What is the quickest way to reach FIRE?

If you are interested in FIRE, you need to know about the best way to reach that goal. This post shows how.

If you are interested in FIRE, you need to know about the best way to reach that goal. This post shows how.

FIRE is defined as:

FIRE = FI (Financially Independent) + RE (Retired Early)

FI = you do not need income from a job or profession since your investments generate enough to sustain your lifestyle

RE = retiring early before the traditional retirement age

There are a few more nuances regarding the income and lifestyle levels at the time of FIRE.

We recap the various types of FIRE to check your current progress towards FIRE.

Use this simple FIRE calculator to estimate your progress towards FIRE: How to plan for FIRE using the bucket approach?.

The lifestyle you want to have once you FIRE impacts the time it will take to reach the target. There are three kinds of FIRE:

If you look at the FIRE stories around you, on social media and in other places, you will see a general trend in FIRE aspirants:

These stories present a misleading picture that if you do not fall in one of these buckets, then FIRE is not possible to achieve in your case. There are a couple of points to note here:

Money’s greatest intrinsic value-and this can’t be overstated-is its ability to give you control over your time - Morgan Housel

The above quote is one of the pillars of the concept of FIRE. If you are targeting to either Retire Early (RE) or go for Financial Independence (FI) or both (fully FIREd), you are essentially giving out a message to the world that:

These three points together counter a few common misconceptions about FIRE:

We discuss these two points below.

We use the twin super-powers of Pay-yourself-first and Conscious Spending to get over the YOLO barrier.

Pay-yourself-first says Expenses = Income - Investments, i.e. spend after you have invested. To reach this state, you need to sit down with your family and decide your spending priorities. It essentially means having a similar conversation like setting financial goals. Once you have started investing for your FIRE goal and then spending on discretionary items that have been appropriately prioritized, you are on the fast track to FIRE. We explain the process below.

Pay-yourself-first is described in more detail here: How to budget, save and invest in a stress-free manner?

Housing costs and vehicles are the most significant line items in any household budget. However, over-spending on home loans and car EMIs can significantly divert money from other goals. This is where prioritization comes in. You and your family need to decide on your primary lifestyle:

The options above will not only require spending different amounts of money every month but will create different types of memories and experiences. It is up to you to choose which one you prefer.

These items are more frequent but tend to add up over time. This is called the Latte Factor.

The Latte Factor was popularized by author David Bach. The concept is simple. Small amounts of money spent on a regular basis cost us far more than we can imagine - [Source: Forbes.com: ‘https://www.forbes.com/sites/robertberger/2017/05/27/the-latte-factor-7-key-lessons-we-can-learn-from-a-cup-of-coffee/’]

It would help if you prioritize your spending on discretionary items like this:

This way, you can spend more money on what you care about and cut down on those items you do not. Related reading: How Goal-based investing lets you do guilt-free spending

Here is how income is handled:

Step 1

Investment is made first, and this includes both FIRE and non-FIRE goals. Non-FIRE goals will consist of emergency and sinking funds and other goals like children’s education and house purchase. The best way to de-risk the other non-FIRe goals is to ensure that these goals are funded before FIRE starts.

Read more here:

Step 2

Whatever is remaining after investing goes into the monthly spending bucket, which is split as:

FI will let me do my morning stand-ups sitting down. - Author

Jokes apart, it is pretentious to assume that FIRE candidates wish to sit under a tree lazing around the whole day while their non-FIREd contemporaries are trading off their time for money. This is an excellent time to mention this particular quote:

The price of anything is the amount of life you exchange for it - Henry David Thoreau.

As we have discussed in our previous post on the concept of the hourly wage, we trade our time for money by spending a good chunk of time every day for generating income. Therefore, the hourly wage calculation is the rate of the same: income per hour.

Achieving FIRE, specifically FI, flips that equation around by using our investment corpus to buy the freedom of choosing to spend time as we wish. If the career is fulfilling, people can and do continue. Others will shift to a different type of role, profile, industry, art, business or shift to something part-time. The options are endless and even includes the option of doing absolutely nothing. That is where the freedom part comes in to have a purpose in life beyond just earning money via a job or profession.

Here is a fact: unless you work until the day you die, you will retire eventually, which is a certainty. Whether you do it before your mandated retirement age or not is entirely up to you. Many professionals (like doctors and lawyers) keep working until their 70s or later. But just because you can, there is no reason to assume that you must. It is a choice. Hence retirement planning, early or not, needs to begin from the day you start earning money. Remember that you cannot take a loan for retirement.

Reaching FIRE depends not on income but on investing to reach the FI stage - Author

