Budget 2024: Should you still invest in SGB after Gold import duty cut?

This article discusses the impact on investors’ psyche due to impact on Gold price due to government policy change.

This article discusses the impact on investors’ psyche due to impact on Gold price due to government policy change.

This article is a part of our detailed article series on Union Budget 2024. Ensure you have read the other parts here:

This article shows you the method for lowering the effect of Tax Collected at Source (TCS) on foreign remittances and travel via RBI’s Liberalised Remittance Scheme (LRS) as per new rules introduced under Union Budget 2024.

This article analyses the changes in Budget 2024 that impact investors investing abroad under the RBI’s Liberalised Remittance Scheme.

This article shows how you can now offset TCS against your salary’s TDS providing significant relief and improving your cash flow.

This article explains the new of the reversal of the 12.5% without indexation tax rule to allow 20% with indexation for all properties bought before 23rd July 2024.

This article helps you calculate the minimum price above which you must sell your property to pay lower taxes under the taxation rule change as per Budget 2024.

This article clarifies the indexation benefit available to property purchased before 2001 from official income tax authority sources.

This article shows you how debt, international and gold/silver mutual funds will get taxed as per the new capital gains tax declared in the Union Budget 2024.

This article shows you how to do tax harvesting for shares and mutual funds as per the new capital gains tax declared in the Union Budget 2024.

This article analyses the most important changes affecting your portfolio as per the Union Budget 2024.

This article analyses the change in taxation of stocks and mutual funds as per the Union Budget 2024.

This article analyses the change in NPS-related tax deductions as per the Union Budget 2024.

This article describes how to use the Arthgyaan goal-based investing tool as a calculator to determine if switching to the New Tax Regime makes sense from 1st April 2024.

This article analyses the change in taxation of real estate sales in India as per Union Budget 2024.

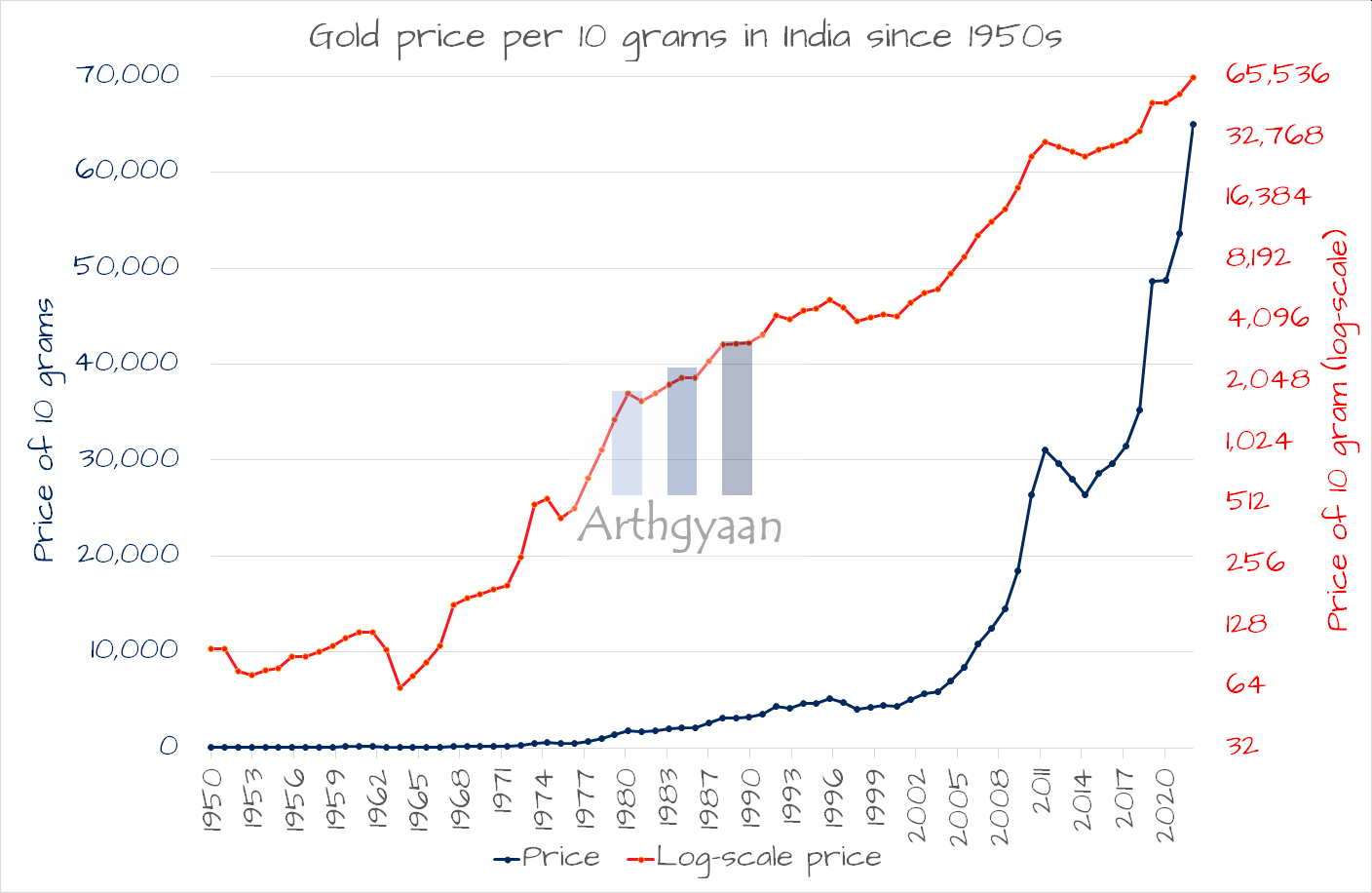

cut the import duty on gold from 15% to 6%. This was a surprise to the gold market in India, where gold prices fell by 5% (as measured by 999 purity prices from the IBJA site) on 23rd July 2024, the date of the Budget speech. In this article, we will explore the impact of the duty cut on Sovereign Gold Bond (SGB) investors. But before going into SGB, let us quickly understand how gold prices work in India.

