Budget 2024: How New Changes Make International Investing under LRS Easier for Indians?

This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

Disclaimer: Taxation is a dynamic concept and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

This article is a part of our detailed article series on Union Budget 2024. Ensure you have read the other parts here:

This article shows you the method for lowering the effect of Tax Collected at Source (TCS) on foreign remittances and travel via RBI’s Liberalised Remittance Scheme (LRS) as per new rules introduced under Union Budget 2024.

This article shows how you can now offset TCS against your salary’s TDS providing significant relief and improving your cash flow.

This article explains the new of the reversal of the 12.5% without indexation tax rule to allow 20% with indexation for all properties bought before 23rd July 2024.

This article helps you calculate the minimum price above which you must sell your property to pay lower taxes under the taxation rule change as per Budget 2024.

This article clarifies the indexation benefit available to property purchased before 2001 from official income tax authority sources.

This article discusses the impact on investors’ psyche due to impact on Gold price due to government policy change.

This article shows you how debt, international and gold/silver mutual funds will get taxed as per the new capital gains tax declared in the Union Budget 2024.

This article shows you how to do tax harvesting for shares and mutual funds as per the new capital gains tax declared in the Union Budget 2024.

This article analyses the most important changes affecting your portfolio as per the Union Budget 2024.

This article analyses the change in taxation of stocks and mutual funds as per the Union Budget 2024.

This article analyses the change in NPS-related tax deductions as per the Union Budget 2024.

This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024.

This article analyses the change in taxation of real estate sales in India as per Union Budget 2024.

Under the RBI’s Liberalised Remittance Scheme (LRS), resident Indians can spend up to $250,000 (over ₹2 crores) per financial year on foreign investments, children’s education, foreign tours, and medical expenses abroad.

Budget 2024 has introduced significant changes for resident Indians looking to invest internationally:

We will cover these topics individually to understand their impact on international investing for resident Indians who invest in foreign shares, ETFs, and mutual funds.

| Due date | Advance tax payable |

|---|---|

| 15th June | 15% |

| 15th September | 45% |

| 15th December | 75% |

| 15th March | 100% |

In each of the above cases, you need to subtract the advance tax already paid.

All taxpayers with an annual tax liability of more than ₹10,000 must pay advance tax according to the schedule above. Since income tax from salary is deducted and paid by the employer, advance tax must be paid on other sources of income like rent, interest from FDs, dividends from stocks and mutual funds, and capital gains from the sale of stocks, mutual funds, property, etc.

