Wall Street or Dalal Street: which is the best option for US NRIs to invest in Indian stocks based on PFIC rule?

The article compares various investment options for US-based NRIs intending to invest in the Indian stock market.

The article compares various investment options for US-based NRIs intending to invest in the Indian stock market.

This article is a part of our detailed article series on the concept of the PFIC taxation rule applicable to US NRIs. Ensure you have read the other parts here:

This article simplifies compliance for US, Canada, UK, and Australia-based NRIs, covering FBAR, FATCA, PFIC, and T1135 requirements.

US-based NRIs investing in Indian mutual funds and stocks must comply with PFIC and FBAR rules or risk severe IRS penalties. This guide breaks down the reporting requirements for FinCEN Form 114 (FBAR) and Form 8621 (PFIC), helping NRIs avoid excessive taxation.

This article makes US-based NRIs aware of the taxation on the unrealised gain rule (PFIC rule) if they invest in Indian stocks, ETFs and mutual funds.

The IRS requires US tax residents to pay tax at their ordinary income tax rate on investments in PFICs for every tax year (1st Jan to 31st Dec). The tax rate depends on the method used to value the PFIC:

🛈 Who is a US tax resident?

Here is a calculator that shows your US tax-residency based on the Substantial Presence Test (SPT):

Learn more about the SPT from the IRS website.

Any NRI planning to stay in the US for some time will become a US tax resident after 183 days. The same rule applies to Green card holders as well. The 183-day rule is a part of the Substantial Presence Test and is the starting point of the calculations, including the weighted average of days present over three years, to determine US tax residency.

🛈 What Is a Passive Foreign Investment Company (PFIC)?

This tax is paid on unrealised gains. If your portfolio goes up by 10 lakhs a year, you pay 3 lakhs tax even if you did not sell anything (assuming a 30% marginal tax rate)

If we combine the above two definitions, any US-based NRI who is either a green-card holder or has stayed longer than 183 days in the US in a calendar year has to pay tax on Indian mutual funds, ETFs and AIFs (Cat 1 and Cat 3 only which do not have pass-through taxation). Direct stocks, real estate and provident fund (PPF/EPF) are not considered as a PFIC.

PFIC rules exist to prevent tax deferral by making you pay tax on gains every year.

This tax is paid on notional gains though you have not sold anything (under the mark-to-market method)

Warning: Taxes paid under PFIC are not refunded if you leave the US and come back to India. This rule will lead to severely lower returns on Indian mutual funds (and other PFIC eligible investments) since you have paid the tax already.

A detailed primer on the concept of PFIC and related calculation is here: Should US-based NRIs sell off their mutual funds and stocks in India?.

This article will cover the return of investing in Indian stock market via two equivalent investments:

We will consider these cases:

Investment Strategy: An investment approach where a US-based investor regularly invests funds in an Indian Nifty 50 index fund.

Tax Implications: Subject to PFIC rules, the investor pays tax on unrealised gains every year in the US at a combined (federal plus state) rate (assumed) of 32%. A 20% capital gains tax in India and the US under DTAA is paid on the final capital gains. If you have paid taxes in the US under PFIC, these will not be refunded in case you move back to India.

End Corpus: The invested funds remain in the Indian stock market and are not repatriated out of India.

Investment Strategy: An investment approach where a US-based investor regularly invests funds in an Indian Nifty 50 index fund.

Tax Implications: Subject to PFIC rules, the investor pays tax on unrealised gains every year in the US at a combined (federal plus state) rate of 32%. The final capital gains tax is 20%, just as the first option.

End Corpus: The invested funds are repatriated out of India at the end of the investment period.

Investment Strategy: Investment in the Indian stock market, specifically the stocks in the Nifty 50 index, through a US-domiciled ETF. This is a passive fund tracking the Nifty 50 index.

Tax Implications: Held in a tax-deferred IRA, allowing for tax benefits or tax deferral for US taxpayers.

End Corpus: The investment is held within the ETF structure domiciled in the US, and no taxes need to be paid until retirement due to the IRA.

