Pay lower capital gains taxes for equity: understand how grandfathering works

This article explains the concept of equity LTCG grandfathering in detail with multiple case studies and examples.

This article explains the concept of equity LTCG grandfathering in detail with multiple case studies and examples.

This article is a part of our detailed article series on the concept of mutual fund taxation in India. Ensure you have read the other parts here:

This article shows how to calculate the tax on selling inherited shares and equity mutual funds using the grandfathering concept.

This article is expected to give investors in India a complete guide on the topic of calculation of taxes on mutual funds.

This articles discusses some benefits and drawbacks of storing your mutual funds in demat mode with one killer feature that makes transmission possible.

This article shows the way forward for investors in debt, gold, hybrid and international funds which have lost indexation benefits on units purchased after 1st April 2023.

This article shows you how the concept of indexation lowers the capital gains tax you pay when you sell debt mutual funds.

This article settles the question of which type of capital gain calculation is better - debt-type funds taxed at 20% with indexation vs equity-type at 10%.

This article talks about understanding capital gains tax calculations and computing offsets vs other income.

This post discusses the concept of tax calculations and tax harvesting in a simple manner.

Long-term capital gains (LTCG) for equity-type assets (like shares and mutual funds) were made taxable, under Section 112A, in the Budget presentation of 2018. Before that, since 2004, LTCG for equity was zero to attract Foreign Institutional Investors (FII).

To assuage investors’ concerns that a lot of capital gains tax will have to be paid for shares purchased at old low prices, the Finance Ministry exempted any capital gains accumulated before 31-Jan-2018. This is the concept of grandfathering of long-term equity capital gains.

This article should be read in conjunction with this one: How is tax calculated on selling shares/MFs?

The formula applies to the sale of the following assets called equity-related assets:

Short-term capital gains arise if the asset is sold only after buying it less than a year back.

The formula is simple:

CG = MV - BV

where

Tax is calculated as:

Tax = 20% * CG

where CG = total equity-related capital gains as per the PAN of the investor across all selling done between 1st Apr to 31st Mar

Long-term capital gains arise if the asset is sold only after buying it more than a year back.

If you purchased units on or before 31-Jan-2018 (Grandfathering applies),

CG = MV - max ( BV , min ( FMV , MV ) )

Else, i.e. you purchased the units after 31-Jan-2018 (Grandfathering does not apply)

CG = MV - BV

where

Fair Market Value (FMV) is calculated from the following data sources using prices on 31-Jan-2018. If you purchased your units after 31-Jan-2018, FMV calculation is not applicable. You can set CG = MV - BV. To calculate FMV, you will need:

FMV = MF Units or Shares sold * (NAV on 31Jan2018 or the highest intraday price of the share on 31Jan2018)

You can download the files from here:

Tax = 15% * max ( 0, CG - ₹125,000 )

where CG = total equity-related capital gains as per the PAN of the investor across all selling done between 1st Apr to 31st Mar. Of course, you can off set this gain vs. any capital loss as explained here: How to calculate taxes from capital gains and combine them with your other income

Note: Before Budget 2024, the rates were 15% for STCG and 10% (with ₹1 lakh exemption) for LTCG.

This is a straightforward calculation:

This is another straightforward calculation:

Case 1: Purchase price < 31Jan2018 price < Sale price

Purchased 100 units at ₹40 on 02-Jan-2017 for a total of ₹4,000. Sold them for ₹6,000 on 01-Jan-2020.

Case 2: Purchase price < Sale price < 31Jan2018 price

Purchased 100 units at ₹40 on 02-Jan-2017 for a total of ₹4,000. Sold them for ₹4,500 on 01-Jan-2020.

Case 3: Purchase price = Sale price < 31Jan2018 price

Purchased 100 units at ₹40 on 02-Jan-2017 for a total of ₹4,000. Sold them for ₹4,000 on 01-Jan-2020.

Case 4: Sale price < Purchase price < 31Jan2018 price

Purchased 100 units at ₹40 on 02-Jan-2017 for a total of ₹4,000. Sold them for ₹3,500 on 01-Jan-2020.

Case 5: Sale price < 31Jan2018 price < Purchase price

Purchased 100 units at ₹60 on 02-Jan-2017 for a total of ₹6,000. Sold them for ₹3,500 on 01-Jan-2020.

Case 6: 31Jan2018 price < Purchase price < Sale price

Purchased 100 units at ₹60 on 02-Jan-2017 for a total of ₹6,000. Sold them for ₹7,000 on 01-Jan-2020

Case 7: 31Jan2018 price < Sale price < Purchase price

Purchased 100 units at ₹70 on 02-Jan-2017 for a total of ₹7,000. Sold them for ₹6,000 on 01-Jan-2020.

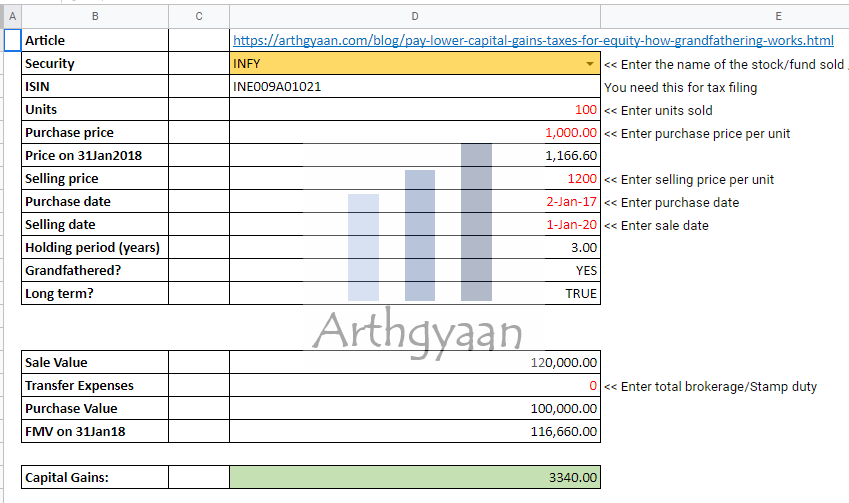

Our goal-based investing calculator contains a dedicated sheet to calculate equity grandfathering, including the NAVs from AMFI and the stock prices from NSE/BSE for 31st January 2018.

Click the image below to get the calculator

Please refer to the “eq-ltcg” tab in the sheet.

Budget 2024, released on 23rd July 2024, made some changes to equity taxation. For LTCG (sale after 1-year of ownership)

For STCG (sale before one year of ownership), the rules are:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Pay lower capital gains taxes for equity: understand how grandfathering works first appeared on 27 Jul 2022 at https://arthgyaan.com