What is the best way to accumulate gold for your child's wedding?

This article shows you how to buy gold in small amounts over years for a child’s wedding goal.

This article shows you how to buy gold in small amounts over years for a child’s wedding goal.

This article is a part of our detailed article series on accumulating gold over time for a child's wedding in the future. Ensure you have read the other parts here:

This article gives the solution for buying small amounts of gold over the years in case buying SGB is not an option.

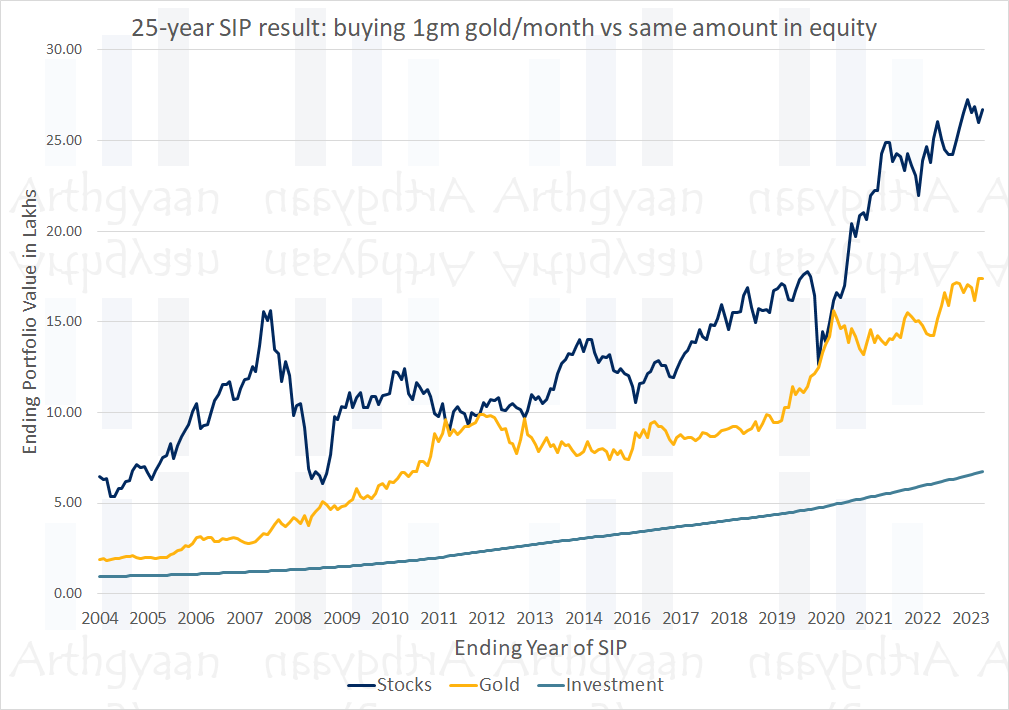

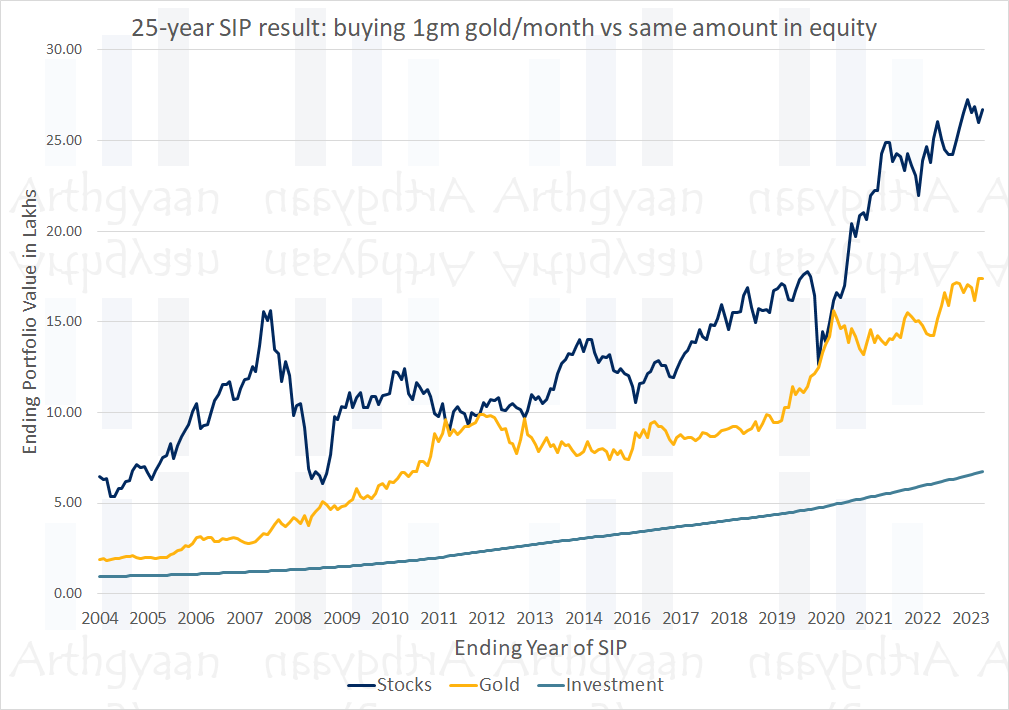

The article shows you if you there is a better alternative to buying gold over time for your child’s marriage goals.

Many parents wish to gift their children a large amount of gold for their wedding. There are two ways of looking at this problem. When the wedding is being planned, you either

The first approach says that you have money for the goal to be spent as and when you need it. If you change your mind later, and instead of spending money on gold, which stays in the locker, you can gift that money for, say, a house down payment, a lavish destination venue, or a college fund for your future grand kids or 10-year school fees for 50 needy children or whatever else you want.

We have shown above that this option works better: What will create a higher corpus for children’s marriage: buying physical gold vs SIP in stocks.

However, we will now discuss the best way for parents interested in the alternative approach of accumulating gold for a wedding.

We will aim to have the highest amount of gold that we can get for our money by

We have argued before that Sovereign Gold Bond (SGB) is the only option that suits all the criteria above: The Ultimate Guide to Which Type of Gold Gives the Best Returns.

However, SGB has two main shortcomings that we need to overcome in our hybrid approach:

We will assume the target is 900 grams of gold for a wedding in 25 years. This goal requires us to buy 3 grams of gold monthly over 300 months.

Every month you will buy 3 units of SGB from the secondary market following this guide: Sovereign Gold Bond (SGB): Which Series is Best for You?. You must do this manually since the “best” SGB to buy will change from month to month. A recurring reminder on your phone will be helpful for this.