In each case, we will consider

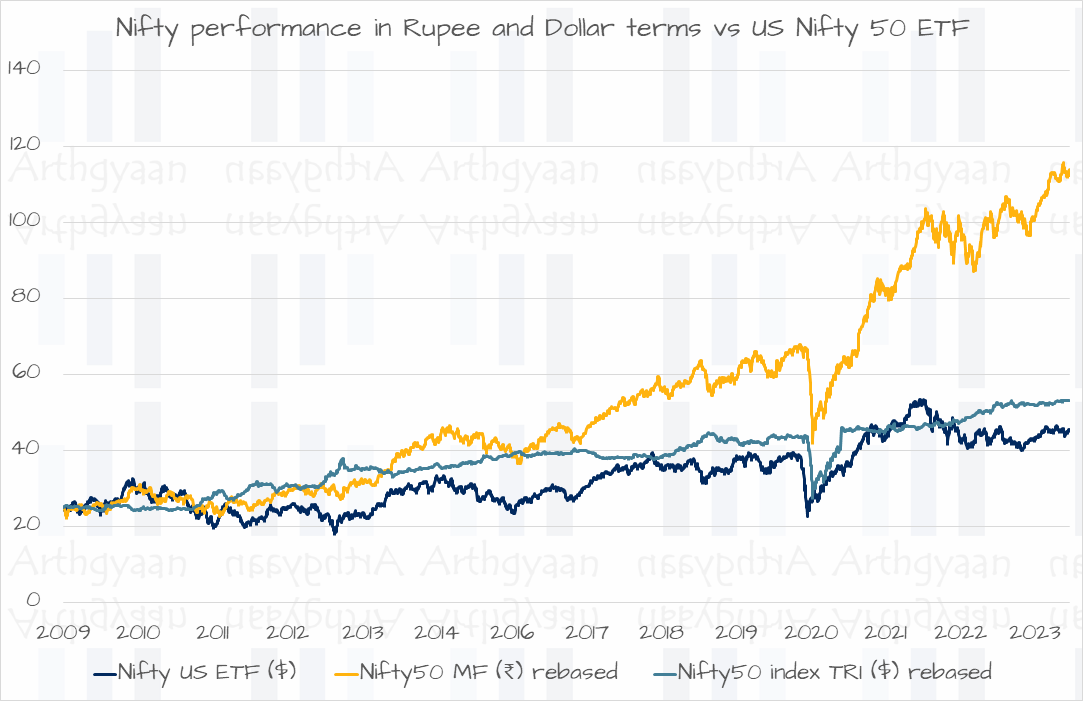

USD/Rupee exchange rate plays an important role when you invest from the US into the Indian market. This chart shows you the performance of the US ETF (in USD terms with dividends reinvested), the Nifty 50 index fund (for a resident Indian investor), and the same Indian fund returns converted to USD. The massive outperformance of the Nifty 50 in Rupee terms disappears once you convert to USD.

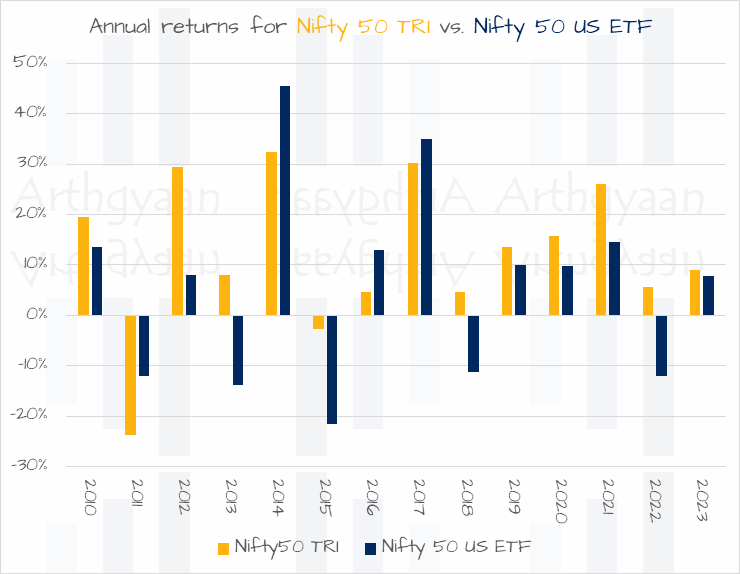

The same trend is seen here for the annual performance figures of the Indian and US funds. Though the underlying stocks are not very different, the returns vary quite a bit.

| Case | Yearly investment | IRR (flat SIP) | IRR (10% step-up SIP) |

|---|---|---|---|

| 1 | In Nifty 50 index fund (kept in India) | 8.36% | 8.45% |

| 2 | In Nifty 50 index fund (remitted) | 4.37% | 4.51% |

| 3 | In Nifty 50 US ETF (in US) | 5.10% | 5.03% |

We are conscious that these are point-to-point returns but the analysis with rolling returns provides the same conclusion.

Invest in Indian stocks only if you are planning to come back to India

Of the three options explored here, the highest returns have come when the NRI has sent money to India, paid the taxes on the capital gains in the US and spent the money in India for some purpose. Alternatively, if the plan is to come back to India, then investing in Indian stocks makes sense.

Direct indexing is the way to create a simple-to-implement portfolio of Indian stocks: Direct Indexing in India: 4 Passive Stock Portfolio Strategies for NRIs and DIY Investors

Invest only in US-domiciled assets if the money is to be used in the US

The worst return has come in case that money, instead of being spent in India, is repatriated back to the US. If repatriation is needed, investing in the US-domiciled ETF is better.

The main investment options discussed are investing in an Indian Nifty 50 index fund without repatriation, with repatriation, or opting for a US-domiciled ETF tracking the Nifty 50.

US tax residents, including citizens and residents, are subject to tax under PFIC rules on unrealized gains in certain Indian investments like mutual funds, ETFs, and AIFs. Direct stocks, real estate, and provident funds are not considered PFICs.

A PFIC is a foreign corporation where a significant portion of its income is passive. For US-based NRIs, certain Indian investments fall under PFIC rules, leading to tax implications on notional gains, even if the assets are not sold.

Returns vary based on the investment strategy. The article compares returns for $1000 yearly investments in Nifty 50 index funds in India, with and without repatriation, and in a US-based ETF tracking the same index. It highlights the impact of USD/Rupee exchange rates and tax brackets on these returns.

The analysis suggests that higher returns typically occur when funds are sent to India, taxes on capital gains are paid in the US, and the money is spent in India or if there's a plan to return to India. Alternatively, investing in US-domiciled assets is recommended if repatriation of funds to the US is intended.

Investing in Indian stocks may be suitable if there are plans to return to India or if the funds are intended to be spent in India. Conversely, opting for US-domiciled assets might be preferable if the funds will be used in the US and repatriation is necessary.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Wall Street or Dalal Street: which is the best option for US NRIs to invest in Indian stocks based on PFIC rule? first appeared on 29 Nov 2023 at https://arthgyaan.com