Best Investment Choices for US NRIs in Indian Stocks: a Rolling Returns Analysis

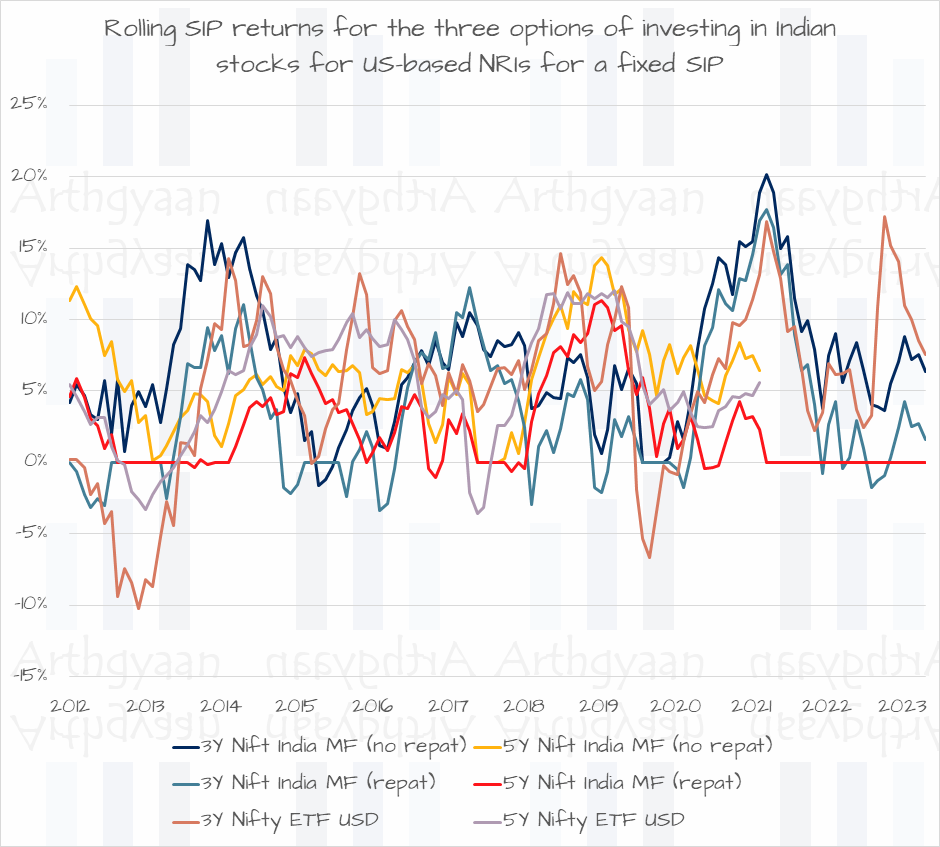

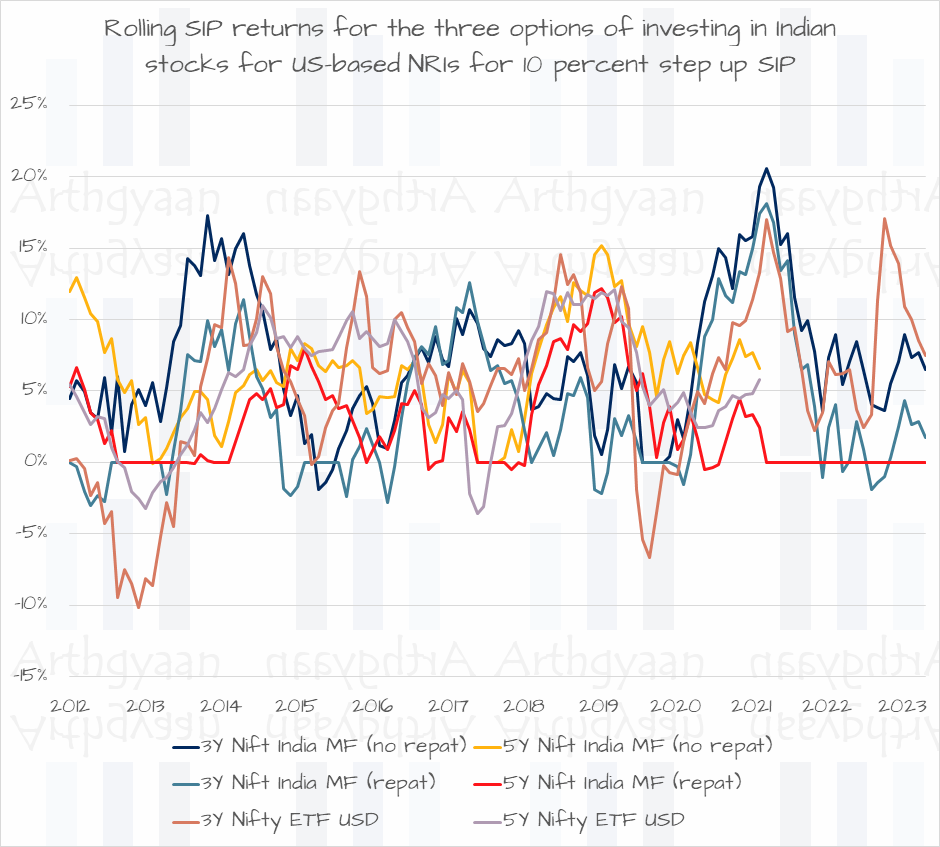

The article uses rolling returns to compare various investment options for US-based NRIs intending to invest in the Indian stock market.

The article uses rolling returns to compare various investment options for US-based NRIs intending to invest in the Indian stock market.

This article is the second part of our analysis of various investment options available to the US-based NRI for investing in the Indian stock market. Please make sure that you have read the first part here: Wall Street or Dalal Street: which is the best option for US NRIs to invest in Indian stocks based on PFIC rule?

Warning: Taxes paid under PFIC are not refunded if you leave the US and come back to India. This rule will lead to severely lower returns on Indian mutual funds (and other PFIC eligible investments) in case you have paid the tax already.

We will consider these cases:

Investment Strategy: An investment approach where a US-based investor regularly invests funds in an Indian Nifty 50 index fund.

Tax Implications: Subject to PFIC rules, the investor pays tax on unrealised gains every year in the US at a combined (federal plus state) rate (assumed) of 32%. A 20% capital gains tax in India and the US under DTAA is paid on the final capital gains. If you have paid taxes in the US under PFIC, these will not be refunded in case you move back to India.

End Corpus: The invested funds remain in the Indian stock market and are not repatriated out of India.

Investment Strategy: An investment approach where a US-based investor regularly invests funds in an Indian Nifty 50 index fund.

Tax Implications: Subject to PFIC rules, the investor pays tax on unrealised gains every year in the US at a combined (federal plus state) rate of 32%. The final capital gains tax is 20%, just as the first option.

End Corpus: The invested funds are repatriated out of India at the end of the investment period.

Investment Strategy: Investment in the Indian stock market, specifically the stocks in the Nifty 50 index, through a US-domiciled ETF. This is a passive fund tracking the Nifty 50 index.

Tax Implications: Held in a tax-deferred IRA, allowing for tax benefits or tax deferral for US taxpayers.

End Corpus: The investment is held within the ETF structure domiciled in the US, and no taxes need to be paid until retirement due to the IRA.

In each case, we will consider

We have taken two options for investing:

For all 3y and 5y SIP investments, we show the return maximum, minimum, average, risk and return per unit risk.

