SGB return vs issue price: what returns do you expect to get from SGB?

This article compares the currently active SGBs vs the latest SGB issue price to see what returns are implied for investors who are already invested.

This article compares the currently active SGBs vs the latest SGB issue price to see what returns are implied for investors who are already invested.

This article is a part of our detailed article series on the concept of Sovereign Gold Bond (SGB). Ensure you have read the other parts here:

This article walks you through setting up and tracking your SGB portfolio for free using this user-friendly and free tool.

This article explains which Sovereign Gold Bond (SGB) series should be bought from the stock market if you are planning to invest in SGB.

This article helps you choose the right type of gold for your long-term investments since all options do not give the best results.

This article shows you how to buy Sovereign Gold Bonds (SGB) from the stock market using your demat account.

This article provides a complete history of SGB issue price history since 2015 to help investors track the how the issue price has moved over time.

This article compiles an exhaustive list of FAQs for Sovereign Gold Bonds (SGB).

As per RBI, the price of SGB is fixed in Indian Rupees based on the simple average of the closing price of gold of 999 purity, published by the India Bullion and Jewellers Association (IBJA) Limited for the last three working days of the week preceding the subscription period. Retail investors get a ₹50/unit discount if they apply online. RBI will issue a Press Release stating the Bond’s issue price before the new issue opens.

For example, if the issue opens on a Monday, the SGB issue price is the simple average of the IBJA closing prices of the previous Friday, Thursday and Wednesday for 999 purity gold.

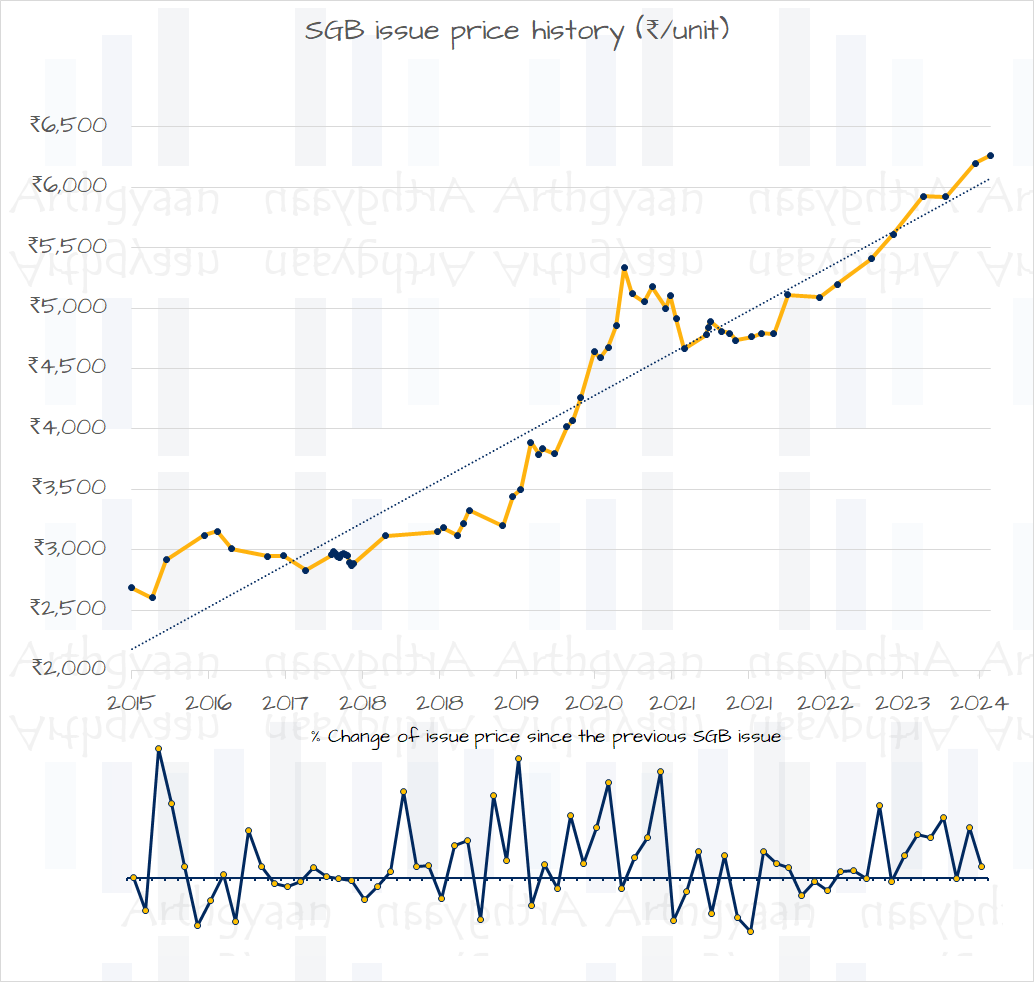

The complete SGB price history in India is here:

