The first SGB issued in Nov 2015 has given 128% return in 8 years. Is that good or bad?

The 2015 Series I SGB showcased a notable return on maturity compared to other investment avenues like fixed deposits and certain equity mutual funds.

The 2015 Series I SGB showcased a notable return on maturity compared to other investment avenues like fixed deposits and certain equity mutual funds.

This article is a part of our detailed article series on the new issues of Sovereign Gold Bond (SGB) as well as maturity of existing SGBs. Ensure you have read the other parts here:

The Feb 2017 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Nov 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Sep 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Aug 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Mar 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Feb 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

Sovereign Gold Bond (SGB) 2023-24 (Series IV): know all the details about it to decide if you should invest.

Sovereign Gold Bond (SGB) 2023-24 (Series III): know all the details about it to decide if you should invest.

Sovereign Gold Bond (SGB) 2023-24 (Series II): know all the details about it to decide if you should invest.

Sovereign Gold Bond (SGB) 2023-24 (Series I): know all the details about it to decide if you should invest.

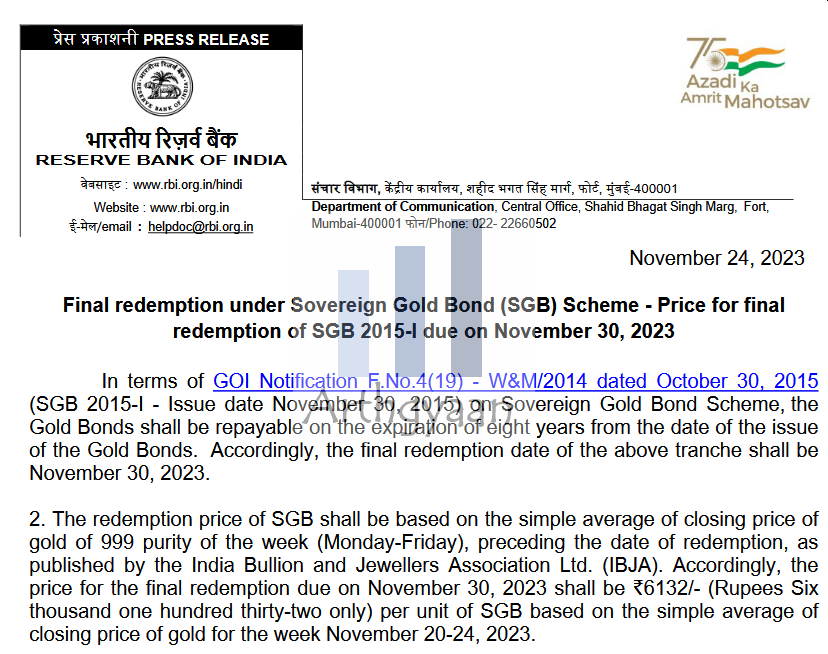

This is the first SGB that was ever issued way back in November 2015.

| Series | 2015 Series I SGBNOV23 |

|---|---|

| Issue date | 26-Nov-15 |

| ISIN | IN0020150085 |

| Issue Price | ₹ 2,684 |

| Interest | 2.75% |

| Maturity date | 30-Nov-23 |

| Maturity price | ₹ 6,132 (tax-free) (source) |

| Headline return | 128% |

| Gold price return | 10.88% |

| Rupee fall vs USD | 25.23% |

| Total interest received | ₹ 590.48 (taxed at slab) |

| XIRR (no tax on interest) | 12.90% |

| XIRR (30% tax on interest) | 12.28% |

The SGB has given a return higher than the gold price due to the interest paid every six months.

If you had bought and held this SGB until maturity, then this is the return you would have got based on the amounts you paid, the intermediate interest you got and the final maturity value:

| Date | Description | No tax | 10% tax | 20% tax | 30% tax |

|---|---|---|---|---|---|

| Nov-15 | Investment | -2,684 | -2,684 | -2,684 | -2,684 |

| May-16 | 6-m interest 1 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-16 | 6-m interest 2 | 36.91 | 33.21 | 29.52 | 25.83 |

| May-17 | 6-m interest 3 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-17 | 6-m interest 4 | 36.91 | 33.21 | 29.52 | 25.83 |