Gold prices in India change due to these factors:

One more factor that is not usually considered in understanding how gold prices move in India is the import duty. Given the massive demand for gold in the country, the government likes to tax imports. $100 of gold imported into the country was costing $115 due to the 15% import duty before . Now, immediately after the Budget speech, the effective price was reduced to $106.

The gold market reacted like this:

| Date | Gold in ₹/10gm | Gold in $/oz. | SGB Feb 2032 per share |

|---|---|---|---|

| Fri 26-Jul-24 | 68,131 | 2,385.57 | 7,708.28 |

| Thu 25-Jul-24 | 68,227 | 2,364.50 | 7,722.25 |

| Wed 24-Jul-24 | 69,151 | 2,397.59 | 7,871.82 |

| Tue 23-Jul-24 | 69,602 | 2,409.21 | 7,925.11 |

| Mon 22-Jul-24 | 73,218 | 2,397.65 | 8,096.42 |

On Tuesday 23rd July, the gold market, which is measured by the 999 purity 10 gram price from the IBJA website, fell from ₹73,218 to ₹69,602, a 4.94% fall. This has rattled a lot of SGB investors. We now explore why.

As we have covered in our detailed FAQs on the concept of SGB, an SGB is a promise made by the Government of India to:

The last sentence is significant. Let us examine it again:

After eight years, give back money equal to the price of gold around the date of maturity

What is the risk here since the government guarantees to return money? The question here, which is implied in the definition of SGB, is this:

If you think in financial risk terms:

SGB has no credit risk (since the government guarantees that you will get back money) but has complete exposure to the market risk of gold price movement.

If the gold price goes up, like it has been going up recently, then nobody complains. But this customs duty cut, which caused a 5% gold price fall, suddenly acted as a wake-up call to SGB investors that:

The S in SGB is Sovereign

This means that the Government has at least partial control over gold price movements. Given that the 2026 Series II SGBAUG24 is due for maturity in August, those investors will be hit the most since there is little chance for gold prices to recover. The one after that, the 2026 Series II SGBSEP24, is another month away from maturity.

| Date | Gold in ₹/10gm | Gold in $/oz. | SGB Feb 2032 per share | ₹ vs $ gold price | SGB vs $ gold price |

|---|---|---|---|---|---|

| Fri 26-Jul-24 | -0.14% | 0.89% | -0.18% | -1.03% | -1.07% |

| Thu 25-Jul-24 | -1.34% | -1.38% | -1.90% | 0.04% | -0.52% |

| Wed 24-Jul-24 | -0.65% | -0.48% | -0.67% | -0.17% | -0.19% |

| Tue 23-Jul-24 | -4.94% | 0.48% | -2.12% | -5.42% | -2.60% |

| Mon 22-Jul-24 | -0.03% | -0.13% | 0.01% | 0.10% | 0.14% |

We will now calculate the change in SGB prices that are closest to maturity at this point due to the duty change for the gold price on 26-Jul vs. 22-Jul. The gold price change from Monday 22-Jul to Friday 26-Jul is this:

| Gold price | Since budget day |

|---|---|

| Gold in ₹ | -6.95% |

| Gold in $ | -0.50% |

| SGB Feb 2032 | -4.79% |

As an effect of this gold price fall, taking the approximate 5% fall of 23rd July 2024, the SGB issued on 5-Aug-2016 has now matured at a headline return of 122% instead of a possible 134%. Read more on this here: SGB issued in Aug 2016 has given 122% return in 8 years. How does that compare with FDs and equity mutual funds?

To answer this question, we need to understand what is the purpose of investing in SGB.

We have long maintained that SGB is an excellent way to buy gold in the future. This view is due to the fact that when you invest in SGB, on the issuance date, you pay the price of 1 gram of gold. When the SGB matures after 8 years, the government gives you back exactly the same amount of money equal to 1 gram of gold at the maturity time. To sweeten the deal further, the government gives 2.5% interest and does not make you pay any tax on the maturity amount.

Therefore, effectively, you bought a piece of (virtual) paper that behaved exactly like one gram of gold. So your investment, if you think of it as a paper form of gold, stayed exactly equal to one gram of gold before, during and after maturity.

However, if the purpose of investing in SGB is to get returns from the gold price, then this would cause some heartburn since your potential returns have slightly fallen. It is therefore important to understand that when you invest in SGB:

In the end, there is one more point that we need to mention here. Every investment has multiple criteria for checking suitability:

Therefore, the duty cut is a classic example of either Unique situations (or alternatively Regulatory risk). The same risk is applicable to all government-linked schemes like EPF, PPF and NPS also. Ultimately, investors should re-examine their motivation to invest in SGB and proceed on that basis.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Budget 2024: Should you still invest in SGB after Gold import duty cut? first appeared on 28 Jul 2024 at https://arthgyaan.com