Union Budget 2024: What are the changes in capital gains tax for Stocks and Mutual Funds?

This article analyses the change in taxation of stocks and mutual funds as per the Union Budget 2024.

This article analyses the change in taxation of stocks and mutual funds as per the Union Budget 2024.

This article is a part of our detailed article series on Union Budget 2024. Ensure you have read the other parts here:

This article shows you the method for lowering the effect of Tax Collected at Source (TCS) on foreign remittances and travel via RBI’s Liberalised Remittance Scheme (LRS) as per new rules introduced under Union Budget 2024.

This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

This article shows how you can now offset TCS against your salary’s TDS providing significant relief and improving your cash flow.

This article explains the new of the reversal of the 12.5% without indexation tax rule to allow 20% with indexation for all properties bought before 23rd July 2024.

This article helps you calculate the minimum price above which you must sell your property to pay lower taxes under the taxation rule change as per Budget 2024.

This article clarifies the indexation benefit available to property purchased before 2001 from official income tax authority sources.

This article discusses the impact on investors’ psyche due to impact on Gold price due to government policy change.

This article shows you how debt, international and gold/silver mutual funds will get taxed as per the new capital gains tax declared in the Union Budget 2024.

This article shows you how to do tax harvesting for shares and mutual funds as per the new capital gains tax declared in the Union Budget 2024.

This article analyses the most important changes affecting your portfolio as per the Union Budget 2024.

This article analyses the change in NPS-related tax deductions as per the Union Budget 2024.

This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024.

This article analyses the change in taxation of real estate sales in India as per Union Budget 2024.

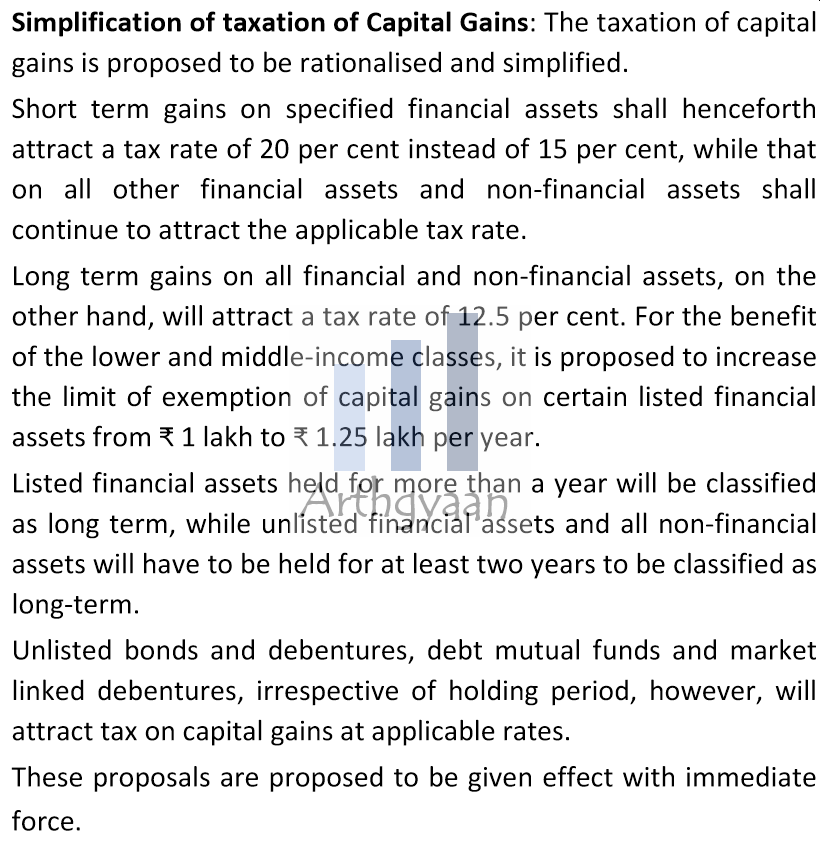

A much-lamented move by the Finance Minister saw an increase in capital gains taxation for both stocks and mutual funds in Union Budget 2024.

Here is the excerpt from the Budget Speech:

Source: https://www.indiabudget.gov.in/doc/budget_speech.pdf

Union Budget 2024 rules do not apply to units sold before 1st April 2024. We are therefore discussing units sold after 1st April 2024 only. We need to keep in mind that the Union Budget 2024 applies only from 23-Jul-2024. Therefore any units already sold between 1st April 2024 and 22nd July 2024 will be taxed at the old rates. The rates image is a screenshot of the AMFI tax page as of 25th July 2024.

Here’s how we interpret these rules:

Types of assets to which this rule applies:

Capital gains tax calculation:

No long-term capital gains tax below ₹1.25 lakhs per PAN in this category per financial year. Earlier, this limit was ₹1 lakh.

Types of assets to which this rule applies:

Capital gains tax calculation:

Types of assets to which this rule applies:

Capital gains tax calculation:

Note: The taxation change for LTCG on gold/silver and international funds will be applicable only from 1st April 2026 onwards. For the rest, the taxation change is applicable from 23-Jul-2024. We have covered this particular class of funds in more detail here: Budget 2024: How will international, debt and gold/silver funds get taxed going forward?.

This change will be welcomed by all where debt mutual funds, fund of funds, international funds are no longer taxed at slab as was proposed in Budget 2023: What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?

As a special case that has a chance of causing confusion, we will cover those hybrid funds where the equity exposure is less than 65% but more than 35%. Some examples of this category are Dynamic Asset Allocation Funds, Balanced Advantage Funds and Multi-Asset Funds.

Please keep in mind that for Multi-Asset, Dynamic Hybrid and Balanced Advantage funds, we will have to look at the portfolio composition in the last 12 months from the sale date to understand which of the above three categories it belongs to.

If we assume debt fund-like taxation for these funds, we get:

Any units sold between 1st April 2024 to 22nd July 2024 will be taxed at:

Any units sold between 23rd July 2024 to 31st March 2025 will be taxed at:

Any units sold between 1st April 2024 to 31st March 2025 will be taxed slab rates irrespective of purchase date and holding period.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Union Budget 2024: What are the changes in capital gains tax for Stocks and Mutual Funds? first appeared on 23 Jul 2024 at https://arthgyaan.com