Budget 2024: Will indexation benefit apply to property purchased before 2001?

This article clarifies the indexation benefit available to property purchased before 2001 from official income tax authority sources.

This article clarifies the indexation benefit available to property purchased before 2001 from official income tax authority sources.

This article is a part of our detailed article series on Union Budget 2024. Ensure you have read the other parts here:

This article shows you the method for lowering the effect of Tax Collected at Source (TCS) on foreign remittances and travel via RBI’s Liberalised Remittance Scheme (LRS) as per new rules introduced under Union Budget 2024.

This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

This article shows how you can now offset TCS against your salary’s TDS providing significant relief and improving your cash flow.

This article explains the new of the reversal of the 12.5% without indexation tax rule to allow 20% with indexation for all properties bought before 23rd July 2024.

This article helps you calculate the minimum price above which you must sell your property to pay lower taxes under the taxation rule change as per Budget 2024.

This article discusses the impact on investors’ psyche due to impact on Gold price due to government policy change.

This article shows you how debt, international and gold/silver mutual funds will get taxed as per the new capital gains tax declared in the Union Budget 2024.

This article shows you how to do tax harvesting for shares and mutual funds as per the new capital gains tax declared in the Union Budget 2024.

This article analyses the most important changes affecting your portfolio as per the Union Budget 2024.

This article analyses the change in taxation of stocks and mutual funds as per the Union Budget 2024.

This article analyses the change in NPS-related tax deductions as per the Union Budget 2024.

This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024.

This article analyses the change in taxation of real estate sales in India as per Union Budget 2024.

In a surprise move, Union Budget 2024 changed the capital gains taxation rules for real estate transactions:

The only things kept unchanged are:

Read more on the changes introduced here: Budget 2024: A Surprise in Real Estate Sales due to Indexation Benefit Removal: Is it good or bad?

This is a question that many property owners are asking. Here is the scenario.

You have a property purchased / constructed in 1990 for ₹5 lakhs. You are selling this property for ₹1 crore on or after 23rd July 2024.

What is the capital gains tax?

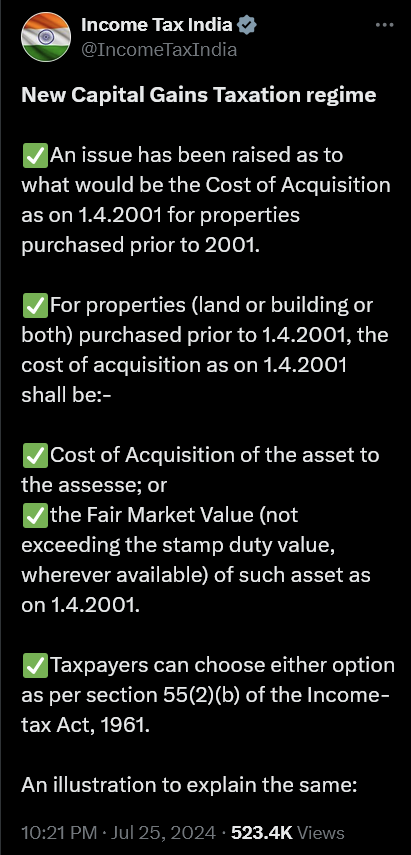

Thankfully, the income tax official Twitter / X handle has clarified this situation like this:

Source: https://x.com/IncomeTaxIndia/status/1816516685127725434

Therefore, the rule for calculation of capital gains is:

Old regime calculation

Cost of acquisition = minimum of (FMV of the property on 1st April 2001, Stamp Duty Value on 1st April 2001)

Here FMV is the Fair Market Value determined by a government-approved property valuation expert.

Profit as per old regime with indexation benefit = Sale price - Indexed purchase price

Here Indexed purchase price = Cost of acquisition * (CII_selling_Year / CII_Purchase_Year) where CII comes from here: How to use the Cost Inflation Index (CII): latest value and historical rates

Tax as per old regime = 20% of Profit as per old regime with indexation benefit

New regime calculation (as per Union Budget 2024 for properties sold on or after 23rd July 2024)

Profit as per new regime without indexation benefit = Sale price - Cost of acquisition

Tax as per new regime = 12.5% of Profit as per new regime without indexation benefit

Final tax payable is the minimum of these two tax values. In case of loss, there is the benefit of rolling forward the capital loss for eight subsequent years.