The metric “Return/Risk” provides a ratio that combines return and risk to offer insights into the efficiency of an investment option in generating returns concerning the level of risk taken. Higher values of this metric typically indicate a better return vs the risk incurred.

| Metric | Indian MF | Indian MF Repatriated | US ETF |

|---|---|---|---|

| Maximum | ——- | ——- | ——- |

| Any 3Y period | 20.15% | 17.67% | 17.18% |

| Any 5Y period | 14.36% | 11.34% | 12.02% |

| Average | ——- | ——- | ——- |

| Any 3Y period | 7.08% | 3.67% | 5.52% |

| Any 5Y period | 6.06% | 2.38% | 4.43% |

| Minimum | ——- | ——- | ——- |

| Any 3Y period | -1.64% | -3.36% | -10.20% |

| Any 5Y period | -2.54% | -1.09% | -3.57% |

| Risk | ——- | ——- | ——- |

| Any 3Y period | 16.27% | 17.02% | 20.51% |

| Any 5Y period | 11.56% | 10.28% | 14.70% |

| Return/Risk | ——- | ——- | ——- |

| Any 3Y period | 44% | 22% | 27% |

| Any 5Y period | 52% | 23% | 30% |

| Metric | Indian MF | Indian MF Repatriated | US ETF |

|---|---|---|---|

| Maximum | ——- | ——- | ——- |

| Any 3Y period | 20.57% | 18.08% | 17.07% |

| Any 5Y period | 15.18% | 12.16% | 12.12% |

| Average | ——- | ——- | ——- |

| Any 3Y period | 7.20% | 3.86% | 5.52% |

| Any 5Y period | 6.30% | 2.60% | 4.44% |

| Minimum | ——- | ——- | ——- |

| Any 3Y period | -1.89% | -3.01% | -10.19% |

| Any 5Y period | -0.09% | -0.53% | -3.55% |

| Risk | ——- | ——- | ——- |

| Any 3Y period | 16.71% | 17.33% | 20.54% |

| Any 5Y period | 12.23% | 11.03% | 14.70% |

| Return/Risk | ——- | ——- | ——- |

| Any 3Y period | 43% | 22% | 27% |

| Any 5Y period | 52% | 24% | 30% |

Some observations on the results:

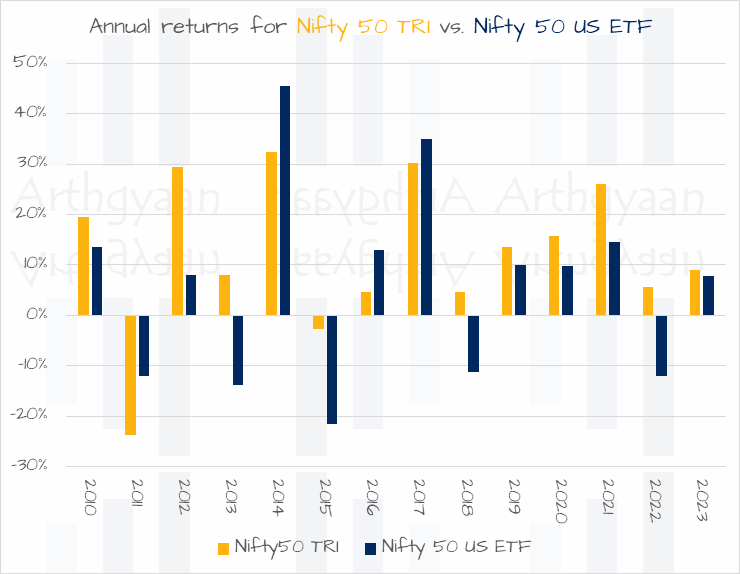

As an investor, you should keep in mind that the USD Rupee exchange rate movement impacts returns:

We will reiterate the same conclusions as in our previous article: Wall Street or Dalal Street: which is the best option for US NRIs to invest in Indian stocks based on PFIC rule?

Invest in Indian stocks only if you are planning to come back to India

Of the three options explored here, the highest returns have come when the NRI has sent money to India, paid the taxes on the capital gains in the US and spent the money in India for some purpose. Alternatively, if the plan is to come back to India, then investing in Indian stocks makes sense.

Invest only in US-domiciled assets if the money is to be used in the US

The worst return has come in case that money, instead of being spent in India, is repatriated back to the US. If repatriation is needed, investing in the US-domiciled ETF is better.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Best Investment Choices for US NRIs in Indian Stocks: a Rolling Returns Analysis first appeared on 17 Dec 2023 at https://arthgyaan.com

Copyright © 2021-2026 Arthgyaan.com. All rights reserved.