You can read the details of SGB price history here: Sovereign Gold Bond (SGB): complete issue price history in India

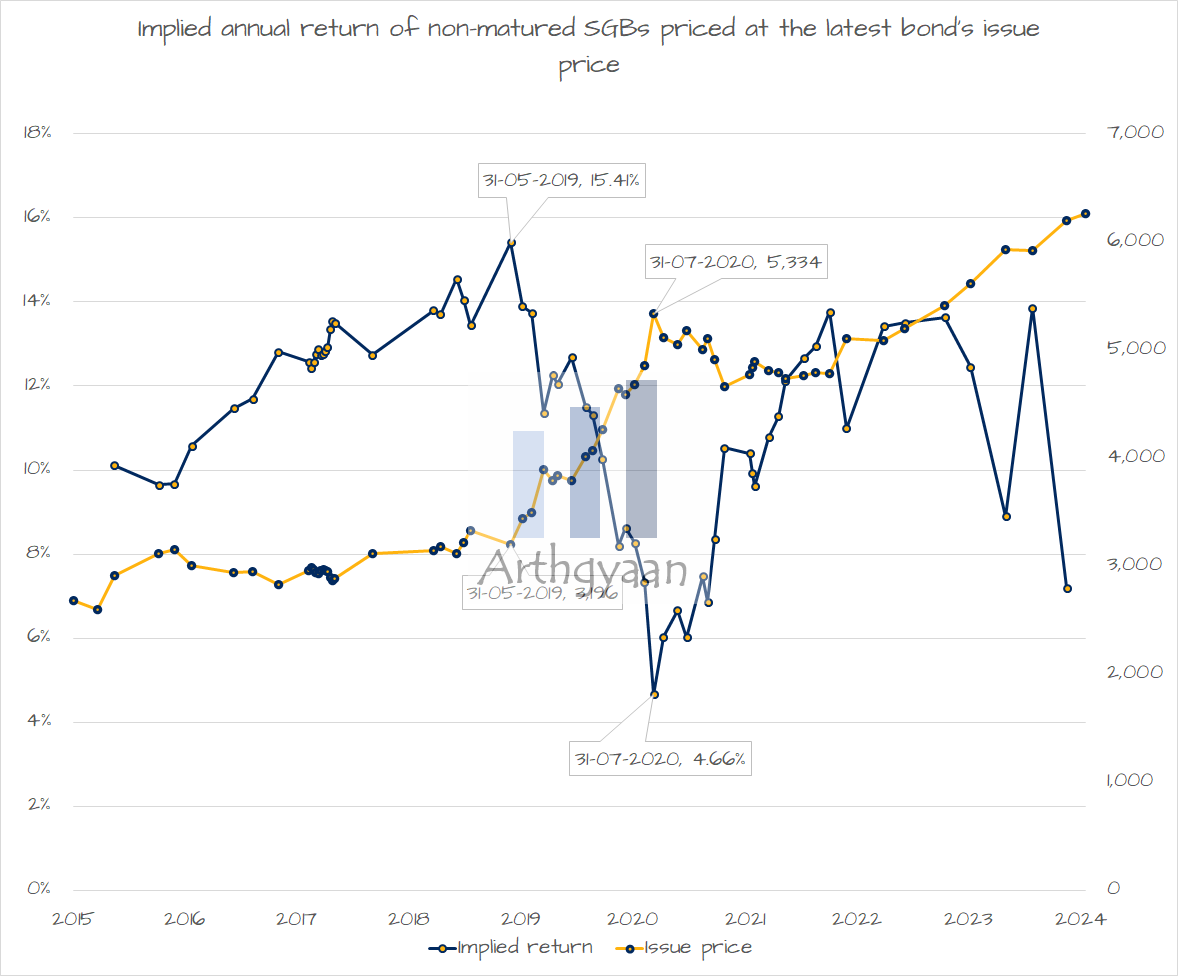

We have compared the currently active SGBs (those not yet matured) against the latest one: Sovereign Gold Bond (SGB) 2023-24 (Series IV): Who Should Invest?

To understand whether these SGB implied returns are good or not:

As the chart shows, prices of gold are at a historical high which leads to lower return expectation at maturity. The highest implied return, based on the May 2019 issue is 15.41% (excluding 2.5% interest). The lowest return is expected from the July 2020 bond which was issued at the high gold price levels during the COVID-19 pandemic.

Investors should note that this return calculation is based on the current age of active SGBs in the market and excludes these matured ones:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled SGB return vs issue price: what returns do you expect to get from SGB? first appeared on 12 Feb 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.