Should US-based NRIs sell off their mutual funds and stocks in India?

This article makes US-based NRIs aware of the taxation on the unrealised gain rule (PFIC rule) if they invest in Indian stocks, ETFs and mutual funds.

This article makes US-based NRIs aware of the taxation on the unrealised gain rule (PFIC rule) if they invest in Indian stocks, ETFs and mutual funds.

Disclaimer: Taxation is a dynamic concept, and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

This article is a part of our detailed article series on the concept of the PFIC taxation rule applicable to US NRIs. Ensure you have read the other parts here:

This article simplifies compliance for US, Canada, UK, and Australia-based NRIs, covering FBAR, FATCA, PFIC, and T1135 requirements.

US-based NRIs investing in Indian mutual funds and stocks must comply with PFIC and FBAR rules or risk severe IRS penalties. This guide breaks down the reporting requirements for FinCEN Form 114 (FBAR) and Form 8621 (PFIC), helping NRIs avoid excessive taxation.

The article compares various investment options for US-based NRIs intending to invest in the Indian stock market.

The IRS requires US tax residents to pay tax at their ordinary income tax rate on investments in PFICs for every tax year (1st Jan to 31st Dec). The tax rate depends on the method used to value the PFIC:

🛈 Who is a US tax resident?

Here is a calculator that shows your US tax-residency based on the Substantial Presence Test (SPT):

Learn more about the SPT from the IRS website.

Any NRI planning to stay in the US for some time will become a US tax resident after 183 days. The same rule applies to Green card holders as well. The 183-day rule is a part of the Substantial Presence Test and is the starting point of the calculations, including the weighted average of days present over three years, to determine US tax residency.

🛈 What Is a Passive Foreign Investment Company (PFIC)?

This tax is paid on unrealised gains. If your portfolio goes up by 10 lakhs a year, you pay 3 lakhs tax even if you did not sell anything (assuming a 30% marginal tax rate)

If we combine the above two definitions, any US-based NRI who is either a green-card holder or has stayed longer than 183 days in the US in a calendar year has to pay tax on Indian mutual funds, ETFs and AIFs (Cat 1 and Cat 3 only which do not have pass-through taxation). Direct stocks, real estate and provident fund (PPF/EPF) are not considered as a PFIC.

PFIC rules exist to prevent tax deferral by making you pay tax on gains every year.

This tax is paid on notional gains though you have not sold anything (under the mark-to-market method)

Warning: Taxes paid under PFIC are not refunded if you leave the US and come back to India. This rule will lead to severely lower returns on Indian mutual funds (and other PFIC eligible investments) since you have paid the tax already.

Let us assume that the NRI holds ₹10 lakhs in Indian mutual funds and ETFs on 1st January. On the following 31st December, the market value is ₹12 lakhs. Therefore, ₹2 lakhs are added to the income of the NRI and taxed at the ordinary tax rates. This tax is paid even though these investments are not sold.

If instead of ₹12 lakhs, the market value went down to ₹8 lakhs, there is no tax to be paid. But the notional loss is not allowed to offset that year’s income. Therefore if your investments go up, you pay tax, but if they go up, you don’t get the opposite benefit of lowering taxes.

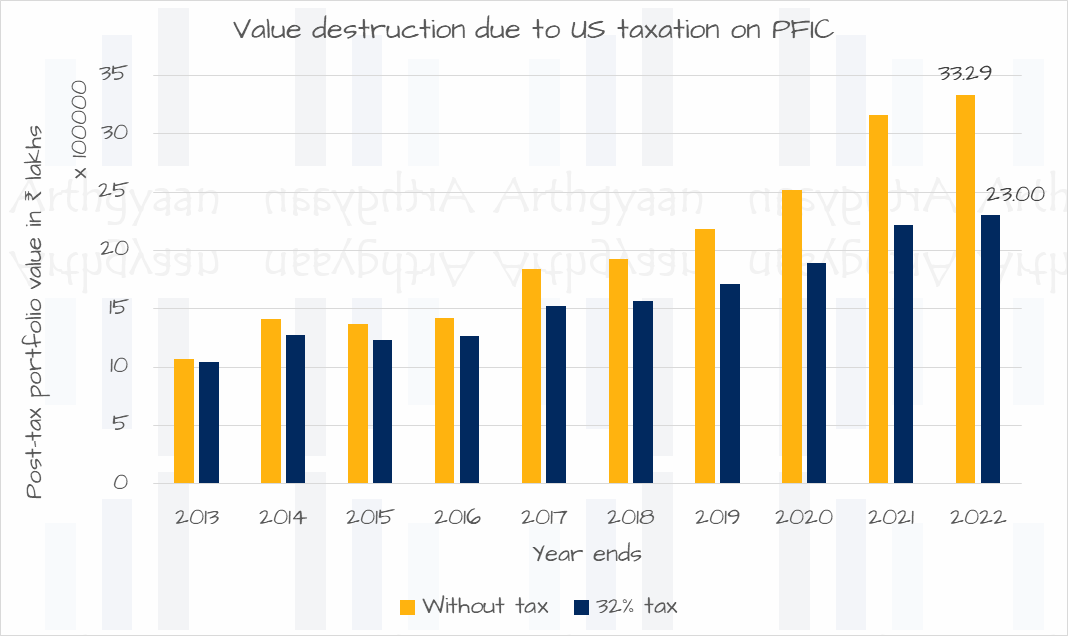

As the chart shows, a portfolio of ₹10 lakhs invested in a Nifty 50 index fund on 31st December 2012 would be worth, after 1st Jan 2023, ₹33.29 lakhs without tax and only ₹23 lakhs after paying tax under the PFIC rule at a 32% tax bracket.

US tax residents must fill out the cumbersome Form 8621 while tax filing to stay within the PFIC compliance rule.

Note: For NPS, PPF and EPF, IRS Rule 519 under the “Source of Income” category has this text:

| Item of income | Factor determining source |

|---|---|

| Investment earnings on pension contributions | Location of pension trust |

It can therefore be interpreted that:

The PFIC rule does not have a lower threshold while FATCA (Form 8938) typically applies above a threshold of USD 50,000 (double the amount when filing jointly) for unsold assets. Therefore, NRIs should check the latest value of this exemption while filing tax returns using Form 8621.

Before shifting abroad, to-be NRIs can gift assets to a family member. The gifting is tax-free for immediate family members like parents, a resident Indian spouse, or siblings. Mutual funds should be dematerialised and transferred via the on or off-market transfer process.

We have covered this concept in detail here: Who should invest in the name of parents to save tax? Who should not?.

We have discussed this concept in a lot of detail here: Wall Street or Dalal Street: which is the best option for US NRIs to invest in Indian stocks based on PFIC rule?.

This article advises on the steps a US-based Non-Resident Indian (NRI) should take regarding unreported mutual funds in India under FBAR and PFIC rules: What should an US NRI do to become compliant with PFIC and FBAR rules on their Indian investments?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should US-based NRIs sell off their mutual funds and stocks in India? first appeared on 12 Apr 2023 at https://arthgyaan.com