How big will your portfolio grow in retirement?

This article gives you a glimpse of how the power of compounding creates a multi-crore portfolio in retirement.

This article gives you a glimpse of how the power of compounding creates a multi-crore portfolio in retirement.

This article continues our previous article on compounding: How compounding works: the journey to a 10 crore portfolio.

We will show how compounding is expected to create phenomenal wealth over the lifetime of your portfolio. In many articles and online calculators, you can see the corpus you need to accumulate by retirement.

For example, an investor expecting to retire in 20 years for a lifestyle that costs ₹50,000/month in today’s money needs to reach a retirement corpus of ₹8 crores in 20 years to retire.

However, you will be surprised to know that this corpus is expected to grow to ₹22 crores over the next few decades. These numbers are expected to be a fun thought experiment based on certain assumptions, so do not expect to get these exact numbers if the markets do not perform as expected.

We will make the following assumptions:

We will use the Arthgyaan goal-based investing tool to calculate the target retirement corpus and the portfolio value from today until the end of retirement.

The outputs are:

Using the Arthgyaan goal-based investing tool, we can see that in the accumulation stage, i.e. while you are earning,

Once retirement starts

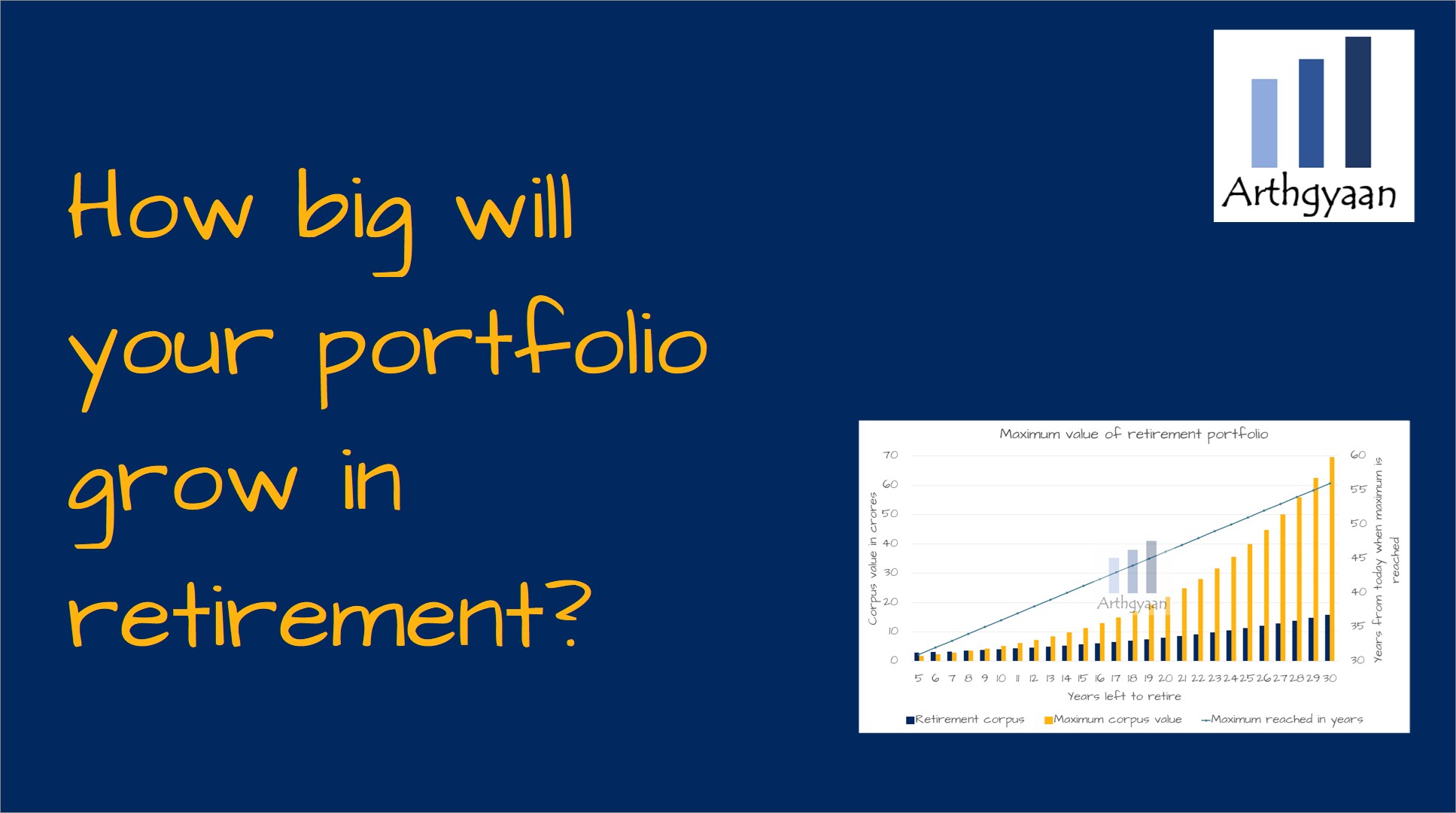

This chart shows how the portfolio reaches its peak at different times, using the same assumptions but varying the time left until retirement. Many investors will be shocked at how, due to the power of compounding, the portfolio value reaches enormous values. For example, a 30-year-old targeting retirement after 30 years may expect to see a portfolio of ₹16 crores (at the start of retirement) grow to ₹70 crores near the end of retirement.

This article shows a simple retirement and review plan that anyone can follow in a step-by-step manner: Low-stress retirement planning calculations: worked out example. Once you follow these steps, creating and maintaining a retirement portfolio and reaching such significant corpus figures becomes very doable.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How big will your portfolio grow in retirement? first appeared on 28 May 2023 at https://arthgyaan.com