Budget (24 articles)

Budget

Tax

NRI

Budget 2025: how NRIs planning to retire in India can get 2 lakhs per month tax-free with a $1million investment

Article: This article describes the tax benefits announced in Budget 2025 that can be used by NRIs planning to retire in India to create a tax-free and inflation-indexed passive income stream.

Published: 1 February 2025

10 MIN READ

Budget

Tax

NPS

Budget 2025: what income tax benefits are there for NPS Vatsalya? Is it good for children?

Article: This article describes the tax benefits announced in Budget 2025 for the NPS Vatsalya Scheme to understand if these benefits make NPS Vatsalya a good scheme for children’s future.

Published: 1 February 2025

17 MIN READ

Budget

Tax

Fixed Deposit

Budget 2025: how retirees can pay zero tax on a 5 crore fixed deposit portfolio with risk-free 2 lakh per month income

Article: This article describes the tax benefits announced in Budget 2025 applicable to retirees and other fixed-income investors.

Published: 1 February 2025

11 MIN READ

Budget

Tax

Calculator

Free Calculator: Union Budget 2025: which is the best tax regime to choose from 1st April 2025?

Article: This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2025.

Published: 1 February 2025

14 MIN READ

FAQ

Tax

Budget

Form 12BAA: How to reduce TCS on foreign remittances and foreign travel after 1st October 2024?

Article: This article shows you the method for lowering the effect of Tax Collected at Source (TCS) on foreign remittances and travel via RBI’s Liberalised Remittance Scheme (LRS) as per new rules introduced under Union Budget 2024.

Published: 8 November 2024

13 MIN READ

International Investing

Budget

Budget 2024: How New Changes Make International Investing under LRS Easier for Indians?

Article: This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

Published: 8 September 2024

11 MIN READ

Budget

International Investing

Tax

Budget 2024 TCS Changes: Minimise the Impact Of TCS on Your Foreign Stocks and other LRS Investments

Article: This article shows how you can now offset TCS against your salary’s TDS providing significant relief and improving your cash flow.

