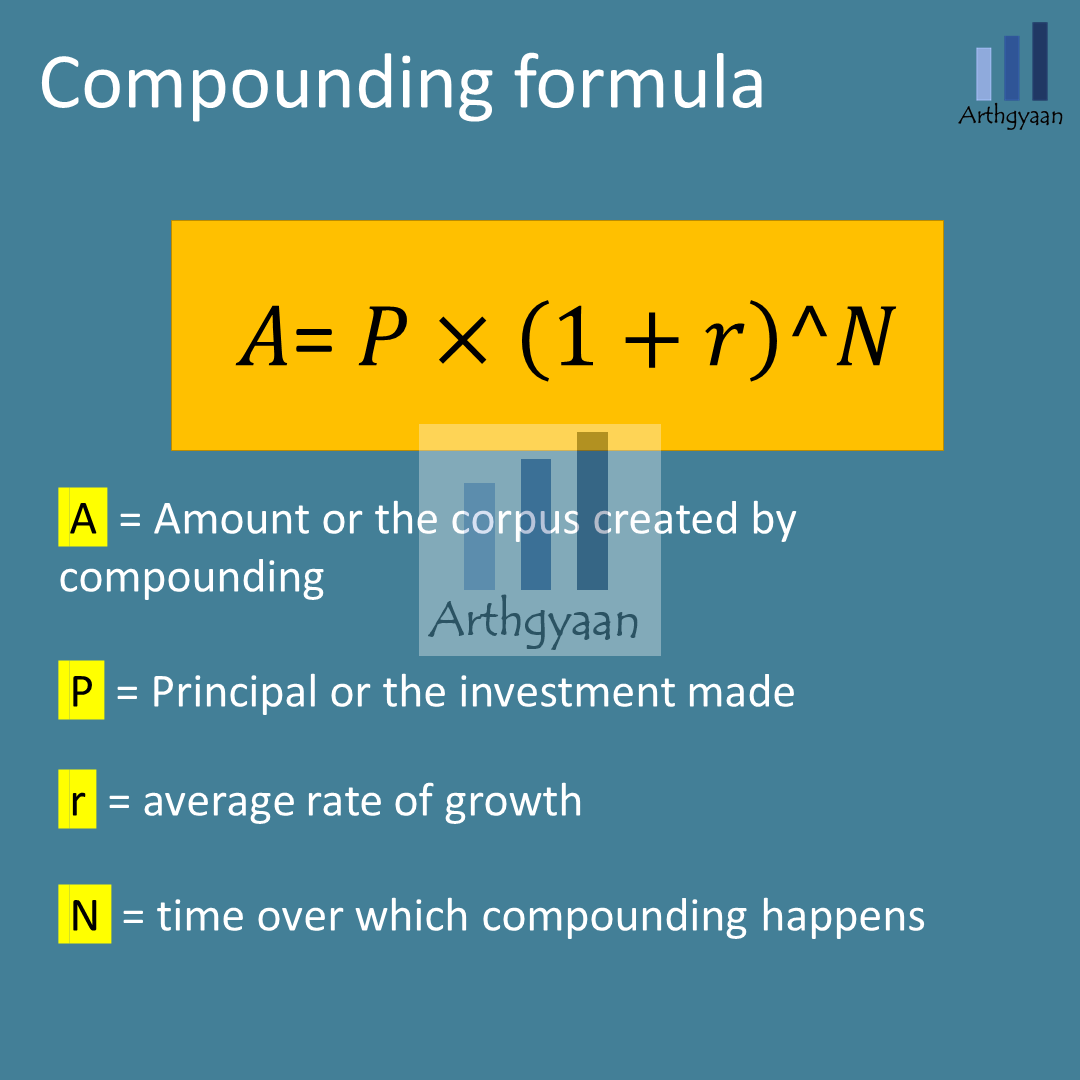

This formula is an example of an exponential curve where the current period growth happens on the entire corpus from the previous period. A good example is simple vs compound interest:

My life has been a product of compound interest” - Warren Buffett.

