What is the biggest benefit of holding mutual fund units in demat form?

This articles discusses some benefits and drawbacks of storing your mutual funds in demat mode with one killer feature that makes transmission possible.

This articles discusses some benefits and drawbacks of storing your mutual funds in demat mode with one killer feature that makes transmission possible.

This article is a part of our detailed article series on the concept of mutual fund taxation in India. Ensure you have read the other parts here:

This article shows how to calculate the tax on selling inherited shares and equity mutual funds using the grandfathering concept.

This article is expected to give investors in India a complete guide on the topic of calculation of taxes on mutual funds.

This article shows the way forward for investors in debt, gold, hybrid and international funds which have lost indexation benefits on units purchased after 1st April 2023.

This article shows you how the concept of indexation lowers the capital gains tax you pay when you sell debt mutual funds.

This article settles the question of which type of capital gain calculation is better - debt-type funds taxed at 20% with indexation vs equity-type at 10%.

This article explains the concept of equity LTCG grandfathering in detail with multiple case studies and examples.

This article talks about understanding capital gains tax calculations and computing offsets vs other income.

This post discusses the concept of tax calculations and tax harvesting in a simple manner.

Source: https://nsdl.co.in/faqs/faq.php

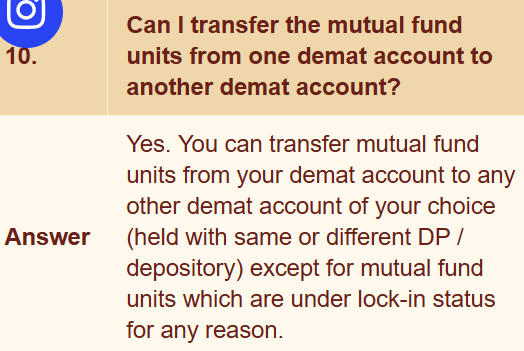

You can transfer mutual fund units (and stocks or bonds) in your demat account to a family member, or anyone else for that matter, anytime using the off-market-transfer or online transfer mechanisms offered by CDSL or NSDL.

There is no benefit of holding an electronic item in a demat account

A lot of investors have been told a variation of the above statement since when they buy mutual funds, they no longer have physical unit certificates. The Mutual Fund Transfer Agencies (RTAs) like CAMS and KFintech maintain detailed statements for every mutual fund investor and the units they hold. This format is called Statement-of-Account (SOA) mode of holding mutual funds.

In contrast, just like shares, you now have the option of holding mutual funds in your demat account which will be maintained by NSDL or CDSL. You can use multiple platforms to buy and sell these mutual funds in demat form.

The main pros are a single statement view of stocks and MFs called CAS along with transactions and tracking via the same platform that you use for stocks.

The cons are being required to trade only in integral units of MFs and platform lock-in: you will need to transfer the units to another demat account to transact with another platform.

However, all of these pros and cons become inconsequential if you consider the transmission facility.

Normally, mutual funds in SOA form, i.e. not in a demat account, can be transferred only by:

But, we know that for all assets,

Transmission to family members is tax free if it is a gift

We will explain below how to make use of this feature to save taxes while selling or transferring mutual funds. By the way, you can transfer or donate shares in the same way.

You are the parent of a 18 year old who needs money for college education in 6 months. As a responsible parent you have most of the money for college admission already in debt mutual funds. However, if you sell those units in your name, you will be taxed at 30% or more if you are in highest tax slabs. However, if you transfer the units to your child’s demat account as a gift:

It is best to create a gift deed on stamp paper and the parent who is making the gift should sign it

To understand the taxation better, we need to know that capital gains tax from the sale of mutual funds or stocks is taxed as per the original purchase date and purchase price. If the items being gifted are shares or mutual funds, or anything that has a purchase date and price, include those details in the deed for making it easy to calculate capital gains in the future.

For example, say the parent purchases ₹5L in mutual funds when the child is ten years old at ₹100/unit, gifts them to the child when they are 18+ when the fund NAV is at ₹200/unit, and the child sells them later at ₹250/unit. The tax will be calculated with the purchase NAV of ₹100 and the purchase date, for determining long term or short term holding, as of the original date more than eight years ago.

The only way the above transaction will save tax is because the capital gain from this sale if the capital gain can be offset against the basic exemption limit. To explain this, currently below ₹2.5L/year income, there is no tax due. Therefore, if the capital gain amount is below this basic limit, then there is no tax to be paid by the child.

Read more here:

There is another use case with retired seniors and their adult children which we will cover in a future article.

Now that you know of this tax saving feature, you can follow this process to dematerialise MF units from SOA form:.

There are extensive FAQs on this process here:

You can also convert demat MF units into SOA form in case you wish to do so for any reason.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the biggest benefit of holding mutual fund units in demat form? first appeared on 01 Nov 2023 at https://arthgyaan.com