What are the tax implications of selling inherited shares and equity mutual funds?

This article shows how to calculate the tax on selling inherited shares and equity mutual funds using the grandfathering concept.

This article shows how to calculate the tax on selling inherited shares and equity mutual funds using the grandfathering concept.

This article is a part of our detailed article series on the concept of mutual fund taxation in India. Ensure you have read the other parts here:

This article is expected to give investors in India a complete guide on the topic of calculation of taxes on mutual funds.

This articles discusses some benefits and drawbacks of storing your mutual funds in demat mode with one killer feature that makes transmission possible.

This article shows the way forward for investors in debt, gold, hybrid and international funds which have lost indexation benefits on units purchased after 1st April 2023.

This article shows you how the concept of indexation lowers the capital gains tax you pay when you sell debt mutual funds.

This article settles the question of which type of capital gain calculation is better - debt-type funds taxed at 20% with indexation vs equity-type at 10%.

This article explains the concept of equity LTCG grandfathering in detail with multiple case studies and examples.

This article talks about understanding capital gains tax calculations and computing offsets vs other income.

This post discusses the concept of tax calculations and tax harvesting in a simple manner.

It is common in many families to have shares purchased decades ago, in the 1980s, 1990s, or later, which have been passed on to other family members due to the death of the original investor. In some cases, these shares were initially in paper form and later converted to Demat form. The same is true for mutual funds, which have been in India since the 1990s.

The issue arises when selling these shares (or equity mutual funds) if the purchase price is unknown. For capital gains tax calculation, it is necessary to determine the original purchase price, which might date back several decades. In this article, we will use the terms “share” and “equity mutual fund” interchangeably.

We are discussing only long-term capital gains (LTCG) tax here since the short-term period for equity is just one year. For shorter-term purchases, the data will be available in digital or physical form, either in an email account or through physical mail.

You can determine the purchase price using the digital version of the physical share or MF certificate as well if you have that.

We are only discussing shares sold after 1st April 2024, as this article is written after the 31st July 2024 tax-filing deadline for all share sales before 1st April 2024. We are using the latest taxation rules from the Union Budget 2024, announced on 23rd July 2024.

The taxation rules that apply here are as follows:

So, we first need to know if the purchase price of the share is higher or lower than the price on 31st January 2018.

As per Budget 2018, presented in February 2018, LTCG was reintroduced at 10% if the LTCG amount exceeded ₹1 lakh in the financial year. Budget 2024 has increased the tax rate to 12.5% and the exemption to ₹1.25 lakhs. However, we have been given the facility to “grandfather” all capital gains on or before 31st January 2018 to zero.

In such a case, capital gains tax will only be calculated based on the 31st January 2018 price. It is easy to obtain the adjusted share price via a platform like Google Finance and check if the price in the past has mostly been lower than the 31st January 2018 price.

