What is a Personal Accident Insurance policy: who needs it and why?

This article explains the pros and cons of a Personal Accident Insurance policy and makes a case for getting one to safeguard your financial goals.

This article explains the pros and cons of a Personal Accident Insurance policy and makes a case for getting one to safeguard your financial goals.

The purpose of the personal accident (PA) insurance policy is to provide a replacement for your income if you have an accident and cannot work after that. Unlike term insurance, where claims are paid on death, a PA cover is applicable when one of the following is the result of an accident:

General insurance companies, just like health insurance policies, sell PA policies. The premium depends on the sum insured (SI) and profession and not too much on the age. The policies are renewable yearly; usually, 2-3 year premiums are offered at a discount. 18% GST is applicable on the premium.

The purpose of the PA policy is for such cases where due to an accident, you do not die but are unable to work. The onus is on the insured person to conclusively prove if the disability due to the accident is preventing you from earning your living.

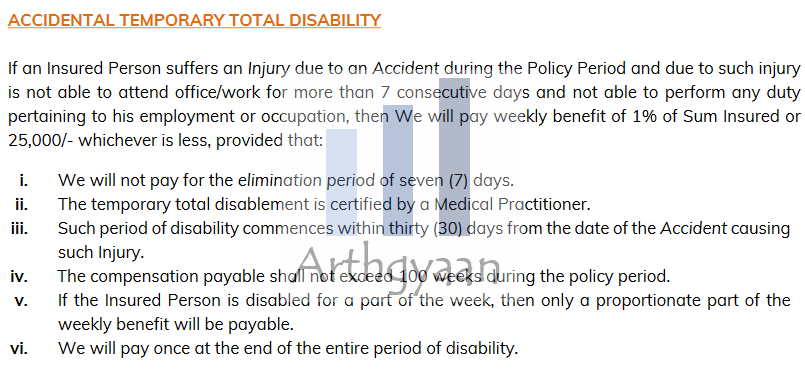

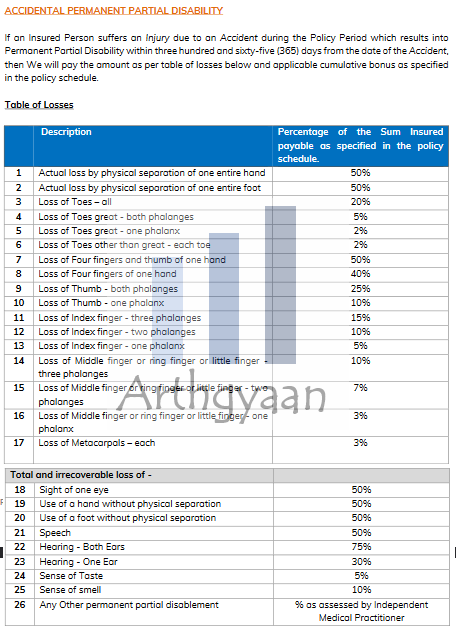

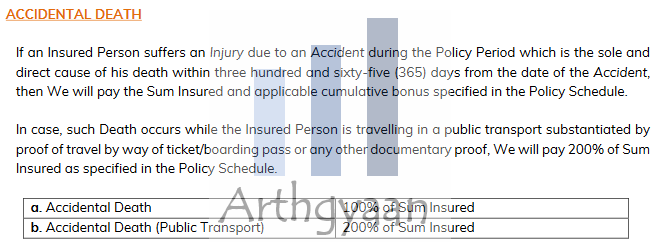

In all cases, you need to be able to prove that the injury is preventing you from doing your day job. In each case, the amount paid out will depend on the policy terms. From least to most severe, the benefits are, using some representative cases, from one of the policy term documents on the Insurance Regulatory and Development Authority of India (IRDAI) site:

These injuries will heal with time, like fractures or paralysis that may get cured. However, these cases offer the lowest payout, around 1% of the SI per week, until recovery or small lump sum amounts. In most cases, TTD/TPD will not be meaningfully covered.

Temporary loss of limb(s), paralysis or sense organs (eye/ear), uniplegia (paralysis of a single limb) etc., fall under this category. The payout may be 25-100% of the SI.

The payout may be 100% of the SI since cases like a total loss of limb(s), sense organ(s) or paralysis are covered here.

The insurance company will generally pay out 100-200% of the sum insured.