Published: 1 September 2024

12 MIN READ

Budget

Tax

Real Estate

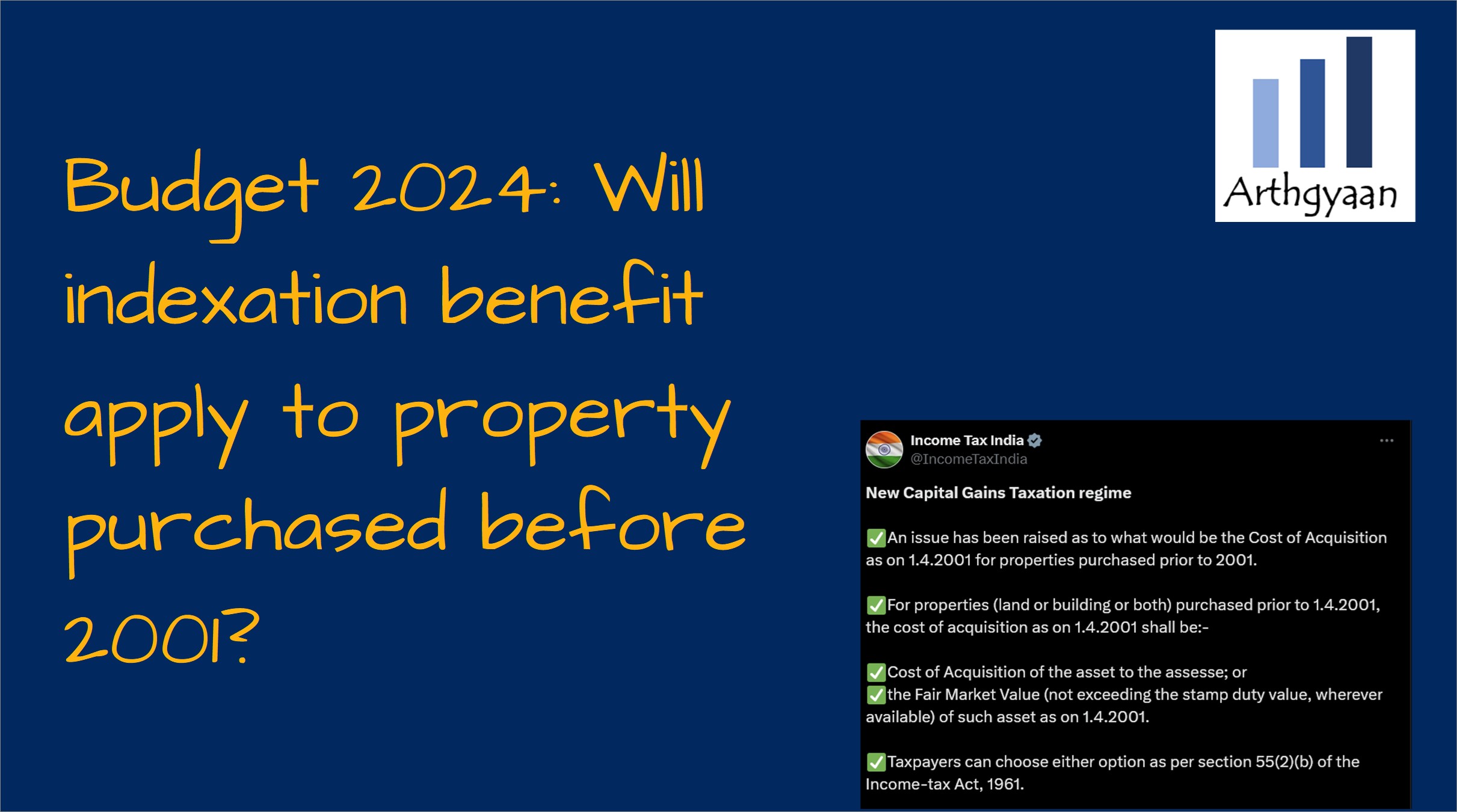

Budget 2024 taxation rule reversal: grandfathering rule brings back indexation benefit to properties acquired before July 2024

Article: This article explains the new of the reversal of the 12.5% without indexation tax rule to allow 20% with indexation for all properties bought before 23rd July 2024.

Published: 7 August 2024

29 MIN READ

Budget

Tax

Real Estate

10L to 80L in 23 Years: How to Calculate Sale Price of Property to Pay Lower Taxes after Budget 2024

Article: This article helps you calculate the minimum price above which you must sell your property to pay lower taxes under the taxation rule change as per Budget 2024.

Published: 29 July 2024

31 MIN READ

Children

NPS

Budget

NPS Vatsalya: A Gimmicky Product That Should Be Avoided If You Are Serious About Investing For Your Children

Article: This article discusses the NPS Vatsalya scheme that does not make any sense as a product for anyone even if you plan to invest for your children’s retirement.

Published: 26 July 2024

20 MIN READ

Budget

Mutual Funds

Tax

Budget 2024: How will international, debt and gold/silver funds get taxed going forward?

Article: This article shows you how debt, international and gold/silver mutual funds will get taxed as per the new capital gains tax declared in the Union Budget 2024.

Published: 25 July 2024

10 MIN READ

Budget

Tax

Calculator

Union Budget 2024: which is the best tax regime to choose from 1st April 2024? (July 2024 update)

Article: This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024.

Published: 23 July 2024

16 MIN READ

Budget

Tax

Calculator

Interim Budget 2024: which is the best tax regime to choose from 1st April 2024?

Article: This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024 as per Interim Budget 2024.

Published: 1 February 2024

10 MIN READ

Budget

Tax

Mutual Funds

What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?

Article: This article shows the way forward for investors in debt, gold, hybrid and international funds which have lost indexation benefits on units purchased after 1st April 2023.

Published: 26 March 2023

13 MIN READ

⬆️ Back to top