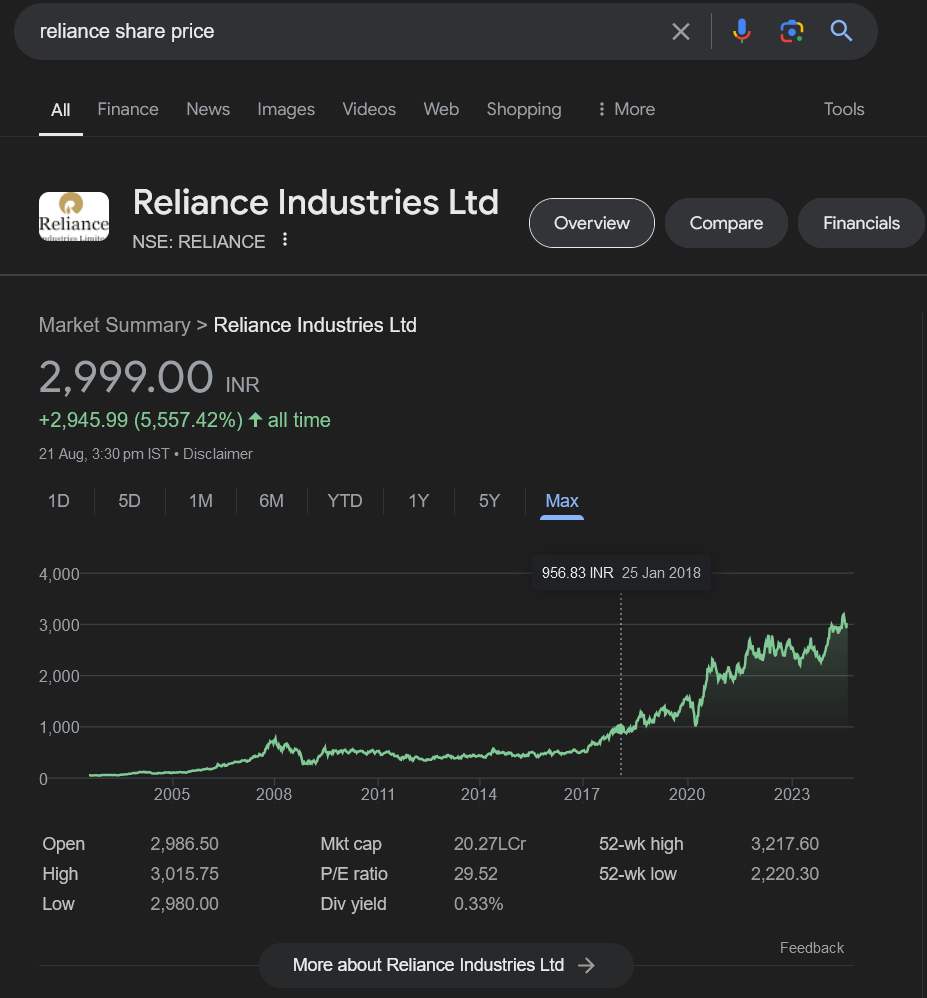

For example, a typical company like Reliance has been around for decades, and its price has overall increased up to 31st January 2018.

If you don’t have the exact purchase price or statement, determining whether the share price exceeds the 31st January 2018 price can be challenging.

Here is an example where the stock price in 2011-2014 was higher than the 31st January 2018 price but lower than the current market price in August 2024. In this case, you need the exact purchase price to know the tax due.

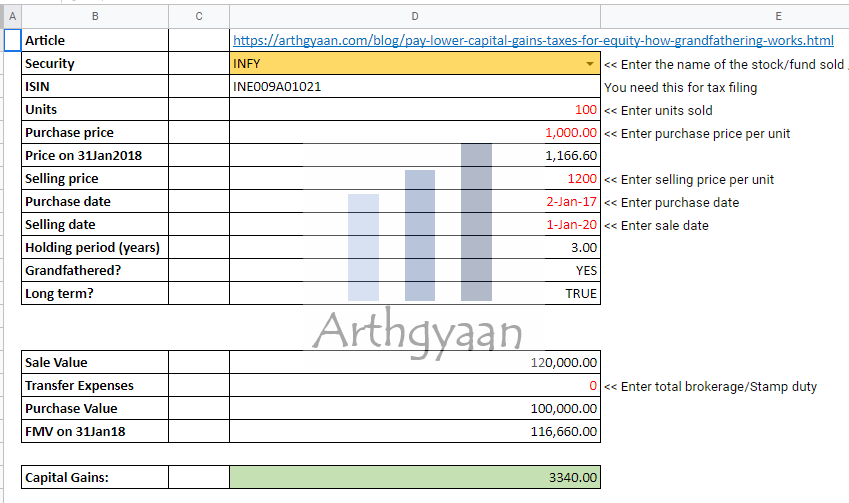

Our goal-based investing calculator contains a dedicated sheet to calculate equity grandfathering, including the NAVs from AMFI and the stock prices from NSE/BSE for 31st January 2018.

Click the image below to get the calculator

Please refer to the “eq-ltcg” tab in the sheet.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the tax implications of selling inherited shares and equity mutual funds? first appeared on 25 Aug 2024 at https://arthgyaan.com