How much real estate should you hold in your portfolio?

This article discusses the role of real estate as an asset class. It shows a few options for valuing and including it in your portfolio.

This article discusses the role of real estate as an asset class. It shows a few options for valuing and including it in your portfolio.

Net worth = Assets owned - Outstanding loans

Real estate is always a part of your net worth. Calculating the net worth of your property, whether plot, residential or commercial, requires market price and any outstanding loan balance.

Net worth of real estate = Value of the property minus Any loan on the property

The property will be the market value (circle rate or above) minus selling costs like brokerage. If there is a home loan or loan-against-property, then the principal owned on that loan should be subtracted to get the net worth.

We will examine if real estate is to be a part of your investment portfolio and how much real estate should be there.

Many investors are still determining if they should include the value of their homes in their portfolios. Given that real estate is the most significant thing most people buy, it is normal to have this doubt. It gives a feeling of accomplishment and comfort to increase the networth by such a large number.

The primary residence has only one purpose: to give the investor’s family a place to live. Under normal circumstances, a family will not be willing to sell off their home and stay on rent. They will either upgrade or sell the older house. Alternatively, they might move to a rented house in a different location and put their old home on rent.

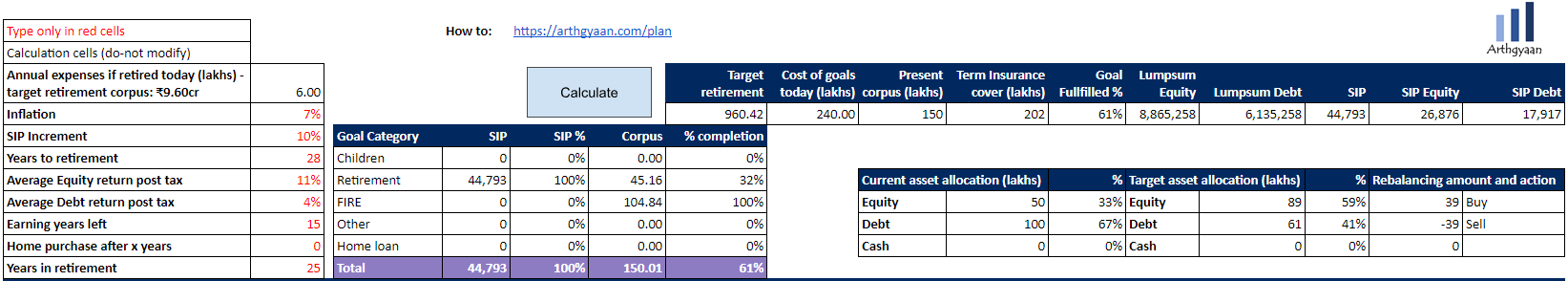

Additionally, the purpose of the investment portfolio is to fund goals like retirement, children’s education and others, as in the image above. Unless plans go drastically wrong, the family home will not be sold. If an investor has a portfolio of ₹1 crore and lives in a house of ₹1 crore, adding the house to the portfolio value will provide a misleading picture since the house is not for sale.

Therefore, we will exclude the primary residence from the investment portfolio.

Our discussion will therefore focus on investment real estate over and above the primary residence. Examples are flats, houses, plots and commercial real estate.

Does real estate behave more like a stock or an FD?

Answering this question will allow us to understand which side of the risk/reward curve we should classify real estate. We know that real estate does not wildly fluctuate like stocks and instead tends to offer steady rental income and capital appreciation. These characteristics make real estate more of a debt asset class than equity.

