Sovereign Gold Bond (SGB): Which Series is Best for You?

This article explains which Sovereign Gold Bond (SGB) series should be bought from the stock market if you are planning to invest in SGB.

This article explains which Sovereign Gold Bond (SGB) series should be bought from the stock market if you are planning to invest in SGB.

This article is a part of our detailed article series on the concept of Sovereign Gold Bond (SGB). Ensure you have read the other parts here:

This article walks you through setting up and tracking your SGB portfolio for free using this user-friendly and free tool.

This article compares the currently active SGBs vs the latest SGB issue price to see what returns are implied for investors who are already invested.

This article helps you choose the right type of gold for your long-term investments since all options do not give the best results.

This article shows you how to buy Sovereign Gold Bonds (SGB) from the stock market using your demat account.

This article provides a complete history of SGB issue price history since 2015 to help investors track the how the issue price has moved over time.

This article compiles an exhaustive list of FAQs for Sovereign Gold Bonds (SGB).

A Sovereign Gold Bond (SGB) is a piece of paper issued (in digital form) by the Government of India with the following features. For every unit of SGB purchased, the investor will:

SGB is available for purchase in two ways:

In this article we will consider the best options for buying SGB from the stock market. This article is the companion article to our SGB purchasing guide here: How to buy SGB from the stock market?.

The price of an SGB in the stock market depends on the demand and supply of the SGB apart from its intrinsic value.

Price of SGB = Intrinsic value + Demand-supply effects

Intrinsic value depends on two things:

The effect of demand-supply factors is unpredictable. Therefore it is important that we understand how to calculate the intrinsic value of the SGB.

Intrinsic value = Gold price + present value of interest payments

Note: In this article, we are not adjusting for the dirty price concept which means that an additional term for the accrued interest.

Gold price comes from the India Bullion and Jewellers Association (IBJA) website for 999 purity gold. The IBJA website is here: link.

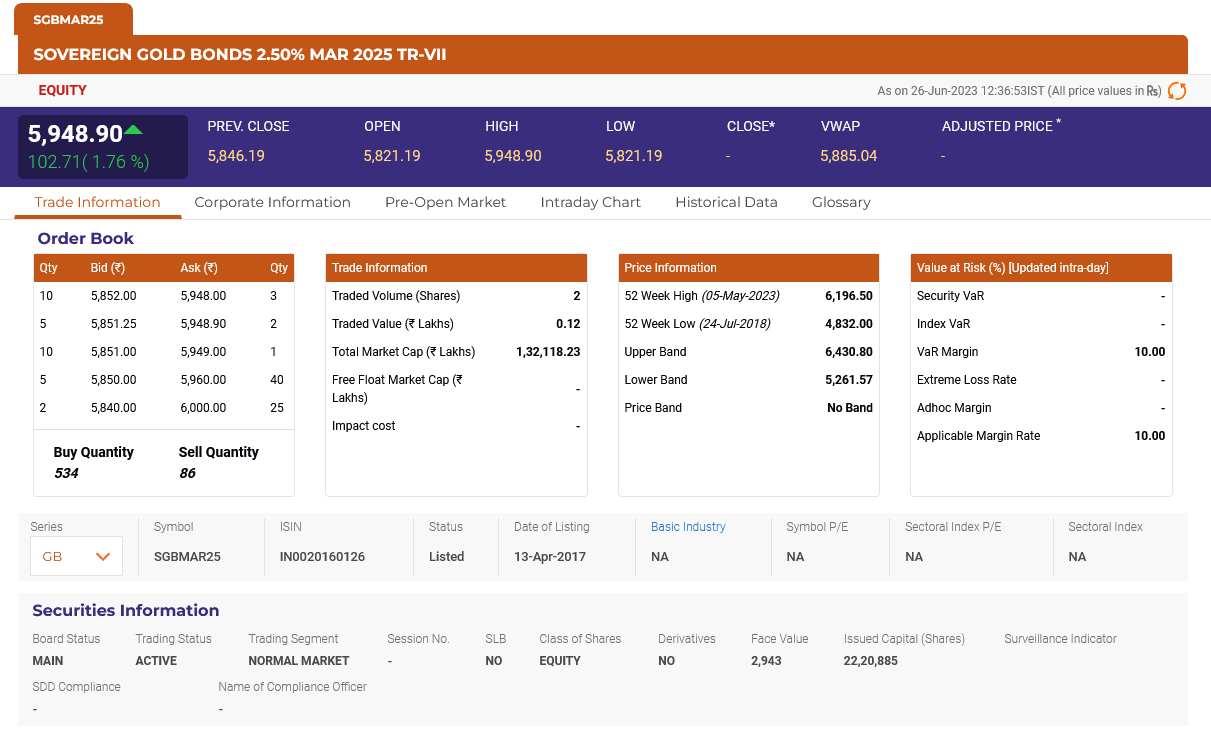

The interest rate is 2.5% on the face value of the bond paid at the rate of 1.25% every six months. This interest is taxable. To calculate the present value of these remaining interest rate payments we will look at this sample SGB quotation page from NSE:

Here the first 3 units of SGB (see the order book) are available for purchase at 5,948. This is a March 2025 bond (see the name on top) which will mature in March 2025. The present value of the interest payments is given by this Excel formula:

PV = ([[Issue Price]] * [[Interest Rate]]/2 * (1 - (1 + (Discount Rate/2)) ^ -(([[Maturity Date]]-Today’s Date)/365.25 * 2))) / (Discount Rate/2)

where

Once you have the PV, the intrinsic value of this SGB is PV + IBJA gold price.

If the SGB is quoted lower than this number, then you should buy it.

If you are planning to accumulate gold for any purpose, first choose among SGBs maturing just before that date. If there is no particular date, you can buy the cheapest (relative to intrinsic value) long dated SGB that is available.

Here is the latest list of SGBs trading at a discount: Which SGB series should you buy based on the highest discount?

Yield To Maturity (YTM) is a concept that is applicable to bonds where the maturity amount is known. SGB, though has the word Bond in the name, is not actually a bond. The maturity value of the SGB depends on the gold price just before the maturity date and is unknown today. Therefore the concept of YTM is not applicable.

There are many calculators online that show the YTM of SGBs by setting today’s gold price as the maturity value. That concept is flawed as explained above.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Sovereign Gold Bond (SGB): Which Series is Best for You? first appeared on 27 Aug 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.