This interest-upon-interest feature is the reason compounding grows so fast. This feature is the premise of the above quote.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

This quote is often attributed to Albert Einstein and has profound implications on personal finance. We are covering the “He who understands it, earns it” bit in this article. The next part “… he who doesn’t … pays it” is covered here: My EMIs take up all my salary. How do I start investing?.

Compounding is a somewhat counter-intuitive process since our brain thinks linearly. This article shows what happens once you start on the compounding journey and how it creates wealth. Readers who wish to understand the steps needed to get started, should refer to this post: Do you want to create wealth? This is how you should plan for it

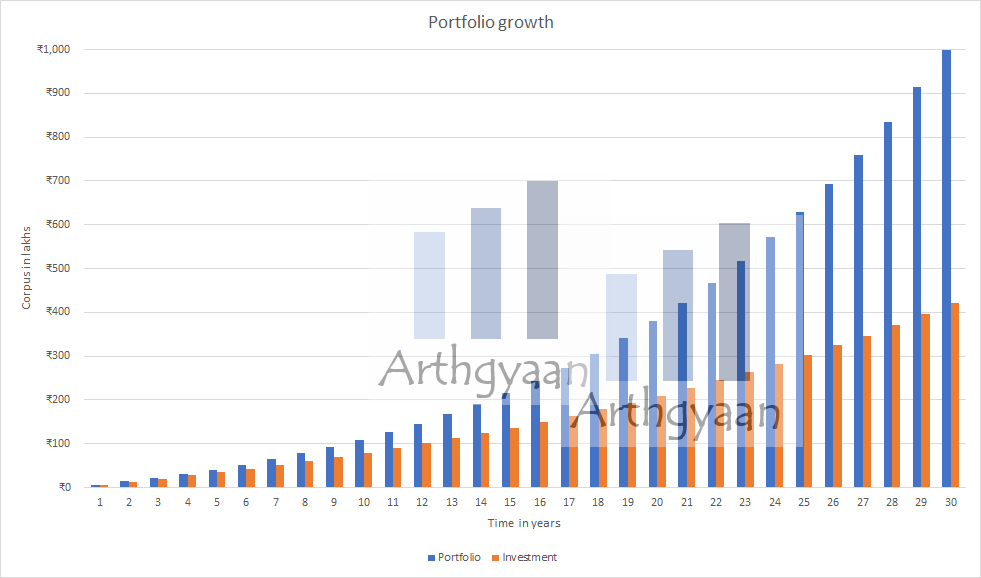

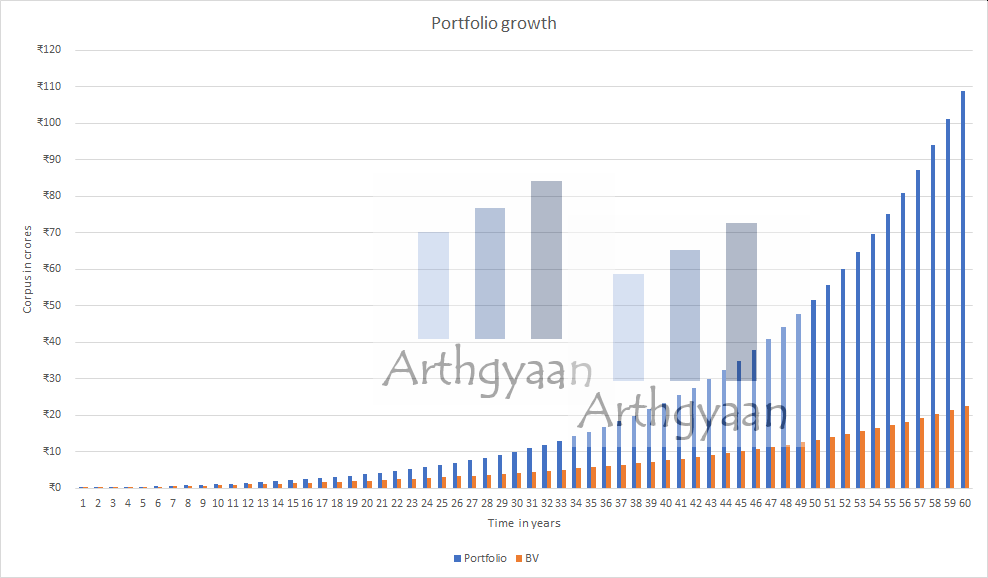

We will show a hypothetical journey of a ₹5,000/month (rounded) SIP increasing at 5% a year being invested in a portfolio that grows at an average of around 6%. The numbers are chosen so that the portfolio reaches exactly ₹ ten crores in 30 years. If you use a commercial SIP calculator to check, plug in the numbers ₹5000,5%,6.855% to reach ten crores. The Excel sheet uses a slightly different set.

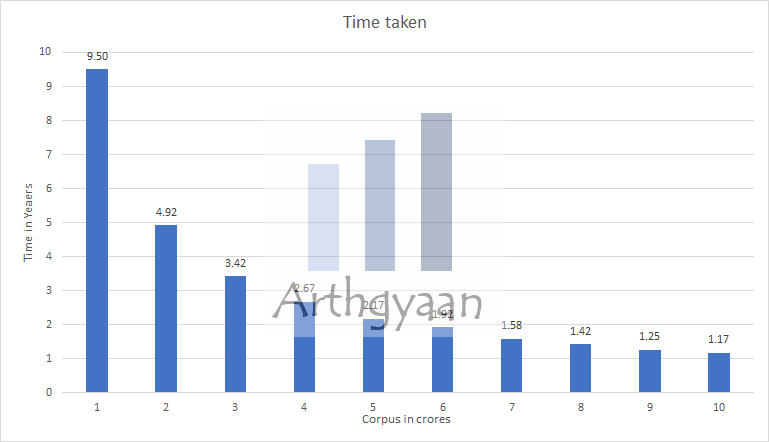

This chart shows how the time taken to reach each additional crore falls over time.