Note: In another surprise amendment to the Finance Bill on 6th August, 2024, the option of paying 20% tax on gains with indexation has been added to all properties acquired before Union Budget 2024 speech date of 23rd July, 2024. This means that for all such properties, including those purchased before 1st April 2001, the capital gains tax can be the lower of:

irrespective of the sale date thereby offering a grandfathering option for such properties. The exact amendment is this:

“where the income-tax computed .. exceeds the income-tax computed in accordance with the provisions of this Act, as they stood immediately before their amendment by the Finance (No. 2), Act, 2024, such excess will be ignored;”

If you read the text of the amendment carefully, then any loss cannot be offset or carried forward here since the amendment does not talk about losses. For properties acquired on or after 23rd July 2024, only the new 12.5% without indexation rule will apply.

We have covered the impact of this new change in detail here: Budget 2024 taxation rule reversal: grandfathering rule brings back indexation benefit to properties acquired before July 2024

Here is an easy-to-use calculator that incorporates all these rules:

This calculator helps you estimate the capital gains tax you'll need to pay when selling a property in India, based on the latest tax rules. We include adjustment for stamp duty/brokerage during both buying and selling as well as Pre-construction Home Loan Interest (assumed to be unclaimed for Section 24 deduction).

First, you’ll need to enter all the details of your property transaction. The calculator automatically populates some fields to make things easier, but you should always double-check and adjust them to match your specific situation.

Once all your details are entered, click the Calculate button to see the results.

The calculator will perform the following steps:

The results section will provide a clear breakdown of your transaction.

NRIs will not see the indexed values since it is not applicable to them.

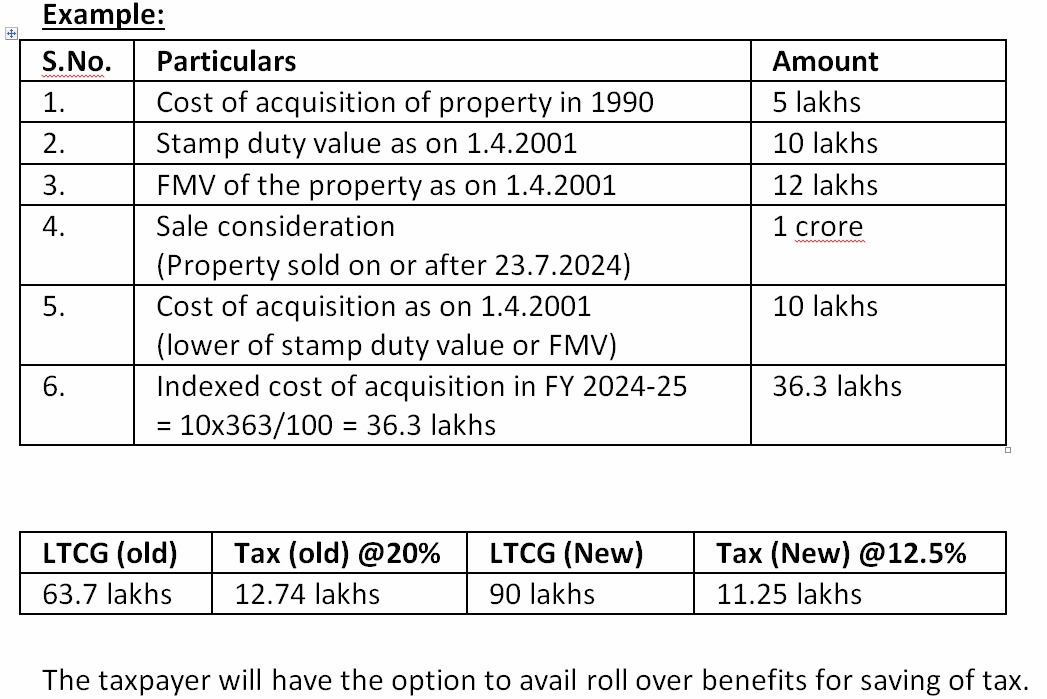

The same post has an illustration as well using the same ₹5 lakh property purchased in 1990 and sold in 2024 on or after 23rd July 2024 for ₹1 crore like this:

Source: https://x.com/IncomeTaxIndia/status/1816516685127725434

While the Tweet does not explicitly say it, there is no mention of any change in the indexation benefit on the cost of improvement over the years on the same property which will reduce the old-regime tax value further.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Budget 2024: Will indexation benefit apply to property purchased before 2001? first appeared on 29 Jul 2024 at https://arthgyaan.com