How do you get SIP amount for retirement: Part 3

Walk-through: Get SIP amount for retirement goal

Walk-through: Get SIP amount for retirement goal

We have already covered

We will extend the concept developed while calculating for a goal like a college education with multiple payments (once every year for each year of college) and use it for retirement planning. If you are entering retirement within the next year, please see this detailed post instead. This post approaches the same problem from a different direction by estimating the corpus for retirement.

A common retirement corpus estimation formula uses the present value of the expenses in retirement discounted using real rates of return in the retirement period. This is an excellent formula to get started:

Corpus = PV(real return,time in retirement,-expense in the first year of retirement,0,1)

The issue with this formula is the difficulty of assuming the real rate of return in the retirement portfolio. An oversimplified version, which readers of this blog must avoid, is to just assume that real returns will be some figure say -2% or 0% or 2% in retirement. This is a fallacious assumption because the real returns of the portfolio will depend on the asset allocation and the glide path of the individual expenses in each year of retirement and cannot be guessed.

Real returns during the retirement period depend on:

In this article, we have shown that the lifetime real return over the entire accumulation and withdrawal phase is close to zero: How much returns should you expect from your retirement portfolio?.

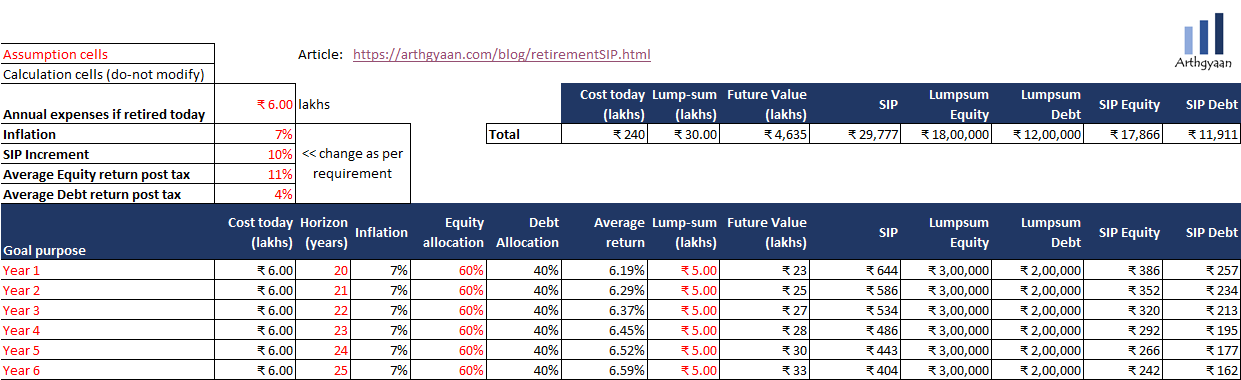

Therefore, instead of assuming the overall real return, we will use the assumptions above and create the retirement portfolio. Our plan Goal-based investing tool or web-based goal-based investing calculator both use this individual expenses method to provide a more accurate estimate of your retirement corpus.

Today with early retirement being common across many professions, the typical 58-60 age for retirement may be brought forward for many reasons. The example Excel workbook assumes retirement to start 20 years from now.

Typically for married couples, this is the life expectancy of the younger spouse and could be as 100 years nowadays. We need to adjust the duration of the retirement accordingly. The longer the duration (assumed 40 years in the Excel example), the more savings are needed every month. We assume constant inflation throughout the period.

Here each year of retirement is modeled as a separate goal. Naturally, once the retirement period ends, there is no money expected to be left for any heirs. If that is needed, please create a separate goal for that using this method.

To beat inflation, one of the best options is equities. Historically equities have beaten inflation both in India and abroad and the trend is expected to continue. This article talks about choosing equity investments in detail.

Apart from equity, there are many debt instruments to invest in for retirement corpus creation. This includes debt mutual funds, NPS, provident funds and others and this is covered in more detail here.

One of the important assumptions will be the expenses in the first year of retirement (20 years from now in the example) assuming the retirement starts immediately. This needs to include expenses like housing, health insurance and travel and will assume no income. If pension or other income is present, then the expenses will be assumed beyond this income. This is covered in more detail here.

These calculations are explained in this comprehensive goal-based planning tool.

A very important part of planning for a long-term goal is increasing the monthly SIP amount as income increases. In the example, the increase is assumed to be 10%/year.

The following needs to be done in this order:

This video shows you how to use the web-based calculator to easily find out your retirement SIP value:

This is the link to our web-based calculator.

At all times ensure that you have the following in place

Once you start investing,

Please see below:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How do you get SIP amount for retirement: Part 3 first appeared on 05 Jun 2021 at https://arthgyaan.com