The first crore is always special since by investing we needed around ten years to reach that milestone. This means that we took around 1/3rd of the time to reach just 1/10th of the destination while the remaining 9/10th took only 2/3rd. The initial one crore then doubles in around the 14.5 year mark taking just less than five years instead of ten. At this point, readers should appreciate the aphorism “Money makes money”. If the compounding journey had not been started 14 years ago and the investor had not been patiently investing for the first 10 years to reach a crore, they would not have doubled the money in so short a period.

Investors should also appreciate the benefit of saving more. The compounding equation shows the importance of having a sizeable principal amount that forms the base of further compounding. Having a high savings rate and starting early are two ways of getting started.

Related reading: What is the danger of starting investments late?.

As you keep investing and your corpus increases, there are some things that you need to keep in mind:

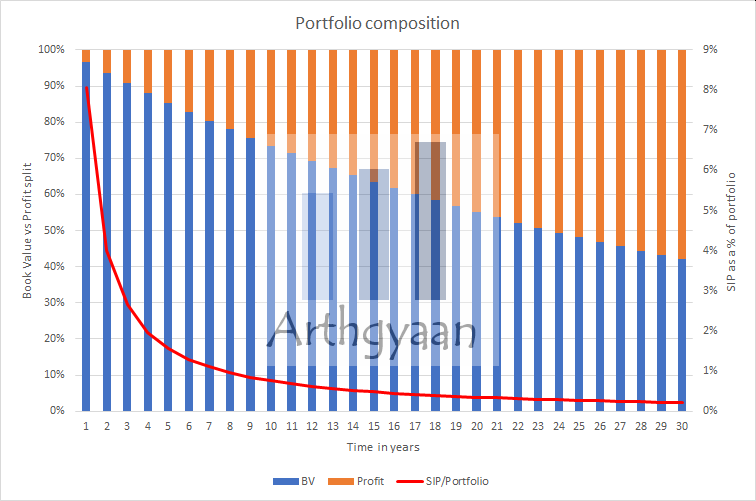

As a portfolio increases in value, the ability to make material changes to the portfolio via monthly SIP or by investing a lump sum reduces. Many investors, who are concerned about taxes on selling, refuse to rebalance and instead try to change their SIP composition with time to move the asset allocation of their portfolios. If you look at the red curve in the figure, you can see how miniscule the monthly SIP amount, even after the yearly increase, becomes relative to the total portfolio value. The takeaway here is that to rebalance, you need to actively sell and buy assets as per your glide path and rebalancing plan. Otherwise it is like using paddles to change the course of a cruise ship. It works but will be quite slow.