We have put accident in italics in the previous paragraphs since the definition is fundamental in buying a PA policy. As per multiple PA policy documents on the IRDAI website, an accident is defined as:

An accident is a sudden, unforeseen and involuntary event caused by external, visible and violent means - Source: IRDAI site

The following examples could lead to claim rejection if they strictly do not follow the definition of an accident:

In many cases, you may need an FIR and medical examiner’s report or autopsy report to support the claim process.

Riders make the claim process complicated since you need to prove the cause of death as well. This may cause issues in claim processing by giving the insurance company more to investigate. It is, therefore, better to take a stand-alone PA policy instead of a term insurance rider.

PA cover in vehicle insurance protects the owner of the vehicle, as long as they have valid driving license. The policy is set at 15 lakhs by IRDAI (since 2018) and covers permanent total disability and accidental death. PA cover is mandatory if you are driving your own car.

There are two cases here:

However, this particular PA cover does not cover cases where you have an accident apart from driving your car.

The PA cover protects you in multiple ways

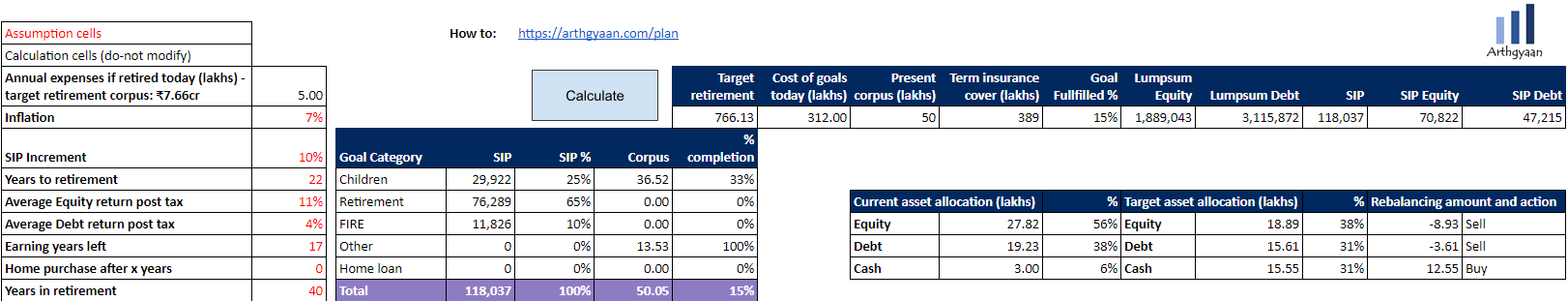

The Arthgyaan goal-based investing calculator accounts for the first two options: monthly expenses and investments in SIP form. The calculator will show you the total insurance cover for both term, and as a result personal accident, in the same field.

A health insurance policy is not the replacement for Personal accident coverage. A health plan covers planned and unplanned medical expenses where you are eventually expected to recover. PA covers income loss due to an accident which causes a disability.

Similarly, having only a term insurance policy does not help since the accident does not necessarily kill you. Instead, it will prevent you from earning income, making it impossible to reach your financial goals.

A third-party vehicle insurance cover, for example, if you are injured when a car hits you on the road, is for the car’s driver’s benefit and not for you.

The only alternative to a personal accident cover is having enough wealth to be unaffected if your income stops today. Astute readers will notice that this is the exact same definition of being Financially Independent: What is the quickest way to reach FIRE?

The biggest challenge at this point is finding policies with sufficient coverage. There are too many policies with coverage of a few lakhs than those with coverage of multiple crores. The higher coverage out there is a policy of 2 crores capped at 12x of your annual gross income. However, this amount may not be enough depending on your goals.

This link is the official IRDAI page with all currently available insurance policies: click here. From the same page, you can get the updated list from Products Offered > Health Insurers for the current year.

The page has the policy documents for all active policies in the market. You should look for individual (i.e. non-Group) policies and shortlist the ones where you are okay with the terms and conditions. In parallel, from the insurance company website, you can get a plan quote. You should be able to buy the policy online in most cases from your shortlist.

Given the definition of accident, onerous claim process and lack of high-value policies, it is natural to believe that a PA policy is not worth the hassle.

There are some significant upsides as well, though:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is a Personal Accident Insurance policy: who needs it and why? first appeared on 31 Jul 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.