| May-18 | 6-m interest 5 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-18 | 6-m interest 6 | 36.91 | 33.21 | 29.52 | 25.83 |

| May-19 | 6-m interest 7 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-19 | 6-m interest 8 | 36.91 | 33.21 | 29.52 | 25.83 |

| May-20 | 6-m interest 9 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-20 | 6-m interest 10 | 36.91 | 33.21 | 29.52 | 25.83 |

| May-21 | 6-m interest 11 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-21 | 6-m interest 12 | 36.91 | 33.21 | 29.52 | 25.83 |

| Jun-22 | 6-m interest 13 | 36.91 | 33.21 | 29.52 | 25.83 |

| Dec-22 | 6-m interest 14 | 36.91 | 33.21 | 29.52 | 25.83 |

| Jun-23 | 6-m interest 15 | 36.91 | 33.21 | 29.52 | 25.83 |

| Nov-23 | Maturity | 6,168.91 | 6,165.21 | 6,161.52 | 6,157.83 |

| 30-Nov-2023 | XIRR | 12.90% | 12.70% | 12.49% | 12.28% |

It is important to note that to get the return in the table above, which is a calculation similar to that of Yield To Maturity or YTM of a bond, the intermediate 6-monthly interest payments must be also invested in SGB, if needed from the secondary market: How to buy SGB from the stock market?.

Simply adding the gold price return with the interest rate will not give the return of the SGB since the interest also has to compound at the same rate.

We all know that SGB gives the highest returns out of all types of gold investment: The Ultimate Guide to Which Type of Gold Gives the Best Returns.

We can see that the SGB has given a return higher than the gold price movement (10.88%) over 8 years due to the interest it pays out.

Please note that the rupee depreciation against the US Dollar, since most of our gold is imported, reduces the headline 128% return by 25% or the yearly return to a more pedestrian 9.27%.

We will now compare this SGB return to other asset classes starting with FD.

SBI was giving 5-10 year FDs offering a modest 7% for non-senior citizens which would have course give a return much lower due to tax. Other banks would have given higher returns but their risk would have been higher as well though all banks are covered under DICGC insurance.

| Investment | No tax | 10% tax | 20% tax | 30% tax |

|---|---|---|---|---|

| SGB | 12.90% | 12.70% | 12.49% | 12.28% |

| SBI FD | 7.00% | 6.30% | 5.60% | 4.90% |

If we look at the universe of all equity mutual funds, and exclude thematic and sectoral funds from it, there were 132 funds at the time of issuance of this SGB which are still active today.

If we consider the 30% post-tax return case, the following 41 funds, i.e. almost 1 out 3 funds, have been beaten by the SGB.