Read more here: Your portfolio needs a glide path: what, why and how?.

The standard advice given to new investors is to start investing via a Systematic Investment Plan (SIP) since that reduces risk. SIP uses the premise of dollar-cost averaging (DCA) to invest a fixed sum of money every month. As income increases, the SIP amount also should increase as a step-up SIP.

SIP is logical since most investors will be earning money monthly from salary, business or profession and should line up income and investments using the same schedule. That is all there to it.

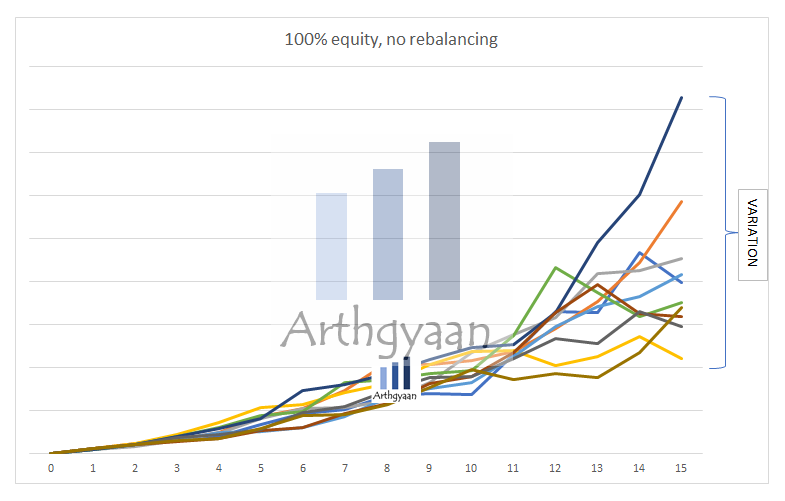

Unfortunately, the mutual fund industry and agents who sell mutual funds are in a perpetual asset-gathering mode causing them to push the narrative that a SIP reduces risk. Here is a diagram that shows what happens if you just start a SIP and keep increasing it with time without managing risk:

This variability happens since at every point of your entire corpus is now exposed to market movements. As time passes, less is the impact of adding new money to the portfolio and more is the effect of the obtained returns.

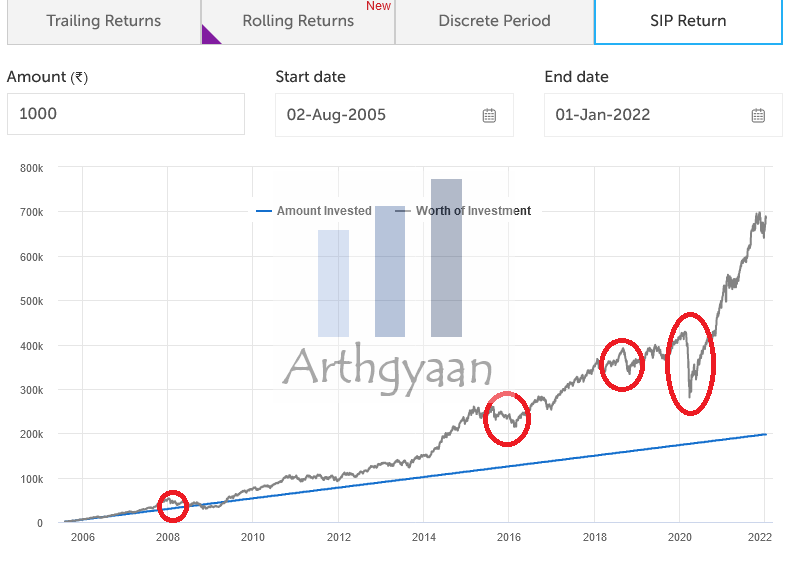

Here is the performance of a SIP in an actual equity mutual fund since 2005. The portfolio lost considerably at every instance of a market crash.