If there is a fresh issue of SGB, like this, you can buy the 3 units from this primary issuance or even more if you have extra cash available.

Since SGB also gives 2.5% interest, once you have 40-50 units of SGB, the annual interest will let you buy 1 extra unit.

When the SGB matures, you will have to take the entire amount and do one of three things:

If more than 8 years are left for the wedding, and SGB is still available either in the stock market or there is new issuance, then invest in SGB in one shot.

If less than 8 years are left for the wedding, then there are two options:

Gold mutual funds (or ETFs) also track the price of gold mostly accurately since they have yearly expense ratio that reduces their overall return. If SGB is not an option and you don’t want to move to physical gold yet, then these can be decent option: How to choose a gold mutual fund?.

Physical gold bars, biscuits or coins have GST and making charge and therefore will have lower return compared to SGB. However, if you are not able to buy SGB due to whatever reason, moving to physical gold is an effective option. Just like SGB, physical gold has no capital gains tax if you use it to make jewellery. Gold ETFs and mutual funds, though convenient to purchase, will have capital gains tax at slab rates for all units purchased after 1-Apr-2023.

When the wedding comes near, you will have the following:

As all the SGB gets converted to cash, you will have the same amount to buy the exact grams of gold as you had units of SGB. You can directly use this cash for jewellery along with the physical gold.

We would prefer that any jewellery be made at the point of the wedding itself since making charge will be wasted in case your plan changes later.

This calculator helps you determine the total cost of gold jewellery, including making charges and GST.

Enter Today’s Gold Price

Input the current price of gold per gram in ₹.

Enter Grams of Gold

Input the weight of the jewellery in grams.

Enter Making Charge (%)

Input the percentage charged for making the jewellery.

Enter GST (%)

Input the applicable GST percentage.

Note: If you already own the gold as a bar or biscuit, GST is applied only the making charge.

The calculator will automatically display:

All calculations update in real-time as you change the inputs.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the best way to accumulate gold for your child's wedding? first appeared on 19 Nov 2023 at https://arthgyaan.com