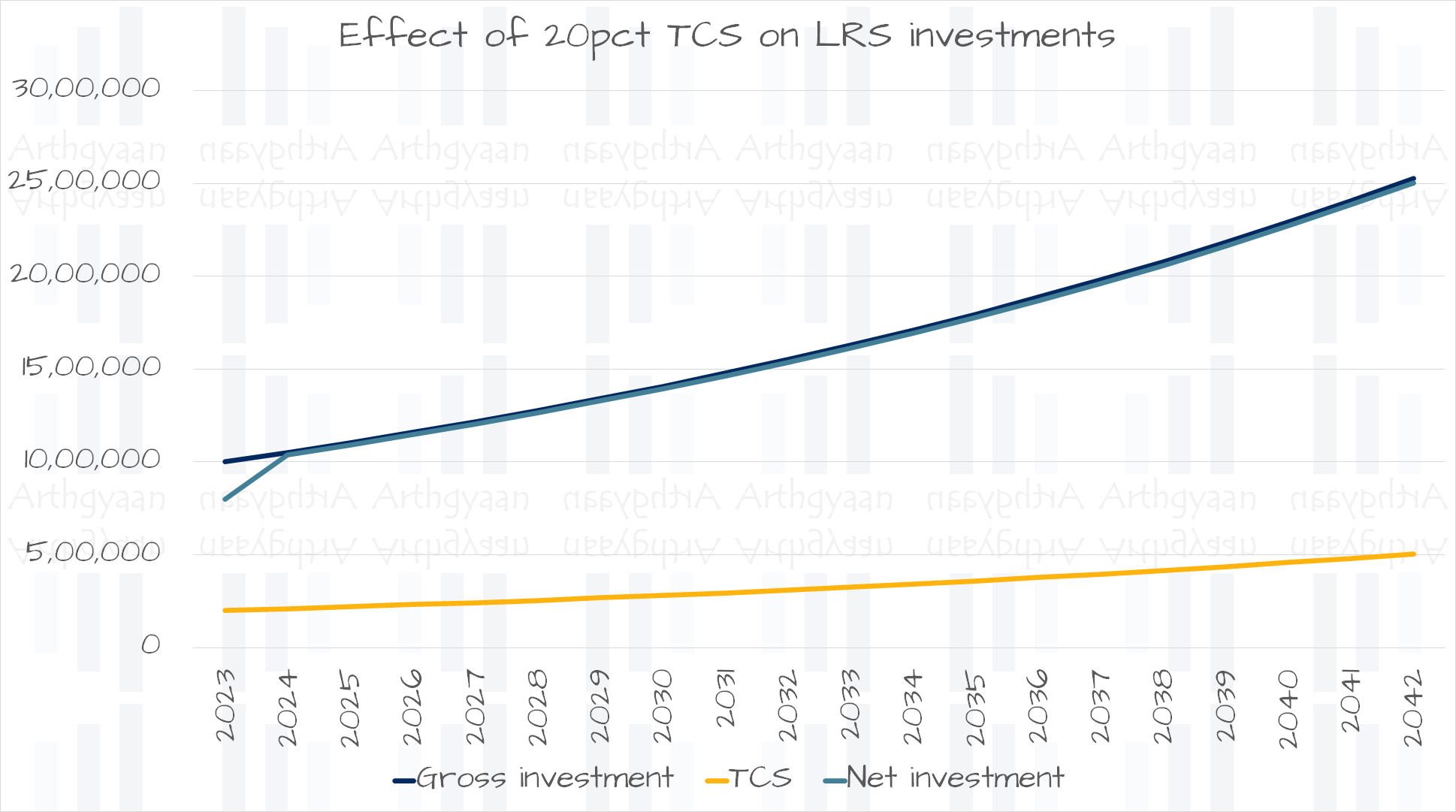

You can adjust the TCS amount on LRS against this advance tax. The issue arises when you do not have enough advance tax to be paid because your salary constitutes most of your income. We have already shown the impact on investment returns, particularly if you invest regularly in foreign stocks, as the first TCS instalment is rarely refunded: What is the impact of the 20% TCS rule on all LRS investments?

Budget 2024 allows employees to declare their TCS details to their employers. Employers are expected to offset this TCS against the monthly TDS, effectively adjusting the in-hand salary to return the TCS to the employee.

We have covered this topic in detail here: Budget 2024 TCS Changes: Minimise the Impact of TCS on Your Foreign Stocks and other LRS Investments

Budget 2024 made changes to the capital gains taxation rules for international investments such as stocks, mutual funds, and ETFs:

However, some elements remain unchanged:

Note: This change aligns the LTCG tax rate on international stocks with that of domestic stocks (except that long-term for domestic stocks is 12 months instead of 24 months). The STCG rate on domestic stocks is 20%, as per Budget 2024.

Investors should note that LTCG taxation on international investments is now the same as for domestic real estate. Some investors may be concerned that the removal of indexation will result in higher taxes. However, given that the expected return on international stocks is higher than on Indian real estate, this change may actually be beneficial.

Minimum profit % on selling international stocks = 8 / 3 * (CII change %)

where,

CII change % = ( CII_selling_Year / CII_Purchase_Year ) - 1

We have discussed this concept in more detail in this article: Budget 2024: A Surprise in Real Estate Sales due to Indexation Benefit Removal: Is it good or bad?

During tax filing, you must declare your foreign assets in Schedule FA (Foreign Assets) in your income tax return (ITR) form if:

Budget 2024 removes penalties for failing to declare foreign assets up to ₹20 lakhs. However, it is still advisable to fill out Schedule FA, even if your foreign assets are below ₹20 lakhs.

We have covered this topic in detail here: Why must you declare your foreign shares and RSUs during tax filing?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Budget 2024: How New Changes Make International Investing under LRS Easier for Indians? first appeared on 08 Sep 2024 at https://arthgyaan.com