To reduce this type of fluctuation and to ensure that you reach your target goal, you need to manage portfolio risk using asset allocation and rebalancing: Portfolio rebalancing during goal-based investing: why, when and how?

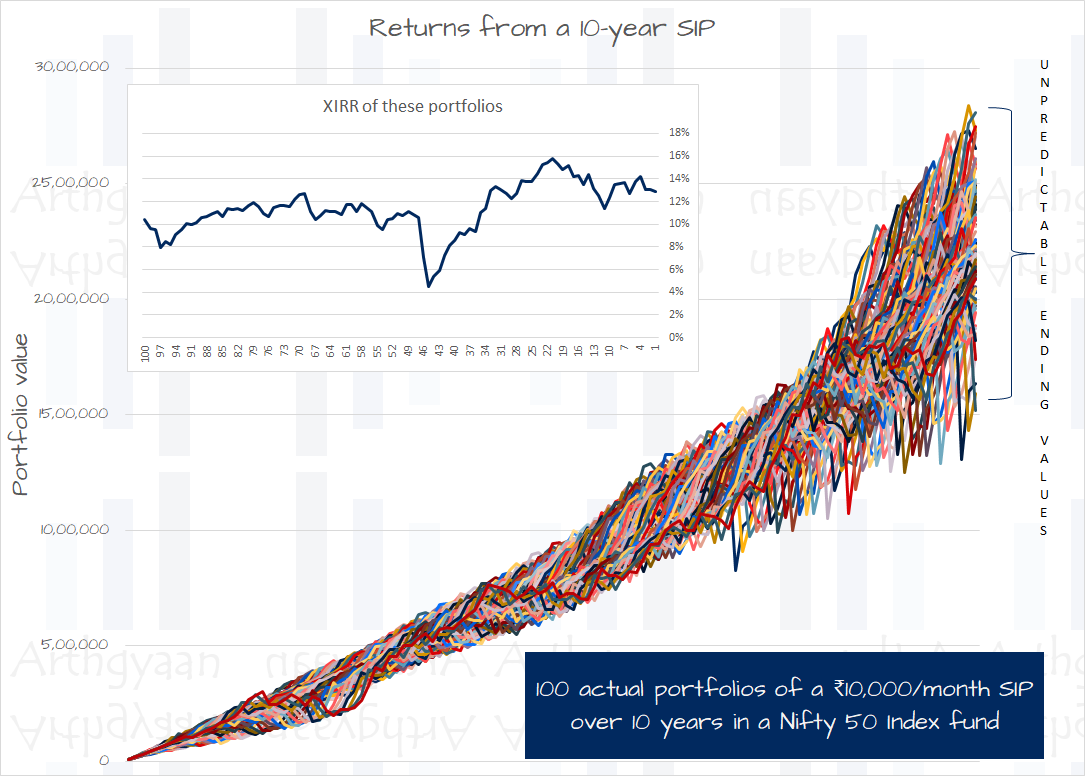

We calculated SIP return data for 10-year periods and saw that a ₹10,000/month SIP (₹12 lakhs investment) reached a figure between ₹15 to ₹28 lakhs. This conclusion is that the return is too unpredictable to be useful.

Read more: The lie of wealth-creation via SIP in mutual funds

Here is the last exhibit which shows what happens if you can run the same SIP for another 30 years, maybe by the original investor’s children. We see that from ₹10cr, this portfolio grows to ₹110cr which is highly impressive.

Inflation: the impact on your goals and how to choose assets that beat it

For those curious about inflation impact, the corpus will have the same buying power, in terms of today’s money, as ₹1.6cr in 30 years and ₹2.8cr in 60 starting from zero.

As a part 2 of this article, once you create a portfolio using the method described in this article, you can reach surprisingly large values: How big will your portfolio grow in retirement?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How compounding works: the journey to a 10 crore portfolio first appeared on 11 Jan 2022 at https://arthgyaan.com