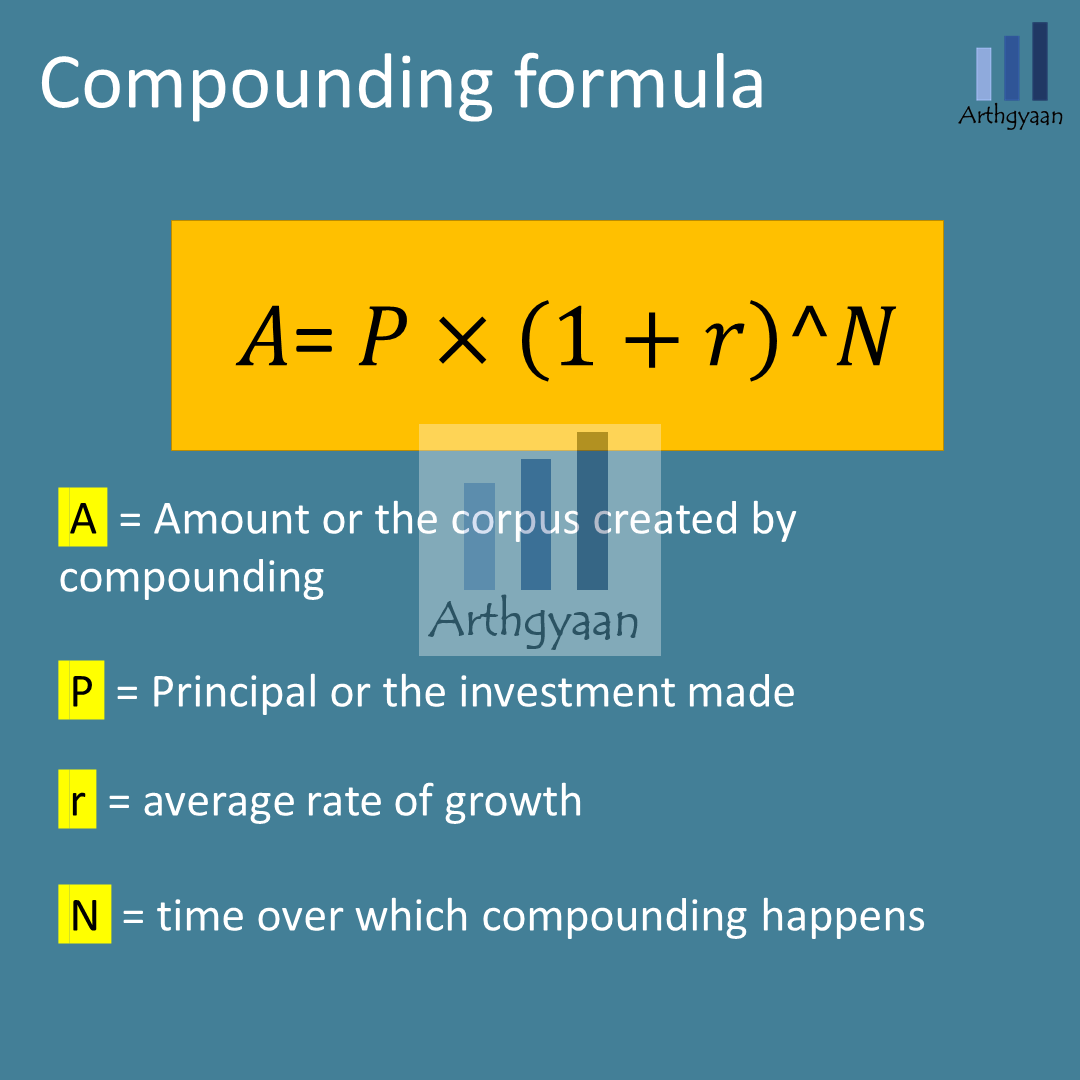

If you are explicitly targeting FIRE, it becomes a different type of goal. While we all know that compounding is magical, specifically while reading How compounding works: the journey to a 10 crore portfolio, it works best when you have time at your side. Unfortunately, suppose you wish to FIRE 5-15 years before your normal retirement age. In that case, you do not have the luxury of time to compound your portfolio.

The conclusions to be drawn from the compounding formula, when applied to a FIRE candidate, are:

The bottom line here is that you need to invest a lot and the only way to do that is by investing at a rate that you can maintain from today until FIRE. On the other hand, if your income increases steadily or there is a windfall gain, say from a rich relative or sale of real-estate, you might reach a stage where there is no need to invest more. At this point, the corpus you have is enough to grow on its own to reach the target value on its own. This is the concept of CoastFIRE.

It’s a marathon, not a sprint - Attribution pending

The line above is overused and cliched but appropriate to the problem at hand. For a few months or a year, you can cut out discretionary and other spending to bump up your savings rate. But that is where the YOLO fear kicks in once your motivation to deprive yourself, relative to your peers and others, runs out.

For example, when faced with a large goal, many people often set up large and unrealistic targets. If you are planning to lose 10Kg weight, do not make unrealistic plans like one mean a day or going to a gym for 6 hours/week. There will be more benefits from sustainable actions. Similarly, if you plan for FIRE in ten years, start with a savings rate that you can maintain consistently for the next ten years.

The savings rate, together with the amount already invested for FIRE in terms of the current annual expenses, together will impact the time left to FIRE. In the example below, we assume a 10% yearly income increase, 5% inflation, 5% long term returns (i.e. zero real returns) for the FIRE portfolio and 4% annual withdrawal rate. Success is defined as the corpus lasting at least 30 years.

The table shows that:

To calculate your progress towards FIRE, use the comprehensive goal-based investing calculator.

We will use the RRTTLLU framework to evaluate the investments suitable for a FIRE portfolio. Unlike a traditional retirement portfolio, the FIRE portfolio, due to the RE part, will have to last longer and will have higher sensitivities to the starting assumptions regarding returns and inflation.

Real returns i.e. returns after inflation and liquidity of assets, will become critical factors in evaluating suitable investments.

A FIRE portfolio should have the following asset classes:

The split of these three asset classes, i.e. the asset allocation of the FIRE portfolio, will be decided using the calculator in the post below: How to plan for FIRE using the bucket approach?

These investments are not suitable for a FIRE portfolio:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the quickest way to reach FIRE? first appeared on 20 Feb 2022 at https://arthgyaan.com