| Fund | Return pre-tax | Return after-tax |

|---|---|---|

| Nippon India Growth Fund | 9.09% | 8.39% |

| Taurus Largecap Equity Fund | 9.24% | 8.53% |

| Taurus Flexi Cap Fund | 9.57% | 8.85% |

| Lic Mf Flexi Cap Fund | 10.36% | 9.59% |

| Nippon India Tax Saver Fund | 10.80% | 10.00% |

| Aditya Birla Sun Life Elss Tax Relief ‘96 | 11.05% | 10.24% |

| Bandhan Flexi Cap Fund | 11.19% | 10.38% |

| Dsp Top 100 Equity Fund | 11.52% | 10.69% |

| Franklin India Bluechip Fund | 11.53% | 10.70% |

| Lic Mf Large Cap Fund | 11.77% | 10.92% |

| Franklin India Equity Advantage Fund | 11.81% | 10.96% |

| Jm Large Cap Fund (Direct) | 11.95% | 11.10% |

| Quantum Tax Saving Fund | 12.21% | 11.34% |

| Motilal Oswal Flexi Cap Fund Direct Plan | 12.38% | 11.51% |

| Nippon India Vision Fund | 12.42% | 11.54% |

| Dsp Focus Fund | 12.47% | 11.59% |

| Groww Largecap Fund | 12.48% | 11.60% |

| Edelweiss Long Term Equity Fund (Tax Savings) | 12.77% | 11.88% |

| Axis Long Term Equity Fund | 12.96% | 12.06% |

| Tata Large Cap Fund | 12.96% | 12.06% |

| Uti Large Cap Fund | 13.06% | 12.15% |

| Aditya Birla Sun Life Equity Advantage Fund | 13.06% | 12.15% |

| Motilal Oswal Focused 25 Fund (Mof25) | 13.08% | 12.17% |

| Aditya Birla Sun Life Frontline Equity Fund | 13.16% | 12.24% |

| Aditya Birla Sun Life Focused Equity Fund | 13.21% | 12.30% |

| Lic Mf Elss Tax Saver | 13.42% | 12.49% |

| Axis Bluechip Fund | 13.42% | 12.50% |

| Axis Focused 25 Fund | 13.43% | 12.51% |

| Uti Flexi Cap | 13.44% | 12.51% |

| Hsbc Tax Saver Equity Fund | 13.47% | 12.54% |

| Icici Prudential Elss Tax Saver Fund | 13.48% | 12.55% |

| Bandhan Focused Equity Fund | 13.49% | 12.56% |

| Hdfc Elss Tax Saver | 13.49% | 12.56% |

| Sbi Blue Chip Fund | 13.51% | 12.58% |

| Hsbc Flexi Cap Fund | 13.53% | 12.60% |

| Bandhan Large Cap Fund | 13.57% | 12.64% |

| Bank Of India Large & Mid Cap Equity Fund | 13.57% | 12.64% |

| Uti Elss Tax Saver Fund | 13.57% | 12.64% |

| Hsbc Large Cap Fund | 13.62% | 12.69% |

| Union Tax Saver (Elss) Fund | 13.70% | 12.76% |

| Franklin India Taxshield | 13.71% | 12.77% |

If we assume zero tax in both cases, then the following 18 funds have been beaten by the SGB.

| Fund | Return |

|---|---|

| Nippon India Growth Fund | 9.09% |

| Taurus Largecap Equity Fund | 9.24% |

| Taurus Flexi Cap Fund | 9.57% |

| Lic Mf Flexi Cap Fund | 10.36% |

| Nippon India Tax Saver Fund | 10.80% |

| Aditya Birla Sun Life Elss Tax Relief ‘96 | 11.05% |

| Bandhan Flexi Cap Fund | 11.19% |

| Dsp Top 100 Equity Fund | 11.52% |

| Franklin India Bluechip Fund | 11.53% |

| Lic Mf Large Cap Fund | 11.77% |

| Franklin India Equity Advantage Fund | 11.81% |

| Jm Large Cap Fund (Direct) | 11.95% |

| Quantum Tax Saving Fund | 12.21% |

| Motilal Oswal Flexi Cap Fund Direct Plan | 12.38% |

| Nippon India Vision Fund | 12.42% |

| Dsp Focus Fund | 12.47% |

| Groww Largecap Fund | 12.48% |

| Edelweiss Long Term Equity Fund (Tax Savings) | 12.77% |

Note: All of these are direct plans and regular plan returns would have been obviously worse: Do not make this mistake when investing in mutual funds.

Readers should understand that this comparison of two different asset classes should be done not on this point-to-point fashion but using rolling returns only: What are rolling returns in case of mutual funds? Why is this better than point-to-point returns?

The 2015 Series I SGB refers to a specific tranche of Sovereign Gold Bonds issued by the government in November 2015, carrying an interest rate of 2.75% and maturing on 30 November 2023.

The return on maturity of the 2015 Series I SGB was calculated at 128%, factoring in the interest payments and the increase in the gold price over the holding period.

The return on the 2015 Series I SGB was higher than the movement in gold prices (10.88%) over the eight-year period, mainly due to the interest it pays out every six months.

In comparison to fixed deposits, the 2015 Series I SGB showed a higher return. While typical FDs offered lower returns (around 7% pre-tax), the SGB yielded returns ranging from 12.28% to 12.90%.

In the scenario with a 30% tax on returns, around 42 out of 132 equity mutual funds analysed were outperformed by the SGB. In a no-tax scenario, around 18 funds were surpassed by the SGB.

We suggest that direct comparison should consider rolling returns rather than point-to-point returns. Rolling returns offer a more comprehensive analysis, considering performance across varying market conditions, providing a better insight into the comparative performance of different assets.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The first SGB issued in Nov 2015 has given 128% return in 8 years. Is that good or bad? first appeared on 26 Nov 2023 at https://arthgyaan.com