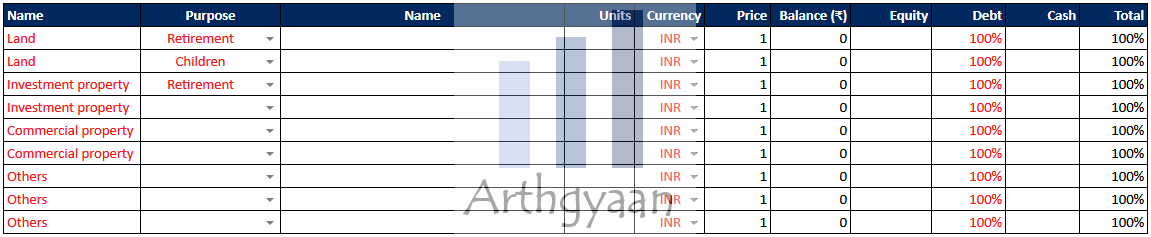

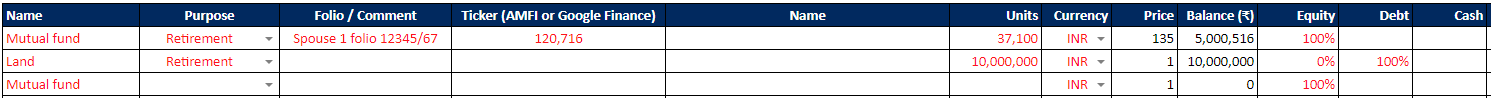

Suppose you use the Arthgyaan goal-based investing calculator. In that case, you should enter real estate as a debt asset, as in the image above.

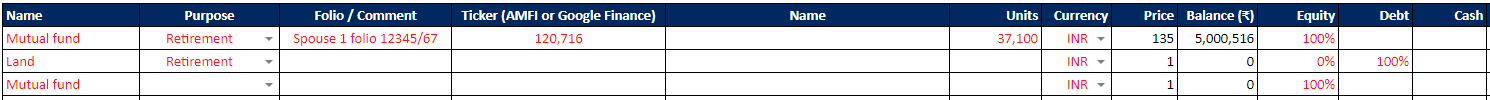

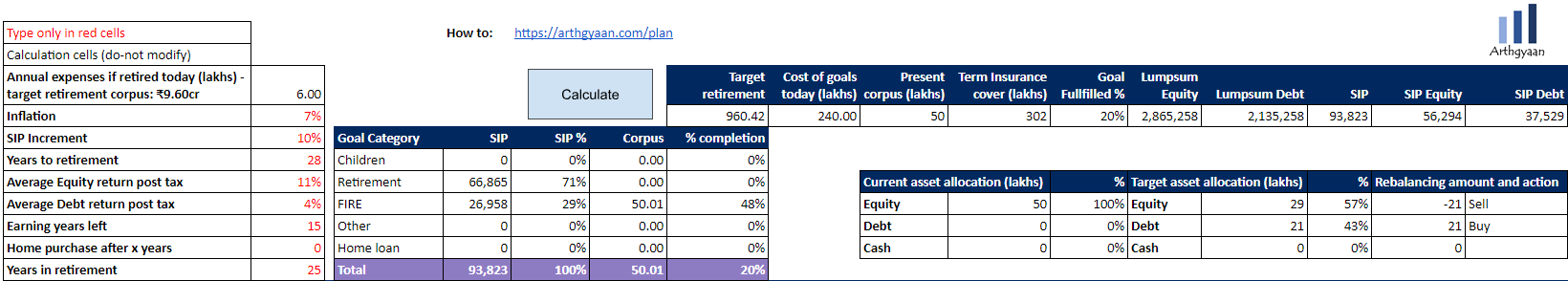

I will take this hypothetical example of a 30-year-old FIRE aspirant looking for a ₹6L/year (₹50,000/month in today’s money) lifestyle 15 years from now. They currently have ₹50 lakhs in assets like PPF, MF and FD. Additionally, they have an ancestral plot of land worth ₹1 crore.

They want to retire early at age 45 (15 years for now) and are expected to live until 85, i.e. 40 more years. The current expenses are ₹50,000/month, and there is ₹50,000/month available for investing.

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

In this example, the SIP required to reach the goal is ₹93,823, which is higher than the monthly available surplus. Therefore the goal is not achievable based on the currently held assets.

If we add the plot to the portfolio, we see that

The case above is an excellent example of how liquidity and ticket size work in real estate. The plot has to be sold in its entirety to reach the required equity allocation. You cannot sell a half or quarter of a plot or apartment. You can sell parts of a house if it is modular, like allowing multiple floors with individual registration.

Liquidity is also an issue with real estate. You might not get the right price when you need the money. If you need cash immediately, you might have to take the distress sale route, where the money you get will be even less.

Are there rules like 20% of a portfolio can go to real estate?

Real estate is another asset class, just like equity, debt and gold. There should be some allocation to real estate with some caveats:

You can keep things more uncomplicated by assuming that:

You can fund a property by paying just 1% of the value per month for investment purpose. If you rent that out, you will get full tax benefits on the loan as well: How to Buy Your Dream Home Without Any Savings: A Step-by-Step Guide

The second part of this article deals with adding your investment properties to your portfolio:

How to include your property with a home loan in your portfolio?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much real estate should you hold in your portfolio? first appeared on 06 Aug 2023 at